And if Auryn started producing in earnest on or about the 10th of August, then we should start seeing results by the end of the month. Coming soon!

All good points and possibilities BB. Your in-depth obsessive pursuit of detail amazes me. I especially liked this particular insight:

Perhaps you could shed some light one thing I found rather puzzling about the company’s August release.

On July 19th, we dispatched an experimental batch of minerals to ENAMI’s direct smelting plant. The settlement results, received today on August 9th, are as follows:

- Gold (Au): 57.5 g/t

- Silver (Ag): 978 g/t

- Copper (Cu): 3.23%

Apparently the Direct Smelt nomenclature is a bit of a misnomer. It appears ENAMI/Codelco labs evaluate the data to design the most efficient extraction protocol. Both the hi and low content gold ore apparently will handle ore containing CU. Is there a distinction between the two shipping destinations regarding credits for higher content copper? Both facilities appear to do the sorting crushing, grinding, and gravity concentration as well as floatation as an integral step in the process. Is this correct? Will both facilities provide copper credits if the % copper is above a specified level? Does the ENAMI site provide concentrate to Codelco to complete the refining process?

TIA

EZ

Hi EZ,

I’ve always used the “tarifa” sheets (rate sheets) on the Enami website to estimate values. They put out a new one monthly. “Fundicion directa” is direct smelting, flotacion is flotation, the soluble and insoluble copper have to do with whether or not that copper mineral is soluble/dissolvable in sulfuric acid or not. Being soluble is a good thing for copper. I believe there’s a cut-off grade for copper at 2.5% in order to get paid but don’t quote me on that.

Thanks for that information BB.

Another opinion concerning the ore in DL1 and how it will eventually be handled. It appears to contain high-grade ore. In a previous post, you had averaged the 16 samples taken from the intersection of Shaft A and Level 2 of the Fortuna Mine/DL1 Vein, arriving at an average expected grade of somewhere between 40 and 116 gpt gold. Much of the appearance of this ore appeared to be free milling. This is much like the example I provided in the “First on Cut URW1 Lode” image where the dashed red circle indicates the approximate location of the grab sample that measured 58.68 g/t Au. Not straight arithmetic averaging but measuring a larger volume representative of many of the chip samples in the surrounding area.

Wouldn’t appropriate milling equipment for crushing and grinding in preparing this ore in DL1 and using inexpensive simple gravity separation (compared to on site flotation mill) be reasonable as a first step for sending Codelco a much higher-grade “concentrate”? Costs of hauling would be reduced as fewer loads would be producing greater amounts of concentrated ore and many additional AU OZs per truckload. We know the ore from the Caren/ Merlin 1 Vein is amicable to gravimetric concentration. At the informational meeting Maurizio said our ore from these veins were amenable to a gravimetric concentration. Tested using a Sepro/Falcon increased headgrade by a factor of 100-to-1!

A couple of years ago you cited the presence of low sulfide lode zones:

Continuing the discussion from Auryn/Medinah - 2021 - 2nd Half General Discussion:

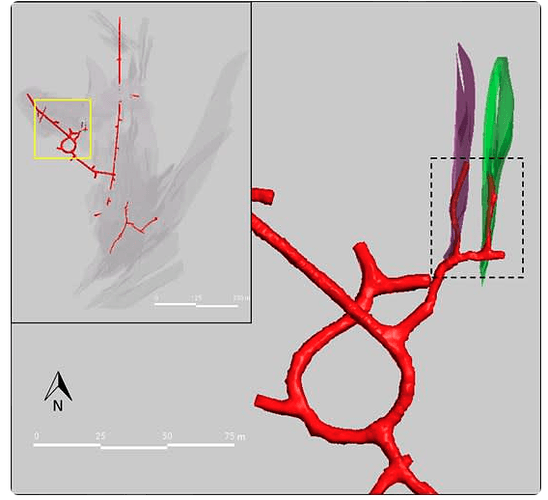

Not only are epithermal gold-bearing deposits of great importance worldwide, it has been shown in SA that they account for as much as 90% of all gold production! Ive taken another image from the Tuvata mine to show how offshoot extensions from the primary MAIN VEIN SYSTEM could provide high-grade free milling material in our ADL deposits suitable for direct shipping, but also amicable for gravitational beneficiation. (This image is just an example of what the future may hold for the Fortuna or possibly even the Caren/ Merlin 1 Veins.) Uncanny how closely this image resembles what is currently underway at our Don Luis vein and Antonino Tunnel.

What are your thoughts regarding these possibilities?

EZ

Huh? We haver no image of what is underway at Don Luis because, unlike Lion One who has spent 10’s of millions on drilling out their asset over the better part of a decade, AUMC has elected not to do so. Could the DL look like Tuvatu? You’ll never know. Simply put, if the decision is made to blindly follow an underground vein you have to deal with the consequences. No resource, no mine life, no way to secure offtake financing because financiers have no way to handicap their risk. This doesn’t mean AUMC can’t rack up a profit but it will be acheived in ebbs and flows and there will never be a true understanding of how long it can be mined. This is why any discussion of PEs or valuations are essentially impossible. The market does not reward multiples based on historical results and a hope for a long mine life. This is not an opinion.

Further information on Lion One Metals per 3/31/23 financials:

Accumulated deficit - $62,000,000

Outstanding shares at August 2010 - 6,300,000

Outstanding shares at March 2023 - 176,895,000

Company has produced no mining revenue to date.

Stock price at 2010 - $1.00 per share

Current stock price - $.70 per share

Note 1. from the 3/31/23 financials:

The Company is in the process of exploring and evaluating its resource properties and has not yet determined whether

the properties contain mineral reserves that are economically recoverable. The recoverability of the amounts shown for

exploration and evaluation assets are dependent upon the existence of economically recoverable reserves, the ability of

the Company to obtain necessary financing to complete the development of those reserves and upon future profitable

production.

Z. Honest question: is this your first investment in a public security?

Your note from the financials is a boilerplate disclosure that any miner has to include when they only have resources. You can google the difference b/w reserves and resources on your own time but, given your citing of the same to try to point out a cloud on the Lion One deposit is pretty laughable. Yes, any mining project that has done the normal, expected proving out of a resource will have a considerable deficit before they enter production. LIO is starting production in the fourth quarter. LIO has already taken their medicine and now they will get paid (disclosure: I’m long the stock at around these levels). The Tuvatu project is being watched with excitement (because there is something to actually analyze) and Walter, the CEO, has had several massive exits in the past.

The stock was valued at $6.3M in 2010 and $120M today. Were you trying to land another jab on that point as well. LOL.

Its almost embarassing the be speaking of AUMC and LIO in the same breath. This is the only reason why I replied to EZ when he/she made the comparison. But thanks for the bullet points on LIO. Very informative.

So much excitement, the market value of $123million is $30million below book value.

Yup. Trading below book value b/c they have taken their medicine and raised a ton of cash to get this into production.

Any chance you’ve been following the junior precious metal’s space? Or are you just assuming that because gold has been sideways to up the PM stocks must also be doing OK? Yes, LIO trades at a ridiculously low valuation. As do most other junior miners. Did you see the discussion tab on this board for Novo? See how that has played out. I’m invested in an private Australian gold company that has well over a million ounces in the ground but only a $25M market cap. Exactly why I’ve continually stated that AUMC is (or at least was) ridiculosusly overvalued.

This being said, recently trading at 22 cents or a ~$15M valuation is starting to get closer to reality. IF management actually starts to report on actual production with reall assays (not experimental batches and a single truck road with mysteriously no revenues) this could be worth a shot in the mid to high teens (pennies) for a lottery ticket (~$10M market cap). I wouldn’t touch shares in MDMN with a gun to my head. All, IMHO

Speaking of ridiculously undervalued …

0.6Moz Au (Ind) + 2.3Moz Au (Inf) , shallow deposit

Current price $0.055 Can. $, Market cap $8.7 Million

I posted info on the other board ;

https://theminingplay.com/t/other-mining-stocks-2023

Quote from Baldy:

“I’m invested in an private Australian gold company that has well over a million ounces in the ground but only a $25M market cap.”

There is a reason why a company with a minimum $2billion worth of minerals in the ground is valued at $25million. It can’t be blamed on crappy market conditions since it’s a private company.

Are these Reserves, Resources or a best guess?

What does the balance sheet look like?

How was the $25million market cap determined if it’s a private company?

This really is your first investment. The private and public markets are not uncorrelated. If the public market stinks you can pretty much assume the private market isn’t doing well. You value a private company based on its last financing. In this case the company has 30M shares outstanding and recently raised money at $1.10 (AUD). They have 800koz in the measured and indicated category with the balance in inferred.This isn’t a guess as they have spent the time and money to drill out the resource and generate (real) assays so they know exactly what their mining plan will be. Based on what the drill programs have indicated this should be a 2M+ ounce reserve. They should be in a position to be in production (~50koz annually) within six months. No debt. There are plenty of precious metals companies valued at less than $30 an ounce/in ground resource. I will admit that many of those do not have a roadmap to production (no plant) or are too far from any tolling opportunities (similar to AUMC).

I have no idea what it will cost AUMC to transport that far of a distance. If they can acheive steady 20gpt+ material they should still be able to make decent money. Unfortunately, investors have to just hope that steady grade and transport costs are manageable b/c the company has offered ZERO visibility on any metrics. Historical results and experimental batches and incomplete assays hold no value in the real investment community. This will be in a holding pattern until those metrics are provided along industry standard parameters.

How far of a distance has management suggested they’re going to ship the ore?

Don’t think management has actually SAID - but I think somebody has written something about the nearest plants being 103 miles and 98 miles?

"spending the time and money to drill out the resource and generate (real) assays so they know exactly what the mining plan will be. Based on what the drill programs have indicated this should be a 2M+ reserve. They should be in a position to be in production within six months. "

Apparently, having achieved all of the above holds no value in the real investment community because they are valuing the $4billion property at $30million (less than 1%). obviously, lots of risk ahead.

Absolutely. There’s always risk. Even when a company has taken the appropriate steps to get into production. That’s exactly my point with AUMC. They have the unenviable task of chasing a vein and trying to find financing without any of the data that facilitates interest across potential financiers.

By the way, you don’t multiply ounces by the price of gold to assess the value of the property. Even companies that are in production and profitable have a difficult time getting more than $200 an ounce in the ground. You clearly have the time and interest to look into some of the names I’ve referenced which is commendable. I would encourage you to read some articles on how precious metals companies are valued. If you rely on some of the pie in the sky posting here you are doing yourself a major disservice.

The point i am trying to make is that the companies that you use as examples are spending tens of millions to hundreds of millions to get to production, at a larger scale than AUMC of course but none the less to get to production. I believe MC is trying a different approach of getting to a small scale production without the massive dilution and generating profits and hopefully grow production and profits as conditions allow. Its two different approaches, massive dilution for a smaller piece of a bigger pie or a bigger piece of a smaller pie. Lets let MC execute his plan and see what happens.

no drill program is a hindrance. i get it.

Hi Drifter,

I liked your comment admitting that “not having a drill program is a hindrance”. I would amend that a bit to “not having a drill program WAS a hindrance” (past tense). It would have been nice for the miners drifting the Antonino Adit to have had some extra data on the angle at which the DL2 Vein was “dipping”. But we got through that and located the DL2 Vein, VALIDATED THE STELLAR HISTORICAL SHIPPING GRADES, COMPLETED THE “GALLERY”, SUCCESSFULLY INTERSECTED THE OLD WORKINGS, COMPLETED THE VENTILATION/SAFETY EGRESS CHIMNEY, GOT IT SIGNED OFF ON BY SERNAGEOMIN, AND COMMENCED PRODUCTION FROM THE VEIN.

The new, recently approved, ventilation system provides SCALABILITY, in that Auryn can now, for the first time, safely mine from level 3 and various underlying sub levels simultaneously. Operations have been streamlined in that the noxious gases released from blasting can now be removed much quicker resulting in less down time and higher PRODUCTION RATES. The recent “COMPREHENSIVE METALLURGICAL STUDIES” have revealed that the ore responds well to flotation methodologies and the feasibility of Auryn putting in their own on-site flotation facility is being studied. The successful intersection of the DL2 Vein with the Antonino Adit now allows Auryn, for the first time, to mine 2 separate working faces on each level. An experimental batch of ore was sent to Codelco/Enami’s DIRECT SMELTING facility and the results came back with an agreed to “settlement” of an extraordinarily high 73 gpt “gold equivalent”. Auryn was granted permission by the Chilean Mining Registry to now make regular shipments to 2 of Codelco/Enami’s processing facilities. One facility will use flotation methodologies for the lower grade ore and the other will provide DIRECT SMELTING for the higher grade ore. So, I’d say the past “hindrance” has been pretty well overcome.

The lack of a formal drilling program COULD HAVE BEEN A HINDRANCE IF a major miner mandated it before being willing to get involved. But Auryn didn’t need the financial wherewithal or the technical expertise to get the project into production. It COULD HAVE BEEN A HINDRANCE IF we were trading on either the Toronto Stock Exchange (TSX) or the Toronto Venture Stock Exchange (TXSV) which mandates drilling programs and NI 43-101 “F1” Technical Reports as a listing requirement, but we’re not trading on those exchanges. It COULD HAVE BEEN A HINDRANCE if Auryn couldn’t make a POSITIVE PRODUCTION DECISION without that data, but they didn’t need that information because the grades were off the chart and it was a no-brainer.

Maurizio gambled and he won. That former HINDRANCE has now been converted into a BLESSING. When calculating our EARNINGS PER SHARE, we are now able to divide the EARNINGS by 70 million shares. If we would have bypassed that TEMPORARY HINDRANCE and did a full drill program and hired a firm to do a scoping study, a PFS study and a BFS study, we might be dividing our EARNINGS by 470 million shares in order to determine our EPS. We got lucky. The EARNINGS are going to be the same no matter what a 150-page report says our official, in the ground, MR/MR is. It’s the EPS that will be forever “supercharged” due to our getting lucky. The appropriate share price will typically be determined by multiplying the EPS by an industry standard “multiple” (31 for metal producers). Does an appropriate share price of about 7-times more (if the 470 figure is accurate) make it worth going through this “bootstrapping” phase where Maurizio was throwing around nickels like man-hole covers? Of course, it will have been worth it. Auryn was also able to keep 100% ownership of the entire ADL Mining District throughout all of the “bootstrapping” days.

Auryn’s Professional Geoscientist, Luciano Bocanegra, already calculated, in a Preliminary Resource Estimate, that 664,000 ounces of gold are present just in the top portions of the Merlin 1 and DL2 Veins. This was prior to successfully intersecting the DL2 Vein and validating the HISTORICAL SHIPPING GRADES.

If you multiply the 1,000-meter “strike” length of the DL2 by its minimal known depth of 700-meters by an average width of 0.6-meters you’ll get a VOLUME of 420,000 cubic meters. If you multiply that by the ore’s SPECIFIC GRAVITY of 2.7 tonnes per cubic meter you get a TONNAGE figure of 1.134 million tonnes of vein ore. If you then multiply this figure by the 64 gpt average SHIPPING GRADE of the artisanal miners you’ll get a figure of 72.57 million grams of gold present. If you divide this by 31.1 grams per Troy ounce, you’ll get 2.33 million Troy ounces of gold estimated for just the DL2 Vein not counting the other 6 Main Veins.

If after 15 years of mining this vein, the final total number of ounces mined is 2.087 million ounces or 2.776 million ounces, does it really matter? Does it matter TODAY, if the final MINE LIFE for the DL2 Vein was 16 years or 21 years? Who cares? There is a significant MINE LIFE to this asset. Is it worth spending 400 million shares to find out the exact numbers TODAY? Of course not.

7 years since taking control. Stock price is worthless .001. Maurizio received 30M shares in AUMC (if he can ever sell his stock he has won, personally). Shareholders have not won. Just look at the scorecard.

A mine plan is a hindrance? So, yes, they found the DL vein for the third time. Now what. While BB prefers to blow up balloons first and face reality last, he’s been early to the “production party” for the better part of twenty years. Once again, he will be disapppointed.

Its a positive that they finally found the vein. Now they have to follow it. Narrow, high-grade veins, pinch and swell and divert in all sorts directions. If you don’t have a map of the vein (through drilling) its EXTREMELY difficult mining. Companies don’t get awarded multiples (P/Es) unless the market is able to assign mine life. No mine plan, no defined resource, no multiple. If this were a private company it would be less of an issue. Just dividend out the cash flows and mine the project until it becomes unprofitable. Unfortunately, this is a public company with many underwater investors. If Maurizio doesn’t want to follow industry standards thats his perrogative but don’t expect appreciation in the stock.

A flotation circuit will cost ~$10M. He’s already publicly stated that raising money through an equity issuance is on the table. I don’t think he’ll be able to find investors at any price based on the lack of industry standard metrics that any legitimate investor needs in order to conduct proper due diligence.

IMHO, success here is 100% on Maurizio’s ability to slowly chase the vein to slowly start spending cash flow from operatwions on things that the market requires. This could inevitablly result in less shares outstanding (dilution on the back end vs. the front end). Not sure who’s going to still be alive to reap the benefits but that doesn’t seem to bother some of the posters here who seem to treat MDMN more like a hobby vs. an actual investment.