Here’s a “Laundry List” of stocks you may wish to consider to get back in the game with a profit!

| Stock Name | Country | Market Cap | PE Ratio |

|---|---|---|---|

| Barrick Gold (GOLD) | Canada | $27.264B | 22.19 |

| Agnico Eagle Mines (AEM) | Canada | $24.365B | 23.65 |

| Franco-Nevada (FNV) | Canada | $20.678B | 30.66 |

| Gold Fields (GFI) | South Africa | $12.018B | 0.00 |

| Royal Gold (RGLD) | United States | $7.547B | 32.73 |

| AngloGold Ashanti (AU) | South Africa | $7.171B | 0.00 |

| Kinross Gold (KGC) | Canada | $6.655B | 12.90 |

| Alamos Gold (AGI) | Canada | $4.803B | 24.20 |

| Harmony Gold Mining (HMY) | South Africa | $3.553B | 0.00 |

| Osisko Gold Royalties (OR) | Canada | $2.658B | 29.26 |

| Triple Flag Precious Metals (TFPM) | Canada | $2.523B | 33.87 |

| Eldorado Gold (EGO) | Canada | $2.454B | 23.51 |

| Iamgold (IAG) | Canada | $1.203B | 250.00 |

| Centerra Gold (CGAU) | Canada | $1.172B | 0.00 |

| Dundee Precious Metals (DPMLF) | Canada | $1.158B | 7.09 |

| Seabridge Gold (SA) | Canada | $0.885B | 0.00 |

| DRDGOLD (DRD) | South Africa | $0.647B | 0.00 |

| Gold Reserve (GDRZF) | United States | $0.324B | 0.00 |

| Osisko Development (ODV) | Canada | $0.217B | 0.00 |

| Jaguar Mining (JAGGF) | Canada | $0.108B | 6.18 |

| U.S GoldMining (USGO) | Canada | $0.068B | 0.00 |

| [US Gold Corp (USAU)] |

(US Gold Corp Profit Margin 2010-2023 | USAU | MacroTrends)|United States|$0.034B|0.00|

![]() The above list is from Macro Trends

The above list is from Macro Trends ![]()

It is a simple fact that Major producers have outperformed $SPX since 2021. Do a weekly chart comparison to your favorite GDX (avg yield 1.75%) component to see. A favorite Nevada small steady producer with an 8% yield and monthly payout is Fortitude Gold. Anyone else have a favorite producer with monthly payouts?

Anyone check last year’s posts for suggested investment research?

GLTA

EZ

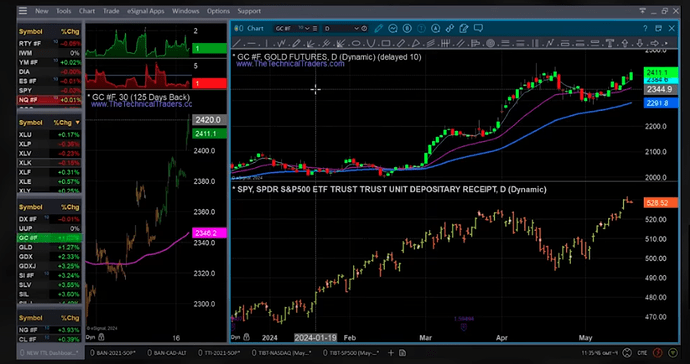

If your retirement funds have been enjoying the melt-up in the major sectors over the past decade this video with Chris Vermeulen will be of interest - or especially if your portfolio has not performed as expected :

(https://www.youtube.com/watch?v=dRBo9olC2hQ)

Commodities based around pricing should do well in the upcoming phases of the market. The VIX is at a multi-month low:

The saying here “When the VIX is low, it’s time to go.” Means fear has left the market. Although this video is a few days old, generally the market is signaling an eventual pullback. If the market (DOW) pauses and starts to move higher, commodities will likely be pulled along higher also.

Chris explains that he likes asset classes with high volatility and rotates out of the slow moving or declining ETF asset classes. There are several graphic charting examples of how he employs this. He does not like the buy and hold strategy many investors employ. Precious Metals is the best play right now and Chris has a different approach in this part of his portfolio. When the metals and miners come to life Chris becomes more bearish on the overall market. If a recession occurs, Vermeulen thinks Nuclear Power will come back into play and covers some of the Uranium market and thinks it has long-term potential that can last for many, many years over the next 5-10 years.

An additional video, that I think will benefit many, I already posted on the Global Economy thread. The discussion is deep and makes sense to me, but also is what has me concerned:

(https://youtu.be/ReVEOLP0Ay8?t=168)

![]() I gained a broader perspective of what to expect regarding currencies and the broader market after viewing this long discussion

I gained a broader perspective of what to expect regarding currencies and the broader market after viewing this long discussion

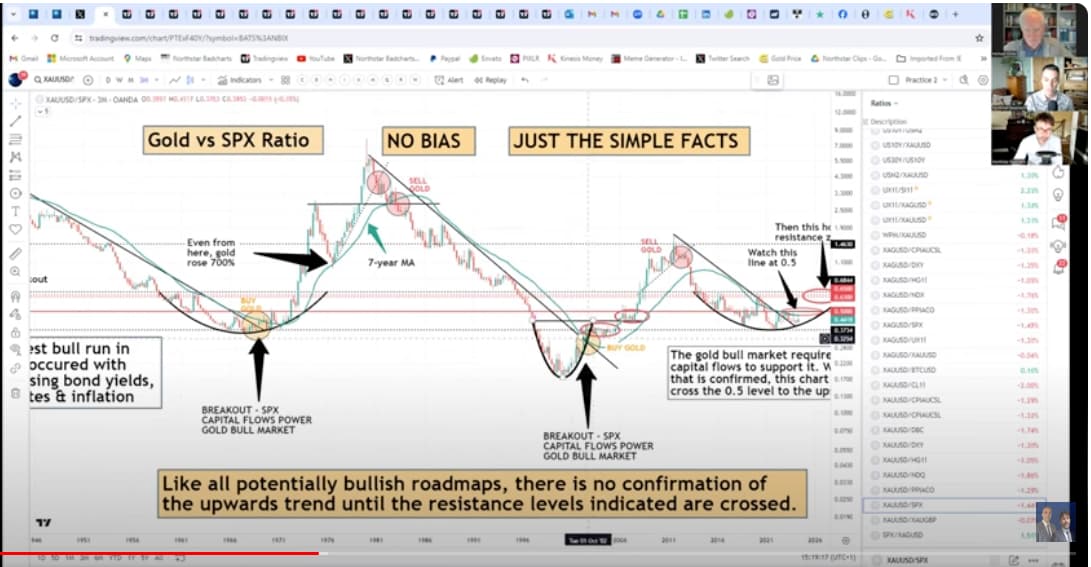

And one more for your viewing pleasure over the long weekend. An interview with Michael Oliver who starts by saying he’s “not a sports fan, but the game unfolding this year is the best you’ll ever see, in the markets and beyond!”

“Gold and Silver Entering Acceleration Phase" -Michael Oliver”

(https://youtu.be/mNFHIXL3cTU?t=173)

Lots of charts with detailed discussion included. He has an unusual momentum based strategy for viewing and investing in markets and gives a detailed explanation of each chart.

![]() This is the one he begins his talk with, with the chart going back 75 years. In your idle time over the long weekend enjoy the videos and the accompanying discussions presented . You may find some information of value.

This is the one he begins his talk with, with the chart going back 75 years. In your idle time over the long weekend enjoy the videos and the accompanying discussions presented . You may find some information of value.

EZ

Anyone follow the saga in 2019 of the Father’s Day 987 OZ Gold rock at Beta Hunt Mine? In 2020 RNC Minerals Announces Name Change to Karora Resources Inc and started trading on the TSX exchange as “KRR” (KRRGF). It had a prolific following on our Other Stocks threads and was hugely profitable over the years for many, myself include.

Recently Karora merged with Westgold, another Australian miner. The announcement excerpt and link are shown here:

Westgold Karora Merger Information

Merger to Create +400 kozpa 1 Australian Gold Miner – Fully Leveraged to the Gold Price

Transaction Highlights:

Westgold Resources Limited (ASX: WGX, OTCQX: WGXRF – “Westgold”) and Karora Resources Inc. (TSX: KRR, OTCQX: KRRGF – “Karora”) have agreed to combine in a merger pursuant to which Westgold will acquire 100% of the issued and outstanding common shares of Karora by way of a statutory plan of arrangement under the Canada Business Corporations Act (“Transaction”).

The Transaction represents a transformational step change in growth for both Westgold and Karora shareholders:

- Creates a globally investable, mid-tier gold producer operating exclusively in Western Australia with a highly complementary combination of mining and processing assets, people and balance sheet;

- Top 5 largest, ASX listed Australian gold producer based on the pro forma market capitalisation with combined Ore Reserves of 3.2Moz2 and Mineral Resources of 13Moz3;

This stock is well worth keeping an eye on. I do have a large position remaining as a result of the this new combined mining merger.

EZ

I like that concept of a “small steady producer” especially if they are high-grade and have a low AISC.

Anyone that was part of the Karora merger with Westgold Resources may want to listen in on this:

part of an in-depth discussion on Westgold Resources’ latest progress with Wayne Bramwell, Managing Director & CEO. He presents the company’s financial year-end update and recent successes, such as the impressive drill results from the Fletcher Zone at Beta Hunt and the newly declared South Junction Ore Reserve. Wayne also provides an overview of what these developments mean for Westgold’s future. A live Q&A session with Wayne follows.

Join Wayne today at 6 AM AWST / 6 PM ET / 3 PM PT

To register, go to It's not too late to join Wayne for a live Q&A!

Spartan, another Australian corp was mentioned by Baldy recently, as one you might want to keep a watch on. I agree, thanks John. Interestingly, it’s not far from the Westgold’s mining sites. Here’s a clip from Spartan’s website:

Artemis Res (ARTTF)- Titan Prospect High Grade Gold Vein Discovery samples 10,000gtAu 23.8%Cu, 10.4oz Gold Bar from samples. {10,000gt is the highest assay capacity of the lab which is 1% Gold ! , so these samples were OVER 1% Gold}

Might be a good time to get in early. for those of us who are suffering with MDMN !

The company has extracted multiple hard rock gold samples from the quartz-iron veining with the largest being an estimated 10 cm by 4 cm.

… these gold occurrences originate from a hard rock source which indicates a potentially large gold structure.

Sampling work was conducted around the Titan prospect with about 300 kg of material removed. This material was sorted, crushed, separated, extracted and a bar weighing 10.4 oz was subsequently produced.

Rock chip samples were analyzed in the ALS laboratory in Perth and included Gold grades of as high as 10 000 g/t, 6 520 g/t and 10.2 g/t.

Copper assay results also returned high values, including 23.8% and 14.55% .

The Titan mineralized trend has been tracked for about 700 m and appears to remain open under shallow cover. Furthermore, recent field observations suggest it also occurs on a much larger and strike extensive structural zone.

“We remain excited by the prospectivity that our tenements continue to deliver. The re-focus of exploration efforts and strategy on a tenement-wide scale is continuing to deliver evidence of multiple new zones for gold mineralization, which we believe could contain the potential for large-scale deposits. The next steps will allow us to refine these zones, delineate bona-fide prospects and work towards more targeted exploration efforts,” commented executive director George Ventouras.

Titan is located within the Artemis owned Carlow tenement and about 2 km from the Carlow project, which has a mineral resource of 374 000 oz, or a mineral resource of 704 000 gold-equivalent ounces.

Artemis Resources (ASX:ARV) Managing Director George Ventouras Titan Gold Prospect Interview

Congrats to Gold now at 2500! Hey Jimmy, how much is the stockpile worth now??

If we knew the tonnage & an approximate grade, we could guesstimate ! But alas, this particular stock (AUMC) gives the least info of any stock I know of, and I follow a LOT of stocks !

Gold actually now at $2,621.40, amazing ! but the naked shorters for all gold/silver stocks (via the $Billion ‘Funds’) are able to drives prices down while gold goes up , so that they can buy at lower prices.

We, the little people, have to watch while we get screwed !!!

This one certainly is worth keeping an eye on. Unfortunately it is only available to those who have international trading available. It makes trading restricted for the majority of those who trade primarily on US exchanges. Also, Osiko Resources has taken an interest in this one.

Aggressive exploration campaign

Back in February 2023, SPR put a target of a 600,000oz deposit that exceeded 5g/t gold for Never Never and has already far exceeded that expectation.

The deposit’s maiden MRE came in at 952,000oz at 5.4g/t and is growing at pace – and so are surrounding prospects, which the explorer has been aggressively drilling into.

Resource expansion, reserve definition and near-mine exploration drilling have been targeting Never Never “lookalikes” which include the Pepper, Four Pillars, West Winds and Sly Fox prospects.

Osisko Gold Royalties Announces Agreement to Purchase Royalties on Spartan Resources’ Dalgaranga Gold Project in Western Australia

MONTREAL, Sept. 30, 2024 (GLOBE NEWSWIRE) – Osisko Gold Royalties Ltd (the “Company” or “Osisko”) (OR: TSX & NYSE) is pleased to announce that it has entered into a binding agreement to acquire a 1.8% gross revenue royalty (“GRR”) on the Dalgaranga Gold project (the “Dalgaranga Royalty” and the “Project”) operated by Spartan Resources Limited (“Spartan”) in Western Australia. In addition, Osisko shall also acquire a 1.35% GRR (the “Exploration Royalty”) on additional regional exploration licenses in proximity to Dalgaranga. The considerations to be paid by Osisko to the seller, Tembo Capital Mining Fund III (“Tembo”), for the Dalgaranga Royalty and the Exploration Royalty, respectively, total US$44 million and US$6 million (collectively the “Transaction”). Closing of the Transaction is subject to approval from Australia’s Foreign Investment Review Board which is expected in the coming weeks.

TRANSACTION HIGHLIGHTS

Exposure to a Premium Gold Development Project in a Top-Tier Mining Jurisdiction

- Dalgaranga is one of the best gold development and production re-start projects globally. The Project is located in Western Australia, one of the most prolific and well-established mining jurisdictions; and

Dalgaranga, a recently mined open pit operation, has been rejuvenated by very impressive new high-grade discoveries, most notably the Never Never and * by very impressive new high-grade discoveries, most notably the Never Never and Pepper deposits, which have shifted the focus towards ore extraction via underground mining methods.

Near-Term Cash Flow Potential

- The Dalgaranga mill is fully-permitted and approvals for future underground mining are in progress, providing a clear path to near-term production. The Project is on the verge of re-starting as one of Western Australia’s next significant high-grade gold mines with first production from underground likely re-commencing within the next 2 years.

Note that miners to gold ratio is at an all-time low as reported by many. There are many more accessible mining stocks on US exchanges that could be reported on this thread, but I’ll have to leave that to others for now, as I’ll be traveling out of state most of October. Tomorrow’s pending longshoreman’s dockworkers strike is of immediate concern to all in the US:

A potential dockworkers strike could mean product shortages and high prices ahead of the holidays

NEW YORK (AP) — U.S. ports from Maine to Texas could shut down Tuesday if a union representing about 45,000 dockworkers carries through with a threatened strike.

A lengthy shutdown could raise prices on goods around the country and potentially cause shortages and price increases at big and small retailers alike as the holiday shopping season — along with a tight presidential election — approaches.

“First and foremost, we can expect delays to market. And those delays depend on really what the commodities are and priorities at the ports and how quickly things move,” said Mark Baxa, president of the Council of Supply Chain Management Professionals.

(A potential dockworkers strike could mean product shortages and high prices ahead of the holidays)

Take care everyone, and GLTA

EZ

Ramaco Resources, METC, is a coal mining company I got into last month. They have discovered rare earth ore at one of their mining sites.