INVENTUS MINING DRILLS 111.45 METRES OF 1.35 g/t AuEq AT COBALT HILL

Microsoft Word - IVS_PR_Apr_11_2022_v4.docx (squarespace.com)

NEWS RELEASE

April 11, 2022 TSX-V Trading Symbol: IVS

INVENTUS MINING DRILLS 111.45 METRES OF 1.35 g/t AuEq AT COBALT HILL

TORONTO, ONTARIO (April 11, 2022) - Inventus Mining Corp. (TSX VENTURE: IVS) (“Inventus” or the

“Company”) is pleased to announce assay results from drilling at the Cobalt Hill target on its 100%-owned Sudbury

2.0 Project near Sudbury, Ontario.

Drilling highlights include:

• Hole CH-22-05A intersected 111.45 m of 1.35 g/t gold equivalent (AuEq)

1

including 1.24 m of 8.35 g/t AuEq

including 3.87 m of 4.13 g/t AuEq

• Hole CH-22-06 intersected 37.1 m of 1.61 g/t AuEq

including 2.03 m of 7.44 g/t AuEq

• Results are pending for an additional seven drill holes with intercepts of the sulphide

breccia.

At the Cobalt Hill gold-cobalt-nickel target, 13 diamond drill holes have been completed in 2022 for a total of 4,133

metres of drilling. To date, assay results for holes CH-22-01 through CH-22-05A and partial assays for CH-22-06

have been received (see Table 1).

In the northwest part of Cobalt Hill (see Figures), hole CH-22-05A was the first hole of this campaign to test the

continuity of sulphide breccia below and to the west of the intersection in hole CH-21-02 drilled last year (see News

Release of April 8, 2021). Hole CH-22-05A is a step out of approximately 40-m from last year’s drilling, encountered

a continuous mineralized intercept of 111 m from 200 to 311 m with interspersed high-grade gold. It also contained

the highest individual cobalt assay observed in drilling to date of 3,350 ppm. The geological control of these highgrade sections is currently not well understood.

Hole CH-22-05A intersected 111.45 m of 1.35 g/t AuEq from 200 m down hole, 0.75 g/t gold (Au), 448 ppm cobalt

(Co) and 135 ppm nickel (Ni); including 1.24 m of 8.35 g/t AuEq, 6.86 g/t Au, 1,124 ppm Co and 320 ppm Ni; and

including 3.87 m of 4.13 g/t AuEq, 3.41 g/t Au, 546 ppm Co and 155 ppm Ni.

Hole CH-22-06 testing the up-dip extent in CH-22-05A, intersected an upper sulphide breccia zone from 71.65 to

108.75 m. Assays have not yet been received for the lower sulphide breccia zone in CH-22-06 from 160 to 237 m

(77 m).

Hole CH-22-06 intersected 37.1 m of 1.61 g/t AuEq from 72 m down hole, 1.26 g/t Au, 261 ppm Co and 78 ppm Ni;

including 2.03 m of 7.44 g/t AuEq, 7.10 g/t Au, 241 ppm Co and 102 ppm Ni; and 0.76 m of 10.80 g/t AuEq, 7.50

g/t Au, 2,520 ppm Co and 612 ppm Ni.

The remaining seven holes with assays pending, all tested the mineralization at the northwest edge of Cobalt Hill

from surface to 300 m vertical depth. All seven holes intersected the sulphide breccia with various intervals ranging

from 30 to 174 m in length. A summary of sulphide breccia intersections with assays pending is listed in Table 1.

The drill program has outlined a large hydrothermal system at Cobalt Hill with broad intervals of continuous goldcobalt-nickel mineralization at the northwest edge that remains open at depth below 300 m. Work is focused on

understanding the geologic controls on gold, cobalt and nickel mineralization and modelling the mineralization in

three dimensions.

2

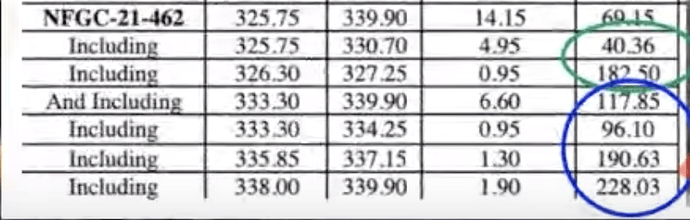

Table 1. Summary of select assays intervals and sulphide breccia intersections observed in holes with

assays pending.

Hole ID From (m) To (m) Interval2 (m) Au g/t Co ppm Ni ppm AuEq1 g/t

CH-22-01 171.00 174.09 3.09 1.30 167 108 1.55

CH-22-02 112.22 119.64 7.42 0.01 891 520 1.32

including 114.50 115.20 0.70 0.03 2,130 872 2.99

CH-22-03 45.49 48.45 2.96 0.13 990 298 1.45

and 63.53 64.10 0.57 0.07 1,020 146 1.36

and 65.95 69.10 3.15 0.05 390 124 0.57

and 73.03 74.42 1.39 0.06 744 352 1.11

and 82.26 82.81 0.55 0.54 500 234 1.25

and 301.58 302.42 0.84 1.17 939 1,510 3.02

and 308.48 309.00 0.52 0.24 1,050 4,850 3.84

CH-22-04 No Significant Assays

CH-22-05A 200.14 311.59 111.45 0.75 448 135 1.35

including 210.12 210.67 0.55 2.21 3,350 1,480 6.92

including 223.30 223.73 0.43 10.70 1,560 424 12.76

including 231.25 232.49 1.24 6.86 1,124 320 8.35

including 250.01 253.88 3.87 3.41 546 155 4.13

including 263.12 265.81 2.69 1.07 1,468 472 3.05

CH-22-06 71.65 108.75 37.1 1.26 261 78 1.61

including 73.03 73.54 0.51 6.88 208 111 7.18

including 75.88 76.47 0.59 7.02 792 281 8.10

including 78.01 80.04 2.03 7.10 241 102 7.44

including 92.28 93.04 0.76 7.50 2,520 612 10.80

and 160 237 77 Assays Pending

CH-22-07 218 286 68 Assays Pending

CH-22-08 0 72 72 Assays Pending

and 123 242 119 Assays Pending

CH-22-09A 0 73 73 Assays Pending

and 162 336 174 Assays Pending

CH-22-10 0 90 90 Assays Pending

CH-22-11 0 69 69 Assays Pending

and 82 183 101 Assays Pending

CH-22-12 0 58 58 Assays Pending

and 70 100 30 Assays Pending

CH-22-13 0 66 66 Assays Pending

Notes: 1AuEq calculated using April 5th, 2022, spot price of $1920 USD per oz Au, $82.00 USD per kg for Co and $33.31 USD per kg for

Ni, and assuming metallurgical recovery of 90% for Co and Ni. Metallurgical characteristics are not yet known. 2Assay intervals were calculated using values of >0.1 g/t Au within <2.5-m interval.

Results are core lengths; true widths are not known.