The only thing I noticed worth mentioning is that they are writing down their investment in the mining assets of $53.2M to $47.6M or a reduction of $5.6M. It appears they are amortizing the investment by $2.8 M per qtr.

It is typical for mining assets to move up and down in value on the balance sheet on the basis of PM prices. I would guess that the value will move up in the next report with the recent rise in POG.

Dos Marias now appears in the latest Hochschild corporate presentation under greenfield exploration:

http://www.hochschildmining.com/resources/1514/1F_INTERIM%20RESULTS_FINAL.pdf

see Slide 18. No information given but placed on the map

The project also appeared in at least a couple of places late last year in Spanish press:

https://proactivo.com.pe/proyecto-las-dos-marias-hochschild-y-auryn-alistan-perforaciones-en-chile/

http://www.economiaynegocios.cl/noticias/noticias.asp?id=498293

I haven’t really checked in for a while paying attention to other things.

I find most interesting the fact that Caren did not even receive mention in July and activity at Fortuna has taken more of a position out front. It has been a long time since any real progress on the Caren has been reported. The chimney issue has been the only thing really mentioned for almost 2 years now.

Perhaps this turned into a more expensive item? Perhaps it turned out to be more complicated in terms of permitting than expected? It seems to me that a calculation must have been made that it may be easier to get some early quick gold revenue from Fortuna than the Caren. Since there is so little information though there isn’t much to do but wait. The POG will help this move forward though IMO.

That is exactly what I would expect, but they specifically stated they are amortizing it at a rate of 2.8m per quarter. I assume that is ongoing.

During January 2018 Cerro Dorado, Inc entered into an asset purchase agreement

with this Chile based mining company to acquire mining concessions in exchange for

6,650,000,000 (six billion, six hundred fifty million) shares of common stock of Cerro

Dorado, Inc. and the return of its 5,000,000 shares of the Chile based mining company.

Amortization expense for the six months June 30, 2019 and 2018 was $2,800,000 and

$2,800,000, respectively.

As of June 30, 2019 and 2018 the mining concessions are reported at $47,600,000

and $53,200,000, respectively

BTW it is good to hear from you, it seems like a long time!

My broker just returned my MDMN shares in cert form. Charged me $500 by the DTC for the return. Never notified by mail, email or phone call that it was being done. Is the charge typical or should I fight to get the money back? Account only had the shares and $495 in cash so no other leverage like loosing my business.

What Broker?

Gold moving up again

Come on MC gives us some August News!

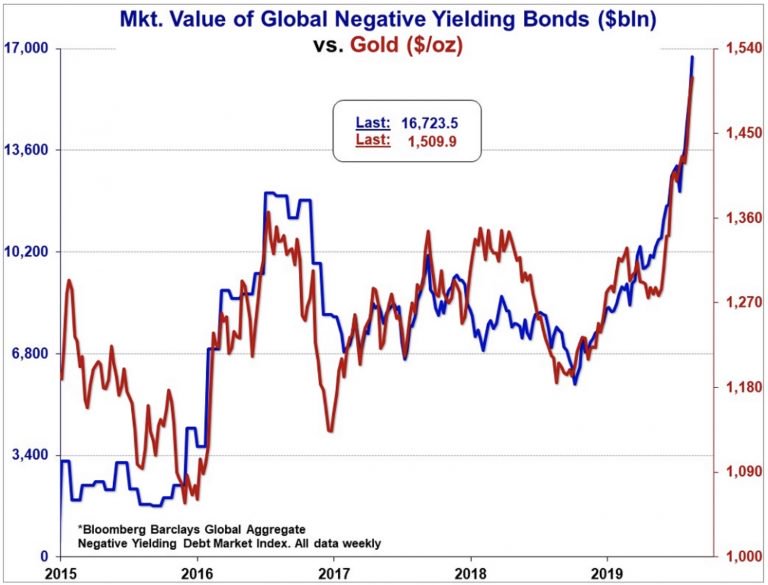

Only a week to go… can we be so lucky on perfect timing of global debt vs the gold price.

We know debt is not going to drop.

Where would gold be if Bitcoin did not exist or they kill it? Why I won’t touch Bitcoin.

TDK

August has been a good month for updates. Last year we were told Hochschild signed a LOI for the LDM. This year who knows, but with the price of gold going up I hope this gets things going for our investment. Also my birthday is on Wednesday and what better way to get a birthday present from Auryn.

With our luck, gold will hit 5,000.00 and our guys will do nothing to move things along, then it will go back down and then they will decide to get with it. I wonder how long it takes to interpret an IP survey?

And just like that gold is up to start the week. Silver moving up as well.

Yea, like last time

Hermann Herald

Medinah Minerals Inc (MDMN) shares might have a significant move ahead as the Mass Index volatility reading has dropped below 26.5. Mass Index …|

Gold moving up 1540 along with Silver breaking 18.00

Hope our guys are seeing this and get this going. Mining season is here!

I gotta opine here that it has almost been three years since that watershed Oct 1, 2016, shareholder meeting in Las Vegas. My personal read is that everything here and now at least feels real. We survivors own a highly speculative stock with a totally uncertain outcome ahead: it seems that anything might happen with MDMN during the next couple of years or decades, anything. And whether we feel as though we get enough information about this stock or not, when I compare this period to the period prior to that Oct 2016 meeting, well, that period, in comparison, felt like a total daily s**tshow — one day we were all on the cusp of — kaboom — being transformed into multi-millionaires (those of us who weren’t already), and the next day people were tumbling down back stairways while trying to sneak out of the hotel and avoid going to prison, etc… Rinse and repeat…

A bunch of us are already dead. The rest of us are inexorably headed that way. Me here, eight years in, looking down the barrel of 70 years old (with my $125k cold-cash bet transformed into $3,834.56 at close of market — up $400 on the day!)… If I can’t laugh about this now, well, when can I?

There’s my take.

— madmen (Brad)

I continue to ponder with all the favorable mining companies that will ride this wave.

Why hold this piece of crap?

- No news

- No movement.

Just as earlier post. I am in for $50k, sitting at $2000. Not nearly as bad but same boat.

TDK

My favorite part of this article is :

"In terms of moving averages for Medinah Minerals Inc (MDMN), the 200-day is currently at 0.00, the 50-day is 0.00, and the 7-day is resting at 0.00."

LOL

Understandably MDMN has frustrated all shareholders and driven a few completely coo- coo! It doesn’t take much to see MDMN is not a trading stock. After share conversion to unrestricted status, and distribution to individual brokerage accounts, there will be an opportunity to become a speculative stock again. Speculative in the sense that real news of progress and positive developments are occurring; that will be the game changer. When this occurs shareholders will have something to base speculation on and the market will be the determining factor.

Sorry if I missed this. Is there a date that the share conversion has to take place by or are we in limbo on that indefinitely?