Maybe our sale price for Nuoco for only 1% additional was in order to meet MDMN’s cash call, that is we are required to make a cash call! I guess this is wishful thinking!

Just hope,it’s not another problem on our shoulders,we have enough as it is now, where’s the update on production?

Questions and answers submitted to From-the-CEO…

Answers inline.

Sincerely,

Kevin Tupper

President & CEO

MEDINAH Minerals, Inc.

On Fri, Mar 10, 2017 at 9:54 AM, Hurricane Rick wrote:

Regarding the recent announcement from Auryn related to a potential cash call by current investors, can you answer the following please?..

- Previously it appeared that MASGLAS was financing operations for Auryn until they became cash flow positive. Was this part of a contractual obligation between MASGLAS and Auryn?

Medinah like the public was informed that Masglas would be funding the initial development costs for Auryn until July 2017. It is not our understanding that this is a contractual obligation, and that never has been our understanding.

- When did this arrangement change to include other investors such as Medinah to be responsible for financing Auryn’s operations when previously it appeared Medinah had a passive role as an Auryn investor?

Medinah is a shareholder in a private company, Auryn. It operates no differently than any other private company. When cash needs to be raised, generally speaking, the company goes to its owners first. If the owners choose not to participate, the are diluted. Auryn operates no differently.

- Assuming Medinah is responsible for 27.5% of the cash call obligations, does that include previous expenses paid for by MASGLAS to Auryn or does it just apply to the upcoming increase to operating capital?

It applies to any expenses incurred from when Medinah became a shareholder. Masglas was loaning Auryn money for operations. All Auryn shareholders are responsible for that debt, pro-rata.

- If a cash call is necessary, what options are available to Medinah in order to meet its pro rata share of this financial obligation?

Still to-be-determined.

Is this how the defrauded financial backers of AURYN decided to be paid back their losses from having bought into the diluted share base at inflated prices? How does this effect our ongoing litigations with Les Price, Pamela Fitzpatrick, MMC Mines, GXK Ventures, et al. ?

posted on Medinah’s From the CEO

Chile Trip Report – Feb 2017

The actions of Medinah’s prior management placed our entire company at great risk and we are relying on Auryn’s goodwill and support to help us correct various deficiencies. For example, prior management signed an option agreement with Auryn which stated that Medinah would not issue over 1.5 billion shares while that agreement was in force. Based on this understanding, Auryn investors purchased significant amounts of Medinah stock. These investors were rightly disappointed to learn that the actual number of shares outstanding had routinely been misreported and was in fact greater than the stipulated cap when the agreement was signed, even though at least one Medinah representative who signed the agreement was fully aware of the violation.

Auryn understands that the common shareholders of Medinah are not responsible for this action. And like the common shareholder, Auryn’s financial backers who bought shares in Medinah have also suffered significant losses due to the actions of Medinah’s prior management. To date, Auryn has not pressed its position as one of the defrauded parties and is letting Medinah’s current management work to rectify the situation in a manner that produces the best outcome for all the common shareholders. I expect that Auryn’s position will remain this way if Medinah’s current management continues along path we have set out – resolve uncertainties and clean the company up. However, I have no assurances from Auryn in this regard. They are not dictating our path and I do believe they want to see the common shareholders salvage what is possible from their investment.

Sorry to say it appears shareholders of MDMN and CDCH have been misled, and backed into a corner once again, primarily by the actions of Les Price. As Thomas Paine said so many years ago, “These are the times that try men’s souls.”

I think you are over reacting.

I don’t think MASGLAS has goals that are perfectly aligned with Medinah’s best interests at this time. I’d be pleasantly surprised to find I am wrong with this apprehension.

“It’s tough to make predictions, especially about the future” -Yogi Berra

![]()

Auryn since you are asking for cash why don’t you tell us what has been done on the mountain for the past 11/2 months?? Where is the cash from the ore that was shipped?, etc…

Here is a thought, maybe not practical, but what if MDMN is willing to allow MDMN shareholders at their options to put up funds for the cash call in return for shares in Auryn directly to those shareholders! It could be done on some proportional basis. ( yes I know we still have the issue of the fraudulent shares) I would go for that, because in the end that is what we are going to get! This especially make sense since MDMN is basically a trust at this point for ownership in Auryn.

A “capital call” is something that is issued in private equity.

A “rights offering” is something that is issued in public equity.

This news, in the absence of details, is very poor IR/PR in my opinion.

Anybody working under the delusion that we weren’t going to be facing further dilution isn’t following the bouncing ball but I’m surprised that Auryn didn’t simply pursue a financing. This may be the first sign that they are taking advantage of MDMN’s lack of liquidity. Hard to say until we know the details. My guess is that they are pursuing the “capital call” route b/c they know they won’t get the valuation they are looking for on the raise. In other words, it might be tough for them to raise money at a $50M to $100M valuation. A capital call is bizarre but might be their only option to not have to raise money at a perceived discount. This goes back to my point that MDMN is fairly valued today.

Even Decosta seems to have abandoned in his insistence of imminent dividends. If you are invested here and not willing to exercise considerable patience, this ain’t the right stock for you. IMHO

Hulkster. Do you have any idea what 20t of 11gpt ore is worth? About the same as a night out with the family for dinner and a movie. More likely, they will lose money in the first 20-30 trucks as Enamu gains a better understanding for the metallurgy/recovery/loss from humidity/water weight/etc, etc…most mines engaged in toll milling dont turn a profit until there is more significant volume. We aren’t even close to that. FWIW

4000000 for sale @ .0067

Hoping for a contractual exclusion to a cash call for Medinah as was announced back in May of last year:

Medinah Minerals, Inc. Announces Completion of Sales Agreement with AURYN Mining Chile, SpA.

AURYN assumes all rights, responsibilities, costs and liabilities of the entire Altos de Lipangue Project. All previous Option Agreement contracts and addendums between the parties have been cancelled.

http://www.otcmarkets.com/stock/MDMN/news/Medinah-Minerals--Inc--Announces-Completion-of-Sales-Agreement-with-AURYN-Mining-Chile--SpA-?id=131937&b=y

Something will need to be worked out to hold AURYN to this approved release of information. Perhaps with the input from Dr. Jannas the best strategy for expanding and developing the project was decided to move forward immediately to show as much value and potential value to the projects prior to an F-1 application. Time is short if AURYN intends to bring an IPO out before the end of the year. If CDCH has similar wording in their contract a cash call will provide funds to move exploitation forward at the fastest pace possible with minimal harm to current shareholders in both MDMN and CDCH.[quote=“Hurricane_Rick, post:878, topic:1735”]

I don’t think we should expect to hear anything from Medinah until after the March 15 meeting since nothing has been decided yet.

[/quote]

I agree, at this point it’s just a wait and see.

what wait and see? see above conversation. I think it is pretty clear, not in terms of dilution amount but for sure we will have dilution. Don’t you think?

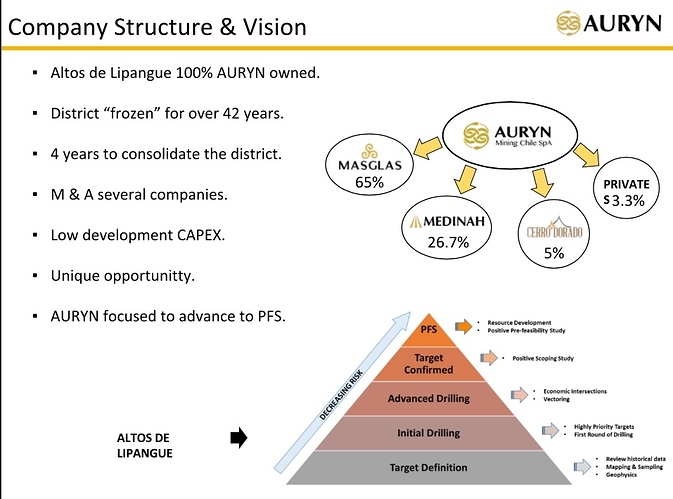

We have yet to see the actual contracts that transferred claim titles from MDMN and CDCH to AURYN. All we (shareholders) know is that both MDMN and CDCH have equity interest in AURYN based on the original issuance of 100 Million shares in AURYN, a private company. CDCH received a certificate for 5 million shares, MDMN received a certificate for 25 million shares at the time of transfer.

News yesterday from Auryn didn’t hit well with investors including myself as there is now 3.5 million shares @ .006 with another 4 million @ .0067

Now MDMN will have 27.5 million shares of Auryn with the recent sale of the Nuoco Mdmn stake.

The even took out the percentage of what each entity had in Auryn. Wasn’t there certain percentage of private investors? Nuoco? Does anyone have a copy of the old Auryn about page.? They didn’t hesitate to remove it very quickly today.

So is Les and JJ a part of the 5%? Are they going to attend the meeting?

Good question. I doubt Les will attend a cash call shareholder meeting. If Les has AURYN shares I expect they would not be excluded from a claw back in an unpaid cash call. I’d love to see him fight that in court with AURYN! ![]()

Greg returned 1,706,000 shares in AURYN Mining Chile SpA derived from his ownership in the NUOCO. I believe the current private ownership of AURYN is about 3.3 million. The sale of MDMN’s 15% of NUOCO brings Medinah’s total interest in AURYN to 27,469,000 shares or 27.5% interest.