I have mentioned Hecla’s new San Sebastian mine as an example of what could be done on the ADL with near term production. Hecla has announced preliminary Q1 production results. Can we draw some insight from the example?

NOTICE: This is not investment advice or such a suggestion. It is a real market example to be applied to MDMN

HL Summary: Hecla is one of the largest U.S. silver producers. They have been in business since the 1890’s. They are located in Idaho and their primary mine, the Lucky Friday, has been mined almost since that time. That mine will soon be producing ore from 8,000 ft below surface, yes, a mile and a half down. Hecla is finishing a $275M project to make a new deep shaft (#4) to get to that level.

They also had two other producing mines they bought in recent years, and just last fall they started up San Sebastian. HL has a market cap of about $1.2B coming off the very painful recent lows of the market.

San Sebastian History: This is so-far modest sized deposit of high grade veins very near surface. It is in Mexico. Hecla owns the property. They mined there about 10 to 15 years ago. Exploration in recent years found some very near surface veins of very high grade silver, 750 to 1000+ g/tonne! If you figure it out it’s in the same ball park of value per tonne as what 20 to 30 g/t gold would be (aka - similar to Merlin). There are no processing facilities at San Sebastian. The rock is dug up and driven to processing 45 to 60 min away as I recall.

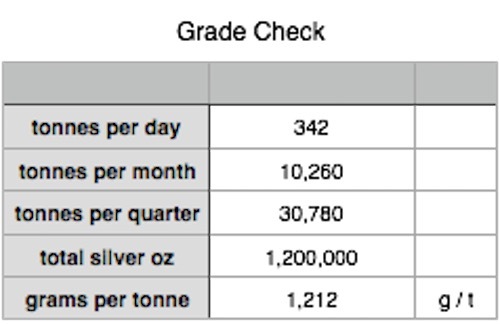

Hecla made a decision to go into production before there was even a formal resource report. They were able to start digging and hauling within 3 mos, with less than $6M in capital expenditure to produce ore at only 342 tonnes per day. The formal resource right now is very modest, about 300 KOz. They obviously believe / know there is more. First Dore was poured on Dec 22, 2015 only 4 months ago.

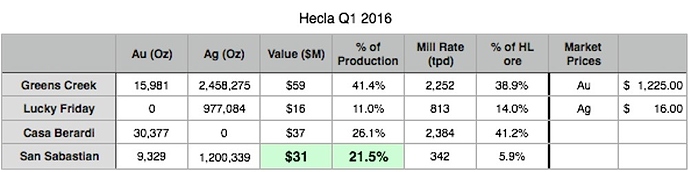

Q1 Results: So how did San Sebastian do in its first full quarter? Here is a comparison:

$31M in revenue with 342 tonnes per day after 3 months of prep work and $6M in expenditures! It’s over 20% of Hecla’s entire production for the quarter (in terms of dollars) and more than their 100 year old mine they just spent $275M on in capital rehabilitating. That’s what grade at surface does! Obviously profit will be whatever is after expenses, which I do not know at this point. Nevertheless, pretty impressive for such modest production.

That is a pretty real similar example. It’s not 100% completely the same, but it’s a good example.

Remember: 5000 tpm is about 167 tonnes per day. That’s the Caren mine only.

Chew on that for a while.

sanity check:

source data: http://seekingalpha.com/pr/16452404-hecla-reports-record-4_6-million-ounces-silver-55688-ounces-gold-production