I watch the futures market on my trading software.

Gold has broken 1500

Its becoming a great time to own mining claims with the size and potential that Auryn owns. As the metals continue to soar, the majors will be looking to replace their stockpiles of cash (inflated currencies) for a better investment, that is more mining claims. Auryn seems to have timed this out perfectly, which they mentioned on several occasions, by capitalizing on the downturn in metals because they believed the upswing was on the horizon.

As Baldy said before, it has been a long bear market for this sector. Now it has been given a huge jolt. I expect JV activity to pick up vigorously in the industry.

Not so much the mining claims…they have basically 3 non-producing mines. The LDM, Caren, Lampa. Got to believe they have very profitable ore just waiting to be mined at current prices. Suddenly producing truck loads of bonanza grade ore sure would stir things up a bit!

You might recall what they posted on December 12, 2018:

“We wish everyone a joyous holiday season and look forward to the possibilities for 2019, including advancement of the Hochschild JV, drilling activities on the mountain, and possible production from the Lampa / Lo Amarillo and Larissa / Merlin targets.”

Of those forward looking statements, the only one that we know that they have been able to meet is the advancement on the Hochschild JV.

I think there is an excellent chance that drilling will commence as early as October so they will probably meet that one.

As for any production this year; who knows?

isn’t the ADL potentially more valuable as a copper poryphry?

Mike, do you think we will hear news of mining activities before the restriction is lifted or after?

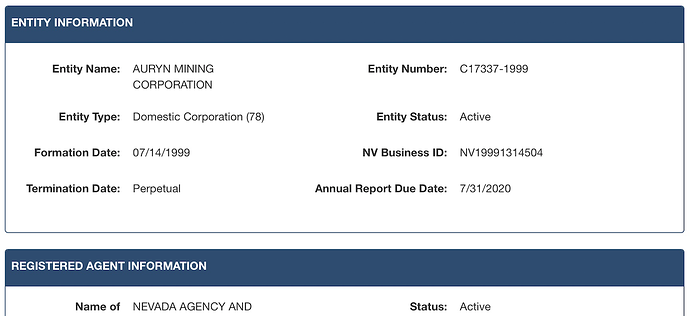

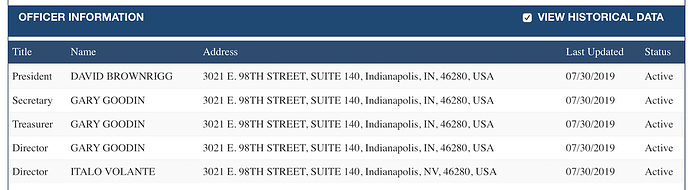

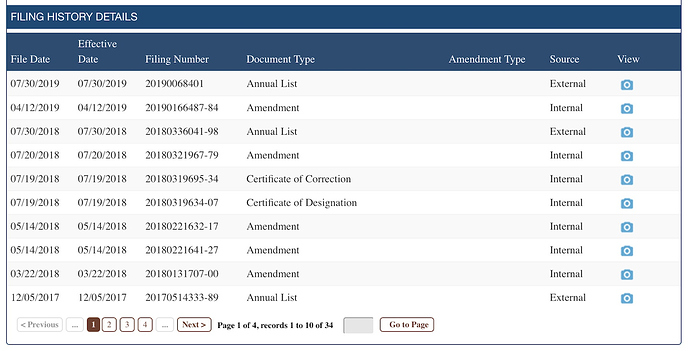

Interesting, formation date July 14, 1999. Can someone tell me how this was formed in 1999 when AUMC only became involved with us a few years ago? IMO, this is a name change. Would have to look through all the filings and find out. Goodin and Brownrigg are also on AUMC BOD. IMO this company does not have anything to do with AUMC, yet. Don’t know quite what they are doing with it.

Cerro was formed then if I recall correctly. That is probably where the 1999 came in.

Ah, if that’s so, I stand corrected. It does have something to do with AUMC.

Hi Folks. New chart update on the Other (non - mining) Stocks forum. Whatever I post I’ll put there from now on.

Some news on these claims would be welcomed. Maybe that will not happen until the share restriction is lifted and full promotion will be under way

From last December Release

We continue to work on the Larissa and Merlin claims and are finishing the chimneys and exit routes. Once approval has been given, we will make a new cut on level 3 to intercept the high-grade ore vein uncovered in a new tunnel found between levels 2 and 3.

Back of the envelope figures for the free float after conversion are difficult to arrive at. The entire 3.5M that are free trading shares of the stock are all from CDCH after conversion. Less than 90K total shares (<3% of float) of this 3.5M of AUMC have traded during all of the past year. The stock is indeed tightly held.

After conversion of MDMN (the major asset to be converted to AUMC) there will be roughly 9.584M AUMC shares (23% of 1,652,420,000 X 0.0058) needed to be transferred to individual shareholders’ brokerage accounts. It is unknown how many 10% holders there are with restricted shares. That leaves approx. 56,916,000 restricted shares assigned to AURYN mining Chile, SpA (AURYN).

The majority of the AURYN mining Chile, SpA (AURYN’s shares) are 10% holders (primarily Maurizio or affiliates) and thus restricted. The maximum total free float after conversion should be considerably less than 70M, and likely less than 25M. It would make little sense to release more than the minimum information required to remain current with the OTC before this conversion takes place. Promotion before conversion and before news of progress worthy of promotion is unlikely to occur.

That is my current perspective of where we are at on AUMC as an investment.

Nobody can have confidence in the future of this stock until after the future conversion is accomplished. AUMC shares must be distributed into individual brokerage accounts at this time of conversion and additional positive news is necessary to drive PPS upwards. Good progress reported, accompanied by promotion is a prerequisite if shareholders are to profit. How much longer will this take? Look at other mining plays and compare. Over the past several years there are quite a few other PM mining plays where money was better invested other than this one.

December 14 of 2015 CDCH there were trades as low as 0.300 (or equivalent to 0.003 in current AUMC terms). Yes, the CDCH float back then was much less than the 350M shares that were present when CDCH was converted into AUMC. However, CDCH shares only represent 5% of the total authorized share count today. This same day, December 14 of 2015, MDMN traded at 0.012 (or equivalent to 0.00007 in current AUMC terms). Follow all the news and revelations since that time. The charts reveal a lot, but they do not tell the whole story. Bottom line, the charts say shareholders have lost miserably, but just maybe 0.50 is not all that bad for AUMC (CDCH) today. The value of mineral deposits in the ADL claims once proven haven’t changed since, if anything they have increased by expansion of the claims comprising the ADL. We know much more as shareholders than we did in 2015. News of progress, however, is very sparse.

Charts are often useful to assist in determining price moves. The chart shown above is primarily a chart for movements in CDCH, up until Dec of 2017. That is when a total share count of the three entities (CDCH, MDMN and AURYN mining Chile, SpA) was reduced from approximately 3B to 70M AUMC with AURYN mining Chile having approximately 72% of all 70M shares. Thereafter, the chart reflects a much different entity, the combined value of CDCH, MDMN and AURYN private). The reduction of total shares had a much different behavior than would be useful for guiding trading as only 3.5M are free trading. Most free trading shares are tightly held, and there is minimal useful information upon which to trade without news and promotion. It is not useful therefore in predicting present price moves in AUMC. This is presently a highly speculative stock, which has no firm timelines for progress, other than a 5 year option agreement with Hochschild Mining PLC.

The chart does show much other useful information if one cares to delve into the movements based mostly on announced news and events. Shown on the monthly chart above, there has been a mostly positive CHF accompanied by a slow, but methodical, accumulation (Aug of last year thru July of this year). This correlates with what is shown on the monthly chart as a “sell off” with declining PPS during the same time period. Money flow is actually starting to turn positive as many shareholders sell at a loss. The usual annual end of the year sell off during 2015 is well demonstrated, especially after the somewhat disappointing progress until early 2016 announcements of high grade gold discoveries in the Caren Mine and positive environmental surveys at Carlin-Merlin-Fortuna areas. Check all the old announcements and you will see movement in the PPS, which correlates with positive news and the lack of news. This is vastly different than a monthly chart for MDMN over the same time period. Compare to the monthly chart for MDMN shown below.

Taking this one step further, I mentioned figures for the lows reached in December of 2015. If one were to look back at the highs over the lifespan of these stocks I wondered what present prices could be reached if the two stocks (not all three combined) reached their previous highs. 5% of the $27 would be worth $1.35 and 23% of MDMN’s valuation after conversion from the high of $0.19 using this guide would not be appropriate because of the unknown massive dilution and fraud, but would be quite low. Not saying this is realistic, but there is presently no appropriate way to value this stock other than the market. Even though there is significant information known about the mineralization on the ADL, it has a long timeline until full monetization can possibly be reached, if at all. Could this stock see a very appreciable gain in the next couple of years? Possibly, but there are much better investments in the PM space at the present time.

Gold pushing up over 1510 bringing more value to our property.

Come on MC whatcha got for updates on the ALTO

This is really all we can hope for. Timed event? I hope. I have thought about moving to something with better potential. My cost in is too high.

Gold to $2000+ can maybe save me.

- I thinks it’s coming.

TDK

There appears to be strong resistance for Gold at 1525, if it can break and hold through that resistance I believe gold can get to 1725 in the next 6 to 12 months and 1650 in the next 3 months. At least that is the general consensus from what I have been reading.

Market Nuggets

De-Dollarization To Boost Gold Price Rally: SP Angel

Anna Golubova Tuesday August 13, 2019 08:42

Kitco News

Share this article:

Gold prices are likely to receive a boost from de-dollarization, say SP Angel analysts. “The recent increase in gold prices may be set to continue on the strength of a global push for de-dollarization,” according to the analysts. More specifically, countries like Russia and China are looking to move away from the U.S. dollar. “Countries increasingly hostile to the U.S. and dollar hegemony, such as Russia and China, are searching for alternatives to the dollar including gold,” the analysts add. “According to the World Gold Council, central banks purchased 70% more gold in Q1 of this year than during the same period last year, the most gold bought since Q1 2013.”

Auryn quarterly report is out:

https://www.otcmarkets.com/stock/AUMC/disclosure

I didn’t spot anything new. Still no revenues and no material changes to anything. At least no new shares issued either.

Thanks Mike!