They still could use a proof reader, though!

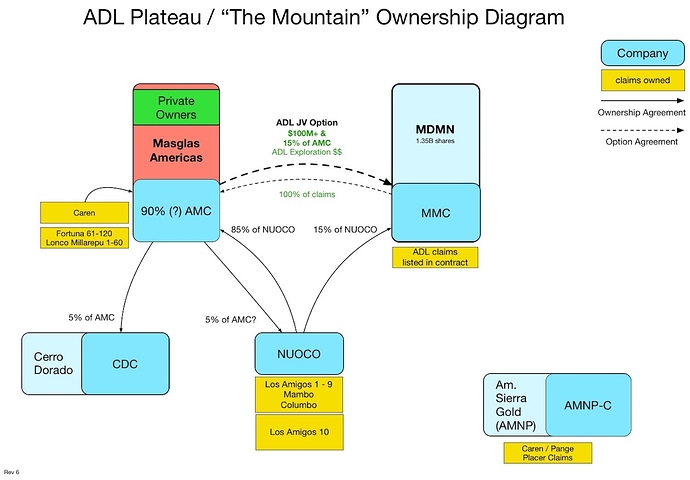

The contract spells out exactly what’s what. Right now we have 0% of AMC. We own 100% of the ADL properties listed in the contract. If AMC exercises the option they pay us $100 million and a 15% of the shares of AMC. We give them 100% of the ADL properties listed in the contract. It cannot be any clearer.

What is possibly now being negotiated is alternative possibilities to waiting for AMC to exercise the option.

You mean a proofreader, right?

I throw my vote in with yours. I would like to see MDMN hold out for $100 million dollars cash, or more, even if it takes us to summer of 2017 to get it. I was good with the three year contract a year and a half ago and I’m still good with it today. As long as Auryn continues spending money to develop/explore the Mountain it’s all free work being done on our behalf and the value of the Mountain will keep going up.

In reference to the the description of the 15% interest, please read the following MDMN updates:

8/1/14

9/17/15

2/1/16

2/25/16

It appears to me that we were going to get 15% of Auryn when the plan was for MDMN to acquire the 85% of NUOCO we did not already own. Now that Auryn has purchased the 85% directly we are back to a 15% interest in the ADL properties.

These updates show that our BOD makes clear distinctions between 15% of Auryn and 15% of ADL.

JMO

Since Wizard is probably tired of saying it I will help him out:

Read the contract. It is 100% perfectly clear. Post exercise, Auryn will have 100% of the ADL claims listed in the contract. MMC will have $100M and 15% of Auryn. 100% clear. Subject to change as part of the ongoing negotiations but perfectly clear.

MDMN’s updates are ambiguously and poorly written and do not and can not change the contract. Only a new agreement can change the old agreement / contract.

It is also 100% clear that management updates made clear distinctions between 15% interest in Auryn and 15% interest in ADL. The 2/1/16 update also clearly states that negotiations are ongoing, or is that just ambiguous and poorly written as well?

the quote is “while maintaining a 15% interest in production coming from their ADL properties” … Call it MDMN’s lie-sense and propensity to confuse with creative writing. What would make sense to me would be if they added the following: “while maintaining a 15% interest in production coming from their ADL properties through equity interest in AURYN” (which is actually 15% of AURYN’s shares).

I’d consider it a NIT, really … very roughly equivalent to when MDMN says “15% interest holder in the project” in the Feb 25 update (referring to MDMN’s interest in LDM/NUOCO). In the 9/17/15 update “MMC would earn a 15% Equity Interest in the Auryn Company’s capital structure” is again ambiguous in telling important details of the LDM/NUOCO acquisition that was mysteriously wrapped into MDMN’s 15%, at least that’s my take away. The original agreement simply stated that after payment of $100M in cash MDMN no longer owned the property of the ADL and “Medinah Mining Chile will retain a 15% ownership/equity interest in the properties” (now, including the LDM/NUOCO ) . The 2/1/16 update reports “an amalgamation of the NUOCO, Caren and CDCH interests on the ADL plateau occurred” … however details were not further clarified.

“What would make sense to me would be if they added the

following: “while maintaining a 15% interest in production coming from

their ADL properties through equity interest in AURYN” (which is

actually 15% of AURYN’s shares).”

But that’s not what they said!

You are right, we don’t have the contracts to examine the details. These are MDMN’s updates, not ADL/NUOCO making a news release, and CDCH was equally lacking contract details, but is now owned by AURYN. We don’t know exactly how these claims were compensated, or exactly how shareholders have a direct benefit, other than in anticipated share of production.

The distinctions are clear because they are real. It is also poorly written, but it’s not that difficult to follow. There are two different agreements.

NUOCO is a separate company from AMC and MDMN.

AMC owns 85% of the shares of NUOCO. MDMN owns 15% of the shares of NUOCO.

MDMN has its own land on the ADL. It owns 100% of that land. If AMC exercises the option it purchases 100% of that land for $100 million and 15% of the shares of AMC.

The option agreement between MDMN and AMC has nothing to do with NUOCO. MDMN still owns 15% of the shares of NUOCO and AMC still owns 85% of the shares of NUOCO regardless of whether or not the option agreement is executed or some other agreement is made.

Here is what I would like to see and that is for cash flow sooner that later and if that means cash flow from production so be it. MDMN price will change significantly after MDMN becomes cash flow positive. So why not let them go into production without exercising the purchase option as long as they give us a significant share of the immediate cash flow from production (including their other properties). Then that share will be reduced back to the original agreement, once they exercise the purchase option whether it is this year or some other year… I believe this would be a mutually beneficial alternative for both parties. JMO

why does this guy even have a key to this room? GET real! NO ONE WANTS TO WAIT NO ONE WANTS TO TRUST MDMN TO DO THE RIGHT HING. Auryn is the company to be in the quicker the better and if it would cost me half the front money SO BE IT! move forward with AURYN im tired of MDMN

We all are getting tired, and is costing us a lot money.

Some people just don`t get it.

I posted it on the blog a couple of weeks ago with a translation.

http://aurynblog.com/masglas-assumes-countercyclical-strategy/

Electronic version of the article.

http://aurynblog.com/wp-content/uploads/2016/03/Masglas_Article_2016-03-02.pdf

Original posts:

Silver just broke $16