This discussion topic is for other stocks unrelated to mining.

Hi Mike. Hi Baldy. I still have my MDMN and AUMC shares and both in the red naturally like everybody after what Les did to us . It is an injustice that he did not have to do time.

The only other mining stock that I invested in since is Ivanhoe and Friedland will make shareholders a bundle eventually, Ivanhoe has great fundamentals.

In the past couple of years I have gotten into pot stocks mostly Aphria and luckily sold most of my position at the highs of mid $20’s and at the current lows I bought back in and averaged down, all the way down to $10.50.

I am telling you all this for 2 reasons; one is to put you onto Aphria, do your research , it is a screaming buy at $10.50 into this new industry growth stock, it is one of top 3 and do not worry, Vic Neufeld is no Les, LOL.

And second is a question about which is the best stock to keep , MDMN or AUMC? I need to sell one before year end for tax loss benefit. I would love to keep both but I need the loss for my pot gains.

I would appreciate advice from anybody on which to keep. Thanks.

I bought APHA at $8.10 last week

Hey Rick, smart move . It was a big move to the NYSE, but the benefit not recognized yet but several significant positive news coming soon.

I would still appreciate your opinion about whether MDMN or AUMC have the better future prospects.

OT - and just like that APHA getting slaughtered pre-market.

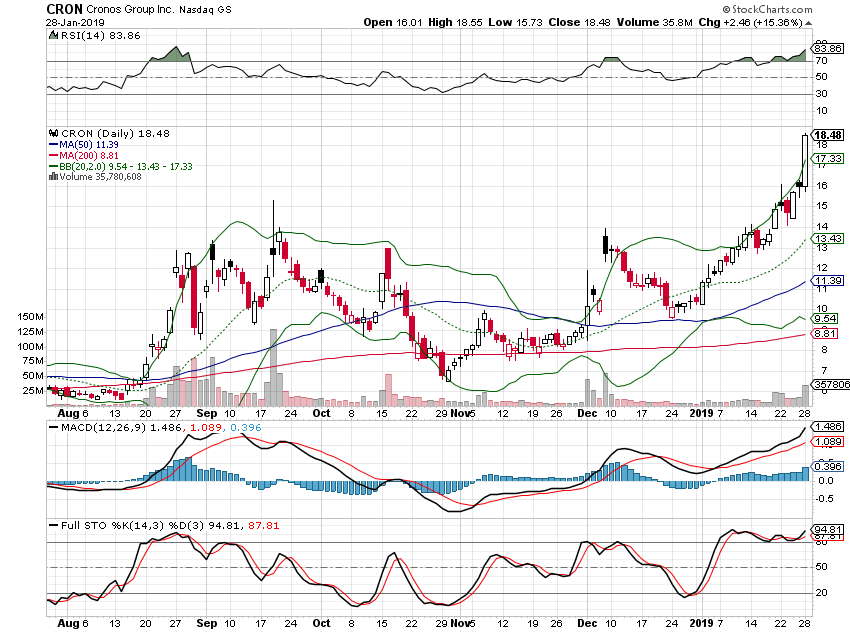

I’d tread very lightly in the cannabis sector. The guys who were smart enough to get involved several years ago are mostly selling their gains at this point (to retail buyers). The momentum has been sucked out of the group which is generally down over 50% as the market is quickly recognizing the inability to support dozens of billion $+ market caps (based on the size of the end market). That being said, this mornings rumors of an Altria acquisition of CRON could get the group moving again. Fun sector to trade but not for those looking to buy and hold. IMHO.

Hey John, that looks like somebody we know from awhile back

https://www.bnnbloomberg.ca/aphria-calls-shortseller-claims-false-and-defamatory-1.1177240 Zerohedge FWIW

I bought APHA today at $6.20 today hoping this is the bottom

Ooh. I may be wrong, but this definitely has all the makings of a falling knife. So many other stocks in this sector, I would’ve steered clear until the dust settles. Even then, I don’t like what I’m reading/hearing. The company’s response was astonishingly flaccid considering the accusations and the serious haircut that is occurring. Though the insiders apparently bought more to show their support for the company. While their Canadian business may very well be legit and viable, I think they got seriously hoodwinked on their LATAM purchases.

The response from Hindenburg Research linked below tells it all IMO, and until the company addresses the accusations direcltly and openly, they won’t regain the trust that has been lost here.

Fortunately, I got out at 6.40 (bought around 8.10) and it wasn’t a large position. One thing that I learned from LP’s antics with MDMN was to flee quickly at the slightest suspicion of malfeasance or lack of transparency. There are plenty of opportunities elsewhere in the market.

Thanks Rick, I have seen this before and took a good profit on the bounce but not this time, you may be right. Will hold off from any more purchases until it settles. Getting my ass handed to me with this market right now, hard to find a good opportunity and may have to wait until the new year.

It’s a fascinating situation (at least when you’re not holding stock). I see points made from both sides. APHA has their Canadian business which appears to be legit…plenty of photos and validation. However, their recently purchased LATAM businesses look highly suspect.

RGBP, a small biotech doing research into small molecule agonists and antagonists of the nuclear receptor NR2F6, is showing signs of a turn around in share price. The advantage here is that small molecule ingestion relieves the need for incubation method in the patient. Veterinary applications being explored first here through a subsidiary company. Some think news is around the corner re: trials on IBS in canines.

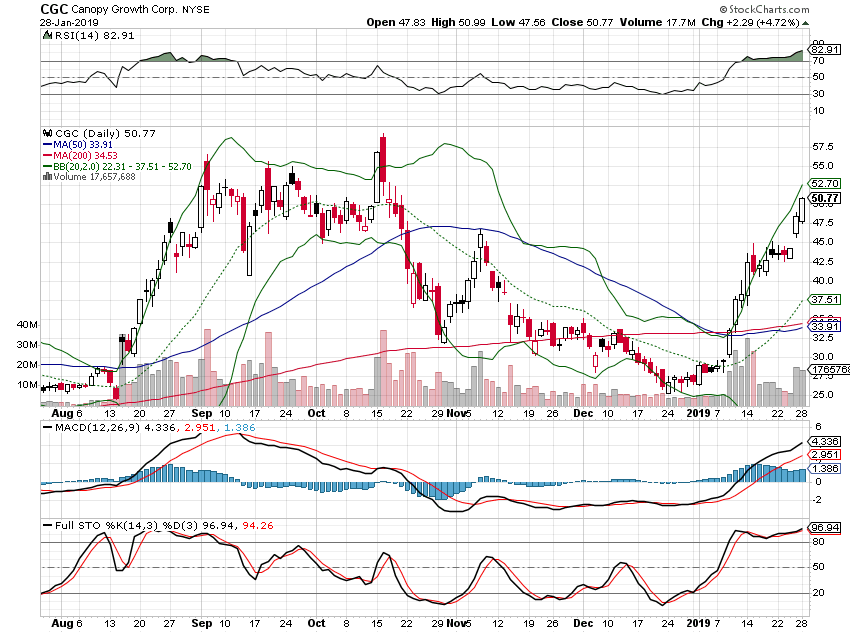

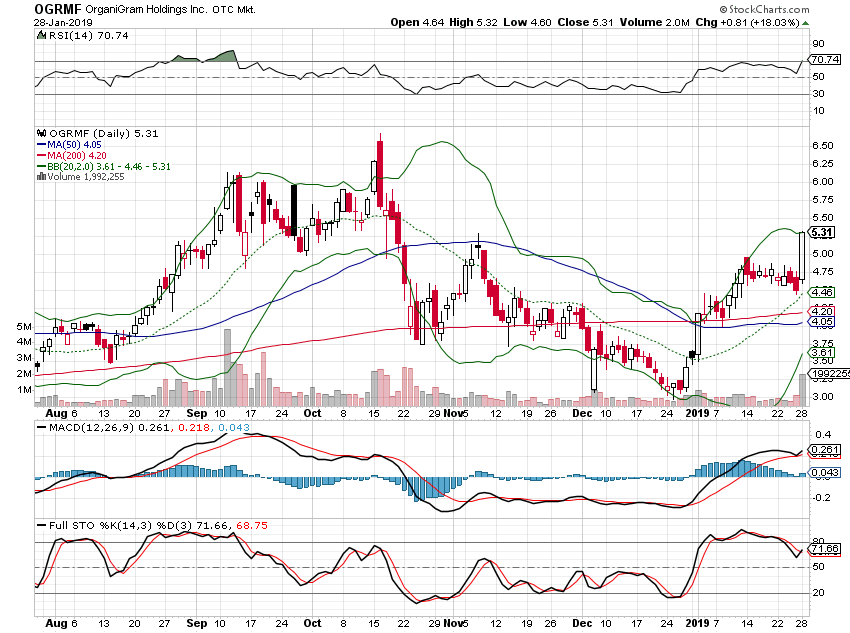

Pot stocks continue their red-hot run, particularly industry leading Canopy Growth (CGC) now over $50 and The Cronos Group (CRON) which is hitting all-time highs still riding the momentum of Altria’s $1.8 billion investment. I’m currently holding (the profitable) Organigram (OGRMF) since $4.10 which was up 18% today on a very bullish earnings announcement today, including forecasting a 200% increase in revenues in the next quarter which energized the sector. I also hold The Green Organic Dutchman (TGODF) since $2.40 which is just starting to get warmed up.

The pot sector reminds me of the .COM boom from the early 90s. Some of the valuations are pretty steep, but it is a completely new and lucrative industry. I’m following about 10 different stocks and buying on dips whenever the opportunity presents itself. Though I sold CGC wayyyy too early at $36.

Artemis put out their quarterly report:

https://backend.otcmarkets.com/otcapi/company/dns/news/document/34762/content

Looks good except for:

“As reported in the September 2018 Quarterly, mechanical refurbishment and installation of key processing equipment at Radio Hill (Figure 8) remains at ≈ 80% complete with outstanding electrical and instrumentation, minor structural repairs and plant piping to be completed once final approval for TSF3 is received and Artemis has defined:

a. 2-3 years of plant feed from its extensive gold and base metal asset base; or

b. equivalent tonnages of gold ore from third parties or joint venture partners.

Either of these options could support the final investment decision to complete plant refurbishment.

With respect to TSF3 approvals, the key submission to the relevant government department was made in late October 2018 and final approval is pending.”

I think investors were expecting the gold plant to be completed in the very near future; now it appears open ended. This will put some pressure on all the Pilbara stocks I suspect.

Another update:

CARLOW CASTLE Au-Cu-Co METALLURGICAL UPDATE

11 February 2019

Objective of programme was to determine amenability of Carlow Castle Au-Cu-Co Project to conventional gravity, leach and flotation processes

Results confirm effective separation and high recoveries of Gold, Copper and Cobalt via conventional process routes

Preliminary test work on two composite samples indicates:

Total recovered gold of 98-99% - with significant coarse, gravity recoverable gold up to 48%

Total recovered copper of 77-85% - with flotation producing premium grade concentrates of ≈30% Cu

Total recovered cobalt of 73-79% - with flotation producing concentrates of 2.3 – 5.3% Co

Gold not recovered via flotation amenable to cyanide leach process

Results provide a strong basis for further flowsheet optimisation and geometallurgical test work

Nice to see IVS creeping back up, as I just noticed that today.

MUX had a nice 5% gain today.

Today’s close 1.88

Chart is starting to look interesting.

MA(50) 1.786

MA(200) 2.005

With the recent news update out on Gold Bar Mine, how long before “golden cross” occurs?

McEwen Mining Provides Update on Gold Bar Mine Start-Up

TORONTO, Feb. 05, 2019 (GLOBE NEWSWIRE) – McEwen Mining Inc. (MUX.TO) is pleased to report that construction of the Gold Bar Mine in Nevada’s prolific Battle Mountain-Cortez Trend is nearing completion, just 14 months after breaking ground in November 2017. The Mine is on schedule for inaugural gold production in late February 2019. Commercial production will follow when the Mine’s systems reach a steady state, which is expected by the end of Q1. The project is tracking on our original capital cost estimate of $81.4 million.

150,000 tons of ore have been placed on the heap leach pad since starting in December 2018. A few weeks ago leaching was initiated and gold is being dissolved by the cyanide solution at the desired rate. We estimate that the Gold Bar Mine will produce 55,000 ounces (oz) gold in 2019 at an all-in cost of approximately US$975 per ounce.

December and January were challenging months on site with heavy snow and cold temperatures delaying some work. Remaining activities to complete the process plant include electrical work, instrumentation installation, and commissioning of the gold refinery circuit. We would like to thank all our employees and subcontractors for their dedication to the job at hand whatever the conditions.

2018 exploration drilling has extended the estimated mine life to 7.4 years. The future addition of the Gold Bar South resource to the mine plan should further extend the mine life by a minimum of one year. Our 2019 exploration budget on the Gold Bar property is $4.4 million. Exploration drilling will target both near surface and deep Carlin-type mineralization.

For those interested in a potential 10+ bagger over the next 18 months, I believe I’ve found one that is plausible, if not likely. It’s an undervalued, under-the-radar company in the high-flying cannabis sector. The name is AgraFlora Organics (PUFXF on OTC, C.AGRA on the Canadian exchange), located in British Columbia.

The story with AgraFlora is that the company is in the process of retrofitting their 2.2 million s/ft greenhouse (the 2nd largest in the world) from tomato crops to producing cannabis. When the 3-phase retrofit is complete by the end of 2020, the facility will have the capacity to enable AgraFlora to produce 250,000 kg of cannabis per year. To get an idea of where an output of 250,000 kg per year fits within the current anticipated market, here is an article of the 10 pot producers that are ramping up production to over 100,000 kg per year:

That would put AgraFlora in the same production output tier of Aphria ($2.5 billion market cap) and Tilray (TLRY) with an overvalued $7.5 billion market cap.

AgraFlora’s market cap is currently a meager $112 million. Even though that is a primitive way to attribute a valuation comparison, at the very least it’s not difficult to see the extraordinary upside in market cap in this scorching hot sector once production ramps up. And because they have the facility already built, they can get the facility producing much faster, cheaper and with greater capacity than if they had to build the facility from scratch.

I bought the stock over the past month with an average of .23. The stock had a nice volume and price spike today. Two articles were released on the company, but I don’t believe that is why the stock got a bump. We’ll see if there is a follow-through is tomorrow. I will continue to accumulate a position and average up accordingly.

Anyway, here are 3 recent articles and/or excerpts that expand on the potential of AgraFlora.

3 Cannabis Companies to Watch in 2019

VANCOUVER, BC / ACCESSWIRE / January 31, 2019 / AgraFlora Organics International Inc.

AgraFlora Organics International Inc. (formerly PUF Ventures Inc.) (“AgraFlora”) (CSE: AGRA) (Frankfurt: PU31) (OTCPK: PUFXF) is a Canadian based company that has recently positioned itself to become one of the largest cannabis producers in the country. Last year AgraFlora partnered with the Houewelings Group in order to secure the second largest built cannabis greenhouse space in Canada. At 2.2 million square feet, the facility represents something unique within the industry, as few cannabis driven organizations in the country are in ownership of already built greenhouse space. Retrofitting operations have already begun at the greenhouse in order to get it up and running for full-scale cannabis growth, and AgraFlora has indicated that the facility will be partially operational by the end of Q1 2019 and fully operational by 2020.

AgraFlora has done more, however, than simply obtain a large scale facility. They have also already secured off-take agreements for their potential future product and taken steps to ensure that they will be growing a wide variety of high-quality strains sourced from around the world. They are part of Canopy Growth’s CraftGrow Family and they also recently negotiated a right of first refusal agreement with Cannmart Inc. on the purchase of up to 25 million grams of cannabis at a price of $4 per gram. In terms of strain variability, AgraFlora recently 184 new cannabis varieties from Venture Genetics Labs, and CEO Derek Ivany has been in Colombia for the last several weeks sourcing exotic cannabis genetics/strains.

You can view drone footage and see pictures of their Delta greenhouse at https://agraflora.com/

These 3 Tiny Pot Stocks Are Diamonds in the Rough

February 26, 2019, 1:12 PM EDT

Smarter Analyst

Industry participants believe the cannabis segment will become a $500 billion industry. For now, it is a fraction of that potential. There have been some companies that have seen significant movements in their stock prices. What I wanted to do is point out some lesser-known stocks that still have the potential for large movements in their stocks. These stocks have lower volumes and are prone to bigger swings as these companies ramp up production. If an investor could stomach a wild ride there may be long-term potential with these companies.

AgraFlora

From what I can tell, AgraFlora (PUFXF) is a perfect example of a company who’s stock is mis-priced. First, the company has teamed up with a long-term tomato grower that has many years of experience with indoor growing facilities, HVAC, and controlled indoor grow environments for vegetables. There is not a tremendous amount of difference in the grow process of one plant versus another. So, the company’s partner may be the best yet in the industry. AgraFlora will have 250,000 kg annual production facility up and running very shortly. Plus, the partnership they have will ensure viability with getting their business up and running as they switch from tomatoes to cannabis.

With 250,000 kg. of cannabis production capability, that could eventually value the company at $5 billion. They are currently valued at under $100 million. Their stock has been pushed downward but that may be a factor of the low volumes for the stock. But, long-term, I see a tremendous amount of potential; this stock may become my favorite for a while.

Agraflora: Buy This Undervalued Pot Stock, And Here’s Why

Feb. 26, 2019 11:25 AM ET

D. H. Taylor

Summary

Agraflora is in the final stages of retooling a 2.2 million sq. ft. grow facility to produce 250,000 kg. of cannabis annually.

When the company achieves its production goals in about 1.5 years, they could be a $4.5 billion company. Their current market capitalization is $100 million.

Agraflora has already made a strong partnership with Canopy Growth owned CraftGrow that will allow for their products to be sold to the largest retail listing of customers.

If you have not heard of Agraflora (OTCPK:PUFXF), you may not be in the minority. It is a smaller Canadian Cannabis company with not only a whole lot of potential, but some of the strongest backing in the industry. The company has the potential to be a major contributor to the cannabis industry. Agraflora is just finishing completion of the company’s 2.2 million sq. ft. facility capable of producing some 250,000 kg. of cannabis annually. This puts them up in the ranks with some of the biggest producers in Canada.

They have partnered up with a company that has been growing produce indoors for nearly a decade and the knowledge this partner brings to the table is well ahead of other cannabis start-ups. They have partnered up with a company owned by Canopy Growth (CGC) for their retail sales. Given where they stand, the company could be a $4.5 billion company. Yet, their current market capitalization is only about $100 million. With a lineup of successful partnerships and solid business execution, this company’s stock has the potential of moving significantly higher in a short period of time.

Like most cannabis companies, there was sharp selling in the last part of the year putting the company’s stock at the bottom of its 52-week range:

Investing in the future

As I mentioned, Agraflora is just finishing completion of their 2.2 million sq. foot facility in Delta, BC, Canada. The company did not build from scratch. Instead, they partnered up with an indoor produce grower, Hoewelings Group, with many years of experience in that segment of the industry. By not having to start from scratch, this saved the two companies a lot of time and money.

Here, the company put out a video that gives a strong sense of how big the facility actually is:

As the company states on its website, Agraflora had this to say about their partner, longtime grower Houwelings Group.

> Almost immediately both parties recognized the absolute potential of combining the science of large-scale growing expertise of the Houwelings Group, with the cannabis and capital market knowledge and experience of Agraflora, to ultimately form the joint venture company Propagation Services Canada

Agraflora is slowly rolling out their production. The first portion of the cannabis section will produce about 10% of their total production capabilities in the summer of 2019. From this, what I am estimating from the numbers the company provides, they should be producing approximately 25,000 kilograms of cannabis starting in year one from the first 250,000 sq. ft. of converted space.

At $5.20 per gram of cannabis, wholesale, the company could expect about $130,000,000 in revenue. With a reasonable net margin (assuming linear SG&A costs), the company’s net profits should come in about $22M with a market capitalization of some $400 million of just that portion of the business (the 10% of space they would use for cannabis).

MarketWatch has the company’s current market capitalization at a mere $6 million. But, if you do the math from the data on the OTC website itself, you get a market cap of $14 million. The discrepancy has to do with the valuation being spread out over the TSE and OTC markets. The TSE, the exchange the main stock is trading on, shows the company as having 389 million shares outstanding with a market cap of C$115 million (Approximately $100 million USD). It is my belief that because of the discrepancies with the stock and the number of shares listed, the stock is viewed as being too small for mainstream investors. This may be why the company’s stock has been overlooked and undervalued.

Eventually, the company will be bringing the entire 2.2 million grow space online for cannabis. With that kind of space, the company will be producing 250,000 kg. of cannabis annually. This would likely bring in $1.3 billion in annual revenue with a market capitalization of some $4.5 billion. My expectation is that the company achieves this revenue and market capitalization by the end of 2020.

I also see the potential of Agraflora moving from OTC to the more mainstream markets such as either Nasdaq or NYSE, as an inevitable eventuality. And, I also see that when this company does take that step a lot of the mispricing that is seen in the stock will be brought back into line with their true potential. With a stock moving to more mainstream markets, there are generally higher volumes, tighter bid/ask spreads, and better price discovery. However, I have not found any evidence at this point that Agraflora is actively moving towards any of the bigger markets yet.

Canopy Growth Partners Up With Agraflora

As mentioned, Canopy Growth has partnered up with Agraflora to do their online retail portion. Agraflora will be assisted by the company owned by Canopy Growth, Craft Grow and Tweed Street:

> Pending a license to cultivate and sell cannabis products, PUF will become the fourth company to join CraftGrow. The program accelerates speed to market for newly licensed producers and provides brand and product exposure by selling partner products via www.tweedmainstreet.com to the market’s largest group of actively registered customers.

This will ensure that the products being brought to market have a substantial customer base for Agraflora to sell to. As the Canadian market ramps up, there will be substantial demand throughout the industry. Having a partner as large as CraftGrow will be very important in the very first days of coming online for the company.

Cannabis As An Industry

The cannabis industry is expected to reach some $500 billion in valuation over the course of many years. There are three main aspects of cannabis: THC-based products, CBD-based products, and hemp-based products. All of these are slowly being legalized in their own way around the world. Cannabis is disrupting all three of these major industries: alcohol, tobacco, and pharmaceuticals.

By my analysis, cannabis in Canada is going to see far stronger demand than market participants are expecting; there will be continued supply issues. As these new companies roll out their products, despite not being first to market, they will still have the opportunity to compete.

But, I am looking at the long game of cannabis. My outlook is for many, many years; perhaps 10-25 years. Given that time frame, my expectation is that these cannabis companies will mature into very large conglomerates just like their competitors such as alcohol, tobacco, and pharmaceuticals.

Takeaway

When I look at the overall size of the cannabis industry in Canada and the United States as well as the global potential, I see a significant opportunity. Cannabis has been illegal for many decades. Now, we are seeing the beginning of this emerging industry that will change, evolve and grow over many years.

I see how Agraflora is positioning themselves and rolling out their production levels as solid moves within the industry. They have made smart alliances and will likely do well in the industry when they roll out their products. And, should the company move its stock away from the OTC to the bigger markets, better price discovery reflective of the company’s true valuation is more likely.

I see Agraflora as a strong buy; I have added it to my personal portfolio.