what the frick…

Do we know what the rumored Auryn offer was?

I am assuming Auryn’s offer to exercise the option now modifies the amount of cash paid (meaning less $$$) vs. a higher % in AMC.

Considering that others (Baldy just to mention one) haven’t seen this move favorable, what makes you so much in favor rather than waiting longer with terms unchanged?

Removes the risk and gets us a cash flow in the quickest way possible.

Otherwise, worst case…Auryn does nothing on the property for the next 16 months besides dump tailings on the Alto claims from all the gold they are pulling out of the Caren and Fortuna.

Otherwise, worst case…Auryn does nothing on the property for the next 16 months besides dump tailings on the Alto claims from all the gold they are pulling out of the Caren and Fortuna.

I sure hope not Mike! Lets wrap this up and move on. We are Not getting any younger

Hi Albireo,

If I understand it correctly, I think AMC and Medinah are trying to find a “win-win” strategy now that the high grade gold early production opportunities are on the table and about to bear fruit. Does Medinah want to stick with the $100 million plus 15% AMC stake that might not get delivered until August of 2017 or do they want to swap out some of that $100 million NOW for a greater percent of the action NOW including the early production opportunities which apparently might start paying off very soon.

I’m sure there’s a win-win to be found but it’s a difficult calculus to make. AMC WOULD WANT TO HOLD OUT AS LONG AS POSSIBLE BEFORE THEY HAVE TO DIVIDE UP THE PROPERTY IN ORDER TO RAISE PERHAPS BILLIONS OF DOLLARS OF CAPEX. At this stage of development the NPV of this property could go parabolic at any time. If they used the cash they saved by cutting a deal with Medinah NOW then when it came time to divide up the pie for CAPEX purposes it might be worth a whole bunch more and their dilution would be that much less. You want to bring in the heavy artillery money RIGHT AFTER AN UPWARD SPIKE IN THE NPV OF THE DEPOSIT. An intersection or 2 into the porphyry might provide that spike.

If the mine life is going to approach perhaps 30 years then it would be very nice for Medinah to have a bigger piece of the action for that long of a period of time and it might make sense to forego some of the cash up front. But the other side of the coin is that $100 million is a lot of money. I THINK IT IS A GIVEN THAT THE OPTION WILL BE EXERCISED OR A NEW DEAL WILL BE DRAFTED. The recent Pegaso Nero results made a very compelling case that whatever we have there is enormous. Recall that they found 3.6 Km of high grade moly right at surface not to mention 1% Cu in the 2 breccias. This is near sea level and can be mined year round.

AMC has owned the Caren for quite some time and it is the property that has the permitting in place to crank out 5,000 tonnes per month. IT WILL BE EXPLOITED FIRST BECAUSE OF THE PERMITTING SITUATION. Nuoco and Cerro will share in those profits because they already cut a deal with AMC for 5% stakes each in AMC. Medinah’s exposure, I assume, would be de minimis UNTIL the option is exercised. Medinah still owns 15% of Nuoco’s 5% I believe.

I personally want Medinah to gain ACCESS TO CASH ASAP and buy back and cancel ridiculously priced shares while they’re ridiculously priced. If you’re looking at a perhaps 30 year dividend stream then you want to do all in your power to gain access to QUICK CASH and buy back and cancel cheap shares so that the entire 30 year stream of dividends will be much higher on a PER SHARE basis.

I’m assuming that AMC has a much longer time horizon than us weary Medinah shareholders. I’d be willing to swap out a percentage of the Medinah action on the long term assets (the porphyries) in exchange for more near term CASH in order to buy back that many more shares. This would “prime the pump” for future cash dividend flow.

Both Medinah and AMC have tons of leverage right now. AMC can put in $1 worth of work on the property and increase the NPV 10-fold during this 3 year period of EXCLUSIVITY they have. Once they slice up the pie with the big funders their leverage drops. With an $18 million market cap Medinah could THEORETICALLY raise $9 million quickly and buy back, demand delivery and cancel half of its shares if this nonstop selling were to continue. Although your first dividend might come a little bit later because of the cash being used to buy back and cancel shares the rest of the perhaps 30 years of dividends would be twice as large on a per share basis. This in turn would drive share prices up to a level at which the dividends would be generous but not insanely generous.

Gold moving up once again 1260

AMC has an updated project deck!

This is how I see it, cash is king, sooner rather than later. How Auryn came up with a $100 million option price escapes me. The ADL et al is not worth $100 million when they signed the deal nor is it worth it today. At its current state, it still in a nascent stage of exploration. The Gordon needs at least 100 core drill holes.

I don’t think it is correct to see AMC and Caren as a divy machine for quite a while. There is the initial cap ex and as it expands additonal cap ex which will be financed via profits. Obviously, as the mine expands, value is created, and some point free cash flow will be available for divy’s.

Just me, give me $50MM cash right now, a larger percent of AMC and let my AMC ownership get diluted if need be by not meeting cap ex cash calls.

Again, JMO, the sooner we wrap this up and get rid of BOD/Officers and just put in a legit trustee to manage the affairs, the better.

What do you mean? Thank you in advance.

I wish we owned part of that Company.

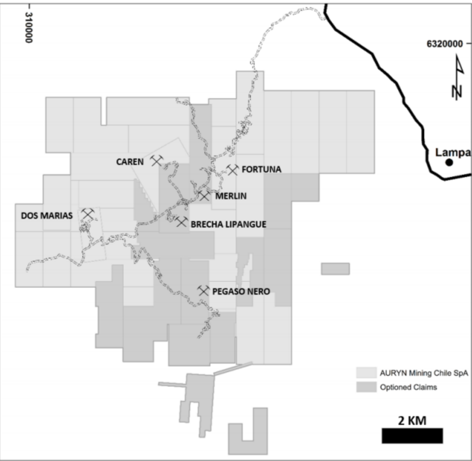

@cornhuskergold – showing proper claims now. AMC has 70% of the land. MDMN is only 30%. So those who say we’re getting an unfair deal are mistaken.

Also note that the MDMN ADL portion likely does not cover the entire porphyry. We need each other! The issue is only one company of the two companies actually a junior mining / exploration company. The other one just owns land. It’s time for the bride to get married – own a significant chunk of the land – and let our husband go out and get to work!

::: apologies in advanced to the modern women among us - the last comment wasn’t meant to be sexist, more just an old-fashioned metaphor :::

Thanks! It is nice to be able to observe the professionalism of the Auryn Team. I am anxious to see this option exercise completed.

right - but note the Caren is actually the box with MDMN claims laid on top and apparently with priority. They are showing the “top quarter of the square” or the 2nd triangle to the north of the MDMN claim on top of what was / is assumed to be a former NUOCO claim. It doesn’t matter at this point. The important part was that the rest of the Caren “square” does not have priority over the MDMN claims in the middle of the high grade gold. Now confirmed.

let’s move this thing forward