Agreed. One would hope meeting that CAP requires massive profits. Thats why we need the details.

Dividends - that means earnings / free cash flow. ![]()

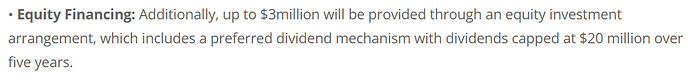

But, how much equity are we giving up in the equity financing deal?

They are preferred shares. Not common shares so it all depends on the details on how dividends are earned and capped for the preferreds.

For instance as an example.

It could state that annually they get 20%. So 80/20 in that case. The % could escalate or de-escalate each year, who knows. Hopefully the preferred arrangement expires after the CAP is met or 5 years, whichever is sooner

Don’t forget we still owe MC $5 million and that gets paid when the mine starts making money. In the end a lot of mouths to feed. They are betting that this will be a grand slam.

Even without the details you can start to compare this against a straight $4M equity raise at .30 - .40 pps (Auryn recent trading range) and speculated offer they had on the table.

$4M at .35 equity raise would lead to approx 11.5M additional shares. That would be giving up ~15% equity in the company. 11.5/(70+11.5) or 11.5/81.5.

I personally am happier to see that we preserved the 70M common share total if we are off the hook after 5 years with the preferreds versus giving away 15% of the company permanently. Hopefully that was their mindset as well, and not that they couldn’t land a straight $4M equity deal. Although I am hearing now in back channels that they may be getting permanent equity.

Bottom line though, they couldn’t secure a straight $4M debt financing (loan). This would have been the most ideal.

We don’t know the terms because they haven’t given us the terms. Their notice was just the highlights.

But, it still goes back to the part they told us they were shipping ore from two years ago and making bank but they were not. Because they earned no revenue, they had no money to self finance the FF machine. They had no other choice but to secure outside financing. Because they have secured outside financing, all of us will suffer dilution. Period. And not only dilution, but non-preferred status.

It’s the hand we are dealt as of now. At least their is some movement. Unfortunately, until we know all of the terms, interest rate, how preferred divi’s paid over regular divi’s, etc., we don’t know how far down the list we sit (remember, besides now paying the financier, Auryn still has to pay Maurizio back). We don’t know whether this deal will finally help the company earn a profit, or put it into insolvency.

Just some simple calculations, IMO, show this may be the final last ditch efforts to make Auryn viable. Using a zero interest on the loan (which we all know is not accurate), Auryn will owe the financier $4m in payments and $20M in divi’s by the end of five years. At the current price of gold at $2340oz, that’s 10,256 ounces of gold, not including the costs to pull it from the ground, FF it, and process it with Enami. This also doesn’t include what Maurzio will pay himself back.

Those of you with a better mining background can provide a better cost analysis, but I’m going to guess you would need to double this amount of gold to offset your costs. Let’s call if 20k ounces.

Therefore, Auryn has to average at least 4k ounces of gold per year over the next five years to basically break even. We will lose the first year because Auryn has to permit, prepare, and build the FF machine. So, Auryn will instead need 5k ouncers per year over four years, commencing June 2025. Using Auryn’s notification of processing of 57g/t that comes to roughly 2oz/t. Therefore, to get to 5k ounces per year, Auryn will have to process at least 2500 tons of unrefined ore per year. That’s 48 tons each and every week for the entire year. Because they have been closing down for the winter, and for other reasons. Let’s say they only can produce during half the year. That means they have to mine and process 96 tons of ore per week for at least 26 weeks.

Can they even accomplish this task? What do most small miners produce on average, due weather, mechanical, labor, etc issues? And if they do, Auryn will just break even. To get to the point to pay the financier, Mairzio, and then us, we have no idea what they will need to produce.

IDK about the rest of you, but, although it is good news they are moving forward, we won’t know if Auryn will survive until at least the end of 2025, when we start seeing some production numbers, and revenue numbers. Once we know if Auryn can pay everyone and cover its costs, we are all just guessing. Until then, IMO, the stock price is going nowhere, and we will all lose more due to the dilution once the financier gets his cut and we know all the terms.

Hi Jak,

I haven’t done all the math yet but just want to point out they don’t owe back $4M + dividends. They owe $1M loan back. The other $3M was secured via the dividend/equity arrangement.

What happened though to the stockpile itself being worth enough to collateralize a $4m loan? Doc??

But Jak I don’t think we need to worry about insolvency. The ore already stockpiled to run through the new circuit should be enough in itself to pay back the loan and therefore not risk any default or insolvency.

This was still an extremely expensive raise for just $4M.

Well time to check again.

Do we have 100 shareholders willing to invest $30K-$40k? Count me in for one. I’m sure we wouldn’t need 100, some would invest more than $30k. Now’s a great time for current shareholders to be willing to consider it, especially given MDMN is frozen currently.

MC should consider getting a group of existing shareholders together to beat out these terms. Is anyone else suspicious that this investing group could be an inside job? And that the returns will get filtered back to Maurizio? This a perfect opportunity for him to grab more equity.

Overall, a timely announcement to show that the project is going to move forward. A glimpse of what MC has been facing to get this project off the ground is discussed in this article with some very knowledgeable mining and finance folks.

Miners Facing Financing Frustration, Where Will the Money Come From?

Pierre Lassonde, Adam Lundin, Jacqui Murray and John MacKenzie spoke about why mining companies are struggling to get funding and what they can do to improve their odds.

“You have to have scale, and you have to have grade and you have to prove that you have something that your peers don’t,” Lundin said. MacKenzie made a similar point, saying that scale is essential for attracting capital.

“There is no doubt that there is a premium for scale,” he said. “The investment funds around the world are getting bigger and bigger, and none of them really want to be holding huge percentages in any single company. So the bigger the company, the more investable they are, the more liquid. And those are the real keys to attracting investments.”

(https://investingnews.com/mining-sector-financing/)

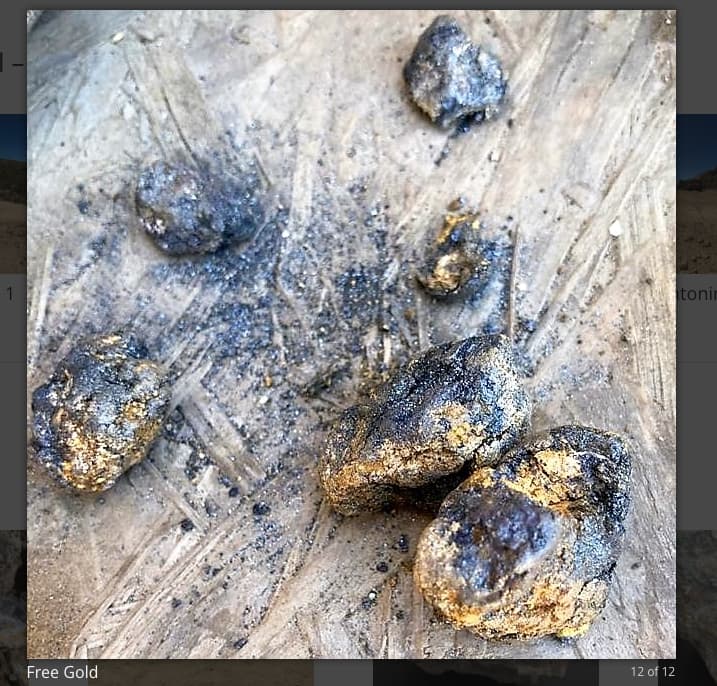

I think even with things moving slowly, MC intends to see this project through to recover all costs and become highly profitable during this secular bull phase for gold. Although a big disappointment, it was not that long ago that the existing company was confident, with concentrated ore, they could produce 5,000 oz quarterly from just what they had at the Caren mine.

“These results make us confident that we can produce a total of 5,000 troy ounces of gold before year-end 2016, and over 25,000 troy ounces in 2017.”

(Caren Mining Preparation Commences | AURYN Mining Corporation)

That was before we had uncovered the unpleasant surprise of 3B shares on the books of MDMN requiring a complete restructuring of the company, projects, and share structure. I think we are banking we can do much better than that 25,000 troy ounces in a year with a FF plant in place and the high grade ore at the Fortuna de Lampa project.

![]() Onward and forward - in for the long haul to prosperity. $$$

Onward and forward - in for the long haul to prosperity. $$$ ![]()

EZ

Yup. You are right. So focused on the dilution, my mind lost focus. It’s approx $21M paid, not including interest, plus Marizio.

RE stockpiled ore, do we really know what’s stockpiled? How many tons? And it’s quality? It’s never been tested, and I don’t believe Auryn has provided any specifics in any of their notifications as to the actual quantity or quality. I know Auryn has tested samples from the mine itself, but I don’t remember reading about testing of stockpiled ore and the amount stockpiled. There’s one reference to 50 tons stockpiled in Jan 2022, but I haven’t seen any other reference to stockpiled ore. I may have missed it, so if Auryn in any of its official notices states the quantity and quality of the stockpiled ore, please correct me.

Because all of us should only use facts which Auryn has provided without speculation, currently, we can’t use stockpiled ore in any calculations as we don’t know the quantity or qaulity. Someone could speculate as to the amount of stockpiled ore, but Auryn has not told us how much ore it has stockpiled nor have they told us of any testing relating to the quality of any stockpiled ore. Unfortunately, until Auryn publicizes it, we can’t believe it. And, even then, they publicized they were shipping ore to Enami for close to two years and that turned out to be false too.

So, until we see hard numbers on the financials at the end of 2025, currently we have nothing. Just more promises.

If the numbers come in ANYWHERE NEAR what BB has been saying, the $20 Million preferred dividend cap will be an afterthought. The 70 Million share structure has technically been preserved.

And why do I remember Bald Eagle saying a FF plant would cost bottoms $10 Million? Maybe bottoms $25 Million for a decent sized one? Looks like the company is gonna get it done for $4 Million tops?

I’m gonna talk to some clients - a 3X in 5 years would sufficiently undercut the “competition” and would be a very enticing return - will inform if anybody bites.

FWIW, Baldy is saying in back channels that this means the new preferreds get permanent equity on top of the $20M preferred divdends.

I implied/hoped that their equity expired after 5 years or cap was met, whichever was sooner. If they carry whatever % ownership indefinitely, this was an extremely expensive financing raise and signifcantly dilutive. It calls into question whether it was worth chasing that extra $5k per oz versus shipping to Enami for now and how off base Docs analysis/assumption that Enami was even a viable option.

Thats was for a much larger plant.

You are probably not ‘purposely being negative’, but your first sentence is about as negative as it gets. You mentioned the details are very limited regarding the dividend plan, but you know the finer details will be disclosed soon.

I doubt that you really believe MC would sell out us shareholders. He certainly isn’t about to make a bad financing deal for himself, either. Details coming soon.

Depends. Maybe not. If the preferred equity arrangement allows for them to retain permanent equity beyond the $20M/5 year period, its indeed dilution with an additional preferred dividend kicker.

![]() Negativity belongs in the trash bin of history. Why does BE even bother with back channels? He is not a shareholder. He can accumulate after production starts and just say what he wants to then. I have a dozen PM stocks that have reached a 52 week high in the last 14 days. We are in a secular Gold and Silver Bull market that will carry these producing stocks into the next decade. MC has carried this company through the worst of storms and is setting a guide to make this a mid-tier mining company of the future. Transparency and the market will repair this stock for all shareholders. Yes, patience is still required. There are only 9,195,353 shares in the Float (unrestricted) as of 01/09/2024. Most shareholders don’t realize how tightly held the AUMC share structure really is. Things can move quickly with some great news, like commissioning of the FF plant. Wait for it!

Negativity belongs in the trash bin of history. Why does BE even bother with back channels? He is not a shareholder. He can accumulate after production starts and just say what he wants to then. I have a dozen PM stocks that have reached a 52 week high in the last 14 days. We are in a secular Gold and Silver Bull market that will carry these producing stocks into the next decade. MC has carried this company through the worst of storms and is setting a guide to make this a mid-tier mining company of the future. Transparency and the market will repair this stock for all shareholders. Yes, patience is still required. There are only 9,195,353 shares in the Float (unrestricted) as of 01/09/2024. Most shareholders don’t realize how tightly held the AUMC share structure really is. Things can move quickly with some great news, like commissioning of the FF plant. Wait for it!

EZ