I noticed the chat there as well and I believe it is much to do about nothing. The hope is that MDMN goes away and I believe the unpaid fees only amount to $500. fwiw

Most anything posted on IHUB concerning MDMN without a legit source or poster without an agenda is pretty much worthless dribble.

I stand corrected the total filing fees are $ 2,450.00 plus $60.00 for a new register agent since ours has resigned and these fees were due on 10,/31/2018. fwiw I see no big deal since the only penalty for filing late is a $175.00 late fee.

Calculate Annual List of Officer Fees for

MEDINAH MINERALS, INC.

| Item | Fee |

|---|---|

| Annual List (due 10/31/2018)File Annual List ONLINE File Offline | $ 1,775.00 |

| Annual List Late Fee | $ 75.00 |

| Business License (due 10/31/2018) | $ 500.00 |

| Business License Late Fee | $ 100.00 |

| Total | $ 2,450.00 |

| IF CHANGING REGISTERED AGENT NAME OR ADDRESS THERE IS AN ADDITIONAL $60.00 FEE. | |

| * These fees are current as of today’s date of 03/15/2019 07:16:24 AM but can change based on events occurring on future dates. The above fees assume that a State Business License Exemption does not apply. Exemptions from the State Business License may not be filed online. |

Note: Any annual list which is not in default which is received more than 90 days before its due date shall be deemed an amended list for the previous year. Filing of an amended list does not satisfy the annual list requirement for the year to which the due date is applicable. The fee for filing an amended list is the same as for filing an annual list.

![]() Click here to add optional extras…

Click here to add optional extras…

Return to Business Details for MEDINAH MINERALS, INC

Posted upon this earlier. I will try to put it to bed once and for all this time.

The failure to register the corp and pay fees to the state does NOT prevent the corp from doing business. It does NOT make checks invalid. It does NOT invalidate contracts. It does NOT prevent the corp from doing any business. It just eliminates the corporate protections from the shareholders, officers, and directors.

The only power any state has to collect their fees is holding a corp not in good standing. (ie: involuntary dissolution, deregistering, etc). So if you don’t pay the state fees, the states holds you not in good standing and involuntarily dissolves you. Otherwise every corp would only register once, and never pay an annual fees because the state had no enforcement mechanism over them.

The idiots on IHUB are spouting nonsense, again. Right now, I could “call” myself Acme, Inc. I could get a FEIN from the IRS electronically for Acme, Inc… I could open a bank account under ACME, Inc. I could sign a lease under ACME, Inc. I could enter a contract under Acme, Inc. I could conduct all business for Acme, Inc., ALL WITHOUT FILING A CORPORATE REGISTRATION IN ANY STATE!! I could do it, but I would be stupid to do it. In fact any of you could do it.

Corporations, LLC, etc. are legal fictions created under the law. The law treats a corporation, LLC, etc. as if it was a real person for the purposes of conducting business. Subsequently, all states passed laws which state to be a valid corporation, LLC, etc., you must register with the state and pay a fees.

The Courts have upheld these statutes as valid. So, initially, corporations started approx 1600 in England with private charters to monopolize territories with the East India Company. The did not require registration, but an act of parliament. As English common law developed, corporations morphed into more areas than just monopolies so they required registering the corporations to avoid duplication and confusion. Since, the states began prior to federal law, and each state based its laws upon the English common law, each state required the registering of corporations, LLC, etc. for the same reason. This then carried over to when we formed as the good ol’ US of A.

The purpose of a corporation is to allow a group of real people to pool their resources to conduct business under one entity, the corp. Doing so, the law treats the corp as a real person for civil purposes (remember if you commit a crime you do so as an individual and corps held criminally responsible do so based upon the acts of the individual director/officer), allow the corp to conduct business, contract, sue, etc. all as the corp (as if a real person). In exchange, the law protects the shareholders, directors, and officers from personal liability for the acts of the corporation. So when I sue Acme, Inc. and I will a judgement against Acme, Inc. for $100, I cannot file a non-wage garnishment against the shareholder, director, or officers personal bank account to collect my $100. I only can collect form corp assets. I posted in detail before about this, so I will only summarize, but they only time you may hold a director or officer personally responsible for corporate act occurs when the director or officer commits any fraud or intentional tort and its really tough to prove unless you have smoking gun evidence. I have never heard of a case where shareholders have responsibility for corporate acts because they have no control over the day-to-day operations of the corp.

Therefore, if I begin a corp without registering it in any state or I let my registration lapse, I can act as if I was a corp every single day until I die. I can take loans, do business, file taxes, etc. etc., etc. But if someone sues me for a corporate act. For example, the corp bounces a check for $1000. I HAVE NO CORPORATE PROTECTIONS AND I AM PERSONALLY RESPONSIBLE FOR THE BOUNCED CHECK. THAT’S IT. NOTHING ELSE BAD HAPPENS TO ME!

Regarding MDMN, since they are currently not in good standing, if someone sues MDMN for a corp act (bad check, bad contract, improper share distribution, etc.) AND secures a judgment against MDMN then they can collect that judgment from any MDMN director or officer.

Sorry for the long post, but we need to put this bullshit to bed.

I am well aware of the facts in your post and maybe it would be helpful to share over on ihub

NP, don’t know who else reading posts. Found IHub a total waste of time. Better things to do than deal with them. Anyone can repost me there, if they want.

They may have let the registration lapse becasue the knew all assets were going to be transfered out of the corporation, and they wanted to save the fees. I have used that technique in the past. After a certain period of time the corporation is automatically dissolved by the state. If everything is transfered to Auryn who cares if MDMN is in good standing.

Administrative dissolution does not “count” for tax purposes - if a tax return is not filed, then penalties/interest accrue.

I would imagine that once we get new shares in AMC and the MDMN shell is no longer needed, our guys will first reinstate MDMN with the State of Nevada Secretary of State and then file the appropriate application to dissolve, after which a FINAL tax return will be due.

dont waste your time with scum

I have no idea what your talking about. Admistrative dissolution and filing requirments for a tax return are completly different issues.

Filing requirements for a tax return occur if you have business income or expenses. When your no longer have income or expenses you simply file a final return, mark the final box, and file form 966.

You can file paper work at the state level to dissolve the legal entity, which normally requires fees. You can accomplish the same thing, dissolving the corporation, by simply quit filing the annual reports and the state automatically does an adminstative dissouution.

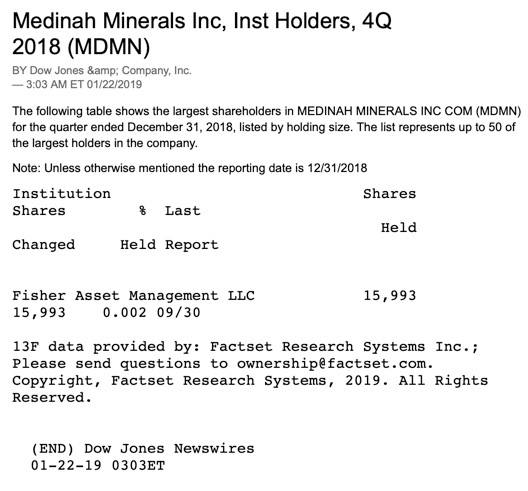

this showed up last month on the news blur by the quote.

$32?

Most of us own more shares than these so called institutions, but I am glad to see the selling has stop and the buying has began, fwiw.

Is anyone swing trading Medinah here…there are some big % swings up and down.

No volume.

It has been about 3 weeks since the Auryn reps at the PDAC convention told Baldy that the issuance/consolidation was just a few days away. Are we EVER going to believe anything they have to say? It just NEVER ends…

Kevin Tupper’s opinion was by end of 1st quarter 19 I believe and BE reported he heard shares out in a few days at PDAC a few weeks ago.

That could have meant MDMN gets shares to distribute?

There is a signed exploration JV so that is a positive.

MDMN will go away and can’t be soon enough as long as we get Auryn shares.

This is the last week of 1st quarter 19 so something better break here.

There is a little voice in my head that keeps saying be weary due to LP and JJ walking free after stealing millions from us and the family circle some are still in.

Meeting MC, KT and Goodin in Vegas gave me the impression theyre solid and this is legit but would take time. Hope my instincts were correct.

The whole LP, JJ story should end up on American Greed show!!

I’ve waited over a decade for this POS to come through and still waiting to get screwed in a new way. It’s because of this POS stock I don’t trade any more.

Geoly, I rarely post to this forum, but read almost daily. I find myself in the same boat (as many others)…over a decade of ups and downs, anxiety, anger and at times excited. Either we are being bamboozled again or their is a master plan. That is a 50/50 odds, where with previous management it was less than those odds and had to endure the lies, deceit and false promises. Les, JJ, et al are gone and a new chapter begun. I remain hopeful and will not budge because if this ship ever takes off, I want to be in it. Fingers crossed, Good luck to us all.

I believe there is a new day coming and it is simply struggling to make its appearance over the horizon.

First Auryn does now have its first real contract with a real major player on a piece of the property. Second Les and JJ for the most part are gone and for all purposes in the rear view mirror, except for some nuisance lawsuits. . Third is what I am mostly waiting for and that is the sun setting on MDMN and the new day arising as AUMC. Also I believe the commodity markets including gold and silver are on the brink of heating up big time over the next 12-24 months. So it is possible that we are not too far away from that new day arising in comparison to how long we have already waited. JMO

We are awaiting the annual report that is expected.

Having a real contract is definitely a good thing. As announced December 12, 2018:

The contract was finalized after Hochschild completed its due diligence on the Las Dos Marias project (“LDM”). The terms of the agreement remain as previously announced upon the signing of the binding Letter of Intent. Hochschild has an option to invest US$7,000,000.00 into the LDM project over a 5-year period to earn a 51% joint venture interest in the LDM properties. An option to invest an additional US$23,000,000.00 is available to Hochschild to gain an additional 9% interest. If all US$30,000,000.00 is invested, Hochschild will own 60% of the LDM project with AURYN holding the remaining 40% as a joint venture partner.

Because Hochschild is extremely important at this stage of moving forward I’d like to emphasize some information on this potential partner. Hochschild has a strong balance sheet and is capable of fulfilling the option, including the $23M closer payment within the time-frame in the contract. On a Hochschild chart the 50 MA is approaching and ready to cross the 200 MA.

Seeing that Hochschild is performing on it’s producing projects it is encouraging that things may also be progressing on the LDM. Hochschild methodically develops and budgets several greenfield projects each year. They have several options for projects in the $5M dollar range. Hochschild is only interested in projects that they have a controlling interest in. Compared to other typical early-stage greenfield projects, the LDM option looks promising. As pertains to the LDM, Hochschild is looking for the best mix of good geological potential and permitting. Optimistically, LDM will prove out to meet expected standards for successfully completing the option for the full $30M.

Hochschild’s Full Year 2018 Earnings Call was mostly for results on their producing projects in 2018.

… A dividend of $1.959 per share, which is equivalent to $10 million for a full year payment of $20 million compared to $17 million in 2017 was paid. So that’s also a positive increase of around 20% year-on-year. Those here that may be interested can learn much from the reading a very long, but detailed Earnings Call transcript.

The cashflow in 2018 was positive. They mention that greenfield exploration will be an important part of their strategy, however brownfield projects have priority. The guidance for exploration for 2019 mentions $10 million for greenfield plus $27 million for brownfield. As stated by others on this forum, the Las Dos Maria is quite far from becoming a brownfield project. Hochschild believes that they offer very attractive optionality in greenfield early-stage projects, including interesting projects in Peru, Chile and Nevada.

Many questions have been raised on this forum. What new progress is revealed in the upcoming Annual Report may not provide the answers shareholders are looking for. The report will cover events for calendar year 2018 and likely will leave the announcing of material events in the current quarter to PRs.