Same here!!! Stock price zero.

[MDMN](https://www.stockwatch.com

U:MDMN) - Q 0.000001 -0.000599 -99.8% Volume : 28,000

Welcome to the Expert Market, You can sell but you’ll probably have no idea what the current BID price is !!!

Now would be the time to do a Roth Conversion, if you hold shares in an IRA. I did one back in September. Wish I had known this was coming.

So we need to create an account on OTC Expert Market to access our shares?

My Schwab account that was moved over from TD will not log in. Getting message “login unavailable, working to resolve the problem”. All day! Anyone else with this message. Doesn’t sound like it’s AUMC specific.

BTW, I’ve been logging in to my Schwab account for months with no issues…

Yes, I’m getting the same message with my Schwab account.

My Schwab said the same thing but it was resolved after about an hour. My MDMN is still there.

Thx. Good to here that it’s not just me…

Thanks Rollin!

Yes my Canadian TD Waterhouse shows my shares are there but stock price is 0. Why wouldn’t we been given a heads up, now what do I do?

Wtf?? Are we done?

Hi geoly37,

Maybe WIZ has a definitive answer for this, but here’s my perspective on where we are at with our MDMN shares. Jimmyp1127 should know that shares on the expert market can’t be transferred into a ROTH account once there is no bid. It is equivalent to selling the share, and then buying it back when one transfers into a ROTH, however, there is no value assigned once it’s on the expert market, which is really only available for brokers.

The only ones “selling” shares are those that have completely given up and decided to take a total loss just so they don’t have to look at MDMN shares in their account, (or don’t want their spouse to see the paper loss!). The AUMC shares are likely still in certificate form and restricted. (Consider them locked in the sock drawer.) They will be converted at the proper time when there is appropriate value and liquidity. Thereafter, the MDMN debt will be taken care of and distribution will occur to all shareholders, including all those shares that go back to the AUMC treasury that were bought at an inflated price way back in 2016 (Completion of Shares Acquisition | AURYN Mining Corporation). Think of the distribution as the 1st and only guaranteed dividend for MDMN. Any subsequent dividends will come from AUMC.

EZ

Interesting. Can you site the source?

Also, everyone chillout. Your shares are safe, its just that they aren’t tradeable/liquid until the conversion. Nobody invested here that actually believes in this investment should be selling at the ridiculously low levels MDMN has been trading at anyway.

In many ways this is a good thing. Like it has already been pointed out, new investors now have to buy AUMC. This will drive up the pps on AUMC and ulimately improve our conversion rate.

Just try it, let me know if you succeed. ![]()

Ha. I already did my conversion. I thought I caught it at the most opportune time. I know you mentioned you had shares in an IRA. Did you try? I think it would work, not seeing why it wouldn’t. With Shwabb you can initiate easily online without faxing in paperwork.

Very fortunate timing. Fidelity let you do the same before MDMN was locked into the expert market.

Now, I believe all shareholders can just assume MDMN shares are safely in the sock drawer.

![]()

EZ

Hi Jimmy,

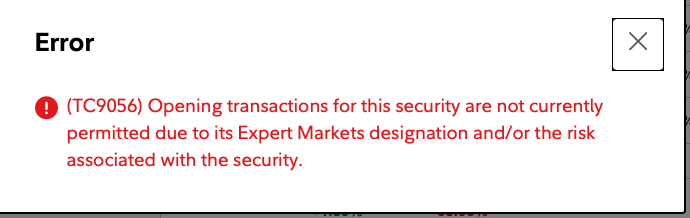

I don’t know 100% if this is true for all brokerages, but this is the message I get from Fidelity for any new transactions other than a sell for MDMN. I believe a transfer request into a ROTH account would be interpreted as an Opening transaction".:

Since I haven’t any MDMN shares in my IRA account, I can’t test whether it’s possible to do a transfer into a ROTH. Since I also assume you have already transferred all your MDMN shares into a ROTH, you did accomplish this at a most fortuitious time so far as not having to pay taxes on any future capital gains. I think many of the “old timers” here would have made this transfer quite some time ago as I did. If they were actively accumulating MDMN shares based on the progress being made and able to accept the risk, I feel as you do that these shares are currently safe, even in an IRA, and will eventually result in receiving a pro rata allotment of AUMC shares.

Those who were accumulating shares for a long time at a higher PPS, and held them in a trading account (NOT an IRA) for an extended period of time may want to let them go; Especially if this type of trader/investor has substantial gains in other stocks or crypto. They may prefer to sell shares before the end of the year for a small tax loss benefit. I can’t imagine any other scenario that makes any sense. Any shares let go at this point, for whatever reason, can only benefit those brokerages whose accounts benefit by not being responsible for the AUMC payout when the event occurs at a much higher AUMC price. This is especially true if a brokerage has an imbalance on MDMN book entry sales that don’t exactly match their MDMN share holdings inventory. The books will have to be balanced.

Is anyone with MDMN shares in an IRA willing to try transferring them into an existing ROTH account?

If so, please report back and let us all know if your brokerage allowed it.

Thanks,

EZ

I think I read yesterday that ETrade will not allow you to simply transfer shares from a regular account to any IRA account - you would first have to SELL your regular account shares and then contribute the CASH to the IRS (traditional or Roth).

However, I think I also saw that you can simply transfer shares upon conversion from one type of IRA to the other.

I hold all of mine in a regular account - so not a good result for me.

mrbubba,

You don’t state you hold MDMN shares in a regular trading account, but if you do, am I correct in thinking that when MDMN converts and distributes AUMC shares, this is treated as a share dividend and not a cash dividend for IRS purposes? So whatever price the AUMC shares are distributed at, there is no cash gain, and the transfer price becomes the new base price for any subsequent sale or loss. Aren’t most share dividends not taxed until sold? If I am correct, the higher the AUMC price is when the conversion takes place, the greater advantage it is for all shareholders receiving conversion shares. Thereafter, any dividends coming from AUMC as cash dividends would be treated in the normal way for tax purposes. This should not be taken as tax advice, but thinking out loud here it appears this may be another angle for MDMN shareholders to tolerate and endure waiting until the existing 9M+ free trading AUMC shares in the OS reach the several dollar range based on production and cash flow.

EZ