Thanks Rick I do appreciate it!

That $100M payment should have included $X upon signing (even if it was $50G). When that didn’t happen alarm bells were ringing. It’s just that we were deafened by Les’ bovine feces !

Weren’t the Letts originally involved with the $100M and after vacating Auryn, Mauruzio stepped in and restructured through increased Auryn ownership for mdmn.

I would imagine Letts attempted to cap the share issuance and upon sniffing out Les’s fraud, vacated quickly

I believe this is the point where Kevin referred to as we could have gone away but Mauruzio stepped in and through restructure of deal, put us back in the game

Les, you are a real piece of work and hope you like really hot places with lots of bad souls

We are at the end of March, how’s the production going ? Would be nice to know how things are going , an update would be greatly appreciate.

I wonder how Les is coming on retaining Ori Kowarsky

When I read that “Our practice includes a strong component of entertainment”, it did in deed make me laugh!!

Maybe they represent more than one clown.

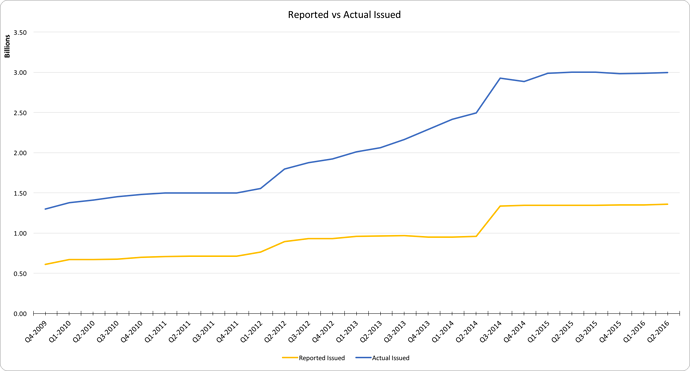

Heavy issuance of shares about the time AURYN came in the picture and put a Cap on the shares.

Thank you newleaf!

Here is the agreement with AURYN.

Aug 1, 2014. Medinah was already over 2.5 Billion issued at the time of the original agreement. Management knowingly signed an agreement that they were in violation of. The penalties would have bankrupted us.

The only reason Medinah is in existence today is because friends of Auryn bought hundreds of millions of shares based on the agreement thinking that the public reports were accurate. They have chosen to try and recoup some of that money. The alternative would be devastating for Medinah. Anyone who thinks otherwise or thinks Medinah would have been better off had we not done a deal with Auryn is delusional.

I think there is a good deal of value in this comment, and it serves to inform about the history of MDMN’s various “deals”.

The deals with Partner A, then Amarant, and finally Auryn had one thing in common: non-industry standard, overly rich terms from the standpoint of the seller. The reason this happened was because Les used the terms to prop the stock up so he and his cronies could sell millions upon millions of shares of stock into a market hyped by the promise of riches. The deal with Partner A happened right at the end of the bull market in commodities so might have had a touch of reality about it; the others were complete BS. Les’s scheme came to an end when the MDMN board, hand-picked by Les for their collective ignorance and indifference, actually renegotiated the deal with Auryn. Les expected Maurizio to walk away, but Maurizio had enough guts and gumption (and, perhaps, insight into the mountain) to stay put and renegotiate. The unveiling of the scheme was only a matter of time from that point on. The deal with Okanadian was Les’s attempt to put the company out of business forever (Okanadian would have owned 95% and screwed us out of the rest) so his tracks (the sale of the bogus shares) would have been hidden forever.

I expect Auryn stayed also because Maurizio has enticed friends and families to invest in MDMN before the fraud was revealed. It also explains why he chose beneficence when dealing with MDMN over the cash call. No bottom-line driven dealmaker would ever lend a borrower money when repayment was contingent upon the results of the lenders endeavor. The only reason for all this “kindness” is it is in Maurizio’s greater interest because he has so many associates/families/friend invested in the fraud.

Which brings me to my last point: I urge all of you, whether invested in MDMN for a long or short time, to understand that you bought into a fraud pure and simple. It is only by dint of luck (Goodin was not looking to expose a fraud when he called Patrick Day; Les could not be reached and Gary needed a number and Patrick answered the question) and because Maurizio hung in there that MDMN is trading at all. The shareholders came within a scintilla of having absolutely nothing. Les had already lobbied Chapin for another shareholder meeting at which the authorized shares were going to be raised to 5 billion to cover the fraud. So, make your guess: 3 billion outstanding, no partner, no cash, Les and JJ in charge, and the massively dilutive lawsuit from Okanadian. Boy howdy!!! Get me some of that! Where does that stock trade?

In the April 4 , 2016 letter, we are told that we had contacted FINRA and the SEC and would be filing formal complaints regarding these discrepancies. Have these complaints ever been filed? It is almost one year from the date of the letter. Does anyone know?

I just hope that Maurizio had enough foresight and knowledge to know what he was actually doing/getting himself into. He’s got an uphill battle to get those friends’ and family’s (and by direct share price association each of us) their MDMN portfolio back into the green.

belmont134,

I do not expect that I, or most of us, including Auryn and Maurizio’s friends, will recoup our investment. It is for this reason that I urge EVERYONE to admit you invested in a fraud, The price you paid, I paid, and Maurizio’s friends paid is not germane. All that matters now is maximizing the value of our holdings INDEPENDENT of what you paid for a share of a fraud. As for me, I am focused on the development of 2a. Nothing else. Tupper is taking care of the share structure to the extent he can. Expect 2.9 billion s/o, no preferred, the $2 million in debt for the liabilities side of the balance sheet. Near term the asset side will be defined by 2a, IMO. Strap in, you are invested in a speculative junior miner.

S O B E R I N G!

So sad but true.

Just erasing a bit of personal stupidity here. Carry on…

It easy to say that I’m wrong but you offer nothing to show that in your response.

Les issued something like 1.5 billion shares…most of which got dumped in the market. This had a drastic effect on the market price even when we didn’t know it was there. Further, it hurt the share price of those shares that were sold by Medinah legitimately. Few, if any shareholders here on MP would be in the red if it wasn’t for that. Medinah did land an excellent deal with Auryn despite Les that easily could take us where we need to be. The numerous failed deals were most likely due to Juan but much of the damage from that was negated by time and landing of the deal with Auryn.

By the way, based the recent little spite of negativity brought on by the regurgitation of old news suggests a new bottom has been reached and it is time to buy.

BUT, the reason a lot of us are still here is that this fraud actually has something of value backing it up, not some stupid mink oil cosmetics or whatever. There is a bigazz mountain out there that will eventually monetize as long as we can keep our internal corporate chit together. Thank you Kevin and Maurizio for showing the rare quality of ethics beyond just self interest.

Not addressed to MG, he just happened to post above me.

Maybe you didn’t have access to the information but considering how well you are at DD I find myself doubting that. My fault if I’m wrong, but here’s a hint… How much do you know about the shenanigans carried out time and time again by JJ? I’m sorry that I am not at liberty to go into details as I gave my word some time ago not to, but the information is out there for those who want to dig for it. Most would be utterly shocked and completely disgusted. It is an absolute miracle that this investment has even a hope of having any value based upon what that man alone did. As I have stated a couple of times before over the past few years, I sincerely hope that someday the complete story is told, but I’m not the one to tell it as I am bound by my word to not pass it on. Seek and you shall find.

Btw, apologies for the snide comment. Old habits sometimes die hard and, honestly Mike, contrary to what you might think, my impression of you is that you are much too smart and too diligent at finding information to not have any idea about what I’ve intimated above regarding JJ. I also have no argument with the rest of your post, fwiw.

Bingo…

Another great post but it’s important to emphasize that this was a fraud with a potentially enormous asset. So the main point of luck was that the fraud was uncovered, hopefully, with enough time to avoid complete dilution of the asset. When the $100M went away the risk crept back into the investment. Many of us tried to argue this point while others chose to convince themselves that more equity in AMC was worth giving up the upfront payment. Silly.

The reality is that AMC could issue another capital call tomorrow with “cram down dilution” similar to the latest call and the common shareholder would be left with nothing. AMC and friends ownership of 500M+ shares is the only reason why we aren’t at zero now. We were obviously led to believe that our ownership in AMC was non-dilutable, but like so many of the previous, ever changing, contractual terms, that turned out to be another lie. Why wasn’t this fact disclosed? I have to assume that all of the MDMN insiders read the contract and is exactly why all of them are just as guilty as Les (in one way or another).

I earlier gave AMC a valuation of $20Mish based on the cash call. You can reverse engineer a valuation based on the dilution ramifications of a capital call. Without Kevin’s negotiation I believe we would have lost approximately 80% our ownership in AMC. CDCH us still in the thick of it. I would encourage investors to voice or email their thoughts to their BOD who needs to do everything in their power to reach an equitable solution. This is a cram down capital call. Make no mistake about it. Until we get through this mess and both MDMN and CDCH cease to exist (through issuance of AMC shares) there is a lot more than geological risk to these stocks. The market is discounting the same.

Trying to argue that we should “go it alone” as long as possible as a separate public entity is truly insane if you actually understand the underlying risks. IMO

I lived through all the painful history just like you did (or even more of it for that matter.) and trying not to relive it again as once was enough.

Yes…there were many things that harmed our investment including what JJ did but subtract out what Les did and we still would have had a great investment. At this point, lets get everyone back in the green and call it good.