Forum for Novo Resources (NVO)/(NSRPF)

Nullagine Gold Project Production Update

KEY POINTS

- No lost time injuries at the Beatons Creek conglomerate gold project through Q3 2021 (“ Beatons Creek ”)

- Minimal COVID-19 pandemic-related operational disruptions

- Gold production of 18,144 oz Au in Q3 2021 (vs 14,890 oz Au in Q2 2021)

- Mining and milling targeted rates achieved

- Head grades have been lower than forecast due to previous reliance on wide-spaced grade control drilling which results in lower accuracy of the modelled Beatons Creek oxide mineral resource

- Higher mining dilution associated with the more complex mining areas of Beatons Creek also a contributing factor

- Continued progression of closer spaced grade control drilling combined with rapid assay turnaround is providing more certainty for forecasting Beatons Creek oxide mineralization grade, with the backlog of assays being mostly resolved through Q3 2021

- Commencement of oxide mining study, focused on further optimizing production and profitability of mining of the Beatons Creek oxide resource

- Batch test processing of Beatons Creek fresh mineralization confirmed processing throughputs and recovery with good grade prediction

- Strong financial position

- Q3 2021 revenue of C$43 million (A$45.8 million) from the sale of 18,753 oz Au at an average realized gold price of A$2,483

- Quarter-end cash balance of C$44.1 million

- Investment portfolio fair value of approximately C$135 million1

| Q2 2021 | Q3 2021 | Change | ||

|---|---|---|---|---|

| Gold Production | (oz Au) | 14,890 | 18,144 | +22% |

| Mining | (tonnes) | 477,000 | 478,000 | - |

| Processing | (tonnes) | 366,000 | 451,000 | +23% |

| Revenue | (C$M) | C$31.7 | C$43 | +36% |

| Cash Position | (C$M) | C$46.0M | C$44.1M | ($1.9M) |

Key Q3 Operational and Financial Performance

____________________

1 This value excludes the fair value of warrants held in GBM Resources Ltd. Novo’s ability to dispose of its investments is subject to certain thresholds pursuant to its senior secured credit facility with Sprott Private Resource Lending II (Collector), LP. Please refer to the Company’s management discussion and analysis for the 11-month fiscal year ended December 31, 2020, which is available under Novo’s profile on SEDAR at www.sedar.com . Novo’s investment in New Found Gold Corp. is subject to escrow requirements pursuant to National Instrument 46-201 Escrow for Initial Public Offerings. The value of Novo’s holdings in Elementum 3D, Inc. (“ E3D ”) is based on E3D’s most recent financing price of US$2.50 per share. Except for its investment in E3D, the fair value of Novo’s investments is based on closing prices of its investments and relevant foreign exchanges rate as at September 30, 2021.

VANCOUVER, British Columbia, Oct. 12, 2021 (GLOBE NEWSWIRE) – Novo Resources Corp. ( “Novo” or the “Company” ) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) provides a Q3 2021 operational update from Beatons Creek, located in Nullagine, Western Australia.

Commenting on Q3 2021 operational performance, Novo’s Executive Co-Chairman Mr. Mike Spreadborough said, “The ramp up of operations since February has proceeded well, with both mining and processing achieving target rates. However, gold production fell short of expectations. We saw lower head grade than forecast as a result of lower accuracy in the grade control grade estimate. This was due to the current predominant wide-spaced grade control drilling at the high-nugget Beatons Creek oxide mineralization combined with higher mining dilution from the more complex mining areas.

We have found that closer spaced drilling is providing more certainty for mine forecasting and we are continuing to progress the completion of this drilling. The rapid assay turnaround provided by the Chrysos PhotonAssay technology through Intertek is allowing for this data to be used to mine more selectively.

To incorporate all of the learnings from this unique mining at Beatons Creek into future mine planning, we have initiated an oxide mining study. We are confident that the outcomes of the review, when delivered later this year, will result in a plan which will further optimize production levels and profitability of the oxide resource.

Importantly, Novo remains in a very strong financial position to optimize production results and maximize value from Beatons Creek and, importantly, our exploration activities are being accelerated.”

NULLAGINE GOLD PROJECT

Safety and COVID Update

Safety is a core value, with continuous focus on safety outcomes. Over the past 12 months through Q3 2021, the lost time injury frequency rate remained zero. The Company continues to experience minimal COVID-19 pandemic-related operational disruptions.

Operations

Mining rates at Beatons Creek stabilized throughout Q3 2021, with 478 kt of mineralized material mined from the Beatons Creek deposit compared to 477 kt in Q2 2021.

The Company’s Golden Eagle processing plant (“ Golden Eagle Plant ”) processed 451 kt of mineralized material in Q3 2021, representing a 23% increase over Q2 2021 throughput of 366 kt.

Since the start of commissioning of Beatons Creek in February 2021 ( refer to the Company’s news release dated February 3, 2021 ) based on the Beatons Creek mineral resource, Novo targeted a throughput rate of 1.8 Mtpa to match the capacity of the Golden Eagle Plant. This milestone was achieved in Q3 2021.

Production in Q3 2021 totalled 18,144 ounces of gold, representing a 22% increase over Q2 2021 production of 14,890 ounces of gold. Recovery rates were approximately 94% throughout Q2 and Q3 2021.

The Q3 2021 head grade was 1.34 g/t Au, a slight increase from a Q2 2021 head grade of 1.30 g/t Au2. However, the head grade has been relatively variable throughout Q2 and Q3 2021, which reflects the high-nugget content of the conglomerate Beatons Creek gold deposit and necessary mine sequencing. Additional high-grade Beatons Creek oxide material assisted to increase July 2021 head grade to 1.94 g/t Au.

The lower head grades compared to forecast is due to previous reliance on wide spaced grade control drilling which results in lower accuracy of the modelled high-nugget effects in the Beatons Creek oxide mineral resource combined with higher mining dilution associated with more complex mining areas.

In order to provide greater certainty in grade forecasting for mine planning, the Company continues to progress its Beatons Creek grade control drilling program at a spacing of 10 m x 10 m. Analysis confirms that this level of grade control drilling provides improved reconciliation between the resource model grade and the actual grade mined.

The operation previously relied on wide-spaced grade control drilling due to slow assay turnaround. The use of the Chrysos PhotonAssay technology through Intertek Testing Services (Australia) Pty Ltd (“ Intertek ”) has allowed rapid assay turnaround allowing for this data to be used to mine more selectively. This assay technique is a necessity given the high-nugget nature of the Beatons Creek conglomerate gold mineralization. This rapid assay turnaround is necessary to support the use of closer-spaced grade control drilling.

In July 2021, a test package of approximately 43 kt of Beatons Creek fresh mineralization was processed at an average head grade of 1.83 g/t Au confirming processing throughputs and recovery with good grade prediction. This data will be used to optimize fresh mining in the future. The most recently announced Beatons Creek mineral resource estimate includes a fresh component comprising approximately 65% of the global estimate (refer to the Company’s news release dated April 30, 2021 and the report titled “Preliminary Economic Assessment on the Beatons Creek Gold Project, Western Australia” with an effective date of February 5, 2021 and an issue date of April 30, 2021). Mineral resources that are not mineral reserves do not have demonstrated economic viability.

To further optimize the Beatons Creek oxide mineralization mine plan, Novo has initiated an oxide mining study which will focus on increased grade control drilling to improve the accuracy of resource modelling, mining approaches, cut-off grade sensitivities, and costs in order to enhance production and profitability of the Beatons Creek oxide resource component of the Nullagine Gold Project. The Company intends to provide an update on this review once complete in Q4 2021.

The Company’s processing and mining rates stabilized sufficiently throughout Q3 2021 to enable Novo to declare commercial production2 effective October 1, 2021. Of particular importance is that the Golden Eagle Plant has met it performance parameters.

____________________

2 Refer to the Company’s management’s discussion and analysis for the six-month period ended June 30, 2021, available on the Company’s website at www.novoresources.com and under the Company’s profile on SEDAR at www.sedar.com .

Novo Financial Position

Novo’s strong financial position allows the Company to address operational requirements while leveraging the value of its strategic investment portfolio.

Q3 2021 gold sales totalled 18,753 ounces of gold and 2,399 ounces of silver, representing a 34% increase over Q2 2021 gold sales of 13,958 ounces.

Q3 2021 gross revenue grew by 36% from Q2 2021 to C$43 million (A$45.8 million).

The Company experienced a Q3 2021 average realized gold price of A$2,483 compared to a Q2 2021 average realized gold price of A$2,4012. Novo sells its gold in Australian dollars to ABC Refinery of Sydney, Australia and continues to enjoy strong gold price performance in Australian dollar terms.

Novo’s cash and working capital positions remain strong, with cash reserves of C$44.1 million as at September 30, 2021 as compared to C$46.3 million as at June 30, 2021 while spending approximately C$6 million on exploration during Q3 2021.

In addition to its cash reserves, the Company’s strategic portfolio of investments held a fair value of approximately C$135 million1 as at September 30, 2021, including its 9.5% investment in New Found Gold Corp. (TSXV: NFG) which was worth approximately C$116 million1.

QP STATEMENT

Dr. Quinton Hennigh (P.Geo.) is the qualified person, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects , responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is the non-executive co-chairman and a director of Novo.

CAUTIONARY STATEMENT

The decision by the Company to produce at the Nullagine Gold Project was not based on a feasibility study of mineral reserves demonstrating economic and technical viability and, as a result, there is an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, including increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Company’s cash flow and future profitability.

The Company cautions that the declaration of commercial production only indicates that the Nullagine Gold Project is operating at anticipated and sustainable levels and it does not indicate that economic results will be realized.

ABOUT NOVO

Novo operates its flagship Beatons Creek gold project while exploring and developing its prospective land package covering approximately 13,250 square kilometres in the Pilbara region of Western Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com.

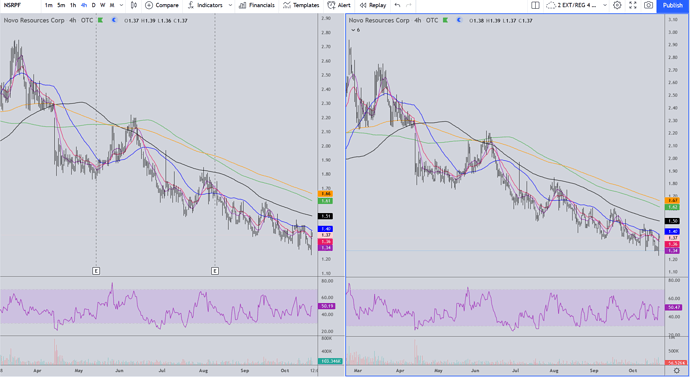

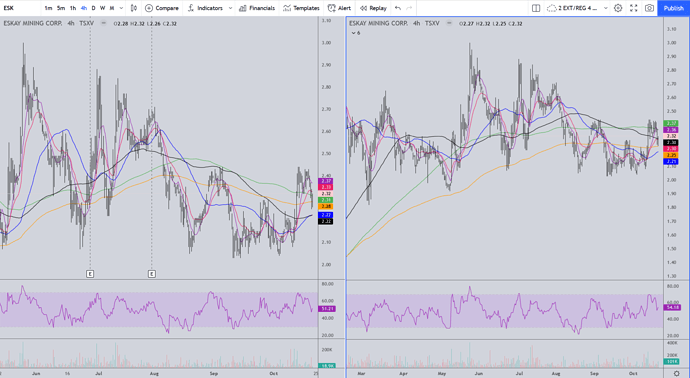

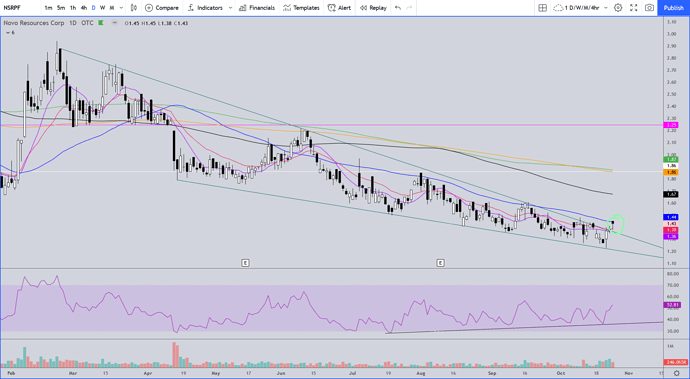

Hey TR, how the chart TA looking?

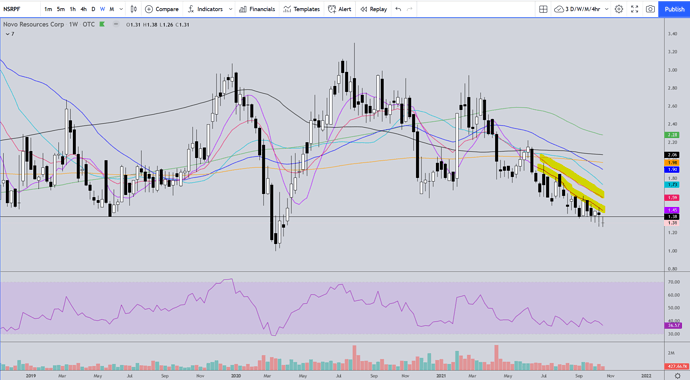

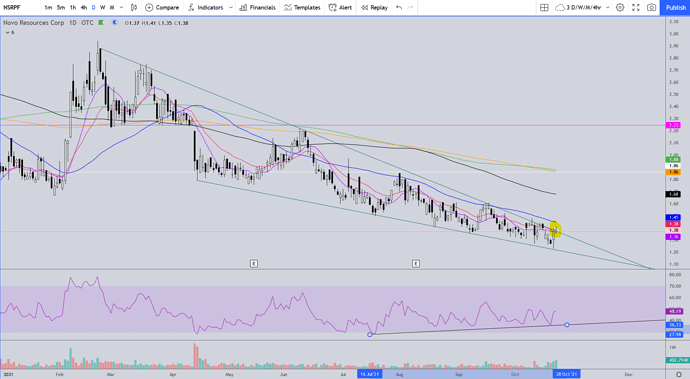

I’m absolutely convinced that this stock is being illegally shorted. The good news is it has been forming a bullish falling wedge formation since the announcement of the last financing, and the lower price lows that continue to be hit have so far been resulting in higher RSI lows, which is bullish price divergence. Eventually we should get an upside break out of this and there’s a good chance when it happens it’ll be a doozy.

I have highlighted the 10MA and 20EMA on the weekly chart to show how they have been consistent resistance for the last 18 weeks. The first bullish step to watch for on the weekly chart is a close above the 10MA…then the 20EMA.

THANKS! great info.

TR,

I’m not much of chart reader; could you make it easier on me and just tell me where the chart says the bottom is?  Thanks…much appreciated!

Thanks…much appreciated!

Geez Mike, if charts could do that I’d be sitting on my own private tropical island, preferably on another planet!

We might have just seen the bottom. I’ll let you know in a week or two!

Thanks! I bought more at 1.30 thinking no further down than maybe 1.20. I agree about the shorts. For instance, I find the negative discussion by a number of individuals(or accounts) on the ceo.ca site over the top ridiculous which is suggestive.

Near-Mine High-Grade Mineralization Confirmed 3 km from Golden Eagle Processing PlantPress Release | 10/21/2021

HIGHLIGHTS

- Preliminary results include 8 m @ 4.6 g/t Au from 26 m, 10 m @ 3.0 g/t Au from 32 m, 3 m @ 8.9 g/t Au from 5 m, 13 m @ 2.0 g/t Au from 12 m, and 8m @ 3.2 g/t from 37m

- Genie is part of a wider, untested +1.25 km long prospective gold zone within 3 km of the Company’s Golden Eagle processing plant (the “ Golden Eagle Plant ”)

- Mineralization remains open in all directions with follow up drilling already in progress

- Maiden reverse circulation (“ RC ”) drilling program intersects multiple zones of high-grade mineralization at Novo’s Genie oxide gold target in the Pilbara region of Western Australia

- New style of gold mineralization in the Mosquito Creek Basin, relating to an interpreted early phase of dolerite intrusion

VANCOUVER, British Columbia, Oct. 21, 2021 (GLOBE NEWSWIRE) – Novo Resources Corp. ( “Novo” or the “Company” ) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to provide an update on recent brownfields exploration drilling conducted at the Genie prospect.

The maiden RC drilling program of 31 holes (for a total of 1,787 m) was completed at Genie in September 2021. Significant intersections returned to date include, but are not limited to:

- 8m @ 4.6 g/t Au from 26 m (21NU0093)

- 10m @ 3.0 g/t Au from 32 m (21NU0089)

- 3m @ 8.9 g/t Au from 5 m (21NU0085)

- 13m @ 2.0 g/t Au from 12 m (21NU0092)

- 8m @ 3.2 g/t Au from 37 m (21NU0094)

Genie is a near-mine oxide prospect that forms part of a broader +1.25 km long previously untested lode-gold target located within 3 km of the Golden Eagle Plant ( Figure 1 ).

“Novo has an exceptional exploration team capable of quickly identifying and testing impactful targets around the Nullagine Gold Project,” commented Dr. Quinton Hennigh, Non-Executive Co-Chairman of Novo. “Quickly recognizing the excellent potential and new style of mineralization at Genie is a prime example of their strength. And Genie is just one of the first targets on our list. Many more targets are currently being tested, all of which could have near-term impact on delivering resources for the operation. We are thrilled with these early results and eagerly await a large volume of exploration drill results to come. With access to Chrysos PhotonAssay, we expect to deliver a steady stream of results to the market on an ongoing basis.”

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c05eca1a-8c72-48dd-b6e0-ec85f617ca56

DETAILS

This maiden drilling program across the western sector at Genie has provided numerous highly significant results and highlights the potential for the prospect to provide valuable oxide feed to the nearby Golden Eagle Plant. Gold mineralization occurs across multiple, stacked, shallow to moderately SW dipping zones and remains open in all directions.

This program was designed to test the tenor of gold mineralization where mapping and rock chip sampling highlighted excellent potential for near-surface mineable gold mineralization. Drilling was completed at 20 m to 40 m line spacing and 20 m hole spacing along the drill traverses.

Table 1 below provides a list of significant intersections (reporting >1 gram/metre) using parameters that include a 0.5 g/t Au cut-off and no more than 2 m internal waste. Reported widths are indicative of true widths.

Considering the highly significant results from this program, further drilling is now a priority with follow up holes designed to extend and further define the extent of mineralization. This second, more aggressive drill program is already in progress.

Genie is located toward the western margin of a prospective gold-mineralized corridor characterized by strong quartz veining within sheeted dolerite dykes and turbiditic sediments of the Mosquito Creek Formation. This style of mineralization relating to an interpreted early phase of dolerite intrusion represents a new gold mineralization style in the region.

The local geology at Genie is characterized by a swarm of mineralized quartz-veined dolerite dykes defined over ~320 m strike, with individual dykes up to 80 m long and 10 m wide ( Figure 2 ). The dolerite dykes trend NW (locally orthogonal to the overall ENE-trending mineralized corridor) and dip shallowly to moderately to the SW. One 50 m long historic working is present in the central drill area. Sand cover and quartz colluvium obscures the geology immediately west, south, and north of the outcropping mineralization where the target extends under cover ( Figure 3 and Figure 4 ).

RC drill samples were submitted to Intertek Testing Services (Australia) Pty Ltd.’s (“ Intertek ”) lab for PhotonAssay ( refer to the Company’s news release dated May 18, 2021 ), providing rapid turnaround time for exploration assay results, with assays received within two weeks of sample submission.

Figure 2 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/37f27fc1-dd56-4390-88ed-4983931d3f9a

Figure 3 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9fec7a6f-0dfa-4dff-a0c6-59d8fd1b6472

Figure 4 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f1b74cfd-fc60-4b03-ab69-22453472de66

Analytic Methodology

RC samples from Genie were submitted to Intertek in Perth, Australia. Samples are crushed to -2 mm and RSD split into a single 500-gram jar for PhotonAssay. To test for gold variability and potential coarse gold effect, field duplicates and crushed duplicates were analysed. Standards and blanks are inserted in the sample sequence to test for lab performance.

There were no limitations to the verification process and all relevant data was verified by a qualified person as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects by reviewing analytical procedures undertaken by the various laboratories. Dr. Quinton Hennigh (P. Geo.) is the qualified person responsible for, and having reviewed and approved, the technical information contained in this news release. Dr. Hennigh is the Non-Executive Co-Chairman and a director of Novo.

About Novo

Novo operates its flagship Beatons Creek gold project while exploring and developing its prospective land package covering approximately 13,250 square kilometres in the Pilbara region of Western Australia. In addition to the Company’s primary focus, Novo seeks to leverage its internal geological expertise to deliver value-accretive opportunities to its shareholders. For more information, please contact Leo Karabelas at (416) 543-3120 or e-mail leo@novoresources.com.

Mike,

You’ve always been a pretty good chart reader. 1.30 looks like a good pickup, especially with the good highlights you posted in today’s news release. Here’s a 15 min, 30min, and daily chart.

15 MIN

30 MIN

DAILY

So, you aren’t trading around a core, at least not for a while. These shorter interval charts may guide your trades once major resistance levels are overcome and sustained. Also, you may want to check a longer interval chart if you haven’t already done some tax loss harvesting on this one. Here’s the weekly interval chart (all the charts here have MAs 50, 100, 200 for resistance/support levels).

WEEKLY

Today’s 8% move was largely responding to the news release. Will it be sustained?

How long is a bottom good for, anyway?

DAILY

WEEKLY

MONTHLY

It appears to depend on the interval you are trading in and out of!

Rich,

What are some of the preferred MA resistance/support levels you choose for different chart intervals? For simplicity, on the first set of charts in the preceding post I used standard 50MA, 100MA, and 200 MA. You’ll notice on these longer interval charts I shortened them a bit to 20MA, 35MA and 50MA. Do you change them depending on the chart pattern you are identifying? I usually have a strategy of trading around a core. Lately, I’ve had to change that some. Strategy and charts don’t always help, but being disciplined usually is profitable, even if it takes longer than one likes. ![]()

Well easy… there are actually many variables; age, diet, exercise. There are different kinds of bottoms… no bottom, skinny, flat, full, bubble, badonkadonk. Some require more upkeep than others, and genetics also play a considerable role. My personal preference is what I would call “full athletic”, but those are most often found on girls in an age bracket that doesn’t seem to much appreciate my appreciation of them, and I seem to be having a rough time remembering my age bracket.

I hope this helps!

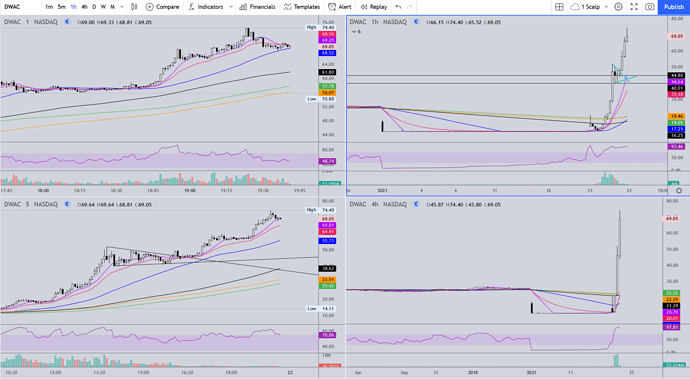

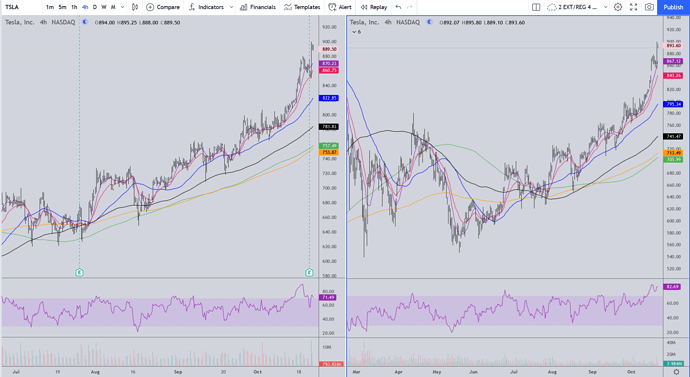

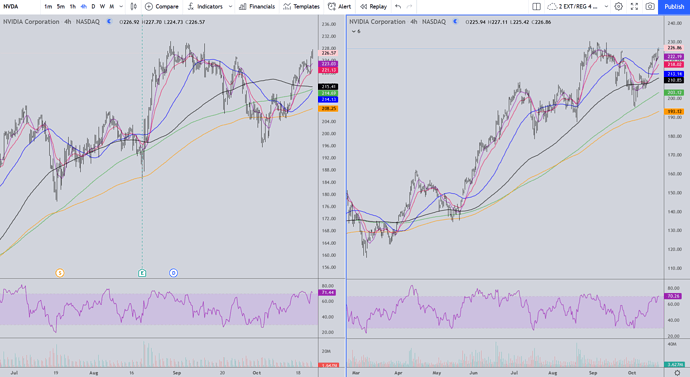

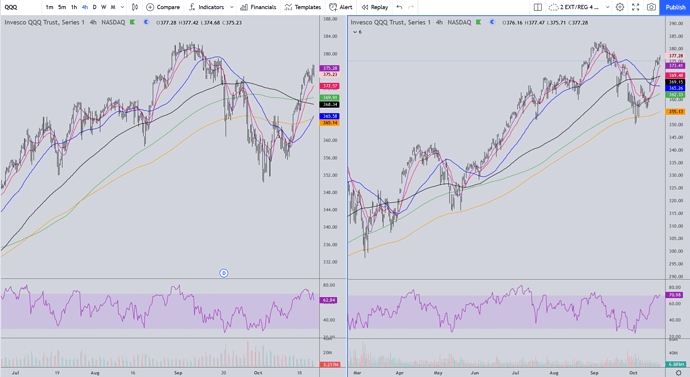

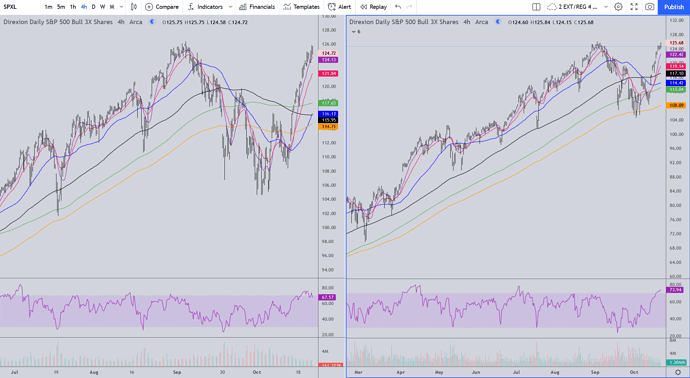

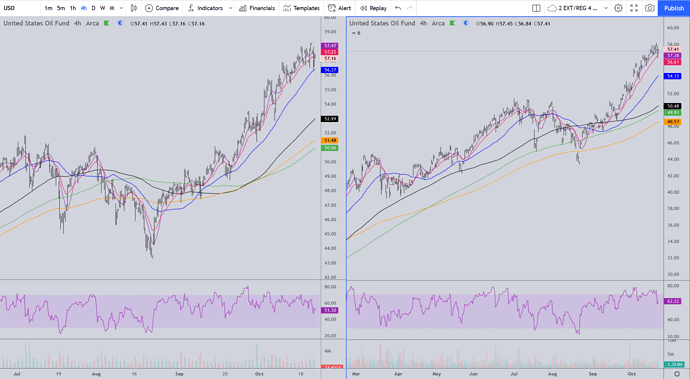

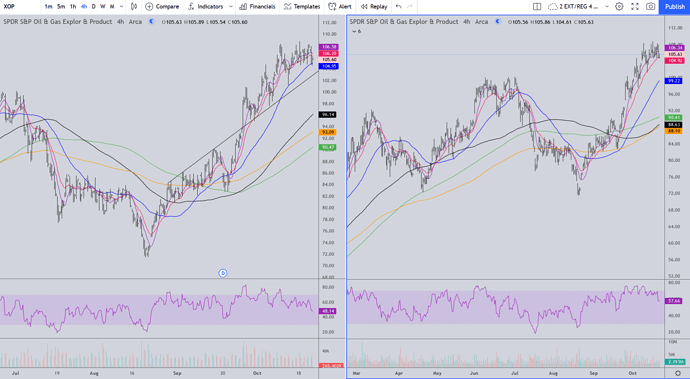

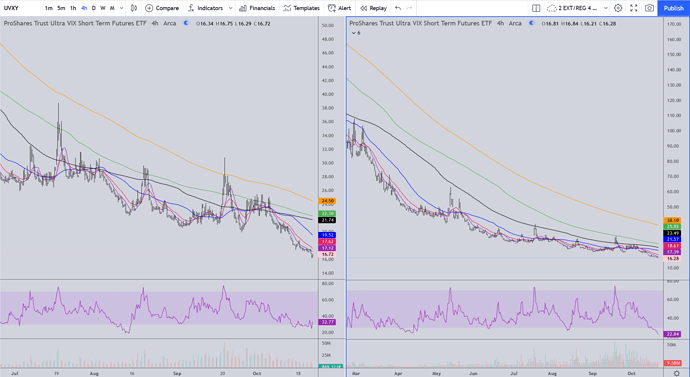

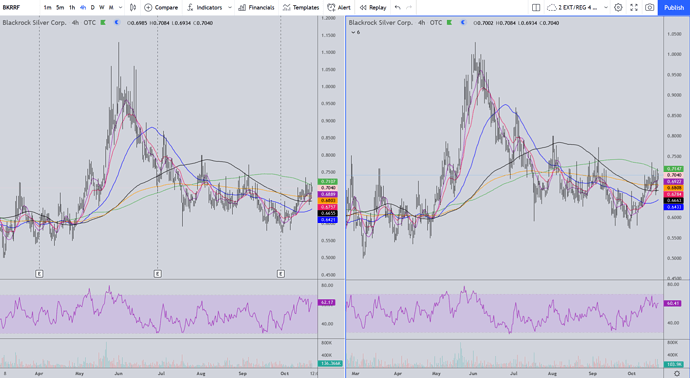

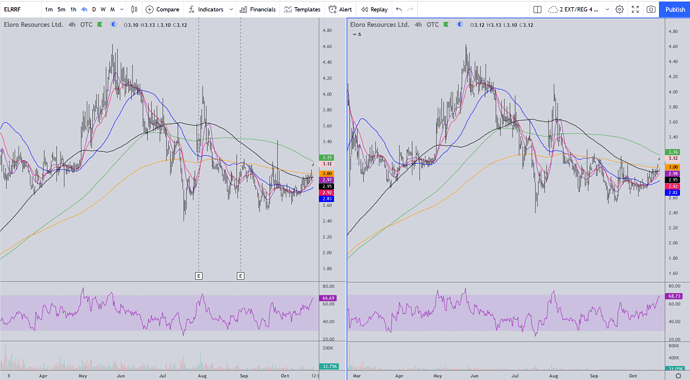

The chart intervals I prefer are always the same: 1 and 5 minute for scalping and/or pinpointing entries and exits from trades; I don’t find the 15 and 30 min intervals to be very useful and the MA’s I use don’t work as well. Plus, I’m either scalping or swing trading, the latter I find the 1 hr, 4hr and daily intervals most useful. I also use the weekly and monthly intervals for investments.

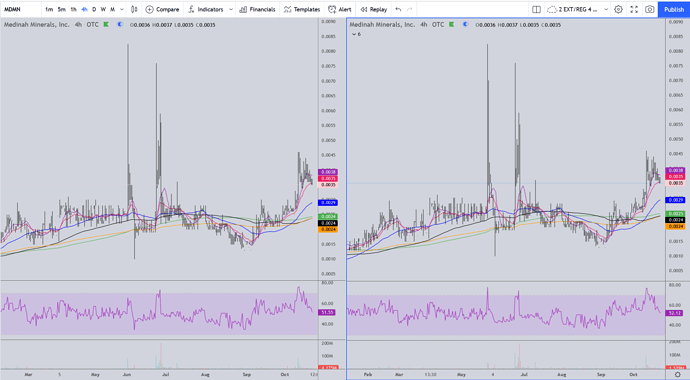

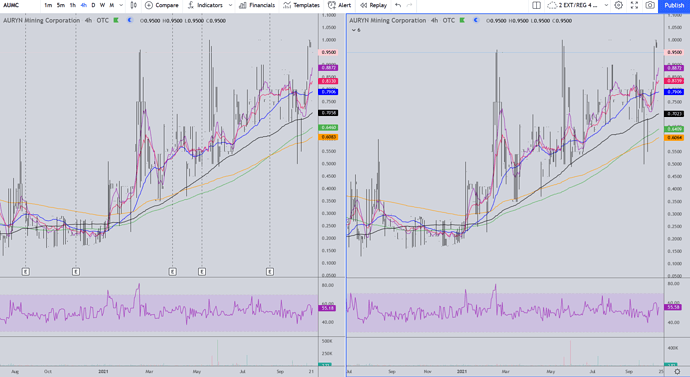

As for the MA’s, I have used pretty much the same MA’s for two decades + and have found no reason to change them over all that time. I use the same MA’s on every time interval and they work exceptionally well. I have tried others from time to time but none have worked as well for me as these: 10 ema, 20ema, 30ma (on the weekly interval only), 50ma, 130ma, 200ma, 260ema. The only study I use is the Relative Strength Index (RSI) set at the default 14 setting.

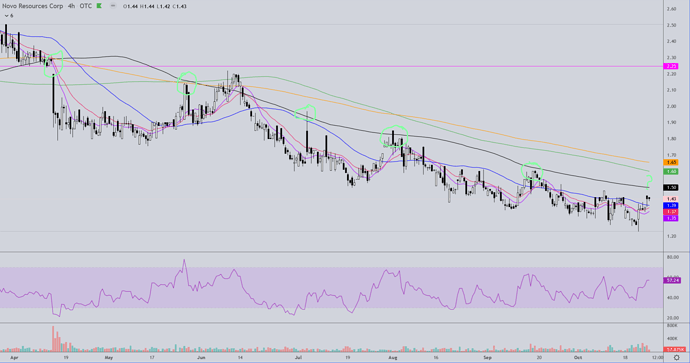

I find the 4 hr interval chart particularly useful for swing trading. It is by far my favorite time interval.

I’ll post a 4hr chart of each of the stocks on my immediate watch list and I think anyone who spends a very little time really looking at them will see why I like this set up so much.

Thanks, Rich. I know I only have basic skills when basing a trade on a chart. Does the company have what it takes to be a success? That’s the basic question I ask myself. I’m more of an investor looking for underlying fundamentals both short and long term.I do have a significant portfolio of speculative plays and I count on the PM sector helping to boost many of these even if it takes longer than I’d like. NVO is one of those that has been particularly painful, but I rely on my other gainful plays to balance it out, One has to have a core position (and I prefer a core that is seasoned at least a year), to make profitable trades that can avoid the wash rule, Your charting skills are why so many turn to you for your opinion. I’ll see what I can do with the information you just posted on charts and let you know how it turns out, eventually. Appreciated; Not so much on the different kinds of bottoms, though!

Ha. No. Maybe intuitively. Certainly, I can see when near year/multi-year lows yet has strong fundamentals in place. Also, during this latest dip, I could signs of shareholder capitulation which is definitely a buy signal. Finally, the Company likely has plenty of good information to share to help prop up the share price until production ramps up further. If for some reason, there is another dip below 1.30, I will more buy more(or stop loss if something bad happens.)

Different version of the previous news story. I like this part:

"Interestingly, Novo is utilizing an exciting new way to assay its drill samples where a purpose built “Chrysos PhotonAssay” machine from Intertek is used to deliver assay results within just days rather than weeks.

The new system essentially “radiates” the sample to produce a grade and is considerably less time consuming than the cumbersome fire assay type system.

Genie is a good strategic discovery for Novo. Its location close to the Golden Eagle mill, its high grades and lode style mineralization just might weigh into Novo’s mine plan in a big way if a serious deposit can be unearthed there."

Gentlemen… it’s not much, but NSRPF closed a smidge outside of the falling wedge formation today and the volume this week was nothing to sneeze at. We even closed at the 20EMA. We would all like to see some more explosive share price movement, but with PM’s being hammered every time they make a run along with our stock being (I believe) artificially/illegally suppressed, this is a good sign. Need follow through next week though.

We’ve got the breakout. Next we need a close above the blue 50MA. A run to the black MA tomorrow would be nice, and a close above that with it holding support is a very good sign of a reversal imo.

This is the 4 hr interval chart of NSRPF. Since the financing that started Novo’s downward drift, Novo had lost support of the black 130MA, testing the underside 5x prior. Four of those times failed the test. One of those times tested the 200MA just above the 130 and almost filled the gap, but then the decline continued to this day. A move above the 130MA on this chart, with the 130 hodling as support will raise my hopes that the decline is over and MG actually did catch the bottom of the fall. A further move above the green 200MA will get us to the previous swing high of 1.61 and further confirm the possibility that the decline has ended. There is clearly more work to be done. I’ll update as things evolve.