Lol

I am with you…

I am with you…

Other four letter words . . .

- Mine

- Gold

- Sell

- Gold

- Gain

- Cash

- Each

- Year

Maybe I’m reading too much into the four letter message posted by Wiz, but I like it. At least it’s been working for me. Capturing gains on mining stocks held more than a year is a useful strategy to get cash. Deploy the cash to replenish your up and coming core mining stocks, especially on any pullbacks. Avoid FOMO!!! Many mining stocks show seasonality, so use it to your advantage.

The way I interpret what Wizard said is that Auryn/Medinah’s goal is to mine gold, sell the gold they mine to gain cash and do it each year. IOW, hold on to your Auryn/Medinah stock for steady gains each year.

I know about the 5000 preferred shares. My question was about their conversion, especially 5000 preferred shares.

one share … is convertible at a rate of 1 to 100. However, all conversions shall be effectuated at a purchase price of $.10 per share (i.e. the conversion of 1 share of preferred into 100 shares of common would cost the individual completing the conversion 10). In the event that the market price of the CDCH shares is above .10, the conversion may be completed on a cashless basis.

So the question is : Are the 5,000 preferred shares convertible into 500,000 AUMC shares, with a payment or without ?

I would like to get everyone’s opinions on Auryn/Medinah’s potential regarding copper.

I know this ask is all hypothetical at this time as, so far, we don’t have anything to show for our investment, but I wanted to ask.

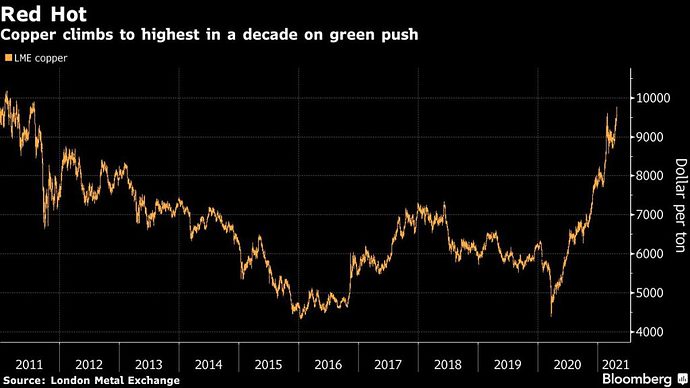

Copper has been seriously increasing in price, the world’s markets and starting (hopefully) to ramp up to full production/consumption, there’s a shiny new toy on the block of EV adoption, there’s a large investment in alternative electricity generation methods (from all sources) which will also need new transmission, the potential infrastructure investments of the US and China, and 5G adoption. In other words, it seems everything right now looks to change to electric or needs electricity to run. These trends will consume a boat loads of copper. I know porphyry deposits don’t necessarily have the highest grades per ton, but with copper’s price getting back to its all time highs (last seen in 2010), do you think Auryn/Medinah would look to capitalize on this trend and have the ability to capitalize on this trend?

I know everyone has talked about gold and the plans and pics so far from Auryn/Medinah seem more limited to tunneling to try to find specific grades of gold instead of a more open pit approach. With this more limited mining scope, can Auryn/Medinah even turn a profit from copper? Will the tunneling even generate enough copper ore to smelt?

Thanks in advance for your thoughts.

Auryn in any imaginable short term scenario will not make any material amount of profit from copper via their mining efforts. At average grade (not too high, not too low) of 0.5% this amounts to maybe $50 / tonne of rock mined. Since they are targeting something > 45g/t gold, that amounts to something on the order of $2500 / tonne of rock mined. So maybe something on the order of 2% of the value of gold per tonne of rock moved.

Having said that, in the long term, the value of the copper in the mountain may very well be much greater than the value of the gold. It is impossible to say at this point. But copper mining is a high tonnage super expensive mining operation typically because you have to move and process so much rock to get the copper. The fact that copper can be very widely spread throughout huge volumes of rock, makes it a different kind of mining more and more limited to very large companies.

Even if Auryn is successful in this self-boot process it will be a number of years before we will have any idea on the copper value in the mountain, IMO. But I agree the rising copper price makes it more likely that they will pursue the exploration required or be able to find a JV with someone willing to do the exploration. But they will have to survive on the gold, hopefully even prosper a bit.

Cornhuskergold is right on: copper mining is a high tonnage “super expensive” mining operation typically because you have to move and process so much rock to get the copper..

Not to mention ! the extensive drill program first just to prove it up…

When might that happen? I think I won’t be seeing it from this side of the fence. But It may be done in my kids lifetime,

. IF some LARGE identity wants to buy us up or in… Thats why I leave this stock in my dream drawer…I’ll be able to see this investment from up there.

Hi Jak,

From Medinah’s point of view, the breakout in the price of copper (currently at about $4.48 per pound) might enhance the perceived value of the ADL, and especially the Pegaso Nero, quite a bit. Until you’ve formally blocked out MR/MR you can’t be real specific as to the actual enhancement in the in situ value of the copper. What’s exciting about the ADL in general is the POTENTIAL ECONOMICS of whatever they pull out of the ground. From a copper point of view, the Pegaso Nero area is very exciting because of the near surface existence of the copper and moly suggested by the ridge crest sampling done by Auryn. The big expense associated with many copper projects involves the removal of the overburden. Sillitoe’s 1974 research indicated that the top of the average copper porphyry deposit lies 1.5 to 4 Km below the surface. In Chile, “the surface” is often 3,000 to 4,000 meters above sea level in the Andes.

At the PN, the copper and moly anomalous areas extend for 3,600 meters below the plateau located at 2,000 meters above sea level (masl). In Q-4 of 2020, the average “all in sustaining cost” (AISC) to mine and process a pound of copper in Chile was $1.58 per pound USUALLY AT 3,000 TO 4,000 MASL. This applies to the “average” copper deposit, the top of which is about 1.5 to 4 Km from the surface and at very high elevations where costs are much higher than they are closer to sea level. I can’t quote you a figure but the AISC to produce a pound of copper at close to sea level and close to surface is obviously much lower. The price of copper now is about $4.48 per pound. The good thing about mining is that at a fixed cost per pound to extract, most of any increase in the price of the sought after metals goes straight to the bottom line.

From a Medinah/Auryn point of view, all of this excitement in the copper arena might translate into a higher level of interest in the ADL by the majors. This might translate into more favorable terms to any JV entered into. It might also translate into a higher probability of an outright buy out of the PN and/or a buy out at more favorable terms to Medinah/Auryn. From a CONTEXT point of view, the price of copper has gone nuts at the very same time that new discoveries are at a 31-year low and the amount of pounds of copper reserves on the balance sheets of the majors is at a 32-year low. Even before the breakout in the price of copper, the majors have been digging deeper and deeper while going after lower and lower grades at more and more remote, unfriendly locations.

For me, the TIMING couldn’t be better for Medinah/Auryn to be sitting on a prospect like the PN. Between the favorable infrastructure at the ADL and the favorable proximity to surface this could be (no promises) a very LOW COST operation after a vast amount of exploration/ development work is completed. The amount of cash in the coffers of the copper producers and their share prices make it an excellent time for them to be acquiring copper prospects. Their biggest problem is there is no SUPPLY of new discoveries to choose from. If you take it a step further, the SUPPLY of near surface, low elevation discoveries in countries wherein mining is well-established is even scarcer. This is clearly an environment in which deals are going to get done. Fingers crossed that the ADL has made it onto the radar screens of the majors in need of entering into strategic alliances or make acquisitions. In an environment like this, the level of development needed to reach in order to attract a major might be a lot less than in the days when copper was much cheaper and new discoveries were more plentiful.

As far as Medinah/Auryn going into very high-grade gold production at a time like this for the copper industry, I would suppose it might provide Medinah/Auryn an opportunity to make the copper prospects look even more appealing to any interested majors.

Four Letter Words?

NEXT

WEEK

Preliminary Exploration at Pegaso Nero Target Suggests the Discovery of a Copper Molybdenum Porphyry System within the Altos de Lipangue Project.

Doc ;

Before you get people too excited about the Pegaso Nero, they should be aware that Pegaso Nero is part of the Las Dos Marias project and that ;

Hochschild has the Las Dos Marias project tied up until Dec. 2023. The ppty is tied up for 5 years with $0 minimum investment required during that time up until the end date, until then $7M must be invested in exploration for them to maintain their option.

For 2 1/2 years (of the 5 years) we have been informed of $0 spent by Hochschild on the property. Although we were told that they did 'field works and an IP survey.

As of December 31, 2020;

“The Company signed a binding Letter of Intent (“LOI”) with Hochschild Mining PLC during 3rd Q 2018, for the Las Dos Marias (“LDM”) project. Hochschild performed various field works and an IP Geophysical survey. Hochschild did not perform any drilling however recommended the Company should undertake a 3-hole exploration drill program in order to evaluate the potential or lack thereof of mineralization. The Company is exploring opportunities to raise funds to complete this drilling program, in the way of private financing, equity, share issuance or rights offering.”

So to sum up, if I surmise accurately, Hochschild is not willing to drill the property on their own dime, but think the AURYN (which has no funds) should do the drilling on their own expense.

I have never heard (in my 30 some years of investing in metals companies) that a company with an option is so ‘uninterested’ that they tell the company that owns the property to do the drilling themselves !

Hochschild not willing to spend a couple hundred thousand dollars drilling a property of this magnitude !

Do correct me if I have any incorrect information.

The JV certainly has been a disappointment to date. The LDM appeared in a couple of presentations by H. but has since disappeared. One might guess reasonably that they spent a little on an IP survey but did not find a ‘hotspot’ that gave them an easy target to explore farther. And in 2019 I think H.'s greenfield exploration budget was minuscule, maybe $2M or $3M and they have a list of greenfield projects to spend that on.

If there is hope for the JV, it is that when it started H. was suffering from a long silver bear market and its balance sheet showed it. Now they are sitting on over $200M cash and raising their exploration budgets. They are mostly spending on brownfield exploration on their currently producing assets. But they have raised their budget to over $30M for exploration. They have started listing new greenfield projects in the U.S. that they are targeting. But with more money maybe the LDM will catch a little more love before the JV expires. Else, by then, if AUMC executes the plans they’ve stated, they will have the money to do the exploration themselves potentially with some hired help instead of a JV partner.

Lawmakers in biggest copper nation ratchet up tax proposal

Bloomberg News | April 26, 2021 | 2:56 pm News Latin America Copper

Image courtesy of Codelco.

The worst-case scenario for Chilean copper producers in a debate over a new royalty system just got bleaker.

![]()

On Monday, a congressional mining committee in the biggest copper-producing nation approved a version of the bill that would charge higher rates at times of high prices.

![]()

The original text had a flat 3% tax on copper. The new version would charge a marginal rate of 15% on sales derived from copper prices of between $2 and $2.50 a pound and as much as 75% on cash generated from prices above $4. At current prices, the effective rate would be 21.5%, although miners could discount refining costs from copper sold as refined cathode.

Even before the modification, the industry had indicated that the proposal would stifle investments and make Chile less competitive. Both company and government representatives want the existing sliding tax on profit, rather than sales, to be given a chance to operate at high prices of $4-plus a pound. The country’s mining society declined to comment on the new article.

The bill’s proponents say the new mechanism would reap $7 billion a year, based on an average price of $3.88 a pound, at a time when Chile is looking to bolster social services and resolve lingering inequalities.

“The argument that making a percentage so high causes companies to fail is not effective because it depends on the price of copper,” said Communist Party representative Daniel Nunez, who heads the finance committee and was one of the authors of the new article. “If the price is $2.50, they will pay much less. It is viable from the point of view of the miners.”

To be sure, there’s a long way to go before the bill passes and the government has indicated it could seek to block its passage via the constitutional court on the grounds that tax measures in Chile have to be introduced by the government. In the meantime, the bill goes to the finance committee and then back for an article-by-article lower house vote before moving to senate.

While lithium sales would be subject to the initial 3% rate, the sliding system based on prices doesn’t consider lithium. That is yet to be discussed, Nunez said.

The initial proposal, introduced in 2018 by opposition lawmakers, has gained momentum amid rallying metal prices. It would fund regional development projects, responding to the rising social and environmental standards of investors and supply chains. Countries around the region are also looking at new revenue sources to help citizens recover from the pandemic.

(By Valentina Fuentes and Tom Azzopardi)

And to follow up the last story. This will be why Chile will still be friendly toward Copper mining in it’s country.

Mining giant Chile flush with cash as copper price soars

Reuters | April 27, 2021 | 11:02 am Intelligence Latin America Copper

BHP’s Spence copper mine, located in the Atacama Desert of northern Chile. Credit: BHP

Chile expects the soaring price of its main export copper to boost growth and underwrite the nearly $16 billion in stimulus the country expects to have handed out to its citizens during the coronavirus pandemic.

![]()

Finance Minister Rodrigo Cerda told lawmakers during a presentation of the government’s quarterly public finance report that Chile expects the copper priceto average $3.99 per pound in 2021, a big increase over its January prediction of $3.35.

![]()

Sky-rocketing copper prices, combined with a major bump in economic activity expected as a result of its fast-paced vaccination drive could see Chile’s gross domestic product jump 6% in 2021, up from a previous estimate of 5%, Cerda said.

The world’s biggest copper producer reaps an additional $60 million in taxes and royalties for every penny the copper price rises, based on official estimates.

The minister said Chile could also thank copper revenues for helping to stabilize debt in 2021 despite rising expenditures.

“The price of copper, now much higher, gives us more income, and permits us, of course, to more rapidly contain debt levels,” Cerda said in the presentation.

Chile’s copper output has continued without much disruption during much of the pandemic as most of its large mining companies adjusted early, stepping up sanitary measures and working with limited staff.

The country is also far ahead of regional neighbors in its vaccination drive, an advantage it hopes will prime the economy for a major rebound in the second half of 2021, Cerda said.

Domestic demand is expected to grow 10.7% in 2021, up from a previous estimate of 8.8%, amid expectations that the pandemic will soon subside as more Chileans are innoculated.

Health ministry statistics show that more than half of a target population of 15 million Chileans has been vaccinated.

The finance report also noted that consumer prices would rise 3.4%, up slightly from a prior forecast of 3.0%.

(By Dave Sherwood and Fabian Cambero; Editing by Chizu Nomiyama and Jane Merriman)

Hi Rod,

Slide 7 of this deck shows a map of the LDM and PN.

I’ve never seen the PN as being referenced as part of the LDM. The expanded LDM (3,000 Ha) which Hoch has a JV on constitutes the western 28% of the ADL as I understand it. The map shows the PN as being in the south half of the ADL at its center. Was the source of your information a map or member of management?

The information from management is not exactly clear.

Drifter,

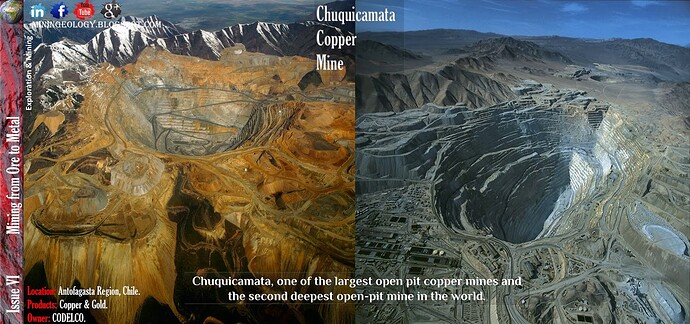

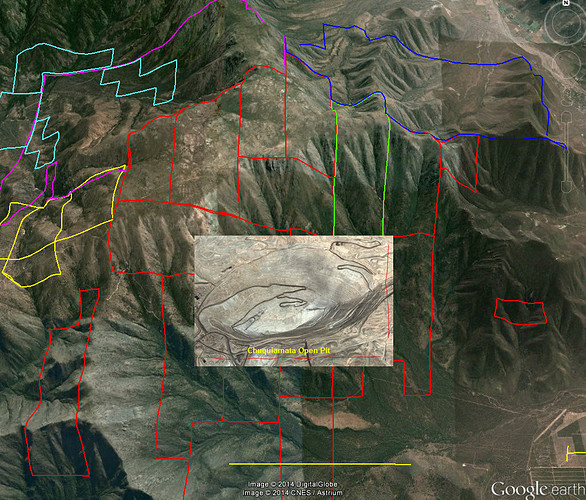

The PN is such a large “elephant” of a claim area it is almost impossible to think that it wouldn’t have some very serious permitting obstacles to overcome. The expense of just getting started on such a project may be cost prohibitive for even Tier 1 companies without greater definition of the deposit. I don’t remember who came up with the image in 2014 showing the open pit Chuquicamata mine projection superimposed on the ADL claim area, or if the image scale is accurate. It may be quite different, but it shows that there is a great deal of claim area that might be profitable to mine given enough time and investment capital to support it.

The claim areas concerning possible gold extraction are a different matter, and extensive as well. It appears the company considers exploration results to date very worthy of being permitted and exploited incrementally. That is what shareholders are expecting to see happen. That is the current aim of management as it methodically progresses to make AUMC a profitable mining operation. The next few quarters should reveal if management can meet the goals it has set for the company outlined in Q2:

Q2 2021 – OBJECTIVES

- Intersect the Don Luis vein and begin exploitation on multiple fronts with regular shipments of ore to Enami. AURYN will ship to two different processing plants. Material with grades over 25 g/t Au will be shipped to one location for direct smelting. Grades below 25 g/t Au will be sent to a second location for flotation processing.

- Continue developing the tunnel to intersect two massive, known structures encountered during previous trenching operations. (See: trenching program update.) These structures are each greater than 2 meters width in the trench. AURYN expects to intersect them this quarter.

- Continue our geological studies and assessment in order to increase production and establish reserves.

- Explore the feasibility, timing, and permitting requirements for the development of an on-site concentration and processing plant.

- Execute a second agreement with the Universidad de San Sebastian to further analyze the entire district including, but not limited to:

- Feasibility of a Flotation Plant project;

- Evaluation and feasibility of improving roads and access;

- A new evaluation of La Fortuna and Lipangue district geology; and

- Feasibility of an infield lab for gold, silver, and copper results from samples taken from the area.

I believe you are correct Doc.

Time to renew my hosting agreements for this site. Given the change over the last few months, I don’t think I need to ask what the community wants to do about keeping this site alive!

Thank you, for putting up with the advertising. It helps keep the lights on.