EZ, if I recall correctly, the entirety of the concessions is about 55 square miles? The portion you show there (above) can’t be more than a couple square miles. This is a HUGE property, admittedly not all mineralized - but there’s a GOOD reason we own all these concessions!

You’re quite right mrbubba. The area shown in that graphic is probably less than 1/2 mile square, but for those who have only been around to focus on the Don Luis DL1 & DL2 structure, there is a lot more to the ADL District. I’d suggest reviewing some of the older Notifications highlighting the potential for the rest of this property such as:

Mapping and Trenching Program Results Indicate High Grade Gold Mineralization in the Epithermal Vein System at Merlin and Fortuna targets in the Altos de Lipangue Project

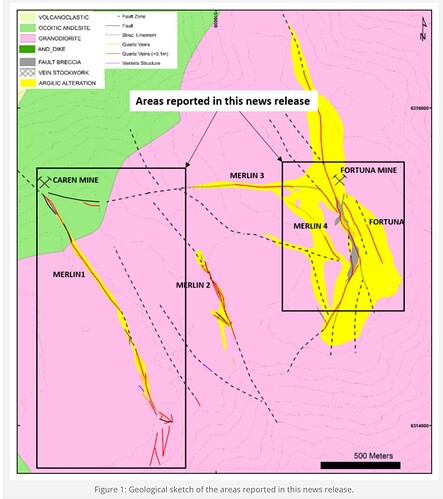

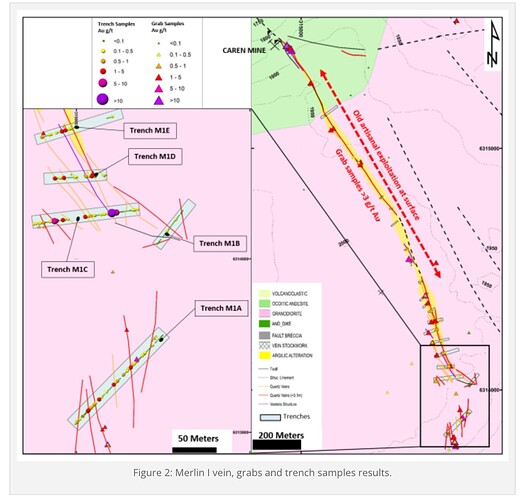

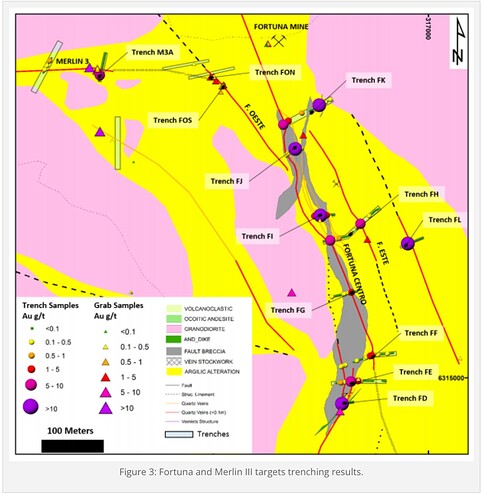

Dec 28, 2015The trenching program in the Merlin-Fortuna targets was finished, and over 1,600 channel and grab samples were collected. Over 5 km of lineal structures were recognized and the structural corridors are still open to be extended in all directions. (See figure 1)

What has been revealed at the surface is just a peek at what lies below. The DL1 & DL2 mining project needs to kickstart the much larger projects that this shareholder hopes to see some day. Fast paths to riches in mining rarely happen quickly. Yes, it does take money, a lot of money. Let’s finish the preparations and begin the mining, and no, it will be carefully laid out over the remainder of this year and next. If good things happen before then, I’m open to surprises like what happened with the Father’s Day vein, if you know what I mean! That’s where the “motherlode produced more than 27,000 ounces — the equivalent of about 760 kilograms of gold — which made Canadian miner RNC Minerals more than $40 million and saved the mine from closing.” That’s the kind of discovery that most shareholders would indeed welcome. That didn’t happen without persistence and a lot of good luck.

Hi mrb,

I’d be glad to share my projections with you but I think it would be prudent to first wait for the next update as it might provide some of the fact checking data my guys have been reviewing and still seeking. I’m going to warn you that if you’re used to making production or profit projections based on the typical scenario wherein a discovery has been made and the preliminary information is just starting to roll in then this particular scenario is going to force you to change your approach. Most of the due diligence heavy lifting has already been performed for you.

The first step in doing these projections is locating the source of the most PERTINENT DATA related to the prognosis for the success of a mining operation or the chances for success in investing in one. The most PERTINENT DATA would also be the most COMPREHENSIVE DATA. For all intents and purposes, the mining operation ends in the driveway of the processing facilities and what exactly got delivered to ENAMI. It’s going to cost a certain amount of money to mine, to do some on site beneficiation (concentration of the ore), transport and process the ore. ENAMI’s going to cut you a check, you take the check and pay off all of the bills and what’s left will be the profit.

Doing projections on this deal is somewhat refreshing because of the HISTORICAL PRODUCTION FIGURES available, in the form of SHIPPING GRADES, that I rarely get to work with on companies going into production. In this case with the DL2 Vein, this INCREDIBLY PERTINENT AND COMPREHENSIVE DATA is just sitting there waiting to be scrutinized and built upon in the interest of providing valid projections. It’s almost like valuing a deposit that’s been in production for 30 years that suddenly came up for sale in a “turn key” fashion except for the “turn key” aspect.

Although this deposit hasn’t been in production for 53 years because of a certain dictator that took power in Chile about 53 years ago and started stealing mining projects, the product being sold has a “shelf life” measured in the billions of years i.e. gold. Auryn had plenty of work to do which would keep this scenario out of the “turn key” category. The bulk of this had to do with locating the extremely high-grade ore immediately beneath where the artisanal miners ceased their operations and simultaneously drifting the “production adit” needed to transport this ore out of the belly of the mountain and onto the plateau surface and then onto ENAMI’s driveway.

HISTORICAL SHIPPING GRADES incorporate the entire mining process as well as infrastructural issues. VEIN GRADES are wonderful but unless you have the grades of the neighboring wall rock and the adit width figures and the beneficiation recovery rates then the information is INCOMPLETE. What investors want to know is the number of ounces that can reliably be produced annually, the average AISC (All In Sustaining Cost) to mine and process each ounce, the average amount paid per ounce, etc.

When you know the HISTORICAL SHIPPING GRADES in terms of “grams per tonne”, you know how many ounces of gold are in each truckload filled to about 16.7 tonnes per truckload. In the case of 64 gpt gold, these truckloads would contain about 34 ounces of gold each. The retail value would be about $63,000. I don’t particularly care if the vein grades are “X” gpt gold and the average vein width is “Y” meters and the average grade of the wall rock is “Z” gpt gold and the average recovery rate from a certain on site beneficiation process is “T”%. The breakdown of these individual critical parameters doesn’t matter. The end product from ENAMI’s point of view is a truckload with an average shipping grade of “Z” gpt gold post-beneficiation and the ore weighed 16.7 tonnes.

The average SHIPPING GRADE accomplished over the course of 30 years of mining the DL2 Vein was an insane 64 gpt gold. Was the VEIN GRADE through the roof or was the grade of the wall rock ore extremely strong or was the recovery of the gold due to any particular beneficiation process beyond all expectations? Who cares?

TAPPING INTO THE VALUE OF HAVING HISTORICAL PRODUCTION GRADES

There is a lot of indirect information available in this DL2 Vein scenario. If, as is typically the case, the highest-grade ore is found in the vein proper and the width of the vein being mined was 0.15-meters up near surface, and the SHIPPING GRADE came in at 64 gpt gold, then if the width of the vein increased to 0.6-meters where production is about to commence, is it logical to expect an even higher SHIPPING GRADE from the new operations? I would assume so but I’d prefer to wait for the actual data.

If the beneficiation process in use 53 years ago, resulted in the grade of the ore being mined to go from “X” gpt gold to 64 gpt gold, is it logical that today’s beneficiation technology might be able to do an even better job? What if the price of the sought after gold went up about 54-fold (from $35 per ounce) in the timeframe since production by the artisanal miners ceased? Would that increase the CURRENT VALUE of this mining operation about to go into its 31st year of production?

EXACTLY WHAT INFORMATION WOULD AN INVESTOR SEEK WHILE EVALUATING THE PROGNOSIS FOR THE SUCCESS OF AN INVESTMENT IN AURYN OR MEDINAH?

I would think the key would be the AVERAGE SHIPPING GRADE for the first dozen or so truckloads of ore shipped to ENAMI from level 3 (the Antonino Adit). Although it might not make a lot of sense from a scientific point of view, I sense that people want to make sure that the TREND of increasing SHIPPING GRADES with depth is still intact. At the DL2 Vein, the top third of the artisanal workings averaged a SHIPPING GRADE of about 54 gpt gold. In the middle third, it averaged about 64 gpt gold and in the bottom third it averaged about 74 gpt gold. Collectively, the average came in at 64 gpt gold. When the artisanal miners deployed a crude “froth flotation” system they were able to get the average SHIPPING GRADE to 92 gpt gold. The engineers at the University of San Sebastian that collaborate with Auryn are testing some different “froth floatation” systems for their efficiency.

Some people might tend to look at this scenario as a virgin deposit just being put into production for the first time because of the time element since it was last in production. Again, the exact breakdown of the individual components would not be necessary. The width of the vein as a function of depth would definitely be helpful. Is the “angle of divergence” of the vein as it descends staying intact as it did earlier when it dilated from 0.15-meters to about 0.6-meters over the course of about 70 vertical meters? Are the VEIN GRADES still increasing with depth?

IF YOU HAVE BEEN GIFTED WITH THE HISTORICAL SHIPPING GRADES THEN IT’S OK TO AUGMENT THOSE WITH SOME BASIC GEOLOGICAL FACTS

These types of HYDROTHERMAL DEPOSITS tend to show 6 different zones vertically. At or near the surface you have the GOSSAN zone. This is typically pretty much barren. The next lower zone is the LEACHED zone. As its name implies, this zone is typically low grade compared to the zones beneath it. Next comes the OXIDE zone. Here the grades become stronger. When you study the photos in the Auryn website “gallery” that pertain to the Antonino Adit or level 3, you’ll note the appearance of the reddish-colored ore like cuprite which is an “oxide” of copper. When one is present, the next lower zone is called the SUPERGENE ENRICHMENT ZONE. The classical presentation here is the bluish-purplish form of copper known as “bornite”. It is pretty much ubiquitous in the Antonino Adit as the 4.5% copper grades attest to. Below this comes the WATER TABLE and below it is the HYPOGENE zone with somewhat boring grades typically.

These 6 zones are not discrete with sharp areas of demarcation between any two adjoining zones. They tend to blend together and telescope into the adjacent zones. The artisanal miners appear to have been averaging a SHIPPING GRADE of 64 gpt gold in an area in between perhaps the leached and oxide zones. One would anticipate stronger gold grades in level 3 than in the “old workings” associated with levels 0, 1 and 2. I’m not predicting this with 100% certainty but just don’t be shocked if it does occur.

THE STORY HERE, WHEN COMPARED TO OTHER NEW DISCOVERIES ABOUT TO GO INTO PRODUCTION, IS “ENHANCED VISIBILITY”

Could you imagine a mining firm with a new discovery that has never been in production that had access to a crystal ball correctly predicting what the SHIPPING GRADES would be for the first “X” number of years of production? Management and their geoscientific team would know where to focus their efforts on. Would they not see the TREND in the SHIPPING GRADES and do everything in their power to intercept the DL2 Vein via drifting an adit targeting right below where the artisanal miners left off?

Until you know the history of why the mom and pop artisanal mining operations shut down while Pinochet was busy stealing mining operations and gifting them to his political cronies, you would wonder why this mine wasn’t totally mined out by now with the kinds of grades being present. Medinah spent about 15 years trying to advance this project but they didn’t have the technical expertise or financial wherewithal to advance the project much.

SO, WHAT’S NEXT?

As mentioned, I think the key now is to try to get a handle on the SHIPPING GRADES to expect from mining and beneficiating the ore at level 3 which is the Antonino Adit level. Based on a 1,000 meter “strike” of the vein, there are approximately 340 truckloads of VEIN ORE ONLY present on this level. This is based on an average vein width of 0.6-meters, a specific gravity of the ore of 2.7 tonnes per cubic meter, a 3.5-meter adit height and truckloads weighing an average of 16.7 tonnes.

I would think that the first dozen or so post-beneficiation truckloads would give us a pretty good indication of the average SHIPPING GRADE to expect at this level. With PDAC about a week away, I’m going to guess that Auryn management wants to ROLL OUT some of the data we’ve been seeking.

Thanks tdog1990 I’m just gonna add the actual announcement they made:

AURYN Mining Corp

](https://twitter.com/aurynmining)

We have received the assay report on the DL2. As expected, they are consistent with the grades provided in the Q4 Shareholder Update. Further metallurgical testing is ongoing to determine the most effective processing methodology. Stay tuned!

AURYN is likely withholding the specific assay numbers until the PDAC convention, March 5-8, in Toronto.

Yes, Jaded - in other words, BONANZA grades.

It’ll be interesting to see how our guys go about ramping up production, from nothing … to something, unless of course you’re one of those who doesn’t believe it’ll be anything worth writing home about. Me, I’m kind of STUCK with this investment - and so I have no other choice than to engage in “hopium” and positive thinking in general.

Hi Jaded,

I think you nailed it on your citing that Maurizio is probably holding off on assay details until PDAC which starts this Sunday. When you get results like they announced at the quarterly update regarding the DL2 Vein (averaging 164 gpt gold over 0.6 meters), the securities lawyers will tell management to sample the heck out of this intersection area and dot all the I’s and cross all the T’s.

When they put out the quarterly update, they kind of left things open-ended noting that once they broke completely through the DL2 intersection area they would resample and get back to us on the results. I’m guessing that we’ll get the comprehensive update in conjunction with PDAC.

There’s a securities law called “Reg FD” which a group of us active in the securities law arena helped push through back around 1999. The law states that an “issuer” of securities must disseminate “material nonpublic information” to all concerned AT THE SAME TIME. The idea was to block the Wall Street analysts from getting special treatment on information distribution. Back then it was common for share prices to double or triple right before big news was released.

I think this tweet suggests that management wanted to confirm the bona fides of the grades mentioned in the quarterly update prior to PDAC but not steal the thunder from PDAC. There may or may not be a press release coincident with PDAC or immediately before PDAC. We’ll see.

WHAT DOES THIS TWEET MEAN IN THE OVERALL PICTURE?

First of all, it represents management putting their imprimatur on the stellar grades noted in the quarterly update. They “doubled down” on them. This in turn corroborates the insane grades seen under the intersection of Shaft A and level 2 right above where Auryn is about to commence production. It also corroborates the HISTORICAL SHIPPING GRADES put out by ENAMI regarding the mining activities carried on right above where Auryn is about to commence production.

We’re still anxiously awaiting the results of the “beneficiating” techniques being tested to see which process increases the SHIPPING GRADE over the “run of mine” grade the most. I would assume they’re testing both gravity concentrating techniques and “froth flotation”. Historically, “froth flotation” was deployed by the artisanal miners of the DL2 and it enhanced the “run of mine” grade from 64 gpt gold to 92 gpt gold. In the last year of production at the DL2 (1970), the artisanal miners produced a “concentrate” grading an average of 102.7 gpt gold. This report didn’t cite the methodology used but I assume it was a gravity concentration technique. The takeaway is that the ore right above where Auryn is about to commence production is amenable to being concentrated by one or another METALLURGICAL process. The beauty of gravity concentration using one of the Sepro-Falconer technologies is that they are inexpensive and free of any nasty chemicals. You simply rev up a centrifuge capable of pulling “60 G’s”.

AS FAR AS THE TOPIC OF DRILLING AT THE ADL MINING DISTRICT

As Maurizio explained at the “informational meeting” in Las Vegas several years ago, he was in possession of the financial wherewithal to put one of the veins at the ADL into production without needing to drill it out. He trusted the HISTORICAL SHIPPING GRADES which he just recently corroborated.

He was very candid about not having the resources to develop the Pegaso Nero in a solo fashion. He confirmed that the CAPEX in a project like that would probably be in the billions of dollars. He predicted a JV arrangement with a major or perhaps a consortium of majors. If this comes to pass, those guys will absolutely make Swiss Cheese out of the Pegaso Nero where Auryn’s sampling revealed a 3,600-meter (north to south down the southern downslope) by 1,200-meter “anomaly” that tested very high for both moly and copper AT THE VERY SURFACE.

A press release referenced these as being the “moly anomaly” and the “copper anomaly”. These are located in the vicinity of a somewhat rare type of breccia known as a “tourmaline/specularite” breccia. This, in turn, was found in close proximity to the “South Road” where a full 2 Km of the associated “road cuts” made during its construction, were inundated with veinlets and “stockworks of veinlets”. This is what “porphyries” are made out of.

“Moly” (molybdenum disulfide) is only mined in association with porphyries. Tourmaline breccias are most often found in conjunction with porphyry structures. The moly found during this sampling was geodated for its age and came in as 91-million-year-old rock. This is the same age (Early Cretaceous) as that of the copper-gold porphyry known as the Andacollo Mine to the north of the ADL Mining District near La Serena, Chile. The ADL Mining District sits in the “Cretaceous-Aged Porphyry Belt” of Central Chile.

From a STRATEGIC point of view, when Maurizio sits with a major or consortium of majors interested in co-developing the Pegaso Nero, should it be deemed worthy of developing, if he were to have a very high-grade gold project INTO PRODUCTION at the time of sitting with these potential strategic alliance partners, the deal he could drive would be VASTLY SUPERIOR to any deal he could negotiate prior to that time. From a geological point of view, a porphyry and the mesothermal veins, skarns, mantos, breccias, etc. that lie immediately above it, share the same underlying progenitor magma chamber.

If the mesothermal veins, just so happened to have atypically-high gold grades then so too might the other various adnexal structures that we know less about. It’s certainly no certainty, but definitely a possibility. The question I have is have the developments at the DL2 had any effect on the interest levels in the other geological structures present. It’s been many years since we learned at the “informational meeting” in Las Vegas, that Freeport McMoRann had given Maurizio permission to reveal that they are a party of interest at the Pegaso Nero and had already scheduled a trip to the Pegaso Nero. Maurizio also noted that there are 2 other major miners, “even larger than Freeport’, that have shown an interest but he did not have their permission to use their names.

As Auryn develops the various horizontal “levels” below level 3 which is the Antonino Adit level, keep an eye out for the texture of the rock to start taking on a “porphyritic texture”. This means rounded larger fragments/phenocrysts sitting amongst a much finer groundmass i.e. a “plum pud

They said they’d share the assay results when they received them. I didn’t see anything saying they’re waiting for Toronto.

They have them in possession now!

So you’re saying that you were part of the group that pushed for Reg FD? Is there no limit to your level of delusion? You’re also saying that the grades were sooooooo good that the company wanted to wait until the booth at PDAC was swarmed by eager investors salivating for the next world class deposit?

I feel like the evil villain is some fantasy novel but would offer another possible explanation: the assays from the last update would never be considered actual “assays” by even the most plebian geologist. They would be laughed out of their booth. Hopefully, they are working on formal assays (which may be great as far as I know) before having the balls to disclose to investors at PDAC who actually understand what is needed for actual economic assignment or rudimentary valuation analysis.

Orrrr, the results of non-industry standard “assays” are so good that Maurizio has hired a battalion of the Chilean military to protect the mountain of gold so that an army of dentists from the Northwest don’t charge the asset for a lifetime of fillings.

Both scenarios seem plausible.

Dentman - I think they’re saying that the grades are “consistent” with what they announced a few weeks back; therefore, we can assume 164 gpt is the average of what they’re seeing. I’m not really sure what these readings mean, because they don’t necessarily say over HOW LONG the average gpt was computed. So, I wonder how the numbers work out when considering the halo and ore in the immediate vicinity which we will also be mining. But, maybe there’s a way to mine just the “good stuff” without having to waste a lot of time and effort with the halo and surrounding? Don’t know the technology these days. But, I’m gonna be patient - the PDAC starts I believe Sunday, and after all these years I can wait another 7 days.

I think CH had a good handle last summer to see where things are headed.

Continuing the discussion from Auryn/Medinah - 2022 - 2nd Half General Discussion:

We need to see the progress made during the next few quarters. I’m still very confident things will turn up for all shareholders, just not as quickly as some would like, or as soon as CH had hoped for. Management has some very ambitious plans and is doing everything “by the book” as surely guided partially on the assessment report by Richard Sillitoe .

Outlook (July 2021)

All indications are that grades are increasing, and the structure is getting wider as it gets deeper. This is consistent with a mesothermal deposit and lines up with previous reports provided by Robert Cinits (A.C.A. Howe) and Richard Sillitoe. Management’s outlook for the future is extremely bullish.

In reaching the DL vein there were numerous delays, and a number of promising new features intersected, which did not match the ore geochemistry of the DL vein. It was back in the beginning of last year that it was clear to me that management has plans to develop more than just he Fortuna Mine when this objective was stated, “Once consistent production is achieved, develop a financial forecast, and begin to outline reserves on La Fortuna and Lipangue Mining District.” There are other areas that will fall into place once full production and debts are taken care of while mining the DL veins. The Caren will be revisited. I don’t think the assays awaiting to be revealed will have much of an impact on share price when released, but they will draw interest. It was stated several times over the past couple of years, that in conclusively reaching the DL Vein, only minor production would occur during this process. Besides the great deal of preparation work yet to be completed and equipment needed, the objective listed below does not look at all like the minor production mentioned, but is a preliminary first step:

Q1 2023 – OBJECTIVES

- Topographers from EGV Ingeniería will return to Lipangue and take new readings to ensure the precise orientation to follow the DL2 from our intersection on level 3 to the old workings on level 2. The team will then construct an evacuation/ventilation chimney following the Don Luis vein to the old workings. Ore from the chimney will be shipped to ENAMI.

This chimney ore is primarily to determine the quickest path to full exploitation, and determine which equipment and beneficiation process will be used while following the main DL vein deposit. Looking at the ore sample assays of the Antonino tunnel as it intersected the DL vein, there is a mixture of high and lower grade ore as described by CH. Much of the ore will not be economic without further processing and a solution as to the best methods to handle the variation of this type of ore will be needed. The evacuation/ventilation chimney is 30 meters in length. Constructing a gallery with an area of 50 square meters and building the “T” to exploit the Don Luis vein in both directions (and eventually at lower levels) will move a lot of dirt. (This will entail “minor production”.) How much can be easily processed and direct shipped will be determined. Some of the lower grade ore may be stockpiled for later beneficiation processes unless capital is expended to buy the equipment to further concentrate it right away. That will need to be determined and answered by the chimney ore shipped to ENAMI. Because of all the delays up until now, I’m not as optimistic that we’ll know a lot before the end of the year, but it is definitely more interesting now being inside the tent and holding a ticket to watch this show unfold! ![]()

![]()

![]()

![]()

EZ

AURYN Mining Corporation Strengthens Leadership Team with Two Key Board Appointments

Mar 1, 2023

AURYN Mining Corporation (OTC: AUMC) is pleased to announce the appointment of two highly accomplished individuals to its Board of Directors. Isac Burstein and Mark Dingley bring a wealth of experience in exploration and mining business development, as well as oil and gas industries.

Isac Burstein is a resourceful and creative exploration and mining business development professional with extensive experience and contacts in Peru, the US, Canada, Mexico, Chile, Ecuador, Brazil, and Guyana. He has a proven track record in identifying and negotiating the acquisition of prospective claims, developing earn-in JV structures, and evaluating mining investment opportunities. Isac has been involved in four discoveries that became operating mines, over 60 deals from asset sales, JVs, earn-ins, private placements, royalty sales, etc. His skills include negotiating and structuring deals, financial modeling and valuation, and technical due diligence. Isac holds a BSc in Geological Engineering from the Universidad Nacional de Ingenieria in Peru, an MSc from the University of Missouri, and an MBA from Purdue University.

Mark Dingley is a board-level senior leader with a background in mining and on-shore/off-shore oil & gas industries. He has demonstrated increasing levels of technical, financial, and decision-making authority and has accumulated extensive experience working with government bodies up to and including heads of governments and heads of states. Mark is a published author and served as the President of Africa Oil (Ethiopia) and Vice President of Operations at Africa Oil Corp. He has also held several executive positions at Talisman Energy, where he was responsible for exploration activities in the Middle East and Latin America. Mark is a certified UK Offshore Installation Manager (OIM) and an associate member of the International Bar Association. He holds a Law degree (LLB) and an Economics Master’s degree from Canterbury, an MBA from Harvard Business School, and a PhD in Applied Economics from Wharton Business School.

The AURYN Mining Corporation is excited to welcome Isac Burstein and Mark Dingley to the Board of Directors. Their vast knowledge, experience, and expertise in exploration and mining business development, as well as oil and gas industries, will be invaluable in advancing the Company’s mission and goals.

Is there oil in them thar hills???

Click into those links and read their full bios. Uh, I think we just changed leagues.

Confirmation of DL at roughly 150g/t AU was our biggest announcement so far. I think these board appointments are confirmation of that announcement and it is our 2nd most important announcement in our history. I am not being demeaning, but Isac Burstein and Mark Dingley are just a different caliber of individual than we have been able to attract before now.

These new BOD members are deal making strategists, add expertise in business development and may assist in developing earn-in JV structures. I wonder if they’ll be around Toronto this week-end at the PDAC. I’d bet they also have the contacts and know-how to procure the heavy equipment that will be needed to expedite the mine.

Very funny TR, I think they’ll be planning to mine ![]()

![]()

![]()

![]()

Wiz, I agree the two new board members have experience in large scale commodity projects and can bring that knowledge to helping Auryn develop the mine and get a return to shareholders.

I do have a concern, however, RE Mr. Burstein and a potential conflict of interest. Considering Auryn’s existing contractual relationship with Hochschild, his two positions have direct opposing goals and a direct conflict of interest exists because he now works for opposing sides on a contract. I don’t know Mr. Burstein in any capacity, but considering the past behavior of those who have been involved in this mining project prior to Auryn, and who shall remain nameless, we can’t have a fox in the hen house.

IMO Auryn needs to address how the decision making would occur within Auryn RE all things Hochschild as it relates to Mr. Burstein. IMO, at a bare minimum, Mr. Burstein must recuse himself from all decsion-making RE anything Hochschild. IMO Auryn needs to “chinese wall” him off from all Auryn internal documents, materials, and info related to Hochschild and he needs to recuse himself from any discussions and deicsion-making related to Hochschild.

Ques to all. Is it normal in the mining industry to have these types of conflicts of interest? If so, how does it normally get handled? I ask, because as an attorney, I’d get in big trouble doing this and wouldn’t advise my client to do something of this nature unless strict controls were in place.

There is no conflict - there is no existing contractual relationship with Hochschild.