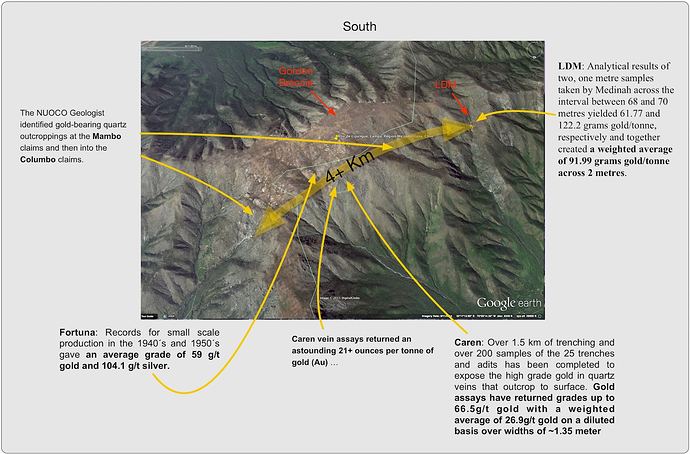

A great post by @cornhuskergold from the old forum.

Working Theses / Assumptions:

-

The JV base price for the “mountain” (ADL, LDM, NUOCO) is $100M for 85%. This is the agreement. That’s it.

1a. Corollary 1A: If there is a “+” to be added to the $100, it is not discussable because we don’t know if it exists or how big it is. So it is useless to discuss. I am trying to “bound the problem” or assign probability to outcomes. We can’t discuss an unknown. Everyone can make up their own “+” with equal validity.

1b. Corollary 1B: This makes $100M / 1.35B or about 7.4 cents the “floor” with 15% of Auryn remaining to be valued. Everything that follows is about that 15%. -

The JV not only sets a base price, it also sets requirements for exploration and it sets a timeline to guide our discussion. The timeline is Aug 2017. The exploration requirements are $1M on the ADL (DONE), 5,000m drilling (and some unspecified geophysics) plus $2.5M for a feasibility study for NUOCO, and 3,000m plus $1.5M for Fortuna. That’s it.

2a. Corollary 2A: Auryn did about 4,000m drilling on the ADL. They are required to do about 10,000m to 15,000m more by Aug 17 according to the above numbers. No more of this will be on the ADL.

2b Corollary 2B: To really get to a decent level of formal reserve definition on any of the targets will require 75,000m to 150,000m. Auryn is under no compulsion to achieve this during this JV. And they won’t because there is not enough time. -

The very large potential copper / moly resources in the mountain will be almost completely valueless from a formal bankable study point of view after the JV drilling, especially at current market prices.

3a. NOTE: I personally agree with MG and Doc re. the potential huge 1,000MT plus potential of the porphyries, and even that at the LDM and at the moly breccia the porphyry may be almost at surface. Fantastic. It was the argument that got me to buy in again in 2012. But 15,000m of drilling won’t get anything in formal reserves, indeed, there is no requirement for any of the remaining meters to be done in those areas.

3b. Corollary 3b: The “goodies” value is “long term” value, not value for this JV. No amount of “not fair” argument can bring any significant portion of this value within the scope of this JV. It will require years more of drilling, minimum 5, maybe 10. Lower prices require even more caution and more drilling because unless the “goodies” can be extracted for a profit, they won’t be extracted. The only way MDMN sees any of that value is if it is still around with its 15% of Auryn at that point, 5 to 10 years from now. IMO - extremely unlikely. -

The value realizable with the scope of this JV is the LDM skarn(s), which were the subject of the LDMC production plan, and the new high grade gold veins.

4a. Corollary 4A: we know a little bit about these things and can do a few back-of-the-envelope calculations about this value.

I don’t want to dive back into all those arbitrary / subjective “cash flow” arguments we once had except for this one thing, to demonstrate the relative importance of the new high grade gold veins.

Assumptions:

-

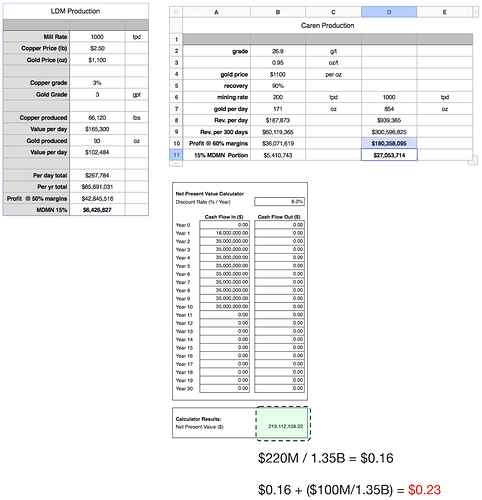

LDMC was “permitted”, so I was told by our ex-CEO, for 200 tonnes per day, one for gold production and one for copper production, for 400 tpd total.

-

Trying to do an “asset” calculation is hard because you have to know the extent and value of the asset and it is very subject to market price conditions now and in the future. And the drilling in this JV will only give a glimpse, not a complete definition of the asset.

-

It is easier to do a cash flow calculation and consider the value of the cash flow. So let’s assume the gold veins do show up in the upcoming drilling and maintain something like their 26.9 g/t over 1.35m to decent depths. We don’t need to know the full extent of the veins, only that there is enough material to last 5 or 10 years a very modest mining rate. This is a safe assumption. If falls very much within LDMC’s estimations made a couple of years ago for the LDM.

-

Let’s assume Auryn can permit and build facilities beyond LDMC’s reach, say 500 tonnes per day, or maybe 1000 tonnes per day each on the LDM and the Caren veins. There are many modest underground mines that run at over $100M / year in revenue on 800 tpd, or 1000 tpd, with say a 1500 tpd or 2000 tpd mill. I know of one that self-booted with a small open pit essentially Gold Rush style with front loaders which money they then used to build their underground mine. They run now at 1000 tpd. This is not outrageous at all.

So if you were to do say 1000 tpd at those two spots using the VERY LIMITED grade information we have what does that tell us? There are lots of assumptions to be made. I am only looking at a “ball park” reference here. But I’ll use these:

a. Copper $2.50 / lb

b. Gold $1100 / oz

c. Recovery 90%

d. LDM grades 3% copper, 3 g/t gold

e. Caren 26.9 g/t gold (iffy but that’s what we have to work with)

f. MDMN is not liable for any construction costs on this effort (iffy but possible)

g. 50% margin on the LDM, 60% on the Caren veins

h. MDMN has claim to 15% of the Auryn profit due to owning 15% of Auryn post Option

As I said lots of assumptions. You can play with these and get your own “range” of outcomes. What is important to me here is more the importance of the Caren high grade veins to the value of the 15% of Auryn ownership based upon cash flow:

NOTE: Under these conditions the Caren veins produce 4x the profit / revenue of the LDM skarn per tonne mined (which is your expense). Now this somewhat assumes that mining 1000 tpd in each place is the same cost, which may or may not be the case. Again, cut me a little slack … 4x is 400%. I’m not arguing about 10% here or there.

So how would this affect a TO now? This comes via the NPV of that cash flow. Basically if the Option were exercised and no TO occurred MDMN would claim 15% of the profits of the operation. So over 5 or 10 years of operation MDMN would claim a certain amount of cash from profits.

-

NOTE - the cash flow is great enough I am assuming the payback would motivate Auryn to build the mine even under the conditions that MDMN would claim 15% of the profits. Big assumption. But at these profits still likely for such a modest operation with low risk.

-

We can then calculate the sum total of those profits that MDMN would be owed, and then calculate their present value today. And this gives us a way, merely on the basis of the short term production opportunities, to give some value estimation to that 15% of Auryn

So, IMO, the argument our guys would be using in negotiations today re. a TO would NOT be primarily about possible but unproven enormous reserves, which may or may not be profitable, but instead about those 15% profits Auryn would owe MDMN over 5 or 10 years of operation of the Caren veins and LDM.

As you can see, under not “slam dunk” but not outrageous assumptions, the cash flow adds up, esp. on the Caren vein operation. What’s important is that it becomes large in comparison to the $100M JV Option floor. And it does.

- Our guys know Auryn wants to go into production with this easily accessible stuff

- Everyone has an idea re. grades and that there is most likely plenty of material for 5 or 10 years of operation

- The modest 15,000m of drilling will not get much into formal reserves but it will give everyone at the table a pretty good idea whether there is 5 to 10 years of material there or not (@ 1000 tpd)

- Our guys argue: you can either pay us this estimated amount over the next 5 to 10 years while we sit here and be a 15% shareholder pain in your *ss as gold goes to $1900 again and we’re taking a 15% cut, or we give you a discount and you pay us this % of it now and we go away.

- Auryn can argue some details like mining rates to be sure, but honestly the details are not nearly subject to anything like the heavy burden of proof a 100,000 tonnes per day $2B copper mine is.

Previous to the Caren grades, our argument was much weaker. Now 15% of the profits over 10 years is starting to look really painful to Auryn completely without reference to the giant porphyry argument.

So our guys take the JV $0.074c and then negotiate the production and NPV assumptions with Auryn, calculate the NPV of those profits and add them in, and that’s how you set the TO price.

SUMMARY: The important thing is you can see that with some “ball park” guesstimates you can at least say that the value of the cash flow NPV can be equal to or greater than the $100M. And that is much less speculative than other arguments that have been used. On the other hand, this argument will not justify enormous multi-dollar valuations. So to me it is a “middle ground” argument. And it can support the proposals various individuals have floated of $0.12 to $0.30 depending upon depending on how aggressive the assumptions are (namely: what permitting will allow and how big Auryn wants to mine and that our current grades hold up). Values above that start to become more and more difficult to justify in a rational way IMO.

BTW:

The above breaks down as you apply it to the giant copper mine vision because, as I’ve stated before, once you start talking about $1B, $2B in construction costs, there is zero chance anyone is paying for such a mine with MDMN sitting on the side not paying anything to whom they would owe 15% profits. ZERO CHANCE. The mine would not be built under those conditions. So the argument above has validity now for a smaller scale operation, IMO, where there is still decent payback for the capital expense even with 15% of the profits being paid to MDMN. It has zero validity for a truly large mine which operates on large tonnages and smaller operational margins where that 15% would kill you. MDMN will not be here for that day, else that day will not come.