Pegaso Nero news? There has been no news other than the mention at the Informational Meeting:

CHG posted this as reported at the meeting:

Continuing the discussion from October 1st, 2016 Informational Meeting News:

The Alto de Lipangue property is too large to develop without bringing in partners, IMO:

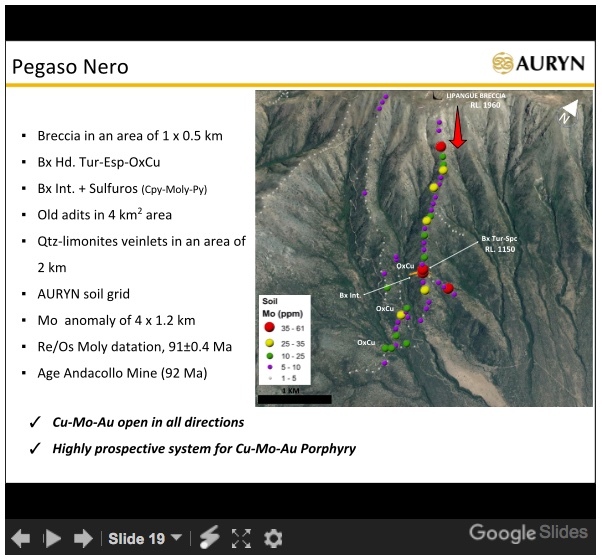

For now, the Pegaso Nero is an exploration target.