[quote=“Baldy, post:14, topic:1377”]

This bizarre notion that AMC is going to provide MDMN with near term liquidity to buyback shares has no basis in reality.[/quote] I know you rarely like engaging my contrarian views of where we are headed. We both have very firm convictions and narrow focus of how this will unfold. Your best guess may or may not be correct as you acknowledge.

Even though MASGLAS has acquired a pipeline of other mining claims/projects very cheaply, one may want to take into account the expenses involved in maintaining, and eventually developing them into an asset that nets a positive cashflow instead of a cash drain.

MASGLAS PROJECTS:

AGUILUCHO

CONDOR

FORTUNA

LLANO

MALI

PLATON

POSEIDON

TESEO

TRISKELION

AURYN has released a great deal of information to date. There is such a volume of information that shareholders have a difficult time digesting it all. I know I do; I appreciate Cornhusker’s frequent attempts to summarize and clarify it.

MDMN discussion for week beginning Continuing the discussion from

MDMN - 2016-05-16 Weekly Discussion:

[quote=“cornhuskergold, post:1044, topic:1280”]

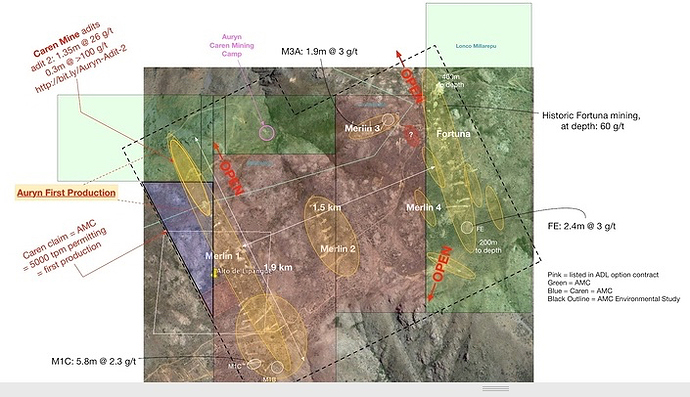

Also recall this diagram from some time ago.

It is easy to forget the detail of what Medinah/AURYN released in December of 2015. It is worth noting that the Altos de Lipangue is the most advanced project for MASGLAS. As we are so often reminded, time is money, and MASGLAS may have limited deep pockets. Included are diagrams of the trenching and summaries of the sample results on Caren Mine, Merlin 1&2, and the Fortuna claim areas. One thing I found particularly interesting was the revelation: “In the mineralized calculations the cut-off grade considered to build is >0.1 g/t Au.” This clearly is a preliminary assessment needed for open pit operations on surface claims:

http://www.otcmarkets.com/otciq/ajax/showNewsReleaseDocumentById.pdf?id=18449

(see) Shareholder Update - December 28, 2015.pdf

Accelerated permitting applications, initially using gravitational concentrator methods (known to be environmentally friendly), would allow selective smaller scale open pit operations to unfold. Will we see something headed in this direction at the AURYN presentation/SHM? An increased cash flow from that already projected for only the Caren mine would certainly qualify as a pleasant surprise. I would think MASGLAS might not mind:

… and allocation of future profits toward share buybacks and / or shareholder dividends.

We look forward to a long and successful relationship with AURYN and to sharing more details regarding these objectives at our next shareholder meeting.

http://medinah-minerals.com

Circular ownership, with it’s limited transparency, has certain hidden advantages that largely escape many investors. With a nice appreciation of PPS, accompanied by a dividend from MDMN, MASGLAS, with a 65% position in MDMN (via AURYN), could pay expenses and accelerate monetization of it’s 9 other projects . A share buyback and dividend, when cash flow and funds allow, would be synergistic in attaining long-term monetization goals expediently while remaining largely under the radar for the investors currently owning MASGLAS. Does MASGLAS have eventual plans for a listing once it’s other projects get further advanced in exploration/exploitation? I also have no urgency to bail on this investment. This is largely my best guess, which also, may or may not be correct.