Ouch…this is sounding a lot more like a hobby vs. BrecciaBoy’s world class deposit. It just shouldn’t take this long to get a single assay reported. The “mineral trader” otherwise known as an offtaker would need a lot more 120kg to make any assessment. Keep in mind, most offtakers want dore or an actual concentrate. Auryn will need to have some sort of onsite mill (processing) to accomodate the needs of any legitimate offtaker (with decent terms). Simply using gravimetric processing does not get you anywere near a marketable (competitive) concentrate. I don’t understand why they aren’t sending this “100 gpt” material down the road to be processed. They would be minting money. Mou’s with “gold traders” and no assays. Something doesn’t add up.

I don’t understand why we need a minerals trader? If we have these amazing grades, why can’t we truck this material to Enami and start getting paid?? Gold is at an all time High!

Trucking/processing the ore offsite will eat up a lot of the profits.

Seems like they could sell forward production to an entity and use the money to setup a processing facility onsite to maximize profits. Other monies could be spent to ramp up production. Hopefully, they could also cut a deal with a different entity that involves more exploration dollars.(Can we also hope the terms won’t be awful?) Some deals need to happen or expect the snails pace level of activity to continue.

MG,

Sounds like maybe something along the lines of a Royalty financing.

“A royalty company serves as a specialized financier that helps fund exploration and production projects for cash-strapped mining companies. In return, it receives royalties on whatever the project produces, or rights to a “stream,” an agreed-upon amount of gold, silver or other precious metal .”

Trouble is, doesn’t this usually involve backing up the loan with shares? Shipping a concentrate would generate immediate cash and perhaps attract a JV to finance a shallow pit over some selected targets along with a processing mill. Gravitometic concentrator is on the shopping list and part of the solution to profitability.

And all done with no dilution.

I’m quite sure MC will figure out something that involves no dilution. He’ll get the expenditures reimbursed and the MDMN shares converted before there is any need for debt financing which involves selling off treasury shares. 70M shares in the OS and 30M “treasury” shares. The AUthorized is 100M shares. I do not expect treasury shares to come into play until well after profitable production is well underway and AUMC shares are trading well into the multiple dollar range. I rest assured we are in good hands with MC at the helm.

EZ

Too much speculation and guesswork

Any chance these MOUs can lead to actual drilling??? Chipping away at existing tunnels isn’t going to do much beyond keeping the lights on IMO

Behind schedule, but meeting objectives.

Things are moving forward following a strategic plan for sucess!

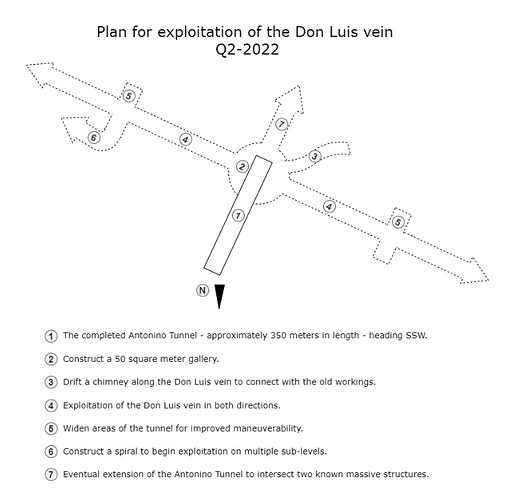

Hi Peter. They are still drilling now. The Don Luis vein was only recently uncovered, and we know there’s plenty of high-grade gold there, too.

MOU’s how many? As I said in my previous posts Maurizio needs to come up with JV or something close to that to get the SP going north. Some are saying that this is a fund, I would side with easymillion’s post and speculate that this would be a Royalty Streaming company.

I see a JV or some kind of a deal being completed with another entity in the not to distant future.

Hulkster,

Maurizio will come up with something to get the SP headed North again. Before everything went South and collapsed plans back in 2016, there were high hopes of the Caren Vein production using a Falcon Concentrator to fund the Fortuna, and exploration drilling at the Pegasus Nero. These guys are dynamic strategic planners and have adjusted plans as needed to maximize profits and success despite multiple setbacks. Remembering back to 2016, just when things were progressing at the Caren Mine and Larissa Adit, Dr. Sillitoe and Dr. Raymond Jannas were brought in to produce an evaluation report of the entire Altos de Lipangue Mining District. Gold recovery test runs had already been completed.

We have conducted metallurgical test runs at recognized laboratories in Chile and Peru. These have resulted in an average gold recovery of over 90% from concentrated ore obtained by a gravimetric Falcon system. Based on this, AURYN expects to produce a total of 5,000 troy ounces of gold in 2016 and over 25,000 troy ounces in 2017.

The cash flow generated from production at the Caren Mine will fund an aggressive exploration program of the Pegaso Nero and further drilling of the Merlin-Fortuna targets.

I’m thinking that based on what was seen, Dr. Sillitoe’s recommendation was to go after the the much larger and higher grade target at the old producing Fortuna mine. From what we’ve seen from all the old and new data, the grades at the Fortuna will meet or surpass those expected at the Caren Mine. If after full production starts and reaches or surpasses the 25,000 AU ounces per year projected for the Caren Vein, there will be no holding back a very rapid expansion of production and some drilling. I noticed in the latest PR release the following wording:

Develop and complete a comprehensive metallurgical study to evaluate the viability of using gravimetric plants for the concentration and recovery of gold in AURYN’s ore, with the aim of finding a higher margin alternative for processing and sale.

Is the use of several models of the Sepro gravitational concentrators being contemplated?

“All Falcon Concentrator models rely on a rotating bowl to generate high gravitational forces, but each Gravity Concentrator model is unique in the way that it collects and produces mineral concentrate. High gravitational forces are used to exploit the differences in density between fine mineral particles, allowing for a cleaner and much finer separation than is possible using low G-force devices. Sepro Mineral Systems has a complete range of Falcon Gravity Concentrators from small portable Concentrators for laboratory testing to units that are capable of treating up to 400 tonnes per hour.”

This leads me to suggest the possibility that a smaller unit (or a less expensive, low G-force device) may be purchased initially and used to concentrate ore shipped directly to ENAMI for quick cash generation. This could then fund a larger commercial Sepro unit treating up to 400 tonnes per hour to meet the exact specifications of the international minerals trader who is interested in purchasing ore concentrate from AURYN’s production. I expect we’ll hear much more of just how management intends to find a higher margin alternative for processing and sale. Things are definitely getting more interesting.

I see the completion of the gallery as a good indication that production will ramp up however the ore is managed.

I would agree that an offtake financing could be an excellent way to get things going on a non-dilutive basis. The only problem: you can’t get an offtake fiancing without a mine plan, lots of assays, and at least an inferred resource from which to base this financing. These offtakers don’t commit risk capital in the hopes of finding/funding the next WCD

This project is WAY too early to generate royalty financing of any sort of quantum. Even if you do get the offtake financing it will come with senior security agains all of the assets (a GSA). If they don’t get paid, for any reason, they own the asset and shareholders get zero’d. This is why its so important to have that mine plan and model in “debt” obligations with large contigencies (margin for error).

…LIKE. … agree…

Baldy, you are applying your strict criteria based on your years of experience. Yes, this has worked for you. There are other models that you (we) have seen fail of a project generator (the Hochschild JV for instance). Obviously, this method was already considered by MC and may still be something he is interested in attracting, provided there is no dilution involved.

This project generator is a method of moving the multiple future projects (multiple targets, i.e. LDM, Caren, Pegaso Nero) forward that should not be abandoned. Timing, and having the right JV partner are all important. This is likely being pursued with the outstanding assay results at the DL and depends largely on cash flow generation in the near term. As we’ve seen, the prospect generator seeks another company to buy a portion of its prospect for a negotiated earn in price thru a joint venture agreement. Typically, this is accomplished with the purchaser paying cash, stock, or a combination of both in staged payments. Committing to spend a substantial sum to explore the prospective deposit over a period of time: the prospect generator usually relinquishes ownership majority, ranging from 51% to 70%, or over time relinquishes ownership for a 2-3% NSR to build the mine. This model failed on the LDM with Hochschild. If anything, MC has demonstrated persistence in making AUMC a successful publicly traded company aiming at profitability. Considering the advancement of geotechnical information, sampling, prospecting, and mapping of targets there may be another mid-tier miner attracted to developing a suitable open pit or underground project.

Did I miss the assays?

Baldy,

Yes, I think you did. Bootstrapping a mining project on a very limited budget without share dilution is a real challenge requiring long-term strategic planning. MC is proving worthy of the task at hand. The immediate problem to solve is maximizing cash flow most efficiently while minimizing expenditures.

Your analysis for viable companies is the “industry standard” that uses extensive very expensive drilling and core samples to define the ore body and define a resource. Thanks for ruling out offtake financing and near term royalty financing. I agree.

The January 27 Shareholder update did provide important information on the exploration progress being made. The fundamental feature in all valuation methods is the worthiness of future exploration. In addition, as has been pointed out, there are multiple methods of performing assays for determining economic viability. Some important considerations may include the following:

Most analytical laboratories offer either single element determinations or packages that include a number of elements. The latter normally do not include gold, which must be analyzed separately at an extra cost. The standard assays are limited, in that they can only determine elemental concentrations up to a certain level. If there is a large amount of an economic element in the sample (e.g., over 1 percent copper), then a separate ore grade assay has to be requested.

Assay labs can provide you with single and multi-element analyses by a variety of methods. Rock and soil samples are crushed, powdered, fused or digested in acid and then analyzed using any one of several analytical methods/instruments.

Several factors (aside from availability of funds) should determine what elements are to be determined. Obviously, the elements that are selected should include those for which you are prospecting.

Many of the following elements are included in extended assay packages:

Al (aluminum), Ca (calcium), K (potassium), Mg (magnesium), Na (sodium), P (phosphorus), Ti (titanium), Rb (rubidium), Ba (barium), Ce (cerium), La (lanthanum), W (tungsten), Bi (bismuth), Cr (chromium), Hg (mercury), Sr (strontium), V (vanadium), Be (beryllium), Cd (cadmium).

There are a number of periodic table websites which you can check out on line. Try the Los Alamos LaboratoryOpens in new window website as a start.

Abbreviations for concentrations

- ppm (parts per million); a measure of concentration of an element in a rock, soil, water, etc. 1 ppm equals 1 gram per tonne

- 10,000 ppm equals 1 percent

ppb

- parts per billion; a measure of concentration of an element, particularly precious metals such as gold. 1000 ppb equals 1 gram per tonne.

- 34,285 ppb equals 1 ounce/short ton

g/t

- gram per ton

- equals about .029 ounces per short ton or 1000 ppb

%

- percent (the same as parts per hundred)

……There is no need to spend money on elements that are irrelevant.

(excerpted from Assays and Geochemical Analysis - Industry, Energy and Technology)

Specifically, you asked if you missed the assays. I think what you may have missed is not seeing the extended assay results typical of “the industry standard” in a core sample. Very relevant information was provided, not necessarily part of your strict requirements for investment standards:

On January 18, 2023, the team received the fully repaired scoop and continued extending the tunnel to fully uncover the DL2. The DL2 vein at level 3 in the Antonino Tunnel is 3 meters from the DL1 vein and 60 centimeters wide. This adds credence to the team’s hypothesis that the veins will converge at depth. The team has taken new samples of the entirely uncovered DL2 and will report these when received.

Don Luis assay results

DL1 @ Antonino Tunnel (Level 3), Elevation 1840 meters, Width 0.50 meters

Sample ID Au – FF + FG (g/t) Ag (ppm) Cu-T (%) FC-087 4.32 81 2.088 FC-088 3.43 38 1.548 FC-089 5.54 128 5.061 FC-090 4.35 110 4.396 DL2 @ Antonino Tunnel (Level 3), Elevation 1840 meters, Width 0.60 meters

Sample ID Au – FF + FG (g/t) Ag (ppm) Cu-T (%) FC-091 92.87 26 2.805 FC-092 256.45 246 3.917 FC-093 173.90 103 5.614 FC-094 134.76 116 6.100

These are impressive crucial assay results in summary form! The present challenge is determining crucial information for maximizing profitability. Before direct shipping to ENAMI, ore is necessarily concentrated by several methods under consideration to maximize efficiency and profit to meet ENAMI’s requirements. All require at a minimum crushing, and probably screening using different size mesh. Older artisanal methods used sluicing, shaker tables, and for larger scale mining flotation was likely used as evidenced by waste ore piles. We know ore shipped to ENAMI could be improved with a gravitational concentrator. Which concentrator method to choose? Will ore concentration shipped to ENAMI be the same that satisfies the ore concentrate specifications of the international minerals trader? Probably not, but the special laboratories in Peru that are offering the most complete set of gold tests will help determine decisions for the most efficient and profitable method of gold recovery and concentrate production. This will allow an informed decision as to whether terms specified by the international minerals trader are better than what ENAMI can offer.

EZ

They stated most recent samples from DL2 were received and consistent with previous samples.

I would like to have seen the actual results and then state they are consistent with previous.

What they actually said raises my suspicion

Pardon me if I lack trust after 20 yrs in this stock

Also, no reassurance on AUMC share distribution

Until we get them we don’t have them