I guess after 6 years we could start a new thread!

TR just posted charts on Blackrock Silver on the new charts 2022 thread. Blackrock Silver is one of my larger plays. I posted several times on the old thread that was getting cluttered up. Blackrock Gold (BRC.V, BKRRF) Closed a C$10.35 Million Bought Deal Public Offering on Feb 19, 2021 and another one in Nov. Blackrock Closes C$7.0 Million Private Placement Led By A C$2.0 Million Investment From First Majestic Silver

There’s a twitter site that is quite active with good info for anyone interested:

https://twitter.com/BRCSilver

The Tax Loss season is over for last year. PM stocks were mostly down this past year. There are expectations by some experts that we may see gains of 20% on PMs in 2022. If this plays out, you may want to look at some favorite stocks I have positions. I may increase positions on some of these (or not). Some of the spec stocks I only have starter positions in. I’m not recommending any of these, but you may want to keep an eye on (watchlist?) them. TR started a thread on Charts for Metals and Stocks 2022 that I hope folks start using and requesting a look. If TR has time, I hope he’ll take a look through the list, and post if he sees something interesting from a chart perspective.

Again, this is mostly just holdings I presently have and NOT recommendations. I do expect a downturn in the markets with many of these stocks hopefully showing appreciable increases during the summer and latter half of the year.

Speculative Stocks

(watchlist – add on opportunity)

| Stock | P/E | Mkt Cap |

|---|---|---|

| BKRRF | -3.22 | 48.2M |

| DOLLF | -10.3 | 44.6M |

| GPL | -5.35 | 78.9M |

| IRVRF | -14.9 | 63.2M |

| IVS.V | -13.51 | 27,2M |

| LTHHF | -23.1 | 127.4M |

| MLLOF | -5.47 | 8.0M |

| NRGOF | -3.57 | 10.9M |

| SKE | -5.23 | 652M |

| SLVRF | -21 | 70.7M |

| ESKYF | -17.5 | 326M |

| LAB.V | -26.5 | 71.3M |

| NKOSF | -27 | 56.4M |

| SSVR.V | -9.45 | 58.9M |

| SSVRF | -9.5 | 46.4M |

| RRSSF | 44.7 | 575.4M |

Stocks for Accumulation (Value? presently under 200 MA?)

| Stock | P/E | Mkt Cap | Div |

|---|---|---|---|

| ATUSF | 14.7 | 587M | 1.37% |

| BTG | 8.81 | 4.0B | 4.23% |

| FSM | 11.3 | 1.1B | |

| FTCO | 5.9 | 151M | 4.66% |

| GOLD | 16.7 | 33B | 1.4%% |

| JAGGF | 5.4 | 240M | 5.8% |

| NEM | 23.8 | 48.1B | 3.65% |

| NSR | 34.3 | 433.5M | 1% |

| RGLD | 4.05 | 6.7B | 1.18% |

| VALE | 3.51 | 66.8B | 19.8% |

Dividend & Spec?

| Stock | P/E | Mkt Cap | Div |

|---|---|---|---|

| FUND | 2.89 | 253M | 8.70% |

| IBM | 26.7 | 124B | 4.60% |

| JBSAY | 4.75 | 14.8B | 8.70% |

| MMP | 11.41 | 10.1B | 8.70% |

| URA | 1.26B | 5.40% |

Wildcards (mostly full positions) long-term holds

AUMC

ARV.AU

KRRGF

MDMN

NFGC

OROCF

SAND

SKE

WPM

Good day people.

This article is not really so much about mining stocks, as it is about what Chile’s future interests are in mining in the near future.

They have a new president, and are working on a new constitution. Both will have a effect on mining in that country. .

It would be wise for anybody invested in that country to do D.D. into that matter.

https://www.seattletimes.com/nation-world/chile-rewrites-its-constitution-confronting-climate-change-head-on/

CORRECTION! Tax Loss season isn’t over yet after all!

I was wrong. Tax loss “season” is over in the US, but not in Canada!

Silver miners lead tax-loss bargain buying as deadline looms

With Canadian investors facing a deadline Wednesday to lock in capital gains or losses for the 2021 taxation year, tax-loss bargain buying is already well underway.

Jameson Berkow

Half of the ten best-performing equities on the Toronto Stock Exchange from Dec. 15 to the start of Wednesday’s trading session are among the year’s worst performers. That suggests investors have, for the most part, finished selling their underperforming holdings in order to offset their capital gains taxes - which typically happens from late November through mid-December - and bargain hunters have moved in to buy the dips.

Link to full article:

(https://www.bnnbloomberg.ca/silver-miners-lead-tax-loss-bargain-buying-as-deadline-looms-1.1701302)

Novo Resources: Wow! When is Novo gonna turn around? Now at .7827

Valuation Ratios

Price/Earnings (TTM)

4.24x

Price/Sales (TTM)

3.28x

Price/Book (MRQ)

0.63x

Price/Cash Flow (TTM)

3.49x

I picked up some yesterday T:NVO @$1.02 !

Congrats Rod, my iPhone sez that converts to about .80 American. It just traded at .85 so you’re immediately ahead of the game. Good timing . . . so far

Rich,

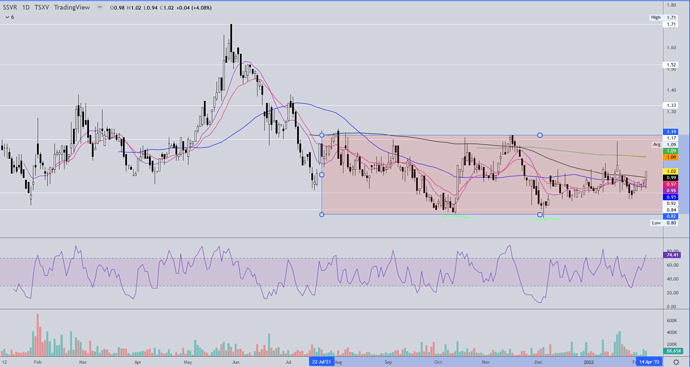

I’m long on SSVR.V (Summa Silver Corp). It’s been volatile on a regular basis. It’s also been in a basing downtrend for quite a while. I expect a reversal as drilling season gets underway. $10M recent funding. Projects in NV & NM. Chart?

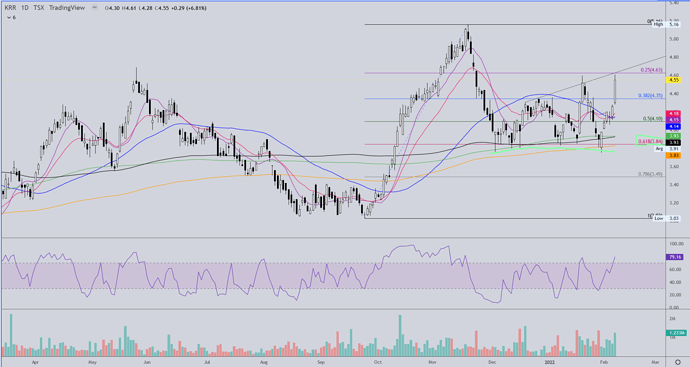

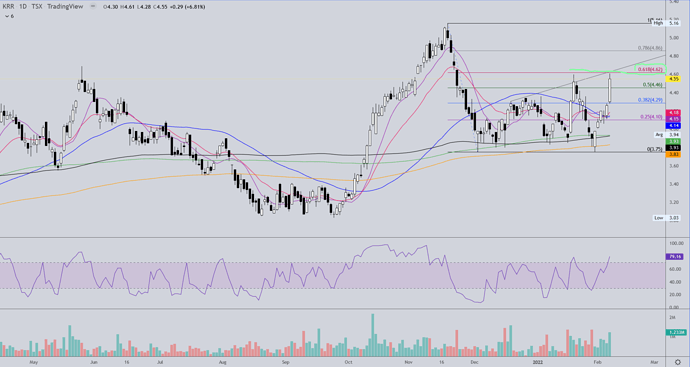

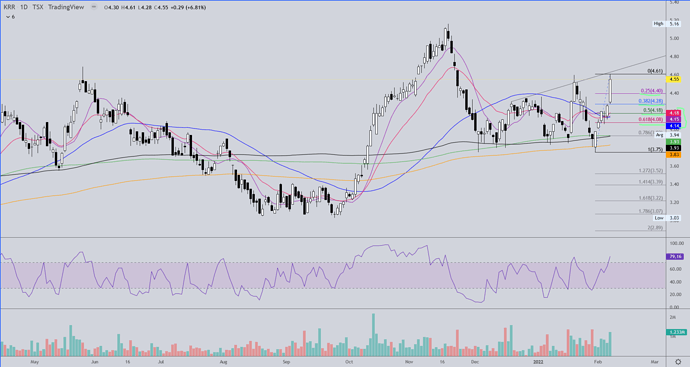

Also, KRR.TO looks like it may be starting to breakout. Chart please.

SSVR has only been around since early last year so the MA’s aren’t a whole lot of good on the daily, but the 130ma has been fairly consistent resistance since the middle of last year. Today you got a close above it and at the high price for the day. The horizontal S/R lines might be more dependable though. What is most interesting to me about the chart is that the stock has been in a trading range since the middle of last year, and you have what appears to be a double bottom as of last December. That’s a pretty long base the stock has for an eventual liftoff. The longer the base, the higher in space (the stock rises).

Last December KRR did a 61.8% retracement from its rise to 5.16. That also happened to be where the 130 and 200 MA’s were and the stock found a solid floor there.

The stock has had some nice volatility over the past couple months and has retraced its drop from its high twice to the 61.8% retracement level. Today it tagged the underside of an uptrend resistance line at that 61.8% level and is getting a bit overbought, perhaps ready to retrace some portion of this move before breaking higher. The RSI has hit a new high today and the possibility exists for more upside, but traders may already be looking to take profits at current levels considering the selling that occurred the last time the stock was trading at this price.

If the stock should retrace from here, watch the Fibonnacci retracement levels on the following chart, along with the MA’s, for support.

KRRGF is very close to all time highs once again on no news.

Previous PR outlined record production in 2021: https://www.otcmarkets.com/stock/KRRGF/news/Karora-Announces-Record-Annual-Gold-Production-of-112814-ounces-and-Gold-Sales-of-113628-ounces-for-2021?id=340770

EDIT: Now at $5.22 Canadian. New high.

KRR.TO closed at an all-time high today at $5.39 surpassing the spike/hype when they discovered the massive “nuggets” at the Father’s Day Vein back in 2018…which essentially made the company what it is today. This is a company/investment to be envied IMO.

Karora Announces Consolidated 2022 Gold Production Guidance of 110,000 - 135,000 ounces at AISC of US$950 - US$1,050 per ounce sold and Inaugural Nickel Production Guidance at Beta Hunt

TORONTO, Feb. 14, 2022 /CNW/ - Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce 2022 gold production guidance of 110,000 – 135,000 ounces and all-in sustaining cost (AISC)1 cost guidance of US$950 – US$1,050 per ounce sold. Karora is also pleased to provide its first nickel production guidance at Beta Hunt (since its 2020 re-naming), following a successful 2021 drilling campaign. Nickel production for 2022 is forecasted to range between 450 - 550 nickel tonnes. Karora has used a conservative nickel price assumption of $16,000 per tonne in its AISC1 by-product credit forecast. Karora notes the 2022 nickel guidance does not include any nickel production from the newly discovered 50C/Gamma zone.

Table 1 – 2022 GUIDANCE

PRODUCTION & COSTS

Gold Production koz 110 – 135

Payable Nickel Production2 tonnes 450 - 550

All-in sustaining costs (AISC) 1 US$/oz 950 – 1,050

CAPITAL INVESTMENTS

Sustaining Capital A$M 9 – 15

Growth Plan Capital A$M 52 – 65

Exploration & Resource Development Capital A$M 21 – 24

- Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures

section of Karora’s MD&A dated November 8, 2021. - Payable nickel production guidance is treated as a by-production credit that is reflected in AISC.

- See below for “Notes to Table 1” for additional information.

Paul Andre Huet, Chairman & CEO, commented: "Following our record full year 2021 gold production of 112,814 ounces, gold production for 2022 is projected be between 110,000 – 135,000 ounces. After careful review, we consider it prudent at this time to both widen and trim our 2022 production guidance range to factor in the ongoing challenges associated with COVID-19 restrictions that are impacting the entire mining sector in Western Australia.

We are also very pleased to announce our first nickel guidance of 450 - 550 tonnes from our Beta Hunt operation (since our 2020 re-naming), as nickel becomes an increasingly important part of the Karora story. Currently, we are mining nickel from remnant nickel Mineral Resource areas. However, the recent 50C and 30C nickel discoveries position us well to increase nickel production in the coming years beyond what we have forecast for 2022. Nickel production is reflected as a by-product credit in our 2022 AISC guidance at a conservative assumed nickel price of US$16,000 per tonne. With the current LME nickel spot price over US$23,000 per tonne, there is upside potential for achieving a significantly higher by-product credit to our AISC.

Like all our peers operating in Western Australia, we have been preparing for continued pressure associated with labour availability and supply chain constraints at our operations. Combining the sector-wide impacts on materials, labour supply, cost inflation and the lack of clarity as to when these constraints may ease, we consider it important to factor this into our production and cost guidance forecasts for 2022.

Should restrictions ease in the near term, we expect some lag before relief from these challenges can be realized across the mining sector. We note that we are not making any revision to our 2023 and 2024 numbers.

We have also adjusted AISC cost guidance slightly upwards due to the same constraints. The increase in AISC is primarily due to increased labour costs, fuel and consumables. We remain optimistic that the situation will improve later in the year with the anticipated easing of restrictions. However, we are forecasting higher AISC in the first half of 2022, with lower second half costs anticipated to bring our full year numbers within the guided range. Our 2022 capital guidance has been increased by approximately 12% (midpoint to midpoint) to account for increased labour, contractor and materials costs associated with our mill expansion work at Higginsville and the development of a second underground decline at Beta Hunt.

With respect to progress on our growth plan, I am pleased to announce that development of our second decline at Beta Hunt is underway and ahead of schedule. Karora crews have commenced work on the second decline from underground with the first cut taking place on the 506 level of the mine. We have also selected a contractor for construction of the portal and upper portion of the decline with mobilization scheduled for February 14, 2022.

We enjoyed strong exploration success in 2021 at Beta Hunt with both new discoveries and significant extensions of gold zones (Larkin, Fletcher and Gamma) and nickel zones (50C and 30C). In 2022, we will continue to push ahead on the exploration and resource development front with an aggressive drilling program planned across both operations with total expected expenditures of between A$21 - A$24 million.

Wrapping up, although challenges exist for our Western Australian operations in the presence of continued COVID restrictions, I have never been more confident in the abilities of our team to execute on our plans, as we have demonstrated during these past three years. Whether it was bush fires, floods or COVID restrictions, our Karora team has continuously risen to overcome these impacts to deliver on our strategy to expand the business and deliver shareholder value."

Figure 1: Beta Hunt Second Decline Commenced Underground

2022 Exploration

Karora’s exploration will be underpinned by both surface and underground drilling at Beta Hunt and Higginsville with a total of 85,000 metres planned in 2022. Drill metres are divided into both Exploration drilling (42,000 metres) aimed at delivering additional resources from new discoveries and Resource Definition drilling (43,000 metres) directed at upgrading and extending existing Mineral Resources.

At Beta Hunt, the growth opportunity is significant. During 2022, Karora plans to drill 43,000 metres to test more of the eight kilometre strike of the gold and nickel mineralized system. Drilling will target extensions to the Western Flanks and A Zone Mineral Resources, Larkin, the new Fletcher Shear Zone and follow up on the significant gold intersections in the under-explored shear zones south of the Alpha Island and Gamma faults. Exploration drills will also be following up on the recent nickel discovery towards the southern end of the mine with drilling aimed at extending the 50C Nickel Trough in the Gamma Block as well as testing for new parallel nickel troughs in the Beta Block. Karora is committed to developing its nickel potential and has committed 16,000 metres to test and upgrade nickel targets in 2022. By the end of February Beta Hunt will have in place three underground diamond rigs (full-time) and a surface diamond rig (part-time).

At Higginsville, Karora’s exploration budget is focused on an extensive near-mine and greenfields drilling program to follow-up on priority targets including the Sleuth Trend as well as extensions to the Spargos Mineral Resource. Planned drilling totals 42,000 metres of which 13,000 metres is aimed at extending, upgrading and adding additional mineral resources at Spargos. On-site drill equipment currently comprises three rigs: two diamond rigs plus one RC rig. Dedicated salt lake drilling equipment comprising diamond, RC and aircore rigs will be used later in the year to undertake the drilling on Lake Cowan.

Notes to Table 1

- 2022 guidance, which was announced in June 2021 (see Karora news release dated June 29, 2021), is updated as detailed above in Table 1.

- The Corporation’s guidance assumes targeted mining rates and costs, availability of personnel, contractors, equipment and supplies, the receipt on a timely basis of required permits and licenses, cash availability for capital investments from cash balances, cash flow from operations, or from a third-party debt financing source on terms acceptable to the Corporation, no significant events which impact operations, such as COVID-19, nickel price of US$16,000 per tonne, as well as an A$ to US$ exchange rate of 0.74 and A$ to C$ exchange rate of 0.91. Assumptions used for the purposes of guidance may prove to be incorrect and actual results may differ from those anticipated. See below “Cautionary Statement Concerning Forward-Looking Statements”.

- Exploration expenditures include capital expenditures related to infill drilling for Mineral Resource conversion, capital expenditures for extension drilling outside of existing Mineral Resources and expensed exploration. Exploration expenditures also includes capital expenditures for the development of exploration drifts.

- Capital expenditures exclude capitalized depreciation.

- AISC guidance includes general and administrative costs and excludes share-based payment expense.

- See “Risk Factors” described on page 29 of the Corporation’s MD&A dated March 19, 2021.

About Karora Resources

Karora is focused on doubling gold production to 200,000 ounces by 2024 compared to 2020 and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,800 square kilometers. The Company also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

For anyone anticipating a downturn in the general indexes as many commentators are now predicting, Barrick (GOLD) may be a reasonable long term hedge. Did Warren Buffit miss this one? It has an interesting Monthly interval chart. What do you make of it TR?

It is up about 5% on latest NR … it just put out guidance:

Barrick Delivers on Guidance, Opens New Exploration Frontiers

February 16, 2022

Full Year and Fourth Quarter 2021 Results

https://www.barrick.com/English/news/news-details/2022/q4-2021-results/default.aspx

New Presentation for Karora. They have an excellent track record for meeting milestones and you can see with confidence on where they are headed over the next several years. This is a one to two year double in price sort of a stock.

Karora is one of my very favorite and largest positions. Yes, I’m overweight on this holding and it hasn’t failed to deliver. I got in early and and have kept adding through the ups and downs. It is a fact that their management team has been methodical and steady in their planning. Many investors wanted the fast and furious return after the Father’s Day vein launched this company out of imminent bankruptcy which was a fun ride. I still have a few shares left over from those days before they reorganized and changed their name to Karora. This company may be guilty in their guidance of “under promising and over delivering”! Can’t say enough good things about having invested in this company.

High-Grade Gold Up to 30.3 g/t Au Defined in Rock Chip Sampling at Nunyerry North, Egina District

9:11 am ET February 17, 2022 (Globe Newswire) Print

HIGHLIGHTS

Novo Resources Corp. (“Novo” or the “Company”) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to report exciting high-order soil sampling assay results (figure 1) for exploration work conducted in Q4, 2021 at the Nunyerry North gold prospect (“Nunyerry North”) in the West Pilbara (figure 2). Nunyerry North is part of the Croydon Project), which is a 70%/30% joint venture with the Creasy Group.

Does anyone know what the $2.00 royalty stock is that they are advertising?

Who is they ?