With the POG at over 2400 looks to be a great catalyst for the Finacier to fund this plant. Like Z said buckle up!

The post was made in jest. Supposedly he signed an NDA and is not able to buy right now anyway.

It’s been long believed by some that there are a lot more shares owned than exist and come reckoning day a short squeeze could occur

What is the impact of moving to the expert market re such a potential squeeze?

Zero impact. What will catch them is when they have to do the share dividend (i.e. conversion). That will reveal too many shares. If the regulators allow it to go unchecked, that means the naked shares will transfer to AUMC proportionately. If that happens, the only way to catch them is to put upward pressure on the AUMC stock price and of course the magic pill is cash dividends. Cash dividends are something MC seems openly committed to doing. So this should all workout as far as any naked short supply out there.

Hi Madmen,

Thanks for the question and I apologize for being so slow in getting back to you. In all sincerity, my “level of confidence” has never been higher in regards to Auryn/Medinah and the ADL Mining District. What encourages me the most, in regards to the DL2 Mine and the ADL Mining District in general, are the POTENTIAL ECONOMICS, from an earnings per share (“EPS”) point of view. I sense a bit of a “perfect storm” lining up. To me, EPS is the single most important parameter to consider in relationship to the prognosis for success of an investment on the OTCMarkets. It’s not top line income, AISC, or EBITDA, it’s good old-fashioned EPS. If you’ve got strong EARNINGS PER SHARE, and not just decent “EARNINGS” in a corporation with a gazillion shares outstanding, then management can convert that “EPS” into “GUARANTEED SHAREHOLDER REWARDS” despite all of the shortcomings of our OTCMarkets, and they are manifold.

In regards to the DL2 Mine, what’s really noteworthy for me is the rather fortuitous TIMING of bringing it into production. It’s always a good time to bring an extremely high-grade vein like the DL2 Vein into production. By “PRODUCTION”, I certainly include the mining and stockpiling of ore while awaiting the permitting, financing and construction of a froth flotation plant, an on-site assay lab and a tailings impoundment facility.

Recall that the construction of this facility is going to increase the “DIRECT FINANCIAL IMPACT” (management’s words) of the project by a full $5,000 per tonne of ore over and above the handsome amount that this ore would have earned by being “DIRECT SHIPPED” to one of the Codelco/Enami smelter facilities. One of the goals of all current shareholders and prospective investors should be to UNDERSTAND the breakdown of that $5,000 per tonne “DIRECT FINANCIAL IMPACT” figure. For a mining project, you’ve got your top line INCOME figure from the sale of that which you produce. You need to subtract from that TOP LINE INCOME figure the COST incurred to produce that which was sold. The differential will be the PROFIT MARGIN.

Management’s DIRECT FINANCIAL IMPACT of $5,000 per tonne had to do with the differential in the profits received between DIRECT SHIPPING the DL2 Vein’s UNTREATED ore to Enami’s smelter versus PRETREATING that ore with froth flotation on-site at the ADL. That $5,000 figure represents a combination of a greater top line INCOME figure and a lesser amount of ALL IN SUSTAINING COSTS (AISC) to produce that which was sold.

If you froth floated the ore on-site and were able to bring in an extra $5,000 per tonne in TOP LINE INCOME because you were selling a product which was greatly concentrated and much more refined but it COST you an extra $6,000 per tonne to enhance the grade, then you actually had a negative DIRECT FINANCIAL IMPACT and you would never build a froth flotation plant under these circumstances. We don’t know the exact breakdown of the higher TOP LINE INCOME and the lower ALL IN SUSTAINING COST that contributed to that $5,000 differential BUT WE DON’T NEED TO. Assume, for now, that the breakdown is an extra $2,500 per tonne in TOP LINE INCOME and an AISC of $2,500 per tonne less. The point is that the ECONOMICS were greatly enhanced by building a FF plant on-site. You need to keep in mind that this $5,000 per tonne “bonus”, if you will, refers to an “extra” $5,000 being realized OVER AND ABOVE THE HANDSOME AMOUNT THAT Enami was willing to pay Auryn for DIRECT SHIPPING that ore to Enami’s smelter.

BREAKING DOWN THE $5,000 PER TONNE “BONUS” ASSOCIATED WITH AURYN BUILDING THEIR OWN FF PLANT

In a nutshell, the DL2 Vein ore has 2 shortcomings, if you can call them “shortcomings”. The gold particles are extremely small and are referred to as “fines” and “ultra-fines”. Their presence makes this ore technically “refractory” (not “free-milling”) and in need of special techniques to recover. Is “refractory” ore necessarily a bad thing? It depends on how expensive it is to address the “refractory” nature of the ore. The good thing about “refractory” ore is that it typically has a much higher GRADE than “free-milling” ore.

The other “shortcoming” of the DL2 Vein ore is the vast amount of “ARSENOPYRITE” or “ARP”, that the DL2 Vein gold coexists with. “ARP” is very much a mixed blessing. On the one hand, it is a very powerful “gold magnet” and the gold contained in the hydrothermal fluids emanating out of underlying magma chambers, makes a bee-line straight to the “ARP” molecules where it tends to accumulate in huge concentrations. That’s a good thing. The bad news is basically the same as the good news. The attraction is so strong, between the gold and the “ARP”, that it’s difficult to separate the gold from the “ARP” when it’s time to recover the gold.

The good news for Auryn is that there is a very inexpensive way to address BOTH of these shortcomings of the DL2 Vein ore. It’s called “froth flotation”. Auryn experimented with DIRECT SHIPPING their DL2 Vein ore to the Enami smelters. The “GRADES” were wonderful and Enami offered to pay a lot of money for the ore but the PENALTIES for the ARSENIC contained in the “ARP” were substantial because it is a human and environmental toxin UNLESS REMOVED BY FROTH FLOTATION PRIOR TO SMELTING.

As noted, the solution for BOTH of the “shortcomings” of the DL2 Vein ore was to put in a RELATIVELY INEXPENSIVE froth flotation plant on-site to recover the “fines” and “ultra-fines” and to remove and store the ARSENOPYRITE in a safe manner on-site. When you expose “ARP” to the smelting process without first safely removing the ARSENIC via froth flotation, the high heats involved in smelting volatilize the ARSENIC and convert it into its most environmentally damaging form i.e. ARSENIC gas. ARSENIC gas is also hard on the clay crucibles used in the smelting process. Thus, Enami needs to hand out stiff penalties for ARSENOPYRITE encountered in the smelting process. In essence, Auryn got very lucky; the ore ended up responding “exceedingly well” (management’s words) to froth flotation.

The combination of being able to INEXPENSIVELY recover the “fines” and “ultra-fines” and to safely and INEXPENSIVELY remove the ARSENIC prior to smelting and thereby circumvent the stiff penalties, results in Auryn being able to realize that “extra” $5,000 per tonne over and above the handsome amount Enami was willing to pay for Auryn to DIRECT SHIP that ore straight to the Enami smelters. When factoring in the CAPEX costs to build a froth flotation plant and the OPEX (OPERATING COSTS) to operate an FF plant, the combined COST is only $10 per tonne treated. Smelting costs closer to $184 per tonne down in Chile. I don’t think it is fair to characterize this particular situation as Auryn being able to put in an extra $10 per tonne in order to realize an extra $5,000 per tonne in income. But I do feel that it reveals the existence of some serious ECONOMIC LEVERAGE being present. If the COST to froth float a tonne of ore was $6,000 per tonne, then we wouldn’t be discussing the ECONOMIC LEVERAGE of putting in your own FF plant. Again, Auryn got lucky when the super-cheap solution to these “shortcomings” performed admirably.

Part of the cost savings has to do with the fact that the worthless “gangue” material removed during froth flotation is stored on-site at the ADL, and never needs to be TRANSPORTED or SMELTED. Nor do you have to pay Enami to store, on their landholdings, the discards from your ore. The product of the froth flotation process is an extremely high-grade “FLOAT CONCENTRATE” which is in very high demand in Chile. Auryn was very fortunate with their metallurgists being able to design a FLOW SHEET that maximized the ECONOMICS of the project. In a recent update from Auryn, Auryn management referred to this as management having received “actionable insights from Auryn metallurgists”.

In an update from a couple of years ago, Auryn cited that they had initiated preliminary lab testing of the DL2 Vein ore and that the results went “exceedingly well”. At the time, I doubt that any of us were contemplating Auryn realizing a “DIRECT FINANCIAL IMPACT” of an “extra” $5,000 per tonne. Recall also that Auryn management had announced the completion of “DETAILED CASH FLOW MODELS” that had been presented to the “potential financiers”, but not yet to us shareholders. I’m going to assume that management pretty much has to make those projections available to us once any financing is completed.

WHAT ARE THE ODDS?

I like to study statistical and geostatistical probability. What are the chances of flipping a coin 3-times and having them all come up heads? Well, it’s 1-in-8 i.e. 1-chance in 2 times 1-chance in 2 times 1 chance in 2 or .5 times .5 times .5. You have to MULTIPLY the chances for 1 outcome, times the chances for a separate outcome, etc. and line them all up in a row.

Let’s start with what are the statistical chances for a miner to bring an average grade (4.18 gpt gold) gold vein deposit into production. The industry/World Gold Council says that somewhere around 1-in-1,000 mineral “prospects” will EVER be put into production. (Note how that dire statistic is self-explanatory. Who is going to fund exploration projects when the chances for failure are so high? Mineral prospects that can’t get funded end up going into the prospects that never got put into production category.) Next, consider the statistical probability of being able to bring an extremely high-grade gold vein deposit (and not just an average grade vein) into production. Of 10 veins being put into production, perhaps 1-in-10 would be considered “extremely high-grade”. Now consider the chances of bringing AN EXTREMELY HIGH-GRADE GOLD VEIN DEPOSIT INTO PRODUCTION AT A TIME WHEN THE PRICE OF GOLD JUST HAPPENS TO BE TRADING AT ALL-TIME-HIGHS. I won’t even venture a guess on the statistical probability for this, but for Auryn it is a STATISTICAL REALITY. This appears to be a VERY fortuitous time to bring that 1-in-1,000 mining prospect, that is also of an extremely high-grade, into production.

Next, consider the odds of a mining corporation accomplishing all of this at a time in which it only has 70 million shares outstanding on a fully-diluted basis. Now the conversation starts aiming towards a significant EARNINGS PER SHARE. Next, consider accomplishing that in a corporation where, of that miniscule 70 million shares outstanding, about 64% of them are RESTRICTED from resale by Rule 144 due to them being owned by management or “affiliates”. Rule 144 protects investors and only allows small dribs and drabs of shares to be sold in a situation like this on a quarterly basis, and that can only be done after the management member publicly files a Form 144 declaring the intent to sell some shares. In other words, fellow shareholders are granted full visibility of management’s intent to sell shares. I think you can start to sense the distant odds that Auryn has overcome to get to the point that they are at today.

Now, layer upon the above facts some other facts:

- That 1 extremely high-grade DL2 Vein is actually one of 6 Main Veins that appear to have similar grades. The DL2 Vein also features significantly high grades of copper and silver.

- Those 6 Main Veins are contained in the ADL Mining District which also features skarns, breccias, stratabound copper deposits, shear zones, mantos, and copper-moly and copper-gold porphyry prospects.

- That entire ADL Mining district is 100% owned by Auryn.

- In the mining industry, when the price of the underlying metals goes up, the additional values tend to drop down to the bottom line because many of the costs are of a fixed nature.

- The world’s attention right now is on gold, copper and silver assets for various reasons including inflation, decarbonization of the planet and solar panels.

- New discoveries in these sectors are at historical lows at the exact same time that demand is through the roof. Many of the majors have shut down their exploration budgets because of the distant odds for success. They know that they’re going to have to pay through the nose for these new discoveries made by the juniors but, to them, that beats risking hundreds of millions of dollars and coming up with nothing.

What I sense going on here is an awful lot of stars lining up at the same time. Because of the importance of GRADES in this sector, what really stands out are the ECONOMIC PROSPECTS and creating an “EARNINGS MACHINE”. In this sector, people tend to concentrate on things like the number of ounces of MINERAL RESERVES/MINERAL RESOURCES (MR/MR) that are in the ground even though they may not be mined for 5 to 10 years (if ever) and when the price of gold might be who knows where. People praise a miner mining 300,000 ounces of gold per year even though they are barely breaking even due to plummeting GRADES and high COSTS.

THE SIGNIFICANCE OF THE PERMITTING, FINANCING AND CONSTRUCTION OF THE NEW AURYN FROTH FLOTATION FACILITY IS CLOSELY TIED TO THE $5,000 PER TONNE “BONUS” AURYN CAN REALIZE BY PULLING IT OFF

The significance of Auryn/Medinah being able to get their froth flotation plant/”mill” not only permitted by SERNAGEOMIN but also financed and constructed, has to do with the resultant ECONOMIC WINDFALL associated with Auryn’s being able to realize that “extra” $5,000 per tonne “DIRECT FINANCIAL IMPACT”, over and above the handsome amount that Enami would pay Auryn to “DIRECT SHIP” the DL2 Vein ore to the Enami smelting facilities. The question then becomes, how many tonnes might we be talking about?

In regards to the shipment of ore sent to the Enami smelter, the “agreed to/settlement” grade came in at an extremely robust 57 gpt gold, 978 gpt silver and 3.21% copper after Enami deducted their smelting “TC’s” (treatment charges) and “RC’s” (refining charges) as well as their PENALTIES for contaminants like arsenic and/or mercury. There is nothing wrong with the amount of money Auryn could make by DIRECT SHIPPING their ore to the Enami smelters. They could make a fortune. The problem is the amount of “extra” money they would end up leaving on the table and could earn by just putting in their own FF plant that is extremely well “dialed-in” to the specific needs for their specific type of ore.

Is the term “ECONOMIC WINDFALL” too strong here? I certainly don’t think so, $5,000 PER TONNE “extra” represents a lot of money, especially when there are a lot of “TONNES” involved over the course of a mine life probably measured in terms of many decades for just the 6 “Main Veins” at the ADL Mining District. The stakes are very high in this endeavor because of the enormous amount of ECONOMIC LEVERAGE present due to the size of that “differential” measured on a PER TONNE basis. One tonne of DL2 Vein ore would equate to an 8’ by 5’ pickup truck bed filled to just 4-inches of depth. One tonne of ore does not represent very much ore when the “SPECIFIC GRAVITY/DENSITY” of the ore is 2.6 tonnes per cubic meter.

The 6 Main Veins, as well as the other different deposit styles present at the ADL, will all share the use of this new “mill”, its contained on-site lab and the tailings facility. Since Auryn owns 100% of the entire ADL Mining District, this $5,000 per tonne “bonus” need not be shared with any other co-owning parties, JV partners, or royalty streamers. The combined “MINE LIFE” of all of these deposit styles and veins is impossible to estimate accurately now, but it appears to be significant.

No need to apologize for anything, breccia.

You of course had me after “my level of confidence has never been higher.”

I went ahead and read (and even believe I understood) all the rest, which, as always, leaves me kinda breathless. Thirteen years and counting…

Thank you for the reply. I always appreciate your words.

– madmen

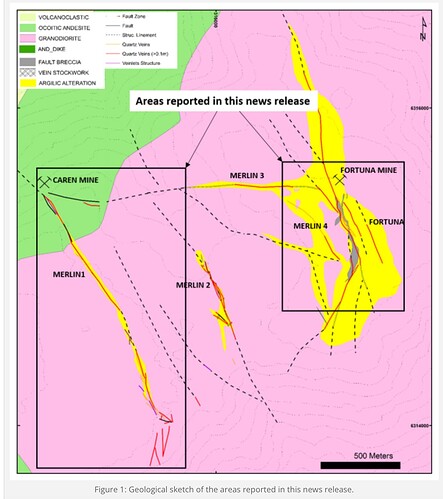

BB, Quite some time ago you mentioned the Caren mine may connect to the Fortuna Mine in the west-east direction through the Merlin 3 vein. Merlin 1, 2, 4 and the Fortuna veins run mostly parallel to each other in a NW to SE direction. These are all believed to be quite high-grade veins at depth and only hinted at by the multiple veinlets running mostly N-S orientation mapped out from the surface trenching. To what depth do the major high-grade vein structures run and do you expect this to be incorporated into future production planning? Is this one of the several possible JV financing options for exploration and development you had in mind?

EZ

Digging way back into what was already known about structures on the ADL as far back as 2015 has not been forgotten. I recall the vein structure graphics shown below in the news release. These are the same veins I mentioned in my previous post. Of special interest are the known veins previously explored at surface yet to be fully explored.

MERLIN III

Merlin III vein is an E-W trending vein and intersects the Fortuna NNW structure close to the old Fortuna de Lampa Mine.

Merlin III has a 2 (two) meters average vein width. The vein is characterized by massive and breccia textures with crystalline quartz-hematite-jarosite.

The intersection between Merlin III (E-W), Fortuna Oeste (NW) and Fortuna central (NNW) develops a highly prospective zone in Altos de Lipangue. (See Figure 3 and Table 2)

It had previously been posted that the DL1 & DL2 mining project was needed to kickstart the much larger projects that shareholders hope to see some day. These two goals were accomplished during the past 2 years. Fast paths to riches in mining rarely happen quickly. It appears MC’s methodical progress towards the goals of expanding the Auryn/Medinah and ADL Mining District are beginning to finally shape up to show long awaited results. Expectations for next several QTR reports are optimistically high.

EZ

AN “AT A GLANCE” VIEW OF THE ORE GRADES ENCOUNTERED THROUGH HISTORY AT AURYN’S DL2 VEIN (FORMERLY THE “FORTUNA CENTRO VEIN”)

“GRADE” is by far and away the single most important parameter in evaluating the potential ECONOMICS of an underground “narrow vein-type” mineral deposit. Nothing else comes even close except for the AVERAGE WIDTH of the vein. The DL2 Vein has a “strike length” of at least 1,000 meters extending from NNW to SSE across the ADL plateau. It extends to a minimum depth of 700-meters below the plateau surface as indicated by surface outcroppings. The “footprint” of this vein, as well as that of the other 5 “Main Veins” present at the ADL Mining District is significant.

From 1940 to 1970, the artisanal miners of the vein (with the corporate name of “SMFL”) mined out a 350-meter stretch of the vein “on strike” at surface, down to a depth of about 100-meters. If you drew a “longitudinal cross section” of the mountain extending from NNW to SSE, the previously mined-out area would look like a rectangle.

What I would suggest is recreating this rectangle on a piece of paper with the 350-meter length extending from left to right across the top of your piece of paper and the 100-meter depth/width extending from the top of the page downwards. I’d then label the top of the rectangle as being 350-meters long and the sides as being 100-meters long vertically. I would then put 2 marks on each of the two 100-meter depths/sides of the rectangle spaced one-third of the way down that 100-meter length and two-thirds of the way down that 100-meter length. Then draw 2 horizontal lines, one connecting the top two marks and the other connecting the bottom two marks. That original rectangle should now be divided into 3 equally-sized but smaller rectangles.

In the middle of that top smaller rectangle, write-in 54 gpt gold. In the middle rectangle, write in 64 gpt gold and in the bottom of the smaller rectangles, write-in 74 gpt gold. These are the gold grades experienced by the artisanal miners/”SMFL” as a function of the depth below the surface. THE GRADES ARE CLEARLY TRENDING HIGHER WITH DEPTH. The horizontal line forming the bottom of the top, smaller rectangle should be labeled “level 0”, the floor of the middle rectangle should be labeled “level 1”, and the floor of the lowest mini-rectangle should be labeled “level 2”. These are the levels of the “old works” that the artisanal miners did their mining at.

Next, with dotted lines (yet to be mined out), add a fourth, equally-sized mini-rectangle, directly beneath the lowest of the 3 smaller rectangles i.e. the one labeled 74 gpt gold. Mark the base of this rectangle as “level 3”. The Antonino Adit (located at “level 3”), intersected the DL2 Vein, approximately at its mid-point, right below the “74 gpt gold” marking. Assuming this “longitudinal cross-sectional” representation is sitting on a flat tabletop, the Antonino Adit approaches this cross-sectional representation from “below” the table i.e. from the NNE. At the intersection point of the Antonino Adit and the DL2 Vein, Auryn then drifted a “ventilation/safety egress raise” in order to break through (upwards in elevation) into “level 2”.

Auryn did 2 sets of “channel samplings” at this intersection point located at the midpoint of “level 3”, beneath the 74 gpt denotation. These came in at 164 gpt for group 1, which consisted of 4 separate channel samples, and 150 gpt for group 2. Write-in “164 gpt,150 gpt” on level 3 directly beneath the 74 gpt marking on level 2.

Next, we need to incorporate the results of 2 groups of smelter tests from the ore found at the intersection of the Antonino Adit and the DL2 Vein at level 3. The samples sent to the Plenge Lab in Lima, Peru came in at an average of 128 gpt gold. The smelter tests run at the Enami smelter came back at 57 gpt gold, 978 gpt silver and 3.21% copper. When you factor in the contributions from the copper and the silver, the “gold equivalent” grade comes in at about 70 gpt gold for this Enami smelter sample. So, now we need to add a 128 gpt and a 70 gpt notation next to the 150 gpt, 164 gpt gold notation on “level 3”.

To the left of the “150,164, 128,70 gpt” notation, where level 3 intersects the left-hand vertical line of this new 4-compartmented mega-rectangle, write in 154 gpt gold. This sampling was done by Auryn earlier on, underneath where “shaft A” intersected “level 2” just beneath the “old workings”. Twelve separate channel samples were involved in this sampling. Of future significance here is the fact that as Auryn works towards the NNW on level 3, they should encounter about 150-lineal meters of grades ranging from the “150,164,128,70 gpt” notations to the “154 gpt” notation 150-meters to the NNW BUT AT THE SAME ELEVATION. (Read that a couple of times if you have to because this is a pretty significant stretch of vein material that should be fairly consistently EXTREMELY HIGH-GRADE ore.) Earlier, Auryn completed another group of samplings from levels 0,1, and 2 that came in at an average of 85 gpt gold. You can chart this on the left-hand vertical line of the 3-membered rectangle at levels 0,1, and 2.

Note that the HISTORICAL PRODUCTION FIGURES from levels 0,1, and 2 i.e. labeled 54 gpt, 64 gpt, and 74 gpt gold, average 64 gpt gold which is how these figures were reported by ACA Howe in their summary report on the “Fortuna Centro Vein/DL2 Vein” system. These HISTORICAL PRODUCTION FIGURES are what are referred to as “agreed to/settlement grades” made with Enami AFTER THEY TOOK OUT FEES FOR PROCESSING THE ORE OF THE ARTISANAL MINERS. We don’t have the original “intra-adit head grades” before Enami took out their fees but they would have been higher than that 64 gpt average. You might think of these grades as “64 gpt gold PLUS “E”, with “E” representing the grade deduction associated with Enami’s fees. The rest of the grades reported on this “AT A GLANCE” drawing are standard “intra-adit head grades” measured at an assay lab without any deductions for processing fees.

For benchmarking purposes, keep in mind that the average grade being mined from similar underground “narrow vein” deposits is currently 4.18 gpt gold worldwide. This figure is dropping by 6% per year because miners typically “HIGH-GRADE” their deposits, selectively mining the highest-grade gold first, and leaving the lower grade gold for later. Well, “now is later” as far as that goes. The artisanal miners, in total, only mined about 4% of the ore present in the DL2 Vein. SUFFICE IT TO SAY THAT THIS IS A VERY HIGH-GRADE VEIN AND THAT THE SUPPOSITION IS THAT THE OTHER 5 MAIN VEINS WITHIN THIS “MESOTHERMAL VEIN SET” ARE LIKELY (no promises) TO FEATURE SIMILAR GRADES, WIDTHS AND MINERAL CHARACTERISTICS. Earlier, Auryn completed an exhaustive trench sampling program that identified over 5,000-lineal meters of gold-bearing veins that made it all of the way to surface. While drifting the Antonino Adit, Auryn intercepted yet another 24 “veins/structures”.

THE TREND

You can clearly see the “UPWARD TREND” in gold grades as a function of depth below the plateau surface. Auryn has commenced mining and stockpiling the ore from the “150/164,128,70 gpt gold” fourth rectangle with the dotted lines. They have temporarily paused these activities as they look after the permitting, financing and construction of the new FF plant. The mining and stockpiling phase lasted a little over 200-days.

The 6 Main Veins that make up this “Vein Set” at the ADL Mining District are what are referred to as “MESOTHERMAL VEINS”. These “Mesos” are famous for improving BOTH GRADES AND WIDTHS WITH DEPTH which is exactly what we are witnessing here. These “Mesos” form at much deeper levels than the much more typical “EPITHERMAL VEINS” being mined worldwide do. The pressures and temperatures are much higher at these depths. The overall grades and widths of the “Mesos” are vastly superior to the “Epithermal Veins”, which the industry is much more used to. They have superior “CONTINUITY AND CONTIGUITY”. You might think of a redwood tree versus a birch tree.

In Chile, there is a well-known “belt” of mesothermal veins that stretch from the Curacavi Mining District, the southern next-door neighbor of the ADL Mining District to Colliguay, which is the northern next-door neighbor of the ADL Mining District (from “THE GEOLOGY OF CHILE” written by Theresa Moreno and Victor Maksaev).

Since the Antonino Adit basically bisected the DL2 Vein near its midpoint in its strike from NNW to SSE, Auryn has been mining from 2 separate “working faces” on level 3. One is oriented towards the NNW and the other towards the SSE. You might add an arrow to the top left border above the various rectangles aiming to the left and labeled “NNW”. Similarly, you might add an arrow above the right-hand corner of these rectangles aiming to the right labeled “SSE”.

Because Auryn successfully intersected the DL2 Mine’s “old workings” and its component 7 vertical ventilation shafts/raises and 5 component “ventilation chimneys”, and this new ventilation/safety egress system was formally approved and permitted by SERNAGEOMIN, Auryn can now add sub levels, below level 3, which will EACH add 2 new “working faces” to the project. This provides what is referred to as “SCALABILITY”. We do not have an estimated timeframe, that Auryn management feels will be needed to add each new sub level. The various sub levels will be accessed via what is known as a “spiral decline”. We anticipate that the INTRA-ADIT PRODUCTION RATE will go up over time in a “stair-step” fashion as each new pair of “working faces” is added with each new sub level accessed. The first sub level added (Level 4) should double Auryn’s INITIAL PRODUCTION RATE since the original 2 “working faces” will be doubled to a total of 4 (and then 6,8,10,12, etc.). Since Auryn can selectively mine the richest and widest vein segments it encounters, it has been provided with OPTIONALITY.

From studying the history of the grades improving with depth from the plateau surface, the question obviously becomes what range of grades might Auryn expect from levels 4,5,6,7, etc. Note that the WIDENING of the vein structure with depth, also basically increases the amount of gold released with each “blast cycle”.

The 6 Main Veins found at the ADL Mining District should be studied as a group of veins or an inter-related “Vein Set”. We know the most about the DL2 Vein because of the extensive amount of work done on it and the HISTORICAL PRODUCTION FIGURES over 30 years of mining totaling about 2,000 tonnes of ore. Although the PRODUCTION RATE achieved by the artisanal miners was not that impressive, nonetheless the 2,000 tonnes mined represents an extremely impressive “SAMPLE SIZE” from a geostatistical reliability point of view.

We also know quite a bit about the Caren Mine and the westernmost Merlin 1 Vein it was developing. It also features “bonanza-type” gold grades, interestingly, at the same elevation above sea level as those found at the DL2 Vein i.e. about at the 1,840 masl elevation. In fact, the trench samples of the Merlin 1 Vein which averaged over 26 gpt gold EVEN AT THE VERY SURFACE OF THE PLATEAU, exceeded those of the DL2 trenching results. The strike length of the Merlin 1 Vein is over 1.9 Km in length at surface. The stellar grades being found at the component veins within a “Vein Set” which are famous for having similar characteristics within their component veins, is very encouraging for what future development efforts might reveal.

NOW IT IS IMPORTANT TO PROVIDE SOME CONTEXT PERTAINING TO WHAT AURYN IS DOING

Most of the discussion regarding GRADES has had to do with the grades found within the “intra adit” ore. This is also referred to as the “intra adit head grade” or sometimes as the “mill grade” which refers to the grade of the ore that ARRIVES AT THE MILL VERSUS EXITS FROM THE MILL. The “intra adit head grade” is obviously of critical importance. But since Auryn is building its own froth flotation plant on-site, there is going to be a GRADE that is even more critical than the “intra adit head grade” and that’s the grade of the “float concentrate” that is the product of the froth flotation system. This is the material that will be shipped and sold. It will be of much higher VALUE than the intra adit ore or else the FF plant wouldn’t have never been built. The enhanced VALUE of the float concentrate over that of the intra adit ore has to exceed the amount of money it cost to build and operate the froth flotation plant. If the froth flotation system is extremely efficient and the FLOW SHEEET designed to run it is well “dialed-in”, then sometimes the enhanced VALUE is extremely significant from an ECONOMICS point of view.

The grade of the “float concentrate” will exceed that of the already stellar “intra adit head grades” by an average factor of in between 2- and 20-FOLD depending on the efficiency of the froth flotation system. We already have had a head’s up as to HOW “efficient” the Auryn FF plant is going to be. This was incorporated into the findings that Auryn will be able to realize an “extra” $5,000 per tonne, over and above the handsome amount that Enami was willing to pay for Auryn to DIRECT SHIP their ore from the adit to the Enami smelters.

In other words, it appears that the already off the chart “intra adit head grade” of the DL2 Vein ore is about to get MAGNIFIED by a significant amount. But the question that then begs to be asked becomes, how much is this GRADE MAGNIFICATION going to cost Auryn. The good news is that the average cost of “froth flotation” worldwide is only $10 per tonne. This includes the CAPEX to build the plant, the OPEX (“operating costs”) to run the plant and provide it with chemical reagents, and the life expectancy of the plant. These plants are usually modular, and the “throughput” of the plant i.e. the amount of ore that can be processed on a daily basis, can be increased on a regular basis as the intra adit PRODUCTION RATE naturally increases.

What’s a little scary is the concept that the nature of Auryn’s ore is such that putting in an extra $10 per tonne in ore processing CAPEX AND OPEX costs, amortized over the life expectancy of an FF plant, can release an extra $5,000 per tonne, in the amount Auryn can realize from the sale of their ore that was “froth floated” on-site, prior to the next step of purification. How do we make sense of that kind of ECOMOMIC LEVERAGE, it seems excessive?

This whole issue started when Auryn took two samples of ore from the area where the Antonino Adit intersected the highly sought after DL2 Vein, and sent them to test how the DL2 Vein ore responded to the SMELTING process. One sample was sent to the smelting facilities at the Plenge Lab in Lima, Peru. The results came back that the ore contained 128 gpt gold. A second sample was sent to the Enami commercial smelting facilities near Santiago. The results came back with an “agreed to/”settlement” grade of 57 gpt gold, 978 gpt silver and 3.21% copper. Note that the smelting process was conducive to Auryn being paid for all 3 of the sought after metals with the majority of the value contained in the gold. These figures were determined AFTER ENAMI TOOK OUT THEIR SMELTING FEES AND ANY PENALTIES LEVIED ON TOXIC SUBSTANCES LIKE ARSENIC OR MERCURY.

Although the amount Enami was willing to pay was very significant even after the fees and penalties, Auryn management was not too pleased with the DIFFERENTIAL between the actual gold content of their ore, 128 gpt, and the 57 gpt “settlement” figure for that gold. The differential was 71 gpt gold. Auryn’s metallurgists determined that the 2 main shortcomings of the DL2 ore was the size of the gold particles, tiny particles known as “fines” and “ultra-fines” as well as the concentration of a metal sulphide known as ARSENOPYRITE which contains the toxin ARSENIC.

ARSENOPYRITE is known as a “gold magnet”. During the formation of gold-bearing veins, gold particles are strongly attracted to any surrounding ARSENOPYRITE molecules and the resultant concentrations of the gold can be enhanced as much as 1 million-fold (not a misprint). ARSENOPYRITE is relatively harmless unless ore containing large amounts of ARSENOPYRITE is smelted prior to the ARSENOPYRITE being safely removed via “froth flotation”. The smelting process is a “pyrometallurgical process” that uses blast furnaces to melt the ore. If the ore contains ARSENOPYRITE, the toxic substance “ARSENIC” will be released in gaseous form and this does represent a human and environmental toxin. Enami has to levy stiff penalties when this occurs.

The froth flotation process allows miners to take advantage of the extremely high-grade gold found n conjunction with ARSENOPYRITE while removing the toxic nature of the ARSENIC molecules contained within ARSENOPYRITE. Due to the stiff smelting penalties being circumvented by the prior froth floating of the ore, the overall ECONOMICS can be vastly improved. Upon learning about the ECONOMIC DIFFERENTIAL at hand, the Auryn BOD unanimously agreed to temporarily pause the mining and stockpiling of the ore at the DL2 Mine in order to concentrate on the permitting, financing and construction of the froth flotation facility. The ECONOMIC LEVERAGE involved in spending perhaps $10 per tonne in order to realize an extra $5,000 per tonne is significant and made the decision to build the plant pretty much a ”no-brainer”.

Based on the stiff penalties levied upon ore containing ARSENIC by the Enami smelter operators and the difficulty in recovering small-particled gold, the Auryn metallurgists determined that on-site froth flotation, the “cure” of choice for BOTH of these shortcomings of the DL2 Vein ore, could drastically change the ECONOMICS of the mining operation. Part of this is due to the fact that “froth flotation” is extremely inexpensive. Approximately 7% of the sulphides present within the DL2 Vein ore is made up of ARSENOPYRITE. This helps to explain how the gold grade of this ore has been pretty much consistently “off the charts” since Day 1.

There are many dozens of articles available in the scientific literature explaining the role of ARSENOPYRITE and inordinately high grades of gold. The attraction between the ARSENOPYRITE and the gold particles occurs at the atomic level and involves processes known as adsorption and chemisorption. In layman’s terms, the concept of ARSENOPYRITE representing a “gold magnet” pretty much explains it sufficiently. In the sciences, it’s interesting how if you study a topic and notice certain “ANOMALIES” like the grades of gold at the DL2 Vein being many, many times the average worldwide, or the economics of a mining project being subject to enormous amounts of improvement and LEVERAGE that initially seem difficult to explain, there is often an underlying phenomenon present, like arsenopyrite or “fine” and “ultra-fine-sized” ore particles, that explains the various “ANOMALIES”.

In their most recent quarterly update, management cited that they had completed “DETAILED CASH FLOW MODELS” outlining the ECONOMICS of the DL2 Mine operation including the FF plant. They had to have completed these before they could calculate that $5,000 per tonne “extra” income figure. The detailed information of the breakdown of the $5,000 per tonne differential has been released to the “potential financiers” studying the financing of the FF plant BUT NOT YET to the shareholders or the investing public. One might be able to appreciate that the “potential financiers” might want Auryn management to “sit on” any news that might encourage other potential financiers to submit competing bids.

From an ECONOMICS point of view, the ideal scenario for an underground miner would be to start with off the chart “intra adit head grades”, perhaps associated with high levels of ARSENOPYRITE, and then deploy the most efficient froth flotation system possible that provides the best “bang for the buck” in enhancing those already high “intra adit head grades”. The Auryn metallurgists and Mining Engineers have no doubt been working with the metallurgists at the various froth flotation manufacturers to design and develop a FLOW SHEET resulting in the maximum RECOVERY PERCENTAGE and GRADE ENHANCEMENT for the DL2 Vein ore.

The point should be made that since the DL2 Vein is indeed a part of a “Vein Set”, the precise “dialing in” of the idealized froth flotation FLOW SHEET as well as the construction of the FF plant itself, should add incremental “value” to ALL of the component veins of that “Vein Set”.

REVIEW OF THE MINING LITERATURE REGARDING THE ENORMOUS GRADES OF DEPOSITS WITH GOLD ASSOCIATED WITH ARSENOPYRITE

When you review this literature, it’s interesting how the various authors cite the enormous grades of gold found in proximity to arsenopyrite with such nonchalance. A gold-arsenopyrite mine found in Siberia featuring average grades of 2,700 gpt gold was treated as no big deal, ho-hum. The gold particles attracted to arsenopyrite are often so tiny that they are referred to as “INVISIBLE GOLD” or “SUBMICROSCOPIC GOLD”.

For many decades, the manufacturers of ore processing equipment have been rolling out new lines of specialized equipment that go specifically after “INVISIBLE GOLD” associated with arsenopyrite. Over the last 20 years or so, several breakthroughs have occurred in the field of “froth flotation” that have finally produced some impressive “recovery rates” for this ore containing “fines” and “ultra-fines” associated with arsenopyrite.

One of the biggest names in the mining industry in general, Glencore, rolled out their “Jamieson” system for recovering “INVISIBLE GOLD” associated with arsenopyrite. The concept of froth flotation is actually very simple. You have a cylinder or “cell” of water that has an agitator to keep the ore, which had been previously ground into a sand-like consistency, suspended in the water as a “pulp”.

A source of bubbles is situated at the bottom of these “cells”. Certain chemicals like water and are referred to as “hydrophilic”. Arsenopyrite fits into this category. Gold, on the other hand, hates water and is considered “hydrophobic”. It would rather implant itself into the lining of an air bubble and ride up to the surface, than to hang out with water down below.

Chemicals like “xanthate” are added to the “cells” and they coat the gold particles and the air bubbles which make the affinity of the gold for the lining of the air bubble to be that much stronger. The submicroscopic-sized gold particles collect at the surface of the “cells” in a “froth”. The froth is periodically swept into a receiving vessel and the arsenopyrite remains at the bottom of the “cells” surrounded by water. It is then pumped in a slurry to an on-site tailings impoundment facility where it is safely stored. The extremely high-grade froth, now known as a “float concentrate”, is sold to a buyer that has the means to convert it the rest of the way into gold bullion.

There were high levels of this “gold magnet” known as arsenopyrite present in the magma chamber that underlies the ADL Mining District. When the pressure levels within the magma chamber periodically built up, arsenopyrite rich molecules laden with gold particles were released upwards through breaches in the roof/carapace of the magma chamber and they filled natural faults and cracks within the overlying rock. This gave rise to things like veins, porphyries, skarns, breccias, mantos, stockworks, stratabound deposits, etc. As these deposit types are studied, it will be interesting to see if the abnormally high grades of gold found in the veins repeats itself in the other deposit types.

We’re sitting on a gold mine (pun intended)!

Thanks BB, even a guy like me can understand this - we’re truly blessed.

I wonder about the logistics of FF - how large are the batches, and how long does it take? Will we be able to send 40 tons of high-grade froth to Enami on a daily basis?

Auryn Mining Corp - Website Update

We have posted an update on our website.

May 29, 2024 – Shareholder Notification | AURYN Mining Corporation

On behalf of the Auryn Mining Corp Board of Directors.

Excellent news!! Financing, Production to commence 1Q of 2025!

Baldy was right again. Sorry Doc, you were wrong about them not giving up equity.

Looks like everyone else gets to eat before we do. They get to take $20M for investing $4M. Earning 5x your money in 5 years. Sounds like an extremely expensive financing deal for a small amount of money to be raised.

And of course, very limited details about this preferred dividend mechanism and how it works.

Sorry not purposely being negative, but I was worried about an insider equity grab or anything dilutive.

It hasn’t closed yet. If you’re able, come up a better offer I am sure management will listen.

Took the words right out of my mouth. Why the hell wouldnt they ask their shareholder base.

$4M isnt that much money

They did. If you can raise $4M, private message me. I’ll bring it to MC.

Im sure Baldys outfit could have given him better terms. But apparently not. Sheesh

Now that this news has come out when are we to expect the share conversion before production or after?

By the way - if they’re able to get a 5x return (capped) in 5 years, think about what that means for us.

They are betting on a grand slam! They make money we make money. I’m good with that!