Your post is right to the point, John. While I agree with much of DOC’s post, I believe MASGLAS has limited deep pockets.

I mentioned this way back.

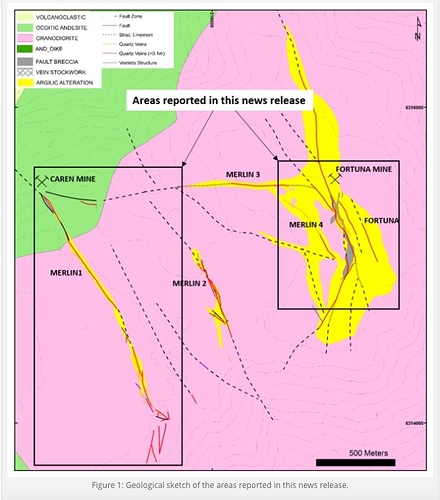

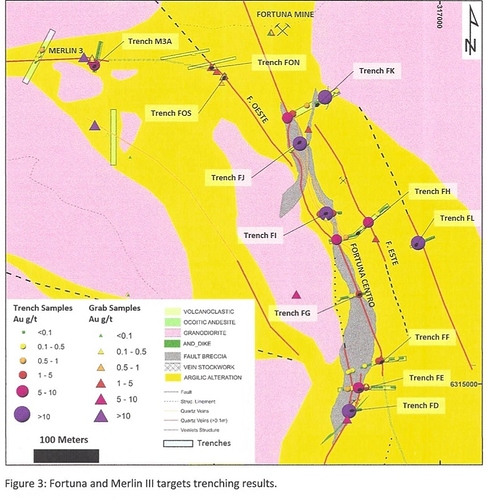

See and read the complete post referenced below in Q3 2016 (as recovered). It is why I asked at the informational meeting if the Fortuna was moving ahead to open pit the surface veins in this area and use a gravimetric concentrator as was originally alluded to. I was surprised that Maurizio said that determination had not yet been made. Cordova added that by using a gravimetric concentrator the gold content would increase 100 fold. The Fortuna will be very profitable in time. I believe they eventually will open pit this claim area, but may have delayed this due to the expense and lack of available funding.

Medinah’s loan is definitely advantageous for reasons already stated here on this thread, wheras CERRO’s loan should be considered predatory, IMO. I think MASGLAS is acting legally, but unethically in taking advantage of current CERRO shareholders. I see that MASGLAS is taking the Fortuna as cheaply as it can, and definitely at the expense of CERRO shareholders. This is to the advantage of future AURYN shareholders, but adding insult to injury to those not holding certificate shares of CERRO. A liquidity event will only reward certificate holders, IMO. Just remember that it does not appear that AURYN is still a wholly owned subsidiary of MASGLAS. It appears that in preparation of an IPO AURYN has become a stand alone private company and is eliminating all debt on the books by issuing the cash call. It is a good move for AURYN to separate itself from the complexities of remaining a subsidiary of MASGLAS before applying for an F-1 in preparation of an IPO. AURYN will use all means available to reward it’s original MASGLAS investors. MASGLAS carries a large monetary obligation in maintaining it’s other mining properties. Also, review the initial news in the January 2016 Chile Explore Report (note: this is no longer in the media section on AURYN’s website - ask yourself why?):

A buyer’s market

Industry crisis creating opportunities for newcomers

…The nine projects are either too small or not suffciently advanced to interest FQM. But they could offer opportunities to patient capital prepared to wait for the promised recovery.

… Masglas now plans to send its geologists to carry out preliminary field assessments over the coming weeks with the aim of determining potential drill targets for 2016.

The team also has to work through an immense quantity of data for the portfolio. Cordova estimates that Inmet and predecessors invested in excess of US$15M exploring the projects, or several times the amount he agreed to pay for them.

The Inmet portfolio is not the only project on Masglas’s books.

“People are letting go of some really excellent opportunities.” Maurizio Cordova, Masglas America

Working through 100%-owned subsidiary Auryn Mining Chile, the group is also assessing the mineral potential of the Altos de Lipangue property in the Metropolitan Region.

http://cexr.cl/wp-content/uploads/2016/01/CER34-ENG-SAMPLE.pdf

Continuing the discussion from Medinah Minerals (MDMN) - 2016 Q3 - General Discussion (recovered):

This was considered to be a slam dunk for an open pit when first released ( December 28, 2015).

http://aurynmining.com/mapping-and-trenching-program-results-indicate-high-grade-gold-mineralization-in-the-epithermal-vein-system-at-merlin-and-fortuna-targets-in-the-altos-de-lipangue-project/

This investment has become an epic saga with much future potential, too many details to recount all that have surfaced in past years, and far too much heartache and disappointment for most investors still on board for any length of time.