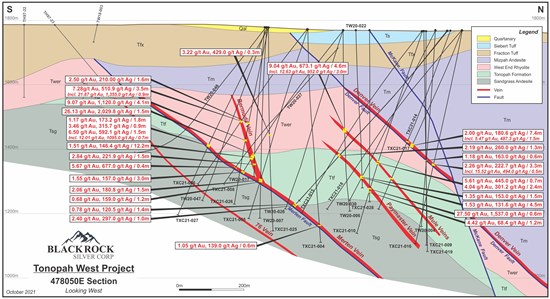

Anyone look at Black Rock Silver…think of taking a position if it gets a pullback. First Majestic has been buying in

Maiden resource due Q1 2022.

100,000 M drill program.

Lithium ;

Image from Neo Lithium Corp.

**And: Just a good idea for the U.S.A…

- GM REACHES HISTORIC AGREEMENT TO INVEST MILLIONS IN LITHIUM PROJECT AT THE SALTON SEA

July 2, 2021

In The News

Jesus Reyes

General Motors (GM) and Controlled Thermal Resources have reached a historic agreement to develop low-cost lithium at the Salton Sea Geothermal Field, the companies announced on Friday .

With this deal, GM becomes the first company to make a multi-million dollar investment in Controlled Thermal Resources Hell’s Kitchen project, which is located near the Salton Sea. The agreement means that a significant portion of GM’s future battery-grade lithium hydroxide and carbonate could come from the Hell’s Kitchen development.

Lithium is a metal crucial to GM’s plans to make more affordable, higher mileage electric vehicles, the company stated in its announcement release .

Hell’s Kitchen Lithium and Power development in the Salton Sea Geothermal Field is located in Imperial County and is the largest known geothermal resource in the world. The area is known as “lithium valley.”

News Channel 3 morning anchor Angela Chen went in-depth on the lithium at the Salton Sea in part four of her special series " Troubled Waters: The Salton Sea Project ."

“One of the single best locations, one of the largest geothermal reservoirs in the world is right at the Salton Sea,” Jonathan Weisgall, Vice President of Government Relations for Berkshire Hathaway Energy.

As the first investor, GM announced it will have first rights on lithium produced by the first stage of the Hell’s Kitchen project and included an option for a multi-year relationship.

“The relationship between GM and CTR is expected to accelerate the adoption of lithium extraction methods that cause less impact to the environment. A significant amount of GM’s future battery-grade lithium hydroxide and carbonate could come from CTR’s Hell’s Kitchen Lithium and Power development in the Salton Sea Geothermal Field, located in Imperial, California. With the help of GM’s investment, CTR’s closed-loop, direct extraction process will recover lithium from geothermal brine,” reads a statement by GM.

Assemblymember Eduardo Garcia (D-Coachella) issued a statement applauding the agreement.

“Our efforts to galvanize a thriving, robust lithium economy in our Salton Sea region are becoming a reality more and more each day. With the ability to meet one-third of the global lithium demand, our Imperial County, Salton Sea area, can take center stage in the future of our domestic lithium supply chain. This strategic agreement between Controlled Thermal Resources and General Motors marks the first major investment in actualizing that vision,” said Garcia, who serves as the Chair of the Assembly Select Committee on California’s Lithium Economy.

On May 26, 2021, Rod Colwell, CEO of CTR, provided testimony at Garcia’s first California’s Lithium Economy Select Committee hearing. Colwell presented slides with an overview of their local project and lithium recovery technology.

“After years of laying the groundwork, we are ready to move forward pedal to the metal on our cleaner air, electric vehicle, and climate goals while utilizing these economic development opportunities to bring vital resources, improve public health, and uplift overall circumstances in our region. More than ever, we must continue to elevate our community engagement efforts to ensure local stakeholders and residents are in the driver’s seat as we set this new course. Our work last year (AB 1657, E. Garcia) to establish the Lithium Valley Commission will help ensure that,” Garcia said.

Last year, Garcia passed AB 1657 creating a Blue Ribbon Commission on Lithium Extraction in California (Lithium Valley Commission) to bring together industry experts and community stakeholders to review, analyze, and report recommendations to advance lithium extraction opportunities.

A final report is due to the California State Legislature by October 1, 2022.

Congressman Raul Ruiz, M.D. issued a statement on the historic agreement:

“General Motors’ investment in renewable energy development at the Salton Sea presents an incredible opportunity for clean energy job creation in our Desert,” Ruiz said. “With the lithium deposit at the Sea, our region can become a global leader in manufacturing for the batteries that will power our clean-energy future. I have long advocated for the renewable energy potential at the Sea, and I look forward to working with GM to develop a supply chain that prioritizes sustainability, public and environmental health, and local job growth.”

Interesting you show a PIC of Neo Lithium. Recent news headlines show:

Oct 12 it is announced that Zijin Mining to Acquire Neo Lithium Corp. in All-Cash Offer Then, on Oct 27 Neo Lithium Announces Definitive Feasibility Study Results on its 3Q Project with a “ *$1.129 billion after-tax NPV with 8% discount rate and a 39.5% IRR at an average price $12,321 /t LCE with a 50-year life of mine and payback of 2 years and 3 months from commencement of production.*”

I had a modest starter position I’d held for some time. Unfortunately I sold ½ my position at 100% profit intending to buy back on retraces. I did buy some back, but not enough to make up for my full position. I’ve resigned myself to make only a 360% profit on my remaining position (Boohoo … Waah!), waiting for news on a possible counteroffer. With a 50 year life of mine I was hoping this would garner more attention rather than be bought out by the Chinese.

There are quite a few other Lithium plays as CS is bringing to everyone’s attention. I recently read where Argentina contains a significant portion of the Lithium Triangle, which comprises more than half of the world’s resources of lithium. Some of the Lithium miners that I have positions in are: OROCOBRE LTD NPV, ALBEMARLE CORP COM, LITHIUM AMERICAS CORP COM and a couple of the more speculative plays. I’m sure others here have positions in some of the Lithium miners. Perhaps this discussion should be moved to the existing “Other (Non-Mining) Stocks” thread as this “Other Mining Stocks” thread has historically been focused mostly on Gold and Silver miners. If there is enough interest we could start a Lithium Miners thread, as the sector is sure to continue to grow in importance and profitability! Anyone else interested in starting a new thread?

Anyone still keeping an eye on Inventus?

NEWS RELEASE

November 2, 2021 TSX-V Trading Symbol: IVS.VINVENTUS PROVIDES EXPLORATION UPDATES AND 2022 OUTLOOK, EXPANDS SUDBURY 2.0 PROPERTY

TORONTO, ONTARIO (Nov 2, 2021) - Inventus Mining Corp. (TSX VENTURE: IVS) (“Inventus” or the “Company”) is pleased to provide an update on its exploration programs at its 100%-owned Pardo and Sudbury 2.0 Projects near Sudbury, Ontario.

Pardo Project

Inventus has signed an agreement with Northern Sun Mining Corp. (“NSMC”) to use the Redstone Mill in Timmins to process the first 6,000 tonnes of a planned 50,000-tonne bulk sampling program. Redstone’s gravity and flotation flowsheet is ideal for processing Pardo’s gold mineralization and is expected to achieve high gold recovery (estimated at +92%) at commercially reasonable costs. Inventus and NSMC are currently marketing the concentrates to secure a sales agreement and awaiting regulatory approvals prior to the commencement of the bulk sample.

The first six mini bulk samples from the 007 Zone in July 2021 were a technical success, with assays ranging from4.0 to 17.1 g/t gold and an average grade of 9.2 g/t gold. This work has prompted a continuation elsewhere on the project with 22 additional mini bulk samples currently being collected.

Sudbury 2.0 Exploration Program

Inventus has secured a diamond drill rig and crew for the upcoming 5,000 m winter drilling program at Cobalt Hill andRathbun. A few test holes are planned at Rathbun, followed by drilling at Cobalt Hill beginning in January.

Cobalt Hill

In August 2021, a 3D induced polarization (IP) survey at Cobalt Hill identified a 600-m north-south by 500-m east- west anomaly. The IP anomaly strongly correlates with Inventus’ surface mapping and drill intersections of sulfide breccia. Drill hole CH-21-02, drilled before the 3D IP survey, crossed the northern edge of the anomaly and returned an intersection of 7 m of 4.4 g/t gold, 0.09% cobalt and 0.03% nickel within 44 m of 1.3 g/t gold, 0.04% cobalt and0.02% nickel (see April 8th, 2021 news release). The center and strongest response of the IP anomaly occurs 200 m south of drill hole CH-21-02 and begins at a depth of approximately 150 m. Twelve holes are initially planned to target untested areas of the anomaly.

Climbing the wall of worry?

INVENTUS (IVS.V) Weekly Chart

Another winning company, New Found Gold, announces the use of Chrysos Photo Assay technology to improve assay times:

New Found Provides Update on Its QA/QC Program and Announces Collaboration with MSALABS to Utilize Chrysos PhotonAssayTM Methods for Its Queensway Project

BY Business Wire

— 7:33 PM ET 11/04/2021VANCOUVER, British Columbia–(BUSINESS WIRE)-- New Found Gold Corp. ( [NFGC]

** (“ New Found ” or the “ Company ”) is pleased to provide an update regarding its QA/QC Program at Queensway and to announce its plans to proceed with Chrysos whole-core PhotonAssayTM methods for the assaying of core samples from its 100%-owned Queensway Project (“ Queensway ”), located on the Trans-Canada Highway 15km west of Gander, Newfoundland.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211104006414/en/

- As part of New Found’s ongoing technical and QA/QC work, independent consultants, RSC, recently submitted 30 half-core samples to Eastern Analytical (“EA”) for assay. The other half of these drill core intervals had previously been assayed by ALS Minerals (“ALS”) and incorporated into the Company’s reported drill results. A scatter plot comparing these results is provided in Figure 1.

- RSC has concluded that the EA half-core samples consistently returned lower grade assays than ALS assay grades for the original half-core samples, and that these data suggest a strong bias in these results that particularly seems to be present in the higher-grade samples.

- Results from a set of 10 similar half-core verification samples were received and reviewed in May 2021. Differences observed in these assay results when compared to the original half-core samples were determined by New Found’s independent consultants to be not statistically significant.

- The Company is now proceeding with a program to further assess the presence and source of the bias, and to implement steps based on its findings.

- The bias observed in the 30 verification samples could be caused by one or a combination of the following: nugget-effect, sample selection bias and/or any part of the process of sample preparation or analytical methods used at the laboratories. The certified reference material (“CRM”) submitted as part of the Company’s internal QA/QC program did not identify a bias at either laboratory, however it should be noted that the CRM’s do not test the entire metallic screening process.

- Two test programs have been designed by RSC with input from the Company to identify the potential sources of bias.

- The first program will test whether there is a bias between the two labs and will involve submitting 167 half-core samples to ALS for crushing and splitting into two equal lots. The two splits are to undergo the standard metallic screening process at the two respective labs, EA, and ALS.

- If a statistically significant bias is demonstrated in test program one, test program two will determine which laboratory produced the bias by collecting two sets of 60 half-core samples where one set was originally assayed at ALS and the other by EA and submitting these 120 half-core samples to a third “umpire” laboratory.

- If testing program one does not indicate a bias between the labs, then the bias is likely to have been introduced during the sampling of the core in the core yard.

- Both programs will run concurrently to limit further delays and the results are expected in approximately eight weeks’ time. The time line for completion of this work will depend on turnaround times at the assay labs, so there may be some variability in this time line. The Company and RSC are putting all their efforts into getting this program completed as soon as possible.

- In the event that the test work determines that a bias was introduced in the sampling process, the remaining half-core samples still held by the Company will be sent for assay and a weighted average of the two half-core samples will then be used to determine an updated assay.

- Recognizing the nuggety nature of gold mineralization at Queensway, for the last several months New Found has been considering implementing assaying of whole-core samples. This approach provides a larger sample for assay which reduces variability of assay results particularly helpful in nuggety gold systems such as at Queensway and removes the possibility of bias from the half-core sampling process. After consultation with RSC, the Company has decided to immediately move to whole-core assay as the primary method for future assaying of drill core intervals.

- As part of the implementation of whole-core assaying, the Company is in advanced discussions with MSALABS to implement the state-of-the art Chrysos PhotonAssayTM method on whole-core samples from Queensway. This method is employed around the world by other companies on nuggety gold ores with excellent results.

- The Company anticipates signing an agreement with MSALABS shortly for approximately 20,000 Chrysos PhotonAssayTM assays per month at a facility outside of Newfoundland and is advancing discussions towards installing a Chrysos PhotonAssayTM instrument in Gander. As part of this arrangement the Company would work with MSALABS to establish a sample preparation facility in Gander.

- The benefits of utilizing the Chrysos PhotonAssayTM method on whole-core samples include:

- The preservation of the entire whole-core sample in this non-destructive testing method leaving it available for additional assay and test work. The current fire assay technique followed by metallic screening for high-grade samples does not preserve residual material for further check assaying.

- A much faster turnaround time for assay results, providing this critical operational information that drives optimization throughout the exploration and discovery value chain.

- Significantly lower assay costs.

- An environmentally friendly, chemical-free, more sustainable replacement for the traditional fire assay methods, significantly reducing CO2 emissions and hazardous waste.

Collin Kettell Executive Chairman of New Found stated: “Management and the Board of Directors are committed to working with RSC to complete a speedy and thorough test program to assess the presence and source of this bias, as well as determine and implement a resolution that will address this issue. Queensway is a nuggety gold system which comes with significant challenges that are widely recognized in the sampling and assaying processes. Moving to whole-core assaying will reduce the variability of assay results in this style of gold mineralization and will remove the possibility of bias from the half-core sampling process. As part of this transition, we are particularly excited to be advancing towards the use of the Chrysos PhotonAssayTM assay method. This technology allows the assay of an entire high-grade interval quickly and accurately and preserves the full sample for further verification assaying by conventional fire assay/metallic screening methods. The Chrysos PhotonAssayTM assay method is gaining wide acceptance and is being used by industry leaders such as Barrick. We are excited to be forming this partnership with MSALABS to proceed towards utilization of the Chrysos PhotonAssayTM method on our Queensway samples, and to work towards installation of a third party operated Chrysos PhotonAssayTM machine in Gander.”

Qualified Person

The technical content disclosed in this press release was reviewed and approved by Greg Matheson, P. Geo., Chief Operating Officer, and a Qualified Person as defined under National Instrument 43-101. Mr. Matheson consents to the publication of this news release dated November 4, 2021, by New Found. Mr. Matheson certifies that this news release fairly and accurately represents the information for which he is responsible.

Addendum: Fire Sale this morning!???

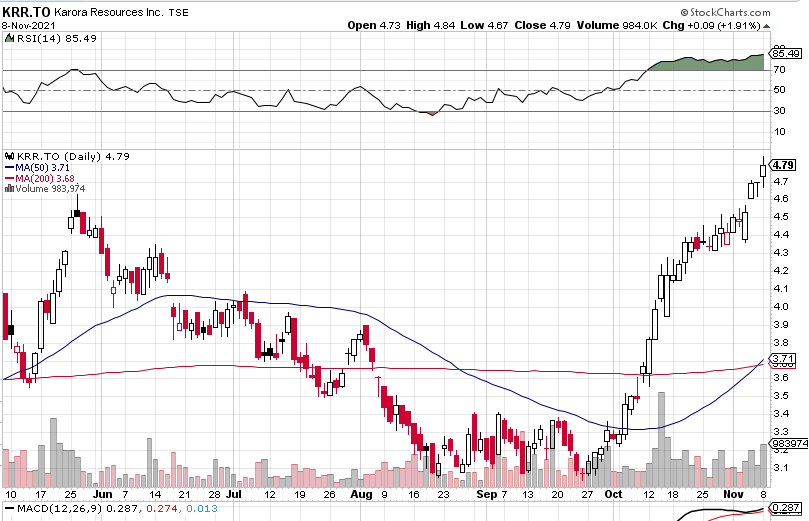

Karora continues to impress:

A couple of other names worth looking into (not sure if they have been mentioned here or not):

BRC/BKRRF - Silver explorer buyout candidate

ESK/ESKYF - gold explorer with nice results thus far

ELO/ELRRF - tin/silver/zinc play. Check out recent comments on the CEO.CA board from the poster “@GoingNorth”… appears to have a head’s up on some things and thinks very good news in the works by years end

TUF/HBEIF - This one I have been told might be a year or more out from doing much, but is working on being like an alternate to a silver ETF.

I think I’ve made it clear over the years that I’m not “a DD guy”… just a lowly chartist  These stocks were shared with me by friends like easymillion/hurricanerick that don’t post here but like to dive into mining stocks, so I think they’re worth a look. Or maybe Easy and Rick may have brought my attention to these and I just forgot! lol

These stocks were shared with me by friends like easymillion/hurricanerick that don’t post here but like to dive into mining stocks, so I think they’re worth a look. Or maybe Easy and Rick may have brought my attention to these and I just forgot! lol

Thanks Rick, I agree this is hitting on all 4 cylinders and will continue to do so for years to come. I actually sold a few shares yesterday … have to take profits somewhere! It is currently one of my largest holdings, as it was clear it was accelerating production and profitability far ahead of Novo, which is also one of my larger positions, though not profitable, yet. I expect the growing pains of Novo can change rapidly over the next year as you’be already indicated in the new Novo thread.

I also see good things ahead for the stocks/tickers TR mentioned and have positions in all of them as well. I would add Summa and Skeena to the stocks TR mentioned.

GLTA posting here.

easy, when you said “I agree this is hitting on all 4 cylinders” which stock are you referring to???

I was reponding to HR’s post:

My mind hasn’t changed much from the earlier days when Karora first morphed from the Fathers Day vein discovery. As TR mentioned on the “Charts for Metals and Stocks” thread this morning, I prefer long term cap gains and I’m not just in for quickies (although they certainly are nice occasionally lol). I don’t recall exactly when I posted the quote below, but I was clearly off when I thought Novo would get it together by later in the summer. I still think and hold my position in NVO/NSRPF, but have a much larger gain from my holdings in Korora as it continues to perform.

I was referring to Korora, even though I took a few off the table yesterday.

I’ve been taking some profits on KRR.T sold about 20 % of my position. Will buy more if we get another pullback. Still my biggest position followed next by NFG.T

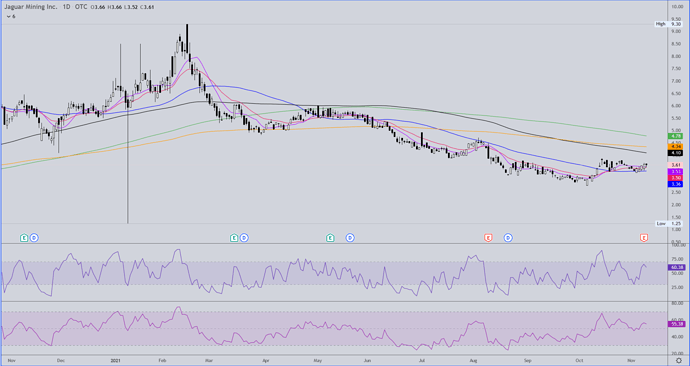

I just learned about JAG/JAGFF a few minutes ago. 3.62 a share right now and pays a dividend. Has the look of a company we could make some nice money off as a buy and hold… you reading this easy???

![]()

I picked up 100 shares today at 3.62 to keep an eye on it/avg down as/if it drops. Oh yeah… Sprott apparently owns 49% of the company.

Yes, thanks.

Time for me to average down! ![]()

P/E is only 5.24

Divy yield 6.16%

Duplicate post

Karora Intersects 40.5 g/t Gold over 4.0 metres in New Discovery and Widest Intercept To Date at Beta Hunt Totalling 1.5 g/t Gold over 90.5 metres

Mon, November 15, 2021, 4:05 AM·15 min read

Highlights:

· New mineralized setting intersected beneath the 50C nickel trough has returned an initial diamond drill intersection of 40.5 g/t over 4.0 metres in hole G50-22-007NE 1,3 . The intersection is associated with a basalt breccia, different to what has previously been observed in the A Zone and Western Flanks Mineral Resources. Interpretation of this new host mineralization is underway.

· A second new gold discovery hole intersected the widest ever mineralized interval drilled by Karora at Beta Hunt. The intersection of 1.5 g/t over 90 metres 1,3 includes 50.9 g/t over 0.4 metres and occurs approximately 250 metres west of the Larkin Zone. Results of the two holes drilled to date west of the Larkin Zone include 1,3 :

· **Recent infill drilling of the Larkin Zone continues to support continuity of the gold mineralization defined to date.

De Grey Mining (ASX:DEG) returns thick mineralised intervals from Brolga Stage 1 Pit

Friday, November 19 2021

(https://themarketherald.com.au/asx-news/), Mining)

- De Grey Mining’s (DEG) latest infill results return thick mineralised intervals from the Brolga Stage 1 Pit at the Mallina Gold Project in WA

- Drilling was conducted as part of a prefeasibility study, with infill results including 80 metres at 1.6 grams per tonne (g/t) gold from 36 metres

- Infill drilling at Brolga is scheduled to continue until the end of 2021 to meet study requirements, with extensional drilling to follow

- De Grey Mining last traded at $1.16 on November 10

De Grey Mining’s (DEG) latest infill results have demonstrated thick mineralised intervals from the Brolga Stage 1 Pit at the Mallina Gold Project in WA.

The resource infill drilling at the Brolga zone was being conducted as part of a prefeasibility study.

The Brolga prospect had previously been identified as one of the early production sources for the project in a scoping study, along with Diucon and Falcon.

Resource infill drilling at Brolga focused on the Stage 1 Pit, used as a risk control exercise for early production. The maiden mineral resource contained within the Brolga Stage 1 pit comprised 1.29 million ounces at 1.3 grams per tonne (g/t) gold.

Novo Commences 15,000 m RC Drilling Program at the Parnell-Vulture Trend at Nullagine

HIGHLIGHTS

- Novo continues its brownfields exploration programs focussing on oxide opportunities at its highly prospective Nullagine gold project (“ NGP ”), with a 15,000 m reverse circulation (“ RC ”) drilling program commenced at the Parnell-Vulture trend (“ Parnell ”) during the first week of November 2021.

- Parnell is located some 45 kms from the Golden Eagle processing facility (“ Golden Eagle Plant ”) and is accessed by a robust, reliable haul road and associated infrastructure.

- Parnell covers a strike length of approximately 2 kms and contains a series of vein-hosted targets with historical drill intercepts including 9 m at 8.4 g/t gold from 7 m, 12 m at 14.6 g/t gold from 40 m and 7 m at 6.1 g/t gold from 40 m. These results are not necessarily representative of mineralization throughout the district.

- First PhotonAssay gold results from the drill program via the Company’s priority arrangement with Intertek 1 are anticipated by early December 2021.

VANCOUVER, British Columbia, Nov. 19, 2021 (GLOBE NEWSWIRE) – Novo Resources Corp. ( “Novo” or the “Company” ) (TSX: NVO, NVO.WT & NVO.WT.A) (OTCQX: NSRPF) is pleased to provide an update on brownfields exploration programs focussing on oxide opportunities at its highly prospective NGP. The Parnell and Vulture RC programs are part of the NGP exploration program ramp-up, with forward programs currently being generated at several priority basement targets ( figure 1 ).

Figure 1 is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b8464201-e8ae-4f29-b900-bf69c71c09e8

The main mineralized trend at Parnell is mostly untested with modern RC drilling, with only few and sporadic lines of shallow holes completed in the 1980s and 1990. In 1987, Chase Minerals NL (“ Chase ”) drilled 25 shallow RC holes totalling 1,098 m, and in 1995, Welcome Stranger Mining Company NL (“ Welcome Stranger ”) drilled a further 11 RC holes for 420 m ( figure 2 ). Targeting directly in and around small historical workings, these operators returned grades including:

- 12 m at 14.6 g/t gold from 40 m

- 9 m at 8.4 g/t gold from 7 m

- 7 m at 6.1 g/t gold from 40 m

(https://www.novoresources.com/news-media/news/display/index.php?content_id=481)

Disclosure: Yes I have a large long position. Patiently waiting for this one to catch up with my gains in Karora. I posted on De Grey because I have a smaller “free” position there as I sold way too many on the way up. Regarding the Hemi deposit, Novo and Artemis Resources may have as yet unproven claims in the area of the much touted DeGrey’s Hemi project. FWIW - Many are finding this tax loss season a great opportunity to average down, build a core position, or enter a position in Novo Resources and other speculative plays, including AUMC and MDMN. Please do your own DD on any of the stocks I mention here as I explicitly am only bringing attention to these stocks I currently own. No guarantees on any of them as they all involve risk that should be evaluated on an individual basis according to one’s risk tolerance, time horizon, and investment preferences.

Artemis Resources - High-Grade Gold & Copper Intercepts at Carlow Castle Crosscut Zone

2.23gtAu 1.39%Cu 0.457%Co 22m

5.95gtAu 5%Cu 0.689%Co 13m

5.23gtAu 0.74%Cu 0.54%Co 7m

& 7 more

40 more drill holes have assays pending

Currently also drilling 2 holes at Paterson (very close to Haveiron [huge high grade find] )

https://www2.asx.com.au/markets/company/ARV

Also ARTTF on OTC