New for 2024- good things should happen!

Yes, hard to believe 2024 is here!

Stay Healthy and Safe.

EZ

Hope everyone has a healthy and profitable year. Rod

Time to find out if MC did play his cards correctly like BB has proclaimed he did. Bootstrapping was going to pay handsome dividends is what the narrative was. Let’s see if this financing raise for the flotation plant blows a hole through that proclamation or adds more credence to it.

Dilution at this step is not welcomed unless it is a significant buy-in from a major mining company. Some private placement that is essentially MC and friends taking more equity away would/should be met with pitchforks. This zero % interest loan from MC is only as good as where it takes us. If it only takes us to a step where he snags another huge equity portion away for himself, it was just smoke and mirrors plus a miserable lengthy waiting time attached to it. That is adding insult to injury.

He failed to get a JV with Hochschild and stated AUMC was fully financed to proceed on its own. No harm no foul yet because it was admirable to use his own funds up to this point. The next move however is ever so important. Some private placement that dilutes shareholders is unacceptable, even more so if it involves a related party.

I trust that MC will do this on the up and up. $15M - $20M is peanuts for a Major. Offering them a piece to put their name and expertise on the actual operation is much more palattable than some “behind the curtain” dilutionary financing with insiders. It would do wonders for the company promotionally and operationally.

Be careful what you wish for with the Majors. $15-$20 million for a Major not a problem. They just might tie it up for decades with nothing happening. And, the major is going to dilute us substantially more than MC would, and MC is going to be aggressive with moving forward.

MC is trying to keep this under his control as long as possible to get it to a point where he will have better leverage with the big boys.

It’s a different strategy than your typical give it all away and hope In The end it’s worth it.

This approach is not for everyone, so if it’s not within your comfort zone, might want to look else where.

Valid point of view however I’d rather dilute to a Major than MC if the dilution rate is the same. Yes we would need to keep them on a tight agreement to bring it into production. Legitimizing the asset to the rest of the investment world while also tapping into a reputable mining company’s expertise and ability to speed things up, rather than slow them down, is vastly more appealing from a promotional perspective.

The best scenario would be to finance without dilution and for MC to actually put this into full scale production without the help or dilution of outsiders. Is that feasible?

This isn’t the only thing holding back precious metals these days. End of the year wrap-up interview with a favorite Billionaire precious metals investor we’re all familiar with; worth listening to for a “Big Boys” perspective. Good information to start the year, “offering essential insights for navigating the economic rollercoaster ahead.”:

(https://www.youtube.com/watch?v=WupEWyvirfM)

Predicts a great year 2024! All just kinda playing the waiting game.”Everytime you punt you loose market cap and let in weak investors.” One stock mentioned has 20 M oz drilled and delineated, valued at only $4/oz in the ground, is near roads and electrical power, and has been drilling since 1991! The stock is selling for 0.40 and is aggressively looking to unlock the value of its multi-million-ounce gold resource in one of the richest placer gold districts in Alaska. I look forward for AUMC moving up in 2024!

EZ

January 2024 – Shareholder Update

Jan 4, 2024

January 2024 – Shareholder Update

AURYN Mining Corporation Shareholder Update

AURYN Mining Corporation (OTC: AUMC) is pleased to share the following update with its shareholders.

ACCOMPLISHMENTS

Mining works on Fortuna

AURYN Mining Corporation is pleased to announce that our mining operations at Fortuna are progressing smoothly, in line with the strategic decision made by our Board of Directors in the previous quarter. Our mining team is diligently carrying out ore extraction and accumulation directly from the vein on a modest production scale. Simultaneously, we are advancing our efforts on the Lipangue Flotation Plant project.

Project visit from German mining experts

The recent visit to Fortuna on December 1st by a group of esteemed German professors and academics, led by Prof. Dr. Helmut Mischo, Dr.-Ing. from the Institute of Mining and Special Civil Engineering at the Technical University Bergakademie Freiberg (TUBAF), was a noteworthy event. Prof. Mischo, a specialist in Underground Mining Methods, has extensive expertise in mine planning and design, underground deposit extraction, mine development, conveyor and transport systems, and mine safety and rescue.

The group thoroughly inspected our Antonino Tunnel project, including key sites such as the Don Luis Vein interception, the Emergency Chimney, and the most significant mineralized structures discovered along the tunnel, as well as the historical Fortuna Old Works. The visiting team expressed high regard for the development of our mining project, with Prof. Mischo offering particularly favorable opinions about Fortuna. He acknowledged the evident presence of significant mineral deposits and the proven access to the vein structure at various levels and areas.

Prof. Mischo emphasized the critical challenge of optimizing mining operations for maximum efficiency. He advised that each mining site’s unique physical and chemical characteristics necessitate a tailored approach, using the latest and most effective extraction techniques. This advice aligns with Auryn’s strategy to consider a 100 ton/day flotation plant, incorporating cutting-edge mineral processing technologies. Prof. Mischo supported this strategy, suggesting that it could yield the optimal combination for recovering Fortuna’s minerals. He assured that once the most efficient recovery method is established, production scaling would be straightforward and highly effective.

In recent weeks, we have engaged in discussions with Prof. Mischo to involve a select group of TUBAF students in developing a conceptual model to optimize Fortuna’s exploitation. We are enthusiastic about this collaboration and anticipate sharing positive developments soon.

On-Site Flotation Plant in Lipangue

We are actively engaged in preparing the essential technical documentation required for submitting our project to the relevant authority in Chile. This preparation is a critical step in ensuring compliance with local regulations and advancing the project efficiently.

Q1 2024 – OBJECTIVES

The company continues to explore options for financing the development of a 100 ton/day flotation plant.

Long-Term Vision

Our long-term goal is to transition the Lipangue project from exploration to full-scale production. The cash flow generated will not only fuel further exploration but will also enable us to return value to our shareholders, reinforcing our commitment to stakeholder profitability.

OUTLOOK

Communications

AURYN will consistently update investors through required financial disclosures on OTC Markets. Expect quarterly shareholder updates during the first week of every calendar quarter. To stay informed, subscribe to email notifications on our website.

For more details, please visit our website, AURYN Mining Corp.

Submitted on behalf of the Board of Directors.

Forward-Looking Statements

This news release contains certain forward-looking statements within the meaning of the United States Securities Exchange Act of 1934, as amended. This forward-looking information includes, or may be based upon estimates, forecasts and statements of management’s expectations with respect to, among other things, the completion of transactions, the issuance of permits, the size and quality of mineral resources, future trends for the company, progress in development of mineral properties, future production and sales volumes, capital costs, mine production costs, demand and market outlook for metals, future metal prices and treatment and refining or milling charges, the outcome of legal proceedings, the timing of exploration, development and mining activities, acquisition of shares in other companies and the financial results of the company. There can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially and substantially from those anticipated in such statements. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that mineral resources will be converted into mineral reserves.

Contact Information

Auryn Mining Corporation

Sign up for Notifications

Follow us on Twitter

@aurynmining

Now we have a number to plug in 100 ton a day.

Still no financing on the plant which is now going to take even longer before we see any kind of return.

At least both Peruvian and now German students have something to work on for their term papers. Academia is thriving at the Fortuna.

Not a lot out of this update with the exception of the capacity of this floatation circuit. Pretty small but expected and most likely a modular approach with the hopes of ramping capacity as the mining progesses. If you cut the right corners its possible to build a plant of this size for as little as $5M. This small cash outlay is clearly important as the market cap drops below $20M. In other words, a $5M raise would only dilute shareholders by ~20% if placed at current prices.

Through this update we also learn that AUMC is still preparing the engineering work/flow sheet (“essential technical documentation”) so that they can submit for the lengthy permitting process. This would indicate that the $5,000 economic impact cited in the previous update and actively debated on this forum could not have possibly incorporated analysis of the economic benefits of the floatation plant as the design is STILL be worked on (several months later).

Its clear at this point that any assertion that AUMC had already lined up their financing at the time they decided to pursue the plant over Enami were wrong.

This is the scenario if Auryn chose to get screwed by Enami’s fee structure and let Enami do all of the ore processing. It remains a very desirable OPTION. Having this OPTION, rules out the need for management to EVER sell shares at ridiculously low-price levels in order to fund developments. That possibility is officially off the table. The new BOD would have never passed this CORPORATE RESOLUTION in a unanimous fashion if it were a possibility.

Put a pin in this statement (not opinion) for reference at a later date.

Also clear that AUMC does NOT have any intention to provide any visibility on the grades and tonnage of the stockpiled ore. Soo, shareholders need to speculate on the transition of mining operations from exploitation and production (Jan 23), to strong (October) progressing smoothly (January 24).

See you in March. I would expect/hope the company will be in a position to announce financing details and completed applications for permits by that time.

In light of today’s update I would humbly recommend my post from one hear ago in Jan 23. Aside from some details it seems to be proving largely decent guidance.

https://theminingplay.com/t/auryn-medinah-2023-1st-half-general-discussion/3097/129?u=cornhuskergold

-

The dilution issue described there largely due to the narrow vein reality of Fortuna and the ADL generally is the root cause of a. second thoughts about shipping up to 90% barren rock, and b. considering a flotation circuit to remedy or counteract this issue not inside the tunnel, but once you get it out of the tunnel, but still on property as opposed to transporting so much barren rock.

-

The modest 100 tpd starting plant is not only a reflection of our very humble financial situation but also due to the physical constraints described in that post imposed by the narrow veins, corresponding narrow tunnels, and corresponding smaller equipment. If you make these bigger, you just end up transporting more barren rock. 100 tpd still represents 5+ operating faces and hundreds of trips per day up and down the tunnel moving rock.

The good news is that reality is being addressed and has some legitimate and known remedies. A few comments:

- I think the lack of precision in mining grade guidance is due to reality behind the sentence:

Prof. Mischo emphasized the critical challenge of optimizing mining operations for maximum efficiency. He advised that each mining site’s unique physical and chemical characteristics necessitate a tailored approach,

In other words, no one knows with precision how this will turn out. They don’t want to set expectations of a certain grade number and then get punished later if they miss it by a few gpt. On the other hand, they have to convince themselves and potential investors that it will in the end be profitable. Getting some experienced eyes on the subject is part of this process. It remains a risk.

-

There is still a risk of meaningful dilution depending on financing options.

-

A meaningful amount time remains before this thing is an operational 100 tpd mine. Financing, permitting, construction → time.

CHG

For those that didn’t attend the informational meeting a few years back in Reno and meet CHG you may not be aware that he has an excellent engineering background. This last post, and the embedded link to the post from a year ago, exhibits a clear understanding of the problems and process needed for future success. Networking with experts to facilitate solutions is a strength shown by management. I look forward to a year where the proper approach to moving the project forward will result in a positive result for all shareholders. Patience and a sock drawer for now.

EZ

Excellent post a year ago and again today. You received a considerable amount of pushback when you previously offered your insight. Your grounded analysis still allows for a decent cash flow story ($6M-$10M EBITDA) with proper execution, and consistently high grades, at some point down the road. A reasonable valution, even in the absense of a MR/MR could still be 5-7x EBTDA (or 40 cents to $1 per share), representing a 100% to 500% ROI from current levels.

Ironically, due to the unrealistic bar set by many of the participants on this board, there will still be some disappointment, even in the face of flawless execution. A very unhealthy investor psychology dynamic that will need to be ironed out along the process.

The announcement :

January 2024 – Shareholder Update

AURYN Mining Corporation Shareholder Update

AURYN Mining Corporation (OTC: AUMC) is pleased to share the following update with its shareholders.

ACCOMPLISHMENTS

Mining works on Fortuna

AURYN Mining Corporation is pleased to announce that our mining operations at Fortuna are progressing smoothly, in line with the strategic decision made by our Board of Directors in the previous quarter. Our mining team is diligently carrying out ore extraction and accumulation directly from the vein on a modest production scale. Simultaneously, we are advancing our efforts on the Lipangue Flotation Plant project.

Project visit from German mining experts

The recent visit to Fortuna on December 1st by a group of esteemed German professors and academics, led by Prof. Dr. Helmut Mischo, Dr.-Ing. from the Institute of Mining and Special Civil Engineering at the Technical University Bergakademie Freiberg (TUBAF), was a noteworthy event. Prof. Mischo, a specialist in Underground Mining Methods, has extensive expertise in mine planning and design, underground deposit extraction, mine development, conveyor and transport systems, and mine safety and rescue.

The group thoroughly inspected our Antonino Tunnel project, including key sites such as the Don Luis Vein interception, the Emergency Chimney, and the most significant mineralized structures discovered along the tunnel, as well as the historical Fortuna Old Works. The visiting team expressed high regard for the development of our mining project, with Prof. Mischo offering particularly favorable opinions about Fortuna. He acknowledged the evident presence of significant mineral deposits and the proven access to the vein structure at various levels and areas.

Prof. Mischo emphasized the critical challenge of optimizing mining operations for maximum efficiency. He advised that each mining site’s unique physical and chemical characteristics necessitate a tailored approach, using the latest and most effective extraction techniques. This advice aligns with Auryn’s strategy to consider a 100 ton/day flotation plant, incorporating cutting-edge mineral processing technologies. Prof. Mischo supported this strategy, suggesting that it could yield the optimal combination for recovering Fortuna’s minerals. He assured that once the most efficient recovery method is established, production scaling would be straightforward and highly effective.

In recent weeks, we have engaged in discussions with Prof. Mischo to involve a select group of TUBAF students in developing a conceptual model to optimize Fortuna’s exploitation. We are enthusiastic about this collaboration and anticipate sharing positive developments soon.

On-Site Flotation Plant in Lipangue

We are actively engaged in preparing the essential technical documentation required for submitting our project to the relevant authority in Chile. This preparation is a critical step in ensuring compliance with local regulations and advancing the project efficiently.

Q1 2024 – OBJECTIVES

The company continues to explore options for financing the development of a 100 ton/day flotation plant.

Long-Term Vision

Our long-term goal is to transition the Lipangue project from exploration to full-scale production. The cash flow generated will not only fuel further exploration but will also enable us to return value to our shareholders, reinforcing our commitment to stakeholder profitability.

OUTLOOK

Communications

AURYN will consistently update investors through required financial disclosures on OTC Markets. Expect quarterly shareholder updates during the first week of every calendar quarter. To stay informed, subscribe to email notifications on our website.

For more details, please visit our website, AURYN Mining Corp.

Submitted on behalf of the Board of Directors.

CHG,

I agree with Baldy’s initial compliment to you. “Excellent post a year ago and again today.” I think the next dozen or so posts that followed that one from a year ago also contributed some great insights. Everyone recognizes narrow veins are so very difficult, so the Dec 1 visit by Prof. Helmut Mischo, Dr.-Ing. does provide value to the plan that is being developed by management. He is recognized as “a specialist in Underground Mining Methods, has extensive expertise in mine planning and design, underground deposit extraction, mine development, conveyor and transport systems, and mine safety and rescue.”

The long-term goal transitioning the Lipangue project from exploration to full-scale production will eventually include much more than the LD veins at the Fortuna mine. CHG asked a few posts later in that thread last year if 4 or 6 working faces were maybe all the Antonino access adit could handle? He then followed up and “So why not start up the Caren instead where you have a starting point? ” This may be much more efficient from a time and effort viewpoint than starting another approach tunnel when the solitary Antonino adit finally limits the expansion of the Don Luis production vein at a certain level of working faces. If they run into other exceptional and significant mineralized structures that did not make it to the surface, perhaps another access tunnel would be built to service the new as yet unrevealed vein and continued expansion of the LD at various levels.

There were quite a few good exchanges that flowed from that thread on January 23 a year ago. WIZ jumped in later that same day and offered, “8-12 faces with the right equipment at a scale far larger than you initially were thinking is possible.”

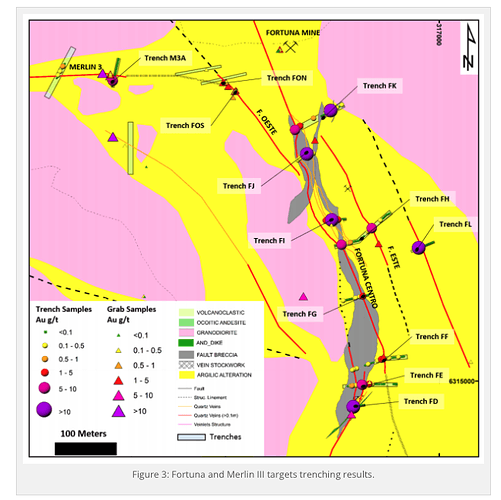

Earlier that day it was mentioned that 68 gpt gold and 124 gpt samples from adit #2 in the Caren Mine (Merlin 1 Vein) were found at the 1,840-meter elevation level. These are at about the same level as high-grade samples that were obtained historically around Fortuna’s LD works. Are any of the other veins shown on the early surface trench exploration map also potential high grade targets on the ADL at this 1840-meter level?

Obtaining the concentrate for shipping to a refiner for processing extracted ore by flotation at $10/ton is the logical method for maximizing full value. WIZ said, “Granted, this isn’t all happening tomorrow. But all they have been waiting on is hitting the high-grade to de-risk MC’s $$$.” That goal has finally been accomplished. Luciano Bocanegra did a very conservative analysis early on of 2 of the 5 veins that made it to surface at the ADL. He came up with a minimum of 664,000 ounces of gold in the top portion of Merlin 1 and DL2 Veins. We’ve been waiting a long time, dealt with too much frustration over too many years to count. Once again, shareholders have little choice but to see what progress will be made with the plan developed with advice from some of the best expert specialists available. There are other larger projects I have invested in taking many years as they slowly progress, but from what has been revealed over the years, there is a fortune under the ADL awaiting to be extracted. I’m sure MC’s team feels the frustration that shareholders are feeling but are also confident they are getting closer to realizing a payday that will make it all worthwhile. This is what all shareholders would like to see.

EZ

Well this is really getting boring and it looks like we are going to have another year of nothing. Where is good old Les so he can pump this up so I can get out of this nightmare! He was a crook but an excellent promoter.

They are still stockpiling ore while this is unfolding. It would be nice to know how much that stockpile is worth.

In the update they said modest, if modest means the same as execution in the past 5 years, well take it from there.

A full five days and not a single attempt at a positive spin. Understandable but disappointing nonetheless. Ironically, I believe this is a constructive development related to investor psychology. The first step is acceptance (of reality) which paves the way for more grounded expectations and an environment where actually acheivable milestones met by the company, likely in the second half, will be greeted with a positive reception and bottoming of the share price.

IMHO, once the financing is finalized/disclosed and AUMC presents a timeline to complete the floatation plant, the stock should begin to bounce (from whatever level) as it discounts the probability of success. Good announcments demonstrating solid execution it goes up, any misteps it does down. If they go over budget or significantly miss their timeline, its probably game over. On that note I would encourage the company to incorporate large contingencies (30%+ over a budget) when considering the quantum of what needs to be raised to give them enough of a cushion to account for unforseeable events (they always happen when it comes to mining).

A little dramatic don’t you think ![]() . Can’t call out BB for extreme talk if you are going to engage in the same.

. Can’t call out BB for extreme talk if you are going to engage in the same.

I fully agree though with your main point that realistic expectations are healthy for shareholder sentiment. At 20gpt and 100 tpd, with a flotation plant, that will yield a very impressive net income. Execution is key as you mention.