What a great day - we first get the free entertainment from Madmen and then Brecciaboy comes on with some good stuff! I still can’t say I understand exactly how the production adits/shafts are gonna be designed, but I do see very clearly Madmen has some smart friends!

BB,

Thanks Jim, this is a great overall analysis of what the future mining progress may well look like. I’m just curious as to what a Falcon SB Concentrator (or one of the other models) would cost. My notes have this model able to preprocess as concentrate before shipping to ENAMI at 400t/h. Additionally the variable frequency drive (FFD) and a dynamic braking system are used to greatly reduce offline time for concentrate flushing. Higher G forces allow for higher efficiency and the recovery of very fine material. During the 1960s the reports in my notes say total production of 280 Tn and concentrate grading 92.3 g/t AU, 133.7 g/t AG and 0.8% CU. I ask, because I have a foggy memory going back 10-15 years, but seem to recall that 64 gpt shipped ore was listed as “concentrate”. I know they didn’t have the same type of concentrator methods back then as used today, but perhaps you could shed some additional information on this. It would also account for why there were up to 5 gpt in the waste dumps. I’m sure your archives regarding this are superior to none, and much better than my recollection and notes.

Lydia says she:

— liked madmen’s post from yesterday quite a lot.

— had nothing to do with the 154,000 shares of AUMC or the handful of MDMN that traded today.

— can’t imagine how those 154,000 did not jerk the needle upward!

— doesn’t consider the $75,000 in trades today as being even remotely near the ballpark of the sort of money she has in mind, not even in the same city or state, either.

— has decided for now to not buy anything until further news unless she changes her mind, may have lost her nerve but is glad she has her new line of credit, and is glad she called me on Saturday — she says her market confidence is always highest on Saturdays.

— madmen

Hi EZ,

That 92 gpt figure had to do with the “concentrate” they produced after adding a crude flotation to capture more of the sulfides. This was the only type of “beneficiation” I could trace down although with a 64 gpt gold average you’d think they were employing some type of process to enhance the grade. Perhaps it was simple sorting and throwing out the non-shiny rocks. The technology was not very good back as is evidenced by their tailings piles still running at 5.3 gpt gold which is higher than the average being mined worldwide.

When I saw the results of the Sepro-Falconer “experiment”, I though that this was huge news because the METALLURGY looked nice and whatever grade the actual working face carried it would be easy to goose it up with a simple gravity circuit. Of course, the market yawned as it always has with good news. In this sector, the odds of going into production are so distant that the market will not give you any credit UNTIL you go into production. Then the EARNINGS take over and everybody speaks EARNINGS.

All of these instances of good technical news have meant nothing as far as eliciting a market response. The good technical news just keeps stacking up in a latent form UNTIL PRODUCTION COMMENCES. A good example is only having 70 million shares issued and outstanding or 100% ownership of the project and of the entire ADL Mining District for that matter. Until you get some production and calculate EARNINGS PER SHARE that might be through the roof because of these two realities, nobody cares. The same holds true for favorable METALLURGY in regards to the ore being amenable to extremely inexpensive gravity separation techniques. Add to that list grades that are to dream of. “The market” wants to see some trucks rolling down the hill. It knows that it will be the first of probably many thousands of similar trips due to the dimensions of the DL2 Vein.

The analogy that seems appropriate is that all of these instances of good technical or geological news are just composing a course of dominoes that still need the first domino (trucks rolling down the hill) to be toppled before they factor in to share price. Then what’s going to happen is insanely high grades will give rise to insanely low ALL IN SUSTAINING COSTS measured on a per ounce basis. This will lead to insanely high profit margins on a per ounce basis. I’d guess somewhere around $1,000 per ounce. This will then lead to atypically high TOTAL PROFITS vis-a vis ounces produced. This plus the small number of shares outstanding as well as 100% ownership of the project will lead to an atypically high EPS which investors will multiply by 30.21 (the mining industry average) to assess whether or not the share price is under- or overvalued.

As the number of ounces produced gets scaled up, the AISC figure will get forced even further downwards. This will further increase profit margins and so on and so on. The profits can then be deployed to buy fancy mining equipment like a “jumbo” which will drive production (not the grade) through the roof compared to production levels based on the use of just jack-leg drills. I’ve been working with some of the “jumbo” drill rig manufacturers to gauge just HOW MUCH MORE EFFICIENT they are than the jack-leg drills. If you thought the Sepro-Falconer gravity concentration system was a big deal in bumping up the SHIPPING GRADE, you should see what a “jumbo” will do to production levels. All of this is predicated on insanely high grades compared to the 4.15 gpt norm. The saying has always been in this industry that GRADE IS EVERYTHING and that’s because PROFITS ARE EVERYTHING. As far as your question on the cost of the various Sepro gravity concentration toys, I can’t help you much there. Being able to process 400 tonnes per hour is an insane number. Their ads say, “the cost is merely pennies on the tonne”. I can’t verify that.

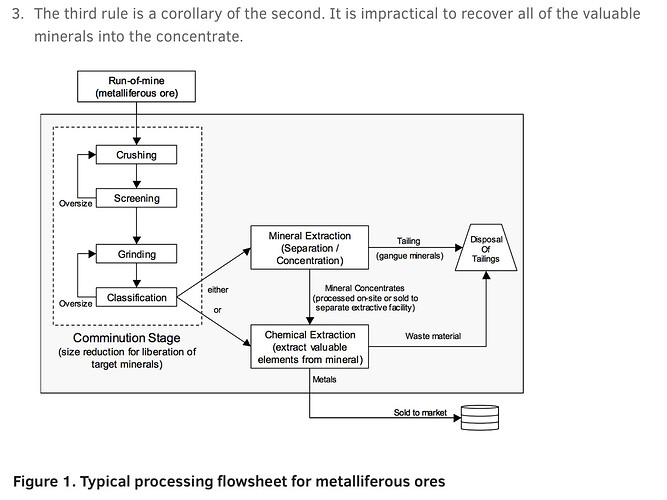

They’re basically a fancy centrifuge. Gold is one of the densest things on the planet. With a SPECIFIC GRAVITY/DENSITY of 19.3 tonnes per cubic meter, it’s almost twice as heavy as lead. When you spin around a sandy mix of crushed ore, the centrifugal force will send the gold to the outside of the chamber and the less dense waste rock/”gangue” stays in the middle of the chamber. The stuff on the outside of the chamber goes into the truck, the other stuff doesn’t. The result is a “concentrate”. Less trucks are needed to transport the ore to ENAMI. This further drives down the AISC which further increases the profit margins. But again, in the past all of this meant ABSOLUTELY NOTHING until the trucks started rolling and the lead domino got toppled. What’s the old saying, “an overnight success in just 23 years”?

Thanks, I agree with much of your response to my post. It was a definite plus, when in April 2021, AURYN announced acquiring a crusher and conveyor belt to reduce the ore size to match ENAMI’s size specifications. The historical ore does not have gold specks visibly identifiable, whereas some DL2 vein ore does. This will be direct shipment ore when mined. The same announcement also stated AURYN is analyzing which type of processing plant is best for ore from the Fortuna de Lampa. This is a larger project than just the Antonio Adit , DL2 and lower Don Luis vein levels. I recall seeing that the Falcon could concentrate extremely low grade ore 10,000 fold! I surmise that initially once “full” production starts the vein will be followed as closely as possible. Concentration for shipment to ENAMI to maximize profits will occur as quickly as possible and save on haulage expenses. Typically, when size reduction is established and used prior to shipping to ENAMI, grinding, screening and then crushing any economical ore will include crushed material suitable for concentrating in a gravitational concentrator. The crusher will be acquired and employed as early as possible. Depending on the model, the Falcon gravitational concentrators may be most useful after this kind of multi-step preshipping processing has sorted the material. Historically, although the ore was high grade, it was not reported that ore had visible gold. This other “lower grade ore”, may actually be high grade, but of a size measured in microns. I’d expect it is very economical ore collected laterally from the vein within the vein’s halo (and extending outwards), and may be stockpiled separately initially for further processing to grind it at some point in the future.

(Introduction to Mineral Processing or Beneficiation)

For the SB Falcon models, “maximum tolerable size for Falcon SB Gravity Concentrators is 6 mm but Sepro strongly recommends reducing the top size to 2 mm or less in most situations”. This refined grinding allows gold as small as 10 microns, and possibly as low as 3 microns to be captured by the Sepro. This type of processing may be very efficient at capturing gold that is not visible in mined ore.That’s the near-term additional equipment and strategy I would think is being looked at, in addition to the economic enhancements you mention by the addition of a “jumbo” to increase the shear volume of high-grade ore produced.

The District-wide Analysis in 2017 brought in representatives from Free-Port McMoRan and Hochschild. Dr Sillitoe was hosted to produce an evaluation report and help refine the business plan to consider development of the entire project. The possibility of bringing on additional partners for the epithermal gold systems and porphyry copper systems of the Alto de Lipangue Mining District were being considered and is still desirable. Remember the closely spaced veins at surface may be amicable to open pit and would almost surely include bringing on a JV partner with special expertise to fund the hundreds of millions of dollars for development of this project. The Pegaso Nero and LDM would also require the expertise and deep pockets of a suitable JV partner. The current Fortuna Project is “on the docket” for showcasing to these and other large developer/miners what other surprises hide in Fortuna’s expanding mesothermal system. Shareholders are at the very earliest stages unfolding of what could easily be a many decades of interrelated projects contained within the ADL Mining District.

EZ

This reminds me of Brecciaboy’s lesson on the Fruta del Norte - all the good news was publicized right there on their website for months and months for everybody to see, but nobody noticed … until.

When theres talk here of gold concentration units one would like to dream big like this video put out by one manufacturer .Knelson™ GX Concentrating Cone - YouTube

But in reality it most likely will look like this for our operation:Gold Mining - Gold Clean Up Concentrator 2 - The Centrifuge - YouTube.

One has to remember these use a fare amount of water ?? and ore needs to crushed to size first to be feed into unit.?? end result lots of time goes into a leach field or small shack on site to be concentrated down further.

All are obstacles to further overcome…

Ok …This next video gives one a insight to wrap your head around the speculative, futuristic, dreaming, talk, that gets printed on this site.

I know this is about a copper operation, but you’ll get a idea whats ahead of us if we (they) start to expand…The Mining Process at Copper Mountain Mine - YouTube

… Now: Don’t take me as a Negative Nancy. I just want to keep one foot grounded.

… I want this as much as anybody to play (pay) out at some point in my kids life time. C.s.

Just a breakdown on timeframe on assays:

December 23 2022 DL1 intercepted

Jan 4 2023 DL2 intercepted and I am guessing at this time turned assays in because got them back on January 9th

Jan 9 2023 Auryn received assay results back on DL1 and DL2 that they posted on latest shareholder update

January 18 2023 Auryn sent more assay results off of DL2 to get sampled

Auryn said they would update us as soon as they get the extra assay results back from DL2 but now sitting at 33 days and nothing still. Just strange how they got results back in 5 days in January according to their own update.

You’re correct Davis don’t understand why it’s taking so long. They could just be waiting for the next update which is less than 50 days away.

PDAC 2023 - Come Visit Us | AURYN Mining Corporation

^^^ posted on twitter.

We are eagerly awaiting the results of our comprehensive assays, which differ from the quick assays commonly used during exploration. These full assays provide a detailed analysis of the mineral content and offer insight into various metallurgical processes that can be utilized in advancing our project. We expect the results to be available soon and will update you as soon as we have more information.

The assays ordered are more thorough and presumably take longer.

That’s a beautiful sample!

Liking this From Auryn Twitter there is more news to come so please stay tuned for further announcements

That’s encouraging - there was always the possibility the reason we were waiting was because things didn’t turn out so well, but now that thought is by the wayside as Auryn is considering metallurgy. Sounds like they’re posturing to go … into production. Yep, I think so. The naysayers better start worrying.

Hi mrb,

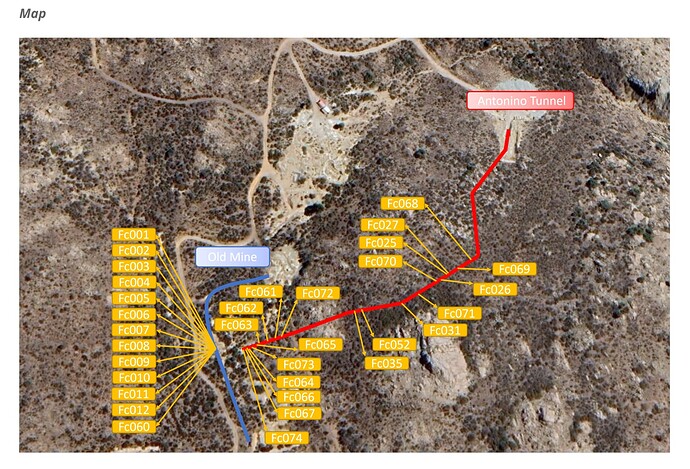

We’ve got some guys doing some production and profit modeling based on all of the data available to date. The piece of information that we need now is an estimate of what the SHIPPING GRADES are likely to be at level 3 which is the Antonino Adit level and its 2 working faces. Thankfully, the historical data from ENAMI was in terms of SHIPPING GRADES which is the critical grade to know because this is what ENAMI pays based on.

In the top third of what the artisanal miners mined the average SHIPPING GRADE was about 54 gpt gold. In the middle third it was 64 gpt gold and in the lowest third is was about 74 gpt gold. The new Auryn production will come from immediately below this 74 gpt level.

The SHIPPING GRADE will be a function of the width of the working face of the adit or about 3 to 3.5-meters, the width of the vein proper, the width of the surrounding wall rock, the grade of the vein material proper, the grade of the wall rock and the grade enhancement caused by the beneficiation procedures like gravity concentration. In yesterdays PR inviting people to the PDAC, they mentioned outlining “the various metallurgical processes that can advance the project”. We already have some of those figures from a few years back when they tested our ore with the SEPRO-Falconer system. The recovery was into the 90% plus range.

Having the projected post-beneficiation SHIPPING GRADE average makes things a lot less complex. This way we can compare apples to apples with that 74 gpt gold material just above where Auryn will start. With the average gold grade being mined in an underground fashion worldwide being at 4.15 gpt gold, you can see how anxious everybody is to see these upcoming numbers.

You can see the grade trend the artisanal miners established. We also know that the vein width has increased from about 0.15-meters in the “old workings” to about 0.6-meters at level 3 which is the Antonino Adit level. The TENOR of the ore has changed markedly as there was no “visible gold” in the old workings but it’s all over the place at level 3. There was also little to no copper in the old workings and all of a sudden, we’re averaging 4.5% at level 3. The average grade of copper being mined worldwide is 0.6%.

We’ve already received readings on the VEIN GRADES (not SHIPPING GRADES) in the area of level 3 that were 100-meters apart. They were pretty much off the charts but we don’t know the grade of the wall rock in this vicinity nor do we know how well the gravity concentration did (or will do) while treating this ore. Hopefully the next update will fill in some of these blanks.

Thanks very much, Brecciaboy!

You might be a bit reluctant (and understandably so), but would you be amenable to sharing any production and profit modelling? I wouldn’t hold you (or anybody else) to it. I have my own version on a spreadsheet, put together by me as a layman after reading all the stuff on this board for a long time - but it’s probably still not computed totally right - and most of the rest of the guys/gals probably don’t want to hear from me anyway.

Just a recap of some information from previous notifications that may shed light on where projects are headed. It is clear to me that AUMC management has methodically laid out both short-term, and longer-term plans to maximize profits as it ramps up into production. This may look like watching paint dry until it gets fully underway. True, we’ve had numerous delays, most recently over the past two years, which included difficulties posed by the pandemic during 2021 and 2022. Weather delays were frequent with flooding from heavy rains, snow and fire evacuations, numerous equipment breakdowns to name a few. Despite the delays, in Q2 2021 objectives outlined included:

- AURYN will ship to two different processing plants. Material with grades over 25 g/t Au will be shipped to one location for direct smelting. Grades below 25 g/t Au will be sent to a second location for flotation processing.

Noted in September 2021, the Mining Engineering group led by headmaster Luis de la Torre of Civil Engineering, was working on the feasibility of a flotation plant. They requested an additional 200 kilograms of ore samples for their tests which AURYN delivered.

Also in Q3 2022, collaboration with Universidad de San Sebastian were further analyzing the entire district, accomplishments mentioned included:

Collaborating with Universidad de San Sebastian

During the third quarter students from the university focused on three projects:

- Completing a financial assessment for a new campsite

- Modeling and evaluating a new ventilation system that combines the existing forced ventilation system and the future chimney at the intersection of the Don Luis vein

- Evaluating the incorporation of photovoltaic energy in transit areas

Final reports on these projects are expected to be ready in the coming months.

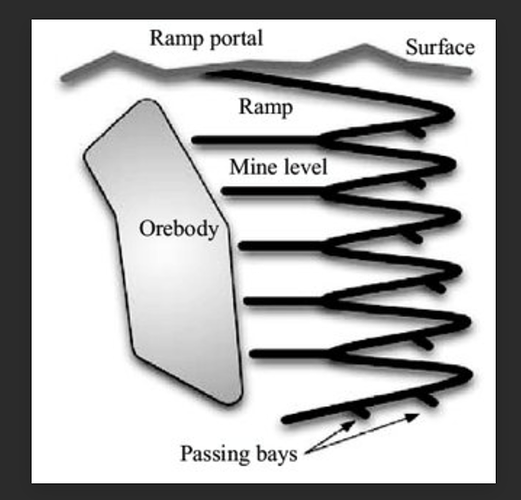

Q4 2022 laid out the plans for exploiting the Don Luis vein which included constructing a spiral ramp to support exploitation of the vein at lower levels. It might look something like this schematic drawing found at researchgatedotnet.

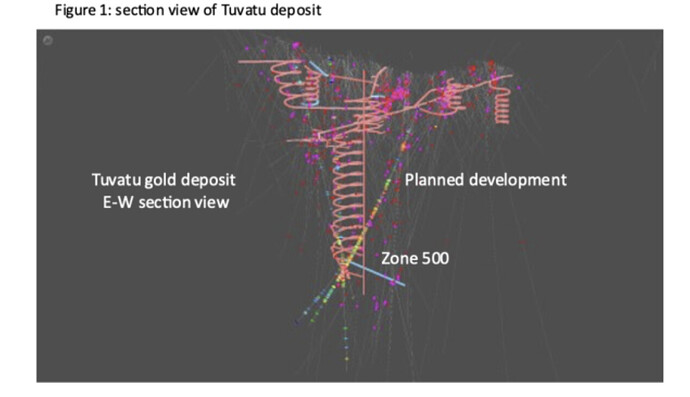

Lion One Metals included a schematic in a recent news release that shows the possibilities of how multiple ramping over different sections could be employed. Notice the depth to which the ramps extend downwards. I envision similar ramping would work for the Fortuna mine at various adit entrances. The Don Luis Vein system is only one area of a much larger District Deposit.

Some of AUMC’s longer term goals may include a conservative, open pit mining plan over selected areas. Assessing the best way to mine what appears to be a complex system of veins in and around the Fortuna Mine and Merlin 4 surface veins makes sense. These areas were trenched and extensively reported on as far back as December 2015. I asked about this possibility during the informational meeting. Mr. Cordova replied that the best method of exploitation had not been decided yet. Gravitational concentrators were also discussed at this time. In looking at the most recent notification, this image looked as though a Falcon concentrator may be on the wish list for some of the next additional equipment desired. It also looks amenable to be crushed to ENAMI’s specification for direct shipment without concentration.

The stockpiled ore will likely also need to be crushed to be economical. Shipping lower grade ore is expensive but can be greatly concentrated with suitable gravitational methods to the specifications required for direct shipment.

Is this ore below the 25 g/t limit for direct shipment? If so, rather than sending it out for flotation processing it would make more sense to obtain a Sepro Falcon, screen and crush it to a suitable size for concentration and direct shipment. This would advance the timeline for feasibility of an on site flotation plant. Will open pit mining be part of management’s longer-term goals? I think they have hinted at for quite some time.

Q 1 2021 – OBJECTIVES.

??? no mention of road improvement.??All this paper dreaming comes real once you get ore off that mountain… And a lot of equipment up it.

Big, Big cost…

- Start selling ore (mineral) to ENAMI for processing or smelting, permit pending and expected to be obtained within this period.

- Start new Fortuna Tunnel construction to improve access ability and size.

- Establish a camp with suitable service buildings, support infrastructure, and power suitable for new protocols related to COVID-19.

- Increase production, initially for this quarter, to a target level of 40 tons/day ore.

- Review and study the potential of a concentration plant at the mine site, including a mobile gold wash plant, vibrating screens for separation, and an ore crusher.

- Start a collaboration program with a prestigious Chilean university. Auryn Mining Corp is pleased to announce, in cooperation with Universidad San Sebastian, that their faculty members and alumni will be conducting field practices at the Altos de Lipangue property site. The goal is for their Civil, Geological, Mining and Environmental Engineering students to learn, study and analyze different topics related to mineral careers. Topics of focus: environment, safety, future expansion, engineering developments, metallurgy, mining, geotechnical, etc.

> * 1. Develop environmental campaigns with the local community to develop a clean adjacent area to the mine and remove historic waste from the zone. Repair and rebuild stone walls and other structures damaged by the passage of time and beautify the water ponds where local animals come to drink water. Reaffirm company commitment to develop inclusive mining practices, done in a safe and clean way.

**

It was communicated several years ago that mining plans are dependent on many factors. The importance of metallurgical tests are used to make decisions on appropriate processing methods that determine appropriateness of direct shipping, concentration methods before shipping, and perhaps even longer-term local processing. Careful conservation of resources requires careful planning to avoid unnecessary share dilution. Surface mapping has been carried out which shows a whole array of unmined veins (i.e. a complete epithermal system) with the Lamp Fortuna mine centrally located in the middle of it.

Nov 2019

AURYN is aiming at the recovering of this site. Once work has finished and the mineralized vein is uncovered, a systematic sampling campaign will be done in order to decide what will be developed in the future. The AURYN team has come to the conclusion that the several high grade veins are all related and interconnected, including the Merlin and Larissa vein, and tentative mining plans are being reviewed.

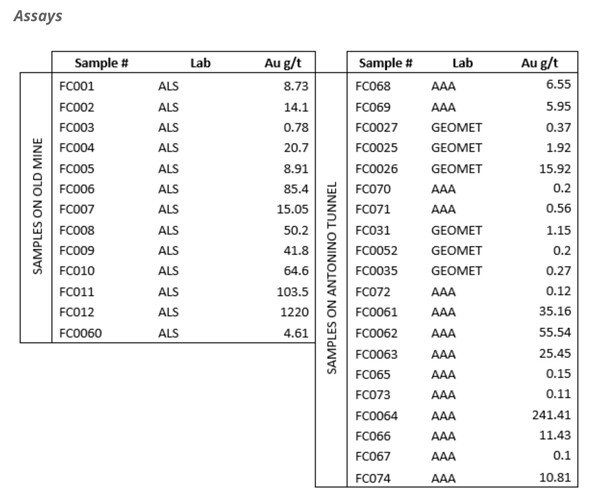

Last year AURYN contracted EGV Ingeniería to produce a detailed topographical map of the tunnel and the old workings and the map and assay details presented below.

The larger decisions on how to best proceed in developing a rapid exploitation plan loom in the remaining quarters of this year and next. Mr. Cordova is doing everything possible to see this accomplished successfully. Progress being made will be showcased March 5-8 this year at the PDAC convention in Toronto. I anticipate it will draw an increased level of attention.

Ha ! so.March…?. So I suppose, Just like school… its always quiet before a BIG exam.???