Don’t be surprised if we get through the weekend and next week with Russia not taking any action against Ukraine.

Is this notion based on your chart readings?

I do think they need some sort of pretext to actually commence the attack. What form will it be? If their plans to create this pretext don’t work out, then what? How will Putin save face short of an invasion at this point? Seems like any chance of concessions out of NATO are already out the window. If they wait any longer, the ground is going thaw and tanks will have trouble. Already, generally above freezing temperatures are in the forecast in the capital indefinitely.

Yes. It’s amazing what a chart can show you.

Funny little story. A number of years ago, my wife and I decided to walk across a bridge over a river to cross into the Ukraine to just say we have been there. The bridge was old and there was literally large holes in the road that were a free fall into the river. Apparently, nobody else actually walks this so the guards on the Ukraine side with automatic weapons were rather taken back by this behavior.(Pretty sure it is a route that is only used by smugglers in cars that bribe the guards to move their contraband.) They were further upset when my wife suddenly demanded that she wanted to use the bathroom. After nearly creating an international incident, a bathroom was provided and the guards became friendly after hearing my last name which happens to be Ukraine. We then preceded on foot into a village that looked like a relic from WW II and appeared to be nearly abandon. I felt like a target waiting for highway robbers to show up. (They didn’t.) We managed to find a small store and went inside. Our presence created quite the spectacle with the locales watching our every move. Seemed like it was well stocked with candy and alcohol but not much else. With nothing else to do, we returned the way we came but not before attempting to take a picture of the scenic river that separates the Ukraine from Romania. Out of nowhere in the middle of the bridge, a man appeared suddenly and informed us that pictures aren’t allowed and disappeared just as quickly. Not much else to tell other than I’m rooting for the Ukraine’s and wish them luck. They are going to need it.

Novo Presentation:

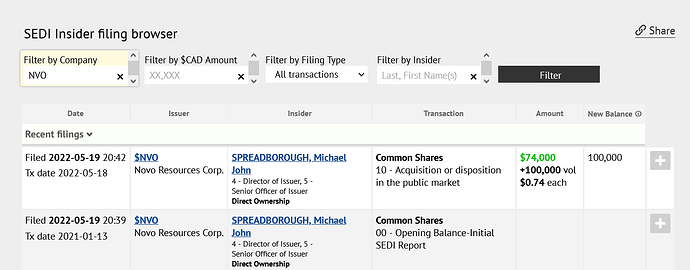

One can see part of the reason for the decline in recent months. They are burning through cash. They have a very large set of holdings and focus on many different projects which likely exceeds their current ability to finance without selling their equity holdings in other miners. Failure to get a positive cash flow out of their mining operation is really hurting them.

" September 30 cash: C$43,953,000

+C$7,970,000 for selling Calidus in October

November 11 cash: C$43,282,000

December 13 cash: C$39,100,000

December 31 cash: C$32.4 million

January 30 cash: C$27.6 million"

Sumitomo Converts Egina Interest to 1.36% Interest in Novo Resources

VANCOUVER, British Columbia, April 21, 2022 (GLOBE NEWSWIRE) – Novo Resources Corp. ( “Novo” or the “Company” ) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to report that Sumitomo has converted its notional interest in the Company’s Egina project in Western Australia to a 1.36% shareholding (the “ Conversion ”) pursuant to a farmin and joint venture agreement (the “ Agreement ”)1. A total of 3,382,550 common shares of the Company were issued upon the Conversion, all of which are subject to orderly sale restrictions and a twelve-month contractual hold period expiring on April 21, 2023. The Agreement was completed as a result of the Conversion.

Pursuant to the MoU, Novo and Sumitomo are discussing new exploration opportunities across Novo’s 12,500 square kilometre tenure package.

Novo intends to advance basement gold targets at the Egina project, including multiple discrete untested aeromagnetic anomalies with characteristics comparable to the “Hemi-style” gold-bearing sanukitoid intrusions being developed by De Grey Mining Ltd.3. Novo’s conglomerate gold focus remains at Comet Well and Purdy’s Reward where Novo intends to relocate its mechanical sorter in mid-2022 to test up to 20,000 tonnes of potentially mineralized material4. In addition, Novo intends to advance base metal opportunities at the Company’s recently identified Au-Cu and Ni-Cu-Co targets at the Southcourt and Andover targets near Karratha, Western Australia.

For those hanging in there on NVO I’m sure you’re aware they are flush with cash now (C$126M total - 2nd traunche settling Aug 5) after selling their NFG stake to ES. I haven’t sold any shares yet, but I did pick up a number of these cheap NVO shares in case it doesn’t turnaround by the end of the year. (Call it insurance as NVO is one of my largest holdings. Yes, tax loss selling if it doesn’t work out favorably, but I believe it will). If you haven’t seen the video linked below check out Quinton’s commentary 59’36" to 1.01’45", I think you’ll find it interesting.

(https://www.youtube.com/watch?v=s7Lcor4ynnM)

Additionally, NFGC is another of my largest holdings, and need I say most profitable positions, that covers the sale of NVO’s holdings in NFG to ES that preceeds the NVO comments starting at 57’53.

Stay invested and keep posting thoughts on your favorite holdings as this forum is important to all those with a goal of making investing profitable.

EZ

June 14, 2022

BEATONS CREEK FRESH FEASIBILITY STUDY UPDATE

HIGHLIGHTS

- A feasibility study for mining of the Beatons Creek gold project (“Beatons Creek”) Fresh mineral resource (“Feasibility Study”) is underway, with completion targeted by mid-Q4 2022

- Metallurgical and geotechnical diamond drilling programs have been completed, with assaying and metallurgical test work underway and due for completion by the end of July 2022

- Phase one of a mineral resource definition reverse circulation (“RC”) drilling program will be completed by the end of June 2022. Results received to May 31, 2022 include significant, high- grade intercepts (> 40 gram-metres gold) of:

- 3.5 m at 43.62 g/t gold from 47 m in GHF0526

- 5.5 m at 16.02 g/t gold from 30 m in GHF0269

- 1.5 m at 48.84 g/t gold from 42.5 m in GHF0500

- 4.5 m at 15.23 g/t gold from 47.5 m in GHF0523

- 2 m at 28.14 g/t gold from 75.5 m in GHF0200

- 3 m at 18.5 g/t gold from 72.5 m in GHF0181

- 3 m at 17.85 g/t gold from 39 m in GHF0014

- 1.5 m at 31.29 g/t gold from 43.5 m in GHF0498

- 2.5 m at 17.66 g/t gold from 41.5 m in GHF0490

- 2.5 m at 16.16 g/t gold from 82 m in GHF0216

- 3 m at 15.3 g/t gold from 61.5 m in GHF0554

- Mineral resource definition drilling to date has confirmed the high-grade nature, strong continuity, and thickness of the Fresh mineralized material

- Commencement of Phase Two mining of the Beatons Creek Fresh deposit is subject to receipt of approvals from various Western Australian regulatory departments1.

(2022 – NOVO Resources)

They are trying out sensor material sorting machine a lot like what RedWave makes for sorting mined rock.

It can be set up to use many sensor types identification eyes, (will call them).

To recognize material they either want to save or discard.

The gold at Beaton creek is alleged to have been captured by algae from mineral rich sea water. Captured in flooded lagoons eons ago and then formed into sizes like very small corn flakes or flattened out small water melon seed.

So they are trying to separate some of it from the waste material by this process. A new way of looking at mining. Mineral sorting of Quartz - Sensor based sorting machines - YouTube

I copied the following from here: CEO.CA | #nvo Novo Resources Corp. (NVO.TO)

@WisGuy1 Quinton Hennigh Tue, Nov 29, 9:56 PM (9 hours ago) to me Marc: Before COVID, I was traveling to Australia around 180 days per year. I was integral in every facet of the company. I wanted us to demonstrate we could advance and mine the very unusual deposits at Karratha, Beatons and Egina using technologies like ore sorting. I wanted to find the next Fosterville at Malmsbury, and I pushed for the investment into New Found on the hope that we could ultimately take over that company and build the next Kirkland Lake. Heck, I even hoped to be in a position to take over Lion One. We had challenges, but we also had a lot of wind in our sails. Along comes COVID. I found myself isolated, and after a few months, I recognized that there was no likely way to travel to Australia any time soon, especially with the vaccination restrictions that came about in 2021. Once I realized it would be a long time before I could get back to WA, I pushed for Novo to take on Millennium and get Beatons into production. Why? Because I truly hoped that the resulting mine would be a success and help make the company and team in WA more autonomous. I recognized that they would have to find their way without me or any other significant support from NA. What has happened? Well, Beatons Creek did not deliver the cash flow we hoped. In my view, we diluted the deposit in order to keep the mill full. Part of the issue was due to a lack of grade control, especially in the early days. This was a real shame. In July, 2021 we hit 8600 oz Au in one month, and I thought the mine would become a success from there. But then we then saw continual turnover of staff and other chronic personnel issues resulting from COVID and a tight labor market resulting from rising commodity prices. Then costs started to skyrocket, and what was a tough situation became impossible. Now, our existing resource has suffered in large due to the obscene costs of operating in WA, and the path to getting a permit for the fresh rock is tortuous in part due to a very constrained permitting regime in WA. As for Egina, although I still remain hopeful the internal struggles of the Aboriginals will get resolved so that working within the reserve becomes possible, I think it could take a lot longer than we have time/money. There is simply no way to move anything forward inside the reserve until there is unity between the parties. Therefore, we have decided to move to areas outside the reserve and focus on basement targets like Becher. I am hopeful we can find another Hemi like discovery there. That would add decent value as demonstrated by DeGrey. Karratha needs ore sorting. And ore sorting needs a dedicated team of professionals who are willing to commit to permitting the project and solving all the challenges of operating such new technology. Rob was continually pulled away from the ore sorting endeavor to put out fires at BC. Although he tried to build a team, people kept getting better offers to work elsewhere. The whole exercise was like watching kids build a sand castle on the beach and watching it get washed away by the tide. Can it be salvaged? Yes, but it needs people who are committed, and it also needs a lower cost environment in which to operate. The economics of BC went pear shaped due to recent cost hikes, and using that experience as a proxy for Karratha, I am not confident that it can make money at this time. Selling the New Found shares was really disappointing and quite frankly, embarrassing. I know what that project has to deliver, and so does Eric. Heck, look at the results this week. I really wanted it to benefit Novo shareholders through acquisition. I could see that sort of deal catalyzing another Kirkland Lake type story. Having to sell shares for a discount in a crappy market and then having to use part of the funds to pay our debt and keep us out of hock was not my intent. Uggghhhh!!! This email is long enough. I will end by saying that I am putting a lot of faith in the exploration team to deliver. There is a lot to be found in the Pilbara. Look at all the discoveries made lately. We have more ground than any junior there, so hopefully one or two major discoveries can be made on our ground by the sharp team we have left working for us at Novo.

Even the most promising speculative PMs have unexpected setbacks. I have to admit, so far NOVO has been a major disappointment. MDMN should have taught everyone here by now, diversify your investments, and always take some profits when you meet your exit strategy. The entire PM sector has been terribly set back this past year or two, but things are certainly changing and looking up in the PM miners, especially the producing miners. BRICS countries may have a major influence on the POG in the years ahead. Stay informed! There are a couple other threads available to share your voice. I have my “picks” spread out among majors, minors, speculative, explorers and streamers. Yeah, I could have just used charts and followed the GDX and GDXJ and saved myself some time. I like holding a year before “harvesting” a profit, but not always. They aren’t all going to be winners, so tax loss season comes every year; but with some discipline, one should have learned by now to at least take some profits when the opportunity to do so is there.

There are other investing styles and goals that are suitable to each individual. Other forums are full of useful information. Our threads here would benefit all of us if everyone would share their thoughts and information. Thanks for your post TR.