De Grey Mining up another 20% today. I sold my position at .133 for like a $50 profit. Considering I was down over 75% on it for most of the year (with little reason to average down on), I’m ecstatic to get my investment back.

Now, the newly discovered Hemi prospect in the Pilbara Australia region is very interesting and if I had a lower cost basis, I’d consider holding longer for drill results and an initial resource estimation which should be out in the next week or two. But after the stock has more than quadrupled in a couple weeks, it is prudent to take my money off the table and be happy I made it back to green.

I’ll continue watching De Grey though because they seem to have quite a deposit at Hemi.

2 Likes

If you’re beholden to trading an etf that follows miners instead of gold then I don’t have any answers, but if you want an etf that follows the movement of gold then you’d be better off looking at something like GLD, IAU, SGOL, or DGL. These are etf’s that actually move with the price of gold, not the miners.

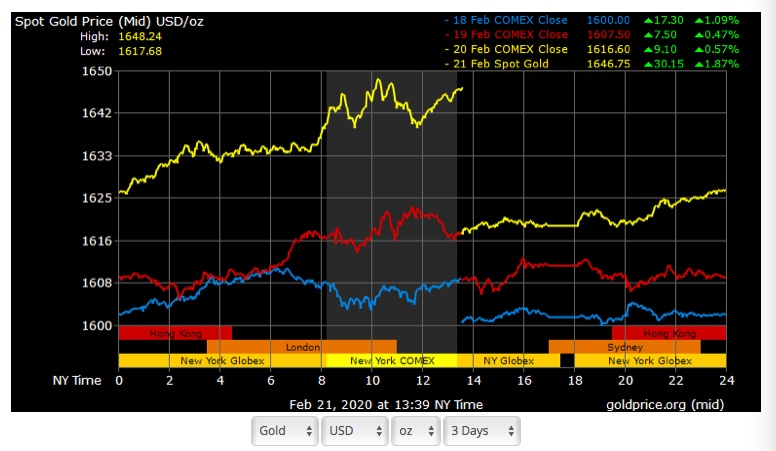

As for the gold chart, I would be tentative about buying right now as the weekly interval gold chart looks overbought to me, with bearish divergence on the RSI. Gold has found resistance over the past 6 weeks at the 1580 - 1600 level, which is the 62% retracement of its all-time high of 1923. If this resistance holds, a shallow pullback could take it to the 1520’s, and a deep one could bring it back to between 1340 and 1400.

1 Like

TR, you’re much more conservative than I am. Between June and Sept. you would have made 20% and I would have made 300%. I’m prepared to take the risk due to the huge difference in return. Unfortunately I can’t keep an eye on it every minute of the day but nevertheless I’ve doubled my money since June while you would have had a nice 25% gain. Here’s to your continued success !!

Just got an email saying Eric Sprott is pushing these silver stocks:

Silver Producer League:

Pan American Silver Corp (AMEX: PAAS) Market Capitalization US$4.5 billion, 2019 Production 25 million oz silver equivalent* , Resources over 1 billion oz silver

First Majestic Silver Corp (AMEX: AG) Market Capitalization US$2 billion, 2019 Production 20 million oz silver equivalent*, Resources 620 million oz silver

Hecla Mining Co (NYSE: HL) Market Capitalization US$1.4 billion, 2019 Production 35 million oz silver equivalent*, Resources 191 million oz silver

Silver Development-Stage League:

Silvercrest Metals Inc (TSX:SIL, AMEX: SILV), Market Capitalization US$ 700million, 2018 Production nil, Resources 87 million oz silver.

New Pacific Metals Corp (TSX-V: NUAG, OTCQX: NUPMF), Market Capitalization US$ 600million, 2019 Production nil, Silver Resources Not Available, it’s a new discovery in Bolivia.

Prophecy Development Corp Corp (TSX:PCY , OTCQX: PRPCF), Market Capitalization US$30 million, 2018 Production nil, Resources: 51 million oz silver.

2 Likes

I just realized that I didn’t notice NUGT is a 3x leveraged etf. That’s why you would have done better. Anyway, if you want a 3x etf that moves with gold, the one I know if us UGLD. Doesn’t appear as though you need it with all of your gains though!

1 Like

Hi TR,

Do you have a chart going back to 1923 that you could post (I didn’t find one). The following is a quite interesting chart showing POG relative to the S&P over the past 50 years.

50-year chart shows how cheap gold price still is relative to stocks

Frik Els | January 23, 2020

The gold price was drifting sideways on Thursday, down some $50 an ounce from a brief (but glorious) near seven-year intraday high above $1,600 an ounce a fortnight ago.

But the metal remains firmly in a bull market with a 20%-plus rise over the past year. Go back 20 years, and the rally is even more spectacular considering at the turn of the century gold was trading for a relative pittance of $270 an ounce.

50-year chart shows how cheap gold price still is relative to stocks - MINING.COM

*Note: On the chart above the vertical Y axis represents ounces of gold needed to buy the S&P. The origin (lower left) starts at 6 and peaks in 1980 at less than 0.2 OZ.

Thought I might as well show spot price today as well:

Hi Easy…

Nope, my chart only starts at '75.

$30 to $38 in 5 days. Thanks for bringing NUGT to my attention and congrats on your profits Wonk!

2 Likes

De Grey Mining halted in Australia. I imagine further drill results on their Hemi property are forthcoming. It should still be trading in US OTC (DGMLF). As mentioned previously, I sold out when I recouped my losses a week or so ago. If there was a bigger pullback I’d reenter, but for now I’m content watching what happens.

Regarding Novo Resources (NVO.V and NSRPF). Stock is down about 33% since the beginning of the year (NSRPF was 3.07 and is now at $2.06). I love this company as a long term hold and will look to average down some here.

1 Like

Eric Sprott in his Weekly Wrap-up: Prophecy Dev. PRPCF

“Invest on small level, interesting silver project in Potosi in Bolivia, has 43-101 50 million oz silver very high grade, company will focus on the asset, good deposit, will get a lot bigger with drills, looking forward to hanging on to that company and perhaps increasing my investment.”

Right now you can get $9.50 of silver in the ground for 21 cents per share.

1 Like

There was a post a few months ago that really didn’t get much review. It had an unusual title which few in the US are familiar with. It was last November that Elrac posted a presentation that was subtitled “Things that make you go Hmmm…” - a more appropriate title than Crikey! There were a couple of comments on the forum, but little other interest. I repost it here as I found it very informative and entertaining. It does not tell you which stocks to buy.

Can’t blame you if you aren’t interested in the keynote speaker’s presentation at a Precious metals Conference a couple months back. After all he only talked about history and parallels to the roaring 1920s with it’s rapid social and political change, bubbles, and interventions on monetary policy since 1933, or actually since the FED was created in 1913. If you prejudged the important content and message because of the forum of where it was presented you may have missed an opportunity to be entertained and gain an insight. After all, we’ve got a full plate of things in the news; Covid-19, worldwide political unrest, trade relations …. Fill in your own list.

Things That Make you Go Hmmm… is a rather thought provoking short video that draws parallels to the exuberance of the roaring twenties and today… Here’s the link again, if you are at all interested in your retirement accounts. Good correlations graphically and easily understood historical notes.

https://www.gowebcasting.com/events/precious-metals-summit-conferences-llc/2019/11/12/crikey-what-s-going-on-with-gold-by-grant-williams/play/stream/28893

Here is a screen shot of one of the opening Power Point slides:

If you can pardon the commerciality of the site, I found the articles in the link below follow my outlook on what to expect over the next 2-3 years and beyond. The super cycle that is just beginning in the PM markets is predicted to be full of volatility, is being led by Gold, with Silver soon to follow. The Bull in PMs should last the next 7-8 years.

Follow-up articles that this forum has avoided, but should be looked at for long term investing in the PM is IMF policies and the SDR rebalance coming about in October 2021. Yes, SDR rebalance is largely determined by the gold reserve backing a country’s currency. There are only five countries that have SDR allocations that many other countries depend on for global trade.

2 Likes

Market seems to be on sale today (again), anyone buying anything?

MDMN has been my safest mining play today. lol.

2 Likes

From 20 days ago!  I think I would have been much better off at shorting than actually buying stocks over the last twenty years. And what gives; even gold(or gold mining stocks for that matter) are in the toilet. With it not even doing well as a safe haven investment, what good is gold anyway? Ugh.

I think I would have been much better off at shorting than actually buying stocks over the last twenty years. And what gives; even gold(or gold mining stocks for that matter) are in the toilet. With it not even doing well as a safe haven investment, what good is gold anyway? Ugh.

2 Likes

There was no safety in the market this week, even with the best of stocks.

PMs took an even bigger smash-down!