I’ve been scratching my head for some time trying to make sense out of a long line of assay results that seemed too good to be true as well as the statement by Auryn management that if they were to froth float the DL2 Vein ore on-site, as the first step of concentrating/”beneficiating” the ore, then they could realize an “extra” $5,000 per tonne over and above the handsome amount of money Enami was willing to pay Auryn if Auryn were to “DIRECT SHIP” their ore out of the adit straight to the Enami smelters.

There were 2 separate things that seemed too good to be true. The first was consistently “off the chart” gold grades and the second was that $5,000 per tonne differential. In the sciences, if you are presented with a pair of anomalies, the first thing you want to determine is if the two are RELATED or not. What underlying reality could explain BOTH insanely high grades AND that “extra” $5,000 per tonne differential for just putting in a froth flotation circuit?

My first question had to do with how Enami could justify not paying Auryn at least some of that “extra” $5,000 per tonne. They’re famous for looking after the needs of the junior gold producers that they service. Enami charges smelting fees of about $184 per tonne on average. So, it wasn’t their fees that were an issue because that $184 per tonne figure was just a tiny percentage of that $5,000 per tonne differential. Recall that Auryn ran 2 smelter tests on the ore they encountered in the DL2 Vein. The sample sent to Enami came back stating that Enami was willing to pay the equivalent of 57 gpt gold, 978 gpt silver and 3.21% copper NET OF THEIR SMELTING FEES (“TC’s” which are treatment charges and “RC’s” which are refining charges) AND ANY PENALTIES THEY HAD TO ASSESS.

If you study the worksheet that Enami uses to calculate how much they will pay a miner for “DIRECT SHIPPING” their ore to Enami’s smelters, you’ll notice that there is a line-item entry for “PENALTIES”. Enami charges significant penalties if a miner’s ore has certain environmentally toxic contaminants contained within it that could be released during the smelting process. These include things like ARSENIC, which can be contained in a mineral known as “ARSENOPYRITE” or “ARP” and MERCURY. But what might this have to do with that other anomaly present having to deal with consistently off the chart gold grades?

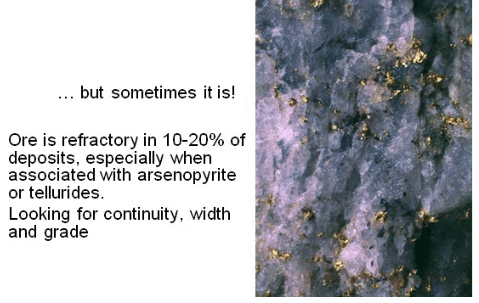

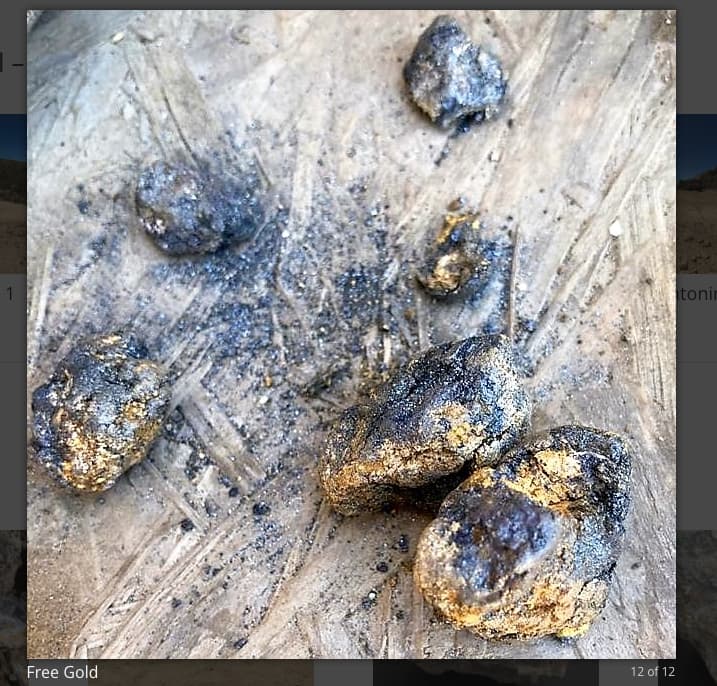

As it turns out, ARSENOPYRITE has everything in the world to do with consistently off the chart gold grades. Arsenopyrite is known as the “gold magnet”. It is made up of an arsenic atom, an iron atom and 2 sulfur atoms or As-Fe-S2. The attraction between gold and arsenopyrite actually occurs at the atomic level. The presence of significantly high levels of “ARP”, can result in the concentration of associated gold levels “UP TO 1 MILLION TIMES” the norm. This is not a misprint.

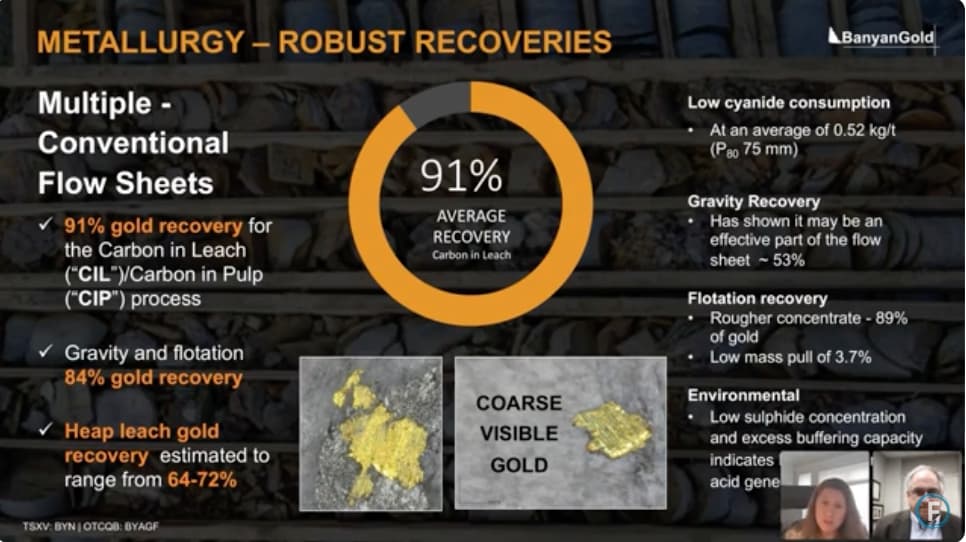

A miner DOES NOT want to DIRECT SHIP gold ore with high levels of “ARP” and gold to a smelting facility. The “PENALTIES” will be enormous even though the paycheck, as we saw in the Enami results, might also be enormous. What is done nowadays is the miner will first remove the ARSENOPYRITE from its ore via FROTH FLOTATION which does a wonderful job in removing ARSENOPYRITE. Then you send the resultant pretty much arsenic-free “float concentrate to the smelter. Froth flotation not only predictably removes the ARESENIC/ARSENOPYRITE, it does so very inexpensively. The ARSENIC contained within ARSENOPYRITE is not much of a hazard in the ground. If you put ARSENOPYRITE into a blast furnace or reverberatory furnace, as is done during smelting, the ARSENIC will volatilize as ARSENIC gas, which is toxic.

So, the insanely high but remarkably consistent gold grades as well as this seemingly enormous $5,000 per tonne “differential”, do make a lot of sense. Froth flotation uses water and is known as a HYDROMETALLURGICAL PROCESS for purifying gold ores. Smelting is a PYROMETALLURGICAL PROCESS, it uses a tremendous amount of heat.

The 100-page report on the DL2 Vein and the ADL Mining District completed by ACA Howe, highlighted the fact that the gold in the DL2 Vein was tightly bound to ARSENOPYRITE just inside the outer margins of the vein proper. When you study a photomicrograph of gold ore with ARSENOPYRITE, the gold and the “ARP” molecules almost seem to be welded together. The froth flotation process cleverly separates the two, and the gold attaches to the bubbles within the FF “cells” and gets transported to the surface to join the “froth”. The “ARP” molecules end up descending to the bottom of the FF “cell” from where they are safely discarded to the tailings facility on the ADL plateau surface as ARSENOPYRITE, with the arsenic atom safely attached to the pyrite molecule, just like in nature. When you smelt ore rich in “ARP”, the arsenic becomes volatilized into its gaseous form which is indeed an environmental toxin. Hence the need for Enami to penalize ore sent to its smelters rich with “ARP”.

Below is a link to an article that reviews the methodologies used to remove ARSENOPYRITE prior to ore being smelted. Before the technological innovations permitting easily removing “ARP” were introduced, the presence of “ARP” was a mixed blessing. The gold grades would be through the roof but so too would be the environmental damage. Now, it’s more of being just a blessing because of the inordinately high gold grades and the ability to froth float the arsenopyrite. So, the 2 anomalies, insanely high gold grades and the ability to realize an “extra” $5,000 per tonne if the miner is willing to do the froth flotation on-site (in order to avoid the smelting penalties), makes a lot of sense.

Smelting is very efficient and usually results in gold with a 90% purity, and it can always be done AFTER the froth flotation. Froth flotation is very INEXPENSIVE. It usually averages a cost of about $10 per tonne and this includes the CAPEX for building the facility and the OPEX (operating expenses) for running the facility. Smelting is more expensive and Enami charges around $184 per tonne to smelt gold ore. In addition to getting rid of the ARSENOPYRITE, the FF process also gets rid of a lot of the worthless material within the ore, the “gangue”, and this way a lesser amount of TONNAGE needs to be sent to the more expensive smelter because a lot of the “gangue” never needs to be transported or smelted because it is sitting in the tailings facility back on the ADL plateau. Lower TRANSPORTATION COSTS, lower SMELTER tonnages, and lower SMELTING PENALTIES are all incorporated into that $5,000 per tonne “bonus”, that Auryn management refers to as having a “direct financial impact”, over and above what Enami was willing to pay for the ore DIRECTLY SHIPPED to their smelter.

Auryn management has in hand what they refer to as a DETAILED CASH FLOW ANALYSIS that includes this $5,000 “bonus”. We shareholders do not have this breakdown but the “potential financiers” do.

Why gold loves arsenic - MINING.COM

In regards to Auryn/Medinah, what’s important to keep in mind is that even though Auryn might be in a position to hit it out of the ballpark in regards to top line earnings, they don’t really need to in order to generate an extremely robust EARNINGS PER SHARE. This is because there are only 70 million shares issued and outstanding fully-diluted. Mining ore with the grades that Auryn has consistently experienced in recent assays or historical production results, at a time when the price of gold is near all-time highs, represents a significant amount of ECONOMIC LEVERAGE.