High BB Where do they plan to put their tailings? Their mine waste? Will they produce there own electricity or buy it from one of the producers in Chile? Where will they get their process water from and how much will they need? TIA

I think the transaction has already been completed and some 24% of the 70 Million Auryn shares outstanding have already been set aside in escrow for distribution to us.

Very nice! Thx

Who wants 281,000 shares at .60. Don’t know who would put that up for sale based off the news we got last week? I would think a Bid will be more like it.

Hi Sackogold,

Good questions that I think others share. Medinah is now a “holding company” without any mining operations of its own. Think of Medinah as a “safe deposit box” containing stock certificates. Medinah “holds” 16.4 million shares of “AUMC” and a position in American Sierra Gold or “AMNP”. “AMNP” has 6 or so mining properties in Chile including their new acquisition “Q-Inti Los Azules”, as well as the Caren and Puange placers and the Mali, Poseidon, Llano and a different “Fortuna” property. I believe Medinah still has debts of about $400,000 with no interest being charged on it. Note that without an interest clock ticking away, this has given Medinah some latitude in WHEN to pay off the debt.

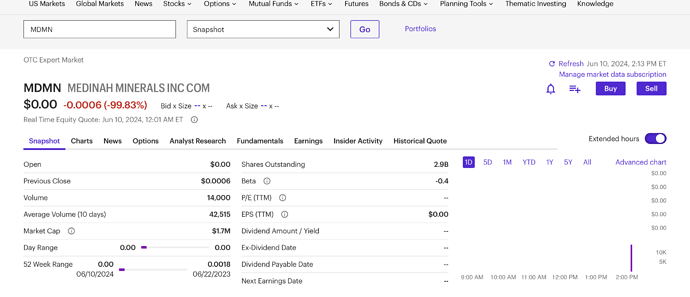

The plan all along has been for Medinah to sell as few AUMC shares (and/or American Sierra shares) as possible to retire the Medinah debt. This translates into allowing the share price of AUMC to run up a bit IF MANAGEMENT FEELS THAT THIS IS WHAT IS LIKELY TO OCCUR IN THE FUTURE. This way, less “AUMC” shares would have to be sold in order to retire the Medinah debt and thus more shares would be made available to the Medinah “shareholders of record” on the date of the allocation/distribution. With Medinah currently being on the “Expert Market”, I’m going to assume that the list of “shareholders of record” is already pretty much set due to the lack of trading activity.

AT WHAT LEVELS SHOULD AURYN THEORETICALLY BE TRADING AT THROUGH TIME?

In the mining industry, the “producers” trade at an average “multiple” of EPS of 30.21. This is from a recent survey done by the Stern College of Business at NYU. If Auryn were to “EARN” 20-cents per share, for example, based on their 70 million shares outstanding they would have to earn $14 million per annum or $3.50 million per quarter. If they can accomplish this seemingly modest achievement, theoretically, they should be trading at 30.21 times $0.20 (the “EPS”) or $6 per share. Later we can go through what it would take Auryn, performance-wise, to earn $14 million per annum which is a number I randomly chose. This would necessitate some projections being made regarding intra adit production rates, FF plant “throughputs”, total income, ALL IN SUSTAINING COSTS, average grades being mined, average recovery rates, etc.

Management has recently made it clear to me that guidance is forthcoming BUT they did not want to make “guesstimates based on partial information” (their words), and I agree. If you’ve had an opportunity to get to know management at all, you’d recognize that they are CLEARLY OF THE SCHOOL OF CORPORATE GOVERNANCE FAVORING “UNDERPROMISING AND OVERDELIVERING”. This is just fine, but it is nice for us shareholders to know about this beforehand. We got a “heads up” on this mindset back when Maurizio wrote an update to shareholders thanking Kevin Tupper for his services back during the transition from the previous management team. Maurizio made it crystal clear what he thought of one of his predecessor’s opting to follow the mantra to “OVERPROMISE AND NEVER DELIVER” when “next week” came around.

Note that the 30.21 industry-wide average “multiple” applies to a mining industry participant with an “average” growth profile. If a young producer like Auryn can rapidly ramp up production by opening up production sub levels on a regular basis, they should be able to command a higher “multiple” until production levels eventually plateau out which is inevitable. “Mega majors” like Barrick or Newmont will typically trade at a “multiple” well below that of young producers capable of producing a dynamic growth profile. The young producers with significant “SCALABILITY”, need to enjoy it while they’ve got it. Auryn’s “SCALABILITY” comes from their being able to successfully intersect the 7 ventilation raises and 5 ventilation “chimneys” that the artisanal miners of the DL2 Vein constructed from 1940 to 1970. The Chilean permitting authority “SERNAGEOMIN” signed off on Auryn’s new ventilation/safety egress system which allows Auryn to produce from the new “Level 3” as well as various sub levels beneath it.

In reality, over the last several years, Medinah has been a pain in the butt to Auryn’s share price. The lack of shares outstanding in Auryn has led to illiquidity and large “spreads” between the highest bid and lowest offer. I never thought I’d see it, but there is such a thing as a share structure that is “too tight”. Medinah’s superior liquidity has been scaring away buyers of AUMC shares because there has been 2 ways to gain exposure to the ADL i.e. Medinah or Auryn.

Most people seeking exposure to the ADL Mining District have been opting to buy the much more liquid Medinah shares while keeping in mind that 1-to-200 ratio based on the differential between the # of shares outstanding for both companies and Medinah’s 24% ownership in Auryn and therefore in the entire ADL Mining District. If you take the share price of Medinah and multiply it by 200 then this should approximate the share price of Auryn.

Medinah’s share price has had its own “thorn in the side” because many broker/dealers refused to take buy orders for Medinah shares due to the low share prices. I don’t think many would-be investors in Medinah would be willing to go to the hassle of setting up a new account at a different broker/dealer just in order to buy Medinah shares. This new lack of liquidity associated with trading on the “Expert Market” trading venue, was already partially in effect for many whose broker/dealers refused to take buy orders for Medinah.

I’m not sure if this is the reason for Medinah voluntarily “going dark”, but if the allocation/distribution of Medinah’s 16+ million AUMC shares is coming upon us soon, it sure makes sense for all concerned, to get all of the buying interest for a stake in the ADL Mining District funneled into AUMC shares only, and leave Medinah off to the side, for example, and onto the “Expert Market”. This would stop the buying of Medinah from being a thorn in the side of the AUMC share price. The “liquidity factor” would thereby be reversed and now in favor of “AUMC” over the now nearly impossible to trade Medinah.

I don’t think that people should be too concerned with Auryn being about to gain more free trading shares. Any Medinah shareholders wishing to sell at these valuations have been able to. Most still need a “5-bagger” or a “10-bagger” FROM CURRENT MEDINAH AND AURYN SHARE PRICE LEVELS, to break even. This scenario is nothing like a bunch of “private placement” shares suddenly going from zero liquidity to becoming fully liquid on a certain date. No, these Medinah shares have been fully liquid all along as “about to become Auryn shares”.

The downside of Medinah “going dark” is that the owners of only Medinah shares and no AUMC shares, will lose liquidity in the near term, but the upside is they will receive more AUMC shares in the intermediate term when the allocation/distribution of the AUMC shares occurs. The new lack of a need for Medinah to pay accountants to generate the financials and filings that a PinkSheet-Information Compliant corporation must execute might have something to do with it also. Medinah had been in good stead with the OTCMarket folks while being PinkSheet-Information Disclosure compliant for a long time, then all of a sudden, they voluntarily allowed their filings to lapse starting with the 2023 Annual filings due 3/31/24. Then they voluntarily missed the 2024 Q-1 filings due 5/15/24.

These events overlapped timewise with some new regulatory rules coming into effect regarding “Rule 211” and the ability of broker/dealers to provide 2-sided quotes. Broker/dealers are no longer allowed to provide quotes in companies that have voluntarily “gone dark”. A lot of smaller companies temporarily “go dark” in order to save money and improve their overall chances for success.

One interpretation of these events might be that the allocation/distribution process is near enough at hand that the lack of liquidity issue for Medinah shareholders would be offset by giving the AUMC shares a better chance of advancing in price since Medinah would stop re-routing buy orders from AUMC for those wishing exposure to the ADL Mining District.

We need to remember that Auryn has also expressed the intent to become “fully reporting” with the SEC and to move up to a trading venue or “listing” superior to the OTCMarkets PinkSheets-Information Disclosure Compliant, where they are now. I have been told in no uncertain terms, that the process involved in allocating/distributing Medinah’s ‘AUMC” shares would go a lot smoother if those AUMC shares being distributed were “fully reporting” with the SEC.

Recall that the mandate of the SEC is 3-fold. They are to firstly provide “INVESTOR PROTECTION”. That includes providing “INVESTOR PROTECTION” to Medinah shareholders about to receive allocations/distributions of “AUMC” shares. Secondly, they are to maintain fair, orderly and efficient markets. Thirdly, they are to assist in the “capital formation” process.

The SEC might figure they’re doing their job if they semi-“force” Auryn to become “fully reporting” prior to Medinah issuing these 16+ million shares. The SEC wants all corporations to be “fully reporting” to the SEC but Congress agreed that it is too expensive for tiny fledgling companies to be “fully reporting”. They didn’t want to impair the “capital formation” process. So, they allowed the OTCMarkets to act as an “incubator” for small corporations wishing to become large corporations, UNTIL they could comfortably afford being “fully reporting” to the SEC and comfortably afford providing audited financials.

If Auryn wants to attract the attention of more mature and possibly even institutional investors, then being “fully reporting” to the SEC and filing audited financials would be the way to go. This way more formal AUDITED “10-K” Annual Statements, “10-Q” Quarterly Statements and “8K-Current Report Filings” would be made on a regular basis. An “8K” typically has to be filed within 4 days of a “triggering event”. Here’s a link to certain “Triggering Events” mandating the filing of an “8-K”.

I might be wrong, but I don’t think it’s a coincidence that Auryn landed a financing, is building an ore processing facility, is going into high-grade production, etc. and is also doing all of these corporate governance reforms at the same time. Might the new financiers have mandated this? I couldn’t tell you, but AUDITED FINANCIALS sure might provide protection to them.

My hope, and I certainly do not know it to be a surety, is that somebody behind the scenes is prodding Auryn to carry out some of these reforms so that they may play a more active role in developing the ADL Mining District. Many of the “big boys” out there ARE NOT ALLOWED to get involved with “non-fully reporting” (to the SEC) corporations. Their BODs might sense too much risk. You could see how a mining major or perhaps a financial institution that likes your mineral assets might say “give us a call when you become fully reporting.”

For them, it’s nice to have an auditor in the mix and penalties assessable to anybody “fibbing” on financial details. I have no knowledge whatsoever in regards to any behind the scenes parties, in regards to Auryn, playing a role in any of these changes. From a mineral asset point of view, I do sense that the assets present certainly qualify as something the “big boys” might want to take a close look at. The DEMAND for copper-gold assets is just too high right now and the SUPPLY of new copper-gold prospects is just too low.

From an information gathering point of view, I feel that once Auryn is in production at the 100 tpd “throughput” level at the DL2 Mine, we’ll have access to the preliminary “DETAILED CASH FLOW STUDIES” that management is already in possession of. The shortcomings of their data is that it is based on “bench-scale lab studies”. We need to study the results of the processing of larger tonnages of ore, over time, after the inevitable “tweaks” are made to the froth flotation process along the way. The grades are just fine, but we need more information on the “RECOVERY” of the sought after gold, copper and silver. I’d especially like to see some progress at the Pegaso Nero, in regards to some of the “big boys” showing an interest in co-developing that asset.

If you want to learn more about FROTH FLOTATION, below is a link to an article that was very well done. There was also an excellent article done by “Rao” back in 1995. He commented on the difficulty in predicting the efficiency of FROTH FLOTATION prior to building a facility and processing many, many tonnes of ore, and making the necessary “tweaks” along the way to improve “recovery”.

POTENTIAL FUTURE TRADING VENUES/”LISTINGS” FOR AURYN

As far as the variety of trading venues/”listings” available to an Auryn-type company, below is a link to the listing requirements for the various NASDAQ tiers. The “NASDAQ Capital” tier might be of interest to Auryn as might be the OTCQX, OTCQB or even the Toronto Venture Exchange which a lot of mining companies trade on. All of these trading venues/”listed exchanges” are willing to work with corporations in order to make them compliant with their various listing requirements. There is a lot of competition out there for new listings.

Hi donedeal,

Medinah needs to sell some of its 16.4 million “AUMC” shares prior to distributing their AUMC shares to us, in order to pay off some debt. That would be my guess.

Nice to see a significant bid. Word is getting out.

I only see 2500 @.50 it’s the ask that is surprising 281,000 at .60. Don’t know who will put that up for sale

Thanks BB!! I’ve been hanging on since 2007 - another year is easy. I’m still way under water, but my 11M mdmn will get me a good chunk of aumc. It’s only up from there.

Excellent reference BB. Thanks for providing the link to Froth Flotation – Fundamental Principles.

From a BB post earlier this year:

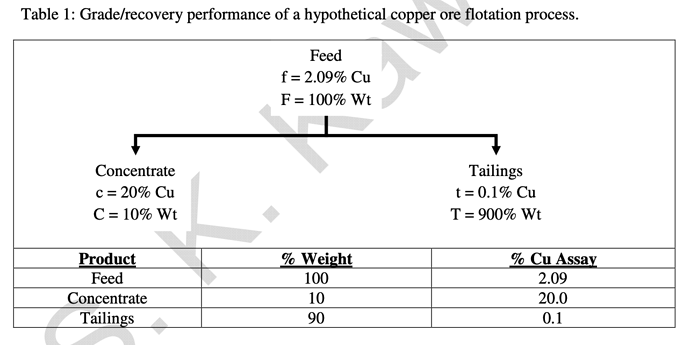

The latest referenced article (Froth Flotation – Fundamental Principles) gave an example of FF for copper as noted below:

Problem: A copper ore initially contains 2.09% Cu. After carrying out a froth flotation separation, the products are as shown in Table 1. Using this data, calculate:

(a) Ratio of concentration

(b) % Metal Recovery

(c) % Metal Loss

(d) % Weight Recovery, or % Yield (e) Enrichment RatioSo, for each 10 tons of feed, the plant would produce 1 ton of concentrate.

(b) Using the example data from Table 1, the % Cu recovery calculated from weights and assays is:

% Cu Recovery = [(10·20)/(2.09·100)]·100 = 95.7%

Can this model predict if an economic recovery is likely from this sample from a Don Luis Vein Assay?

Assay samples DL1 & DL2 Antonino Tunnel

Is it safe to assume the above referenced example is the end result of a beneficiation process where the end stage used CIL (cyanidation carbon in slurry method) for CU? In a mixed mineral raw ore such as shown in several Shareholder Updates there is more than one metal of possible economic value. Can the CIL process be applied in multiple stages to recover primarily AU, but also AG and CU? :

(August 2023 - Shareholder Update) On July 4th, ENAMI granted us the Mining Register, which authorizes the delivery and sale of minerals from our operations to ENAMI. This encompasses both Direct Smelting and Flotation Recovery techniques - the latter specifically for mineral shipments with reduced gold concentrations. On July 19th, we dispatched an experimental batch of minerals to ENAMI’s direct smelting plant. The settlement results, received today on August 9th, are as follows:

Gold (Au): 57.5 g/t

Silver (Ag): 978 g/t

Copper (Cu): 3.23%

(July 2021 – Shareholder Update) On May 17, 2021, AURYN received approval from the National Geology and Mining Service (SERNAGEOMIN) on its closure plan. On May 18, 2021, SERNAGEOMIN requested more information regarding AURYN’s exploitation plan. AURYN provided this information to meet the requirements and is awaiting a definitive permit issuance.

As announced AURYN sent 9 tons of ore to Enami for processing with a result of 45 grams of gold per ton. The remaining ore has been stock-piled and will be processed once AURYN begins regular shipments of ore to Enami.

AURYN’s objective was to intersect the Don Luis vein early in Q2 and begin exploitation with regular shipments of ore to Enami. At the beginning of the quarter, AURYN anticipated intersecting the vein within a couple of weeks, including 10-15 meters more of tunneling. This was not the case. It took almost the entire quarter to intersect the vein. Several days were missed for weather and equipment related issues, and miners encountered extremely hard rock most of the way. In total the tunnel is 125 meters. On June 23, 2021, AURYN intercepted the Don Luis vein.

Nineteen samples have been taken from the Don Luis vein and surrounding area. Lowest grade samples were taken from surface. All other samples are from underground development with eleven having grades of more than 20 grams per ton. The highest grades identified are 103.9, 112.5 and 1220 grams per ton. Images of the exploration effort, a hand-drawn map with results, and an official assay example are on our website.

(August 2023 – Shareholder Update) On July 4th, ENAMI granted us the Mining Register, which authorizes the delivery and sale of minerals from our operations to ENAMI. This encompasses both Direct Smelting and Flotation Recovery techniques - the latter specifically for mineral shipments with reduced gold concentrations. On July 19th, we dispatched an experimental batch of minerals to ENAMI’s direct smelting plant. The settlement results, received today on August 9th, are as follows:

Gold (Au): 57.5 g/t

Silver (Ag): 978 g/t

Copper (Cu): 3.23%

Importantly, lets not forget:

(October 2023 Update)

We’ve previously reported that the Plenge Laboratory identified the gold in our Lipangue site as refractory, requiring specialized methods for optimal extraction. This key finding was compounded by a notable discrepancy between Enami’s reported gold content of 57.5 g/t and the 128.57 g/t figure we obtained through independent smelting tests in a Peruvian lab.

It apparently becomes a more complicated beneficiation process if a multi-stage FF plant is used for metal recovery. Do we know if Auryn management intends to only extract gold without producing a CU concentrate? BB, You had earlier suggested that at some point a conventional circuit that includes crushing, grinding, gravity, flotation and cyanidation would be an optimal method for the gold. Will AUMC only recover AU as the primary metal and use AG and CU for credits?

Interesting times ahead.

EZ

Thanks, Easy. VERY interesting.

I know BB was saying we should maybe expect increased grams per ton from FF, anywhere from 2-20 times higher - but I think he said it could go as high as 1 million times? Good Heavens!

Anyway, I note that the concentrate in your example above is TEN times what the feed was (2.09% to 20%).

The result, it seems is the number of daily truck trips to Enami will be reduced - which will lower our transportation cost. But, the concentrated ore which has already removed the arsenopyrite will cost us less with Enami too (less “penalties”). In the end, the way we ramp it up is increase the tons of ore per day we process, am I right?

Doc didn’t you suggest they are waiting for higher prices to sell AUMC? However above you are guessing that they are starting to sell some at .60? Please explain

Bubba,

Yes, the ore will definitely be debulked. Thanks for asking. Using the CIL process increases recovery and thus profitability. My best guess is the FF plant will primarily go after the GOLD/SILVER content of the ore and forego CU content because of the low recovery (<30%) using the CIL process, which in addition uses up a lot of reagents required. I expect the GOLD recovery be in the 85-95% based on the exact chemistry composition of the ore.

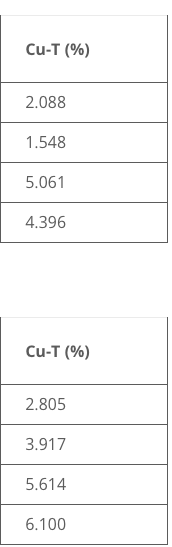

As I tried to show in the Banyan graphic back in February, there can be successive stages used to extract the maximum amount of profit from an ore in a multistep process.

The grade and chemistry of the ore is all important and requires a great deal of analysis. Banyan is very low grade ore, so take that in consideration … the flow analysis will be different for the high-grade ore in the Don Luis Vein. My guess is CIL will not initially be used but will probably be added in later, or in an intermediate step after gravity froth concentration of a coarse grind. In the simplest Gravity/FF process that shows 84% recovery, but that I’m assuming is for a standardized grind size as determined by the lab analysis. What is much more likely is that a multi-stage grinding process will be utilized from coarser gold to successively smaller grinding sizes. Recall that in a standardized processing incorporating conventional circuit that includes crushing, grinding, gravity, flotation and cyanidation you can see how different steps in the process are used. At a minimum, I would expect a 90% debulking of the ore and a high recovery resulting in a very economical concentrate to be shipped.

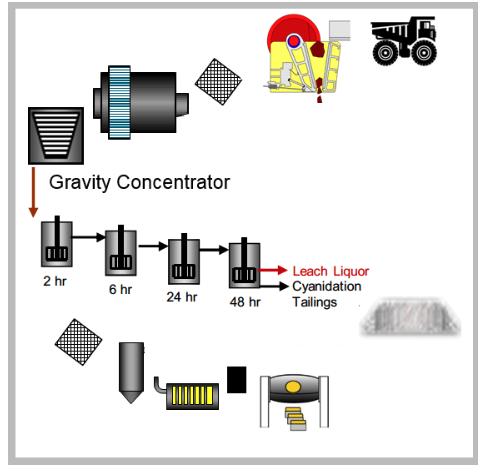

CIL LEACHING FOR GOLD / SILVER CONCENTRATION

Gravity Recovery and Leaching of Gold & Silver – CIL Stripping & Refinery : This complete hydrometallurgical process plant is to recover silver and/or gold metals from oxide or very low sulphide ore deposits. Provided here are all major equipment for a plant arranged to recover dissolved precious metals using the Carbon-in-Leach process. CIL with activated carbon is best suited for ores with no or some levels of preg-robbing carbonaceous material. The initial gravity circuit will extract any coarse, slow dissolving GRG gold and silver. The simple CIL technology deals best with low grade gold and/or silver deposits.

This simple metallurgical concentrator includes single stage crushing, conveying, primary grinding, spiral classification, gravity concentration, slurry pumping, cyanide leaching tanks, loaded carbon stripping and regeneration as well as refinery.

With this simple flowsheet, you will recover silver and/or gold into a bullion bar.

The gravity recovery components of this circuit can easily be removed in cases where laboratory testing has revealed there are no GRG precious metals in your ore.

Our standard packages are for process plants of:

· 25 Tonnes/Day = 1 Tonne/Hour

· 50 Tonnes/Day = 2 Tonne/Hour

· 100 Tonnes/Day = 4 Tonne/Hour

· 250 Tonnes/Day = 10 Tonne/Hour

This is a standard process plant which includes only the major components of the complete metallurgical flowsheet. A detailed engineering study is required to identify unforeseen omissions that may be required to design the optimum plant.

Additionally, we offer two separate packages for plant tailings thickening/filtration and water treatment. Contact us for details.

Hopefully this article offers a greater insight in what might be utilized by AURYN. We’ll have to wait and see what gets revealed and implemented in upcoming company notifications. I’m confident that expectectations will be met and have a good chance of being greatly exceeded. The increasing POG for next year will also be beneficial.

EZ

Hi EZ and mrb,

One way I was taught to learn about ore processing was to picture various piles of ore on a “stage” in different levels of purification. Way to the left you’d have 1 tonne of raw intra adit ore that just got mined and crushed. At the DL2 Mine the grade might be around 40 gpt gold (use whatever grade you are comfortable with as long as that grade is consistent with historical production grades and historical assay grades.) The pile of ore on the furthest left would weigh 1 METRIC tonne.

One METRIC tonne of 40 gpt gold ore would contain 40 grams of gold. Since there are 31.1 grams per troy ounce, then 40 grams converts to 1.28 Troy ounces. Everything is METRIC in mining. One METRIC tonne weighs 2,204 pounds (not 2,000). At the right hand extreme of this “stage” is .9999 gold bullion. 1.28 Troy ounces of .9999 gold bullion would equate to 1.28 Krugerands. From left to right, each sequential “pile” of gold containing ore would contain the same amount of gold but not the same overall TONNAGE.

If you froth float that 1 tonne of ore on the left-hand side of the stage, you’ll typically multiply the grade 4-fold on average. The FF process will typically enhance the original grade of the ore in between 2 and 20-fold, with the average being 4-fold. In this case, the grade of the resultant “float concentrate” in pile #2, would be 160 gpt gold. That “float concentrate” no longer weighs 1 tonne, like the first pile did, it now weighs about one-fourth of a tonne and that second pile on the stage is much smaller than the first. The differential represents the tonnage sent to the discards/tailings pile associated with the FF plant.

You still have 40 grams of gold in that second pile of ore, the float concentrate pile, but now it is 40 grams of gold contained within one-fourth of a tonne of ore which equates to 160 grams per tonne. Nobody is adding any gold as you purify that original raw intra adit ore into smaller and smaller piles, from left to right. The piles, extending from the left-hand part of the stage to the right, however, are gaining VALUE. The purity is increasing, it takes money to purify ore. The .9999 pure gold bullion on the extreme right-hand side of the stage (the 1.28 Krugerands) are worth about $2,350 per ounce or about $3,008.

.9999 gold bullion grades out at 1 MILLION GRAMS PER TONNE. This is because there are 1,000 grams per kilogram and 1,000 kilograms per metric tonne in the metric system. Even though the average grade of gold being mined in veins is 4 gpt gold and Auryn’s DL2 Vein might be averaging 10-times that, it is still incredibly impure versus .9999 grading out at 1 million grams per tonne “gold bullion”. The mining business is all about “taking out the trash” and discarding it.

In staring at those piles of ore on that stage, if the VALUE of, let’s say, pile #3 is “X” more than pile #2, and if it costs less than “X” to purify it the stage of pile #3, then you do it and you make some extra money in the process. If you can’t do it very cheaply, then you sell the ore at whatever stage of purity you could get it to without losing money in going to the next step.

In the case of that Auryn 100 tpd froth flotation plant, every morning there will be a new fresh 100 tonne batch of “raw” intra adit crushed ore, being dropped on the front door step of the plant. There will always be a mining industry participant with the ability to add value to the ore at whatever stage of purity you want to sell at. A gold/copper smelter might cost $1 billion to build and equip. Even the smelter operators make money in this value chain. Mining industry participants are “specialists” in getting the ore to a certain state of purity and then selling it. IF YOU CAN START OUT WITH EXTREMELY HIGH-GRADE GOLD ORE LIKE AURYN, WHICH “MOTHER NATURE” DID A LOT OF THE HEAVY LIFTING IN PURIFYING, THEN OF COURSE YOUR PROFITS WILL GREATLY EXCEED THAT OF THE OTHER INDUSTRY PARTICIPANTS MINING LOW TO “AVERAGE” GRADE GOLD ORE. Although you might not know the exact numbers until you’ve been in production for a while and produced a lot of tonnage, if the vast majority of the Chilean miners mining 4 gpt “average” grade ore are making good money at $2,350 per ounce gold, then, of course, Auryn is going to be making a lot more money than them while mining gold perhaps 10-times as rich. What would it cost for the miners of “average” grade ore to purify that 4 gpt gold ore 10-fold to 40 gpt gold ore? That’s the head start that Auryn enjoys.

If an Auryn-type company can swing the permitting, financing and building of an FF plant that increases the grade of the already high-grade intra adit ore ANOTHER 2- to- 20-fold for an average cost of only $10 oer tonne, then, of course, their earnings are going to blow away that of the “average” miners. It’s not critical to know the EXACT AMOUNT OF THE ECONOMIC DIFFERENTIAL right now, because we won’t have any reliable “EXACT” numbers until large tonnages of ore are froth floated and sold.

The miners of “average” grade gold ore will never be able to pull off the permitting, financing and building of an FF plant that can increase the purity of gold 2- to 20-fold for only $10 per tonne. A willing financier simply cannot get the numbers to “work” unless the grade exceeds the “average” by quite a bit. The financiers need to make a nickel too. In addition to smelters, Enami also operates froth flotation facilities and they will gladly take in a customer’s ore and process it for them on a “tolling” basis but they’re going to have to charge a customer a lot more than $10 per tonne to do it and still make a buck for themselves.

A froth flotation facility is an example of a TECHNOLOGICAL INNOVATION that can provide a tremendous amount of ECONOMIC LEVERAGE to those capable of getting it permitted, financed and built but the numbers have to be there in order to have enough profit to have it make sense to the financier. Another example of a TECHNOLOGICAL INNOVATION that can provide a tremendous amount of ECONOMIC LEVERAGE to a miner is a “jumbo” drill rig capable of vastly improving the DAILY PRODUCTION RATES for a de minimis amount of money on a “per tonne-mined” basis.

The miner of “average” grade gold will probably never be allowed to access the ECONOMIC LEVERAGE” associated with these TECHNOLOGICAL INNOVATIONS. It’s just not likely to “pencil out”. Auryn’s miners got a lot of work done drifting both the Larrissa and Antonino Adits in order to access the metals they will be mining, while using archaic hand-held “jack leg” drills. They opted not to sell shares to buy these “toys” during the “bootstrapping” days when progress seemed to be ever so slow. The result of the patience of the shareholders and management is only having 70 million shares currently issued and outstanding, to divide the future profits by in calculating the all-important EARNINGS PER SHARE.

WHAT DOES IT MEAN WHEN A FINANCIER AND AURYN CAN COME TO TERMS ON A FINANCING AGREEMENT FOR THE FF PLANT?

It means that when the numbers were crunched, there was enough profit available to give the financiers a piece of the action in exchange for providing Auryn with the ECONOMIC LEVERAGE to increase the grade of their ore from 2- to 20-fold, while only costing Auryn an average of $10 per tonne. The real feather in the hat here, from Auryn’s point of view, was getting this done WITHOUT DILUTING THE SHARE STRUCTURE OF AURYN. Both Auryn and the financiers had the capacity to do the number crunching needed to determine if the potential profits were enough for both sides.

Now there is a new player involved, that has already cut a check for $500,000, that is heavily incentivized to make sure that Auryn is successful in generating the PROFITS needed to support CASH DIVIDENDS. Might there be another set of circumstances further down the road in which the cutting of another check might make good sense to all parties concerned so that further LEVERAGE can be accessed? Who knows?

Thank you - in essence, when we use FF we are just “taking out the trash”, eliminating excess material but keeping the same gold. When that excess material goes away, then the total weight goes down, meaning that the percentage of that same gold to the total weight goes up. In the end, we’re driving less excess material to Enami (which saves us money), but the resultant ore has to be processed less and the percentage of our gold to the total weight goes up. Thanks again, sir!

BB,

Thank you for that most excellent clarification on how at each successive stage of froth floatation processing, remaining gold is increasingly recovered, and profitable concentrate is produced. See if I get this somewhat right if the 1st step is not froth floatation, but coarse crushing to liberate free milling with gravimetric processing. From my perspective, this is just a possibility (maybe my “dream” solution) from my limited knowledge base. The ore will likely be crushed and screened to an optimal size for gravitational refinement of free milling gold. Since this 1st stage might be a coarse grind run through a gravitation concentrator only free bound gold is recovered with practically no bulk reduction. Let’s say as in the Banyan graphic, it only recovers 53% of the head grade gold; so bulk tonnage may not be reduced that much, but the purity recovered will be extremely high (almost doré quality?) It is known from the visible gold in the ore samples this should recover the larger gold particles, but not the fines. How much, depends primarily on the gravitational concentrator chosen and grind size. In one of the earliest test runs a Falcon Sepro Falcon was used with extremely good results:

Falcon Sepro

Maximum tolerable feed size is 6mm, however we strongly recommend a feed size of no more than 2mm for the highest recoveries and lowest operating costs. Mineral recoveries down to 20 micron are made possible by up to 200Gs of force generated by the SB Gravity Concentrator.

Let’s do the simplest math estimate for gold ore as an example starting with a head grade of 40 grams per tonne. Using numbers from the Banyon Graphic , the remaining gold ore still retains 47% of the original head grade ore, from just the 2mm crushed raw ore run through a suitable gravimetric concentrator. (At this point I’ll just pose the question if this almost pure free milling concentrate can be shipped for sale to gain quick cash while stockpiling the ore that is 47% of the original head grade?). After certain lab tests are run, several different grinding sizes will also be tested to determine optimal size and chemistry to process the remaining ore for economic recovery of remaining gold and silver. This may result in further crushing, grinding and screening as specified to eventually maximize profits as additional components may be added to the FF processing circuit.

Moving on, the next stage may just be gravity and floatation where 84% of the remaining processed ore has 47% of the original head grade you started with recovered. Again, this is just taking the Banyan graphic numbers (very low grade at Banyan, open pittable at 84%), let’s do a math example starting with the 40 grams per tonne head grade and do a rudimentary simple mathematical estimate of just these two gold runs. (Is the proper recovery percentage actually the 89% flotation recovery of the “rougher gold concentrate” shown on the graphic? Does “rougher concentrate" refer to the 2 mm crushed ore after the gravitational concentration?)

40 gpt head grade X 53% recovery = 21.2 grams of very pure free milled gold

21.2 gpt X 84% gravity and froth floatation gold = 17.808 grams per tonne concentrate.

Recovered gold from 2 runs = 21.2 grams + 17.808 gpt = 39.6 grams total of concentrated gold or 39.6/40 = 99% recovery (with perhaps ¼ tonnage as you demonstrate in your example; my guess would be 1/10th the tonnage at 89% recovery.)

Bulk tonnage reduction will be much greater than 90% of the original 40 gram per tonne head grade if you transport the gravity concentrated almost pure gold. along with the 1st froth recovery of the “rougher gold concentrate”. How many 20 ton truckloads will it take to reach the break even point to profitability?

This results in an economical concentrate of much reduced weight and saves immensely on trucking costs of concentrated ore.

Granted this is a much simplified example if I interpreted the Banyan process correctly, and as extra steps are quite likely needed that add expenses to a final concentrate product. There will be additional steps to remove some unwanted contaminates and chemistry required in the successive columns employed as shown in the “CIL LEACHING FOR GOLD / SILVER CONCENTRATION” graphic, especially if the silver component of the ore is economical and CIL processed in the completed FF plant circuit. AS BB explained, repeat required processing until no longer economical/profitable to refine ore further (and capture the gold and silver components). I’m sure others can envision a refinement process different from what I’m suggesting here as a possible example of the process. Additionally, I didn’t realize that both a Krugerand and a US Gold Eagle weigh 1.0909 ounces that weigh (33.931 g). In this case, an ounce isn’t the ounce we usually think to measure. I’m confident this long beginning of our AURYN adventure is not the Never Ending Story. There is a very bright future for present MDMN and AUMC shareholders ahead. Best wishes and pleasant dreams

to all for enjoying the upcoming weekend.

EZ

I noticed the “SB Gravity Concentrator” link in the above post ![]() did not take you to the citation I intended it to show. It was supposed to say, “ Maximum tolerable feed size is 6mm, however we strongly recommend a feed size of no more than 2mm for the highest recoveries and lowest operating costs. Mineral recoveries down to 20 microns are made possible by up to 200Gs of force generated by the SB Gravity Concentrator.” The reason for this becomes clear in the video clips shown in the remainder of this post.

did not take you to the citation I intended it to show. It was supposed to say, “ Maximum tolerable feed size is 6mm, however we strongly recommend a feed size of no more than 2mm for the highest recoveries and lowest operating costs. Mineral recoveries down to 20 microns are made possible by up to 200Gs of force generated by the SB Gravity Concentrator.” The reason for this becomes clear in the video clips shown in the remainder of this post.

There are many short videos on the Sepro site that are very informative. I hadn’t looked at these before I wrote up my previous post or I would have changed a few things. I fully realize what I was trying to convey was not as clear as it could be. These are short clips that are quite good in conveying information supporting what I was trying to say. Using the Banyan graphic was for very low grade ore, so the gravitational recovery would be expected to be quite different, but it demonstrates why a GRD test would need to be run on the available samples and why setting up a floatation circuit has many different tweaks that may be needed before it can be commissioned to full service. Much of that testing can be run ahead of time in a lab. I think viewing these informative clips in the sequence I’ve placed them in will make sense as you run through them. I really liked the last one on the new Frontier Bowl Concentrator design. It shows a very measurable increased recovery based on a new design.

This is one to pay attention to. It’s been noted that there are some very inexpensive Knelson Concentrators out there that are widely used. ![]()

What’s the Difference Between a Falcon and Knelson™ Gravity Concentrator?

(https://www.youtube.com/watch?v=awSrKnW6EIs)

Why install a gravity circuit?

(https://www.youtube.com/watch?v=qSqvNwqFe2s)

This one is quite tedious and dry, but provides information not found elsewhere. The polymetallic comment is somewhat confusing. More information is needed.

Importantly, it is mentioned that the gravity recovered gold can often result in a quick cash payment.

Gravity Recovery of Gold from Grinding Circuits

(https://www.youtube.com/watch?v=-zwSN2LX-lA)

This one identifies the things that work together and impact recovery efficiency.

GRG is explained. Size of the screened material is important.

Information and explanations presented are very clear. Size distribution of the GRG is very important. To maximize efficiency, a GRG test is performed for different size ranges in order to optimize recovery.

How to Interpret a Gravity Recoverable Gold Test Report

(https://www.youtube.com/watch?v=8P9w-SeXElM)

This one clearly demonstrates how the GRG is derived in 3 stages from multiple samples and screen/grind sizes.

Sepro Frontier Bowl Overview | Frontier Bowl Whitepaper … 2022

(https://youtu.be/eGVujBWSBfo)

This is one that shouldn’t be skipped. It employs the newest design features that combine features of both Knelson and Sepro concentrators.

Let me know if my previous mathematical example comes together for you and makes more sense after taking time to investigate these short video clips (sorry, you’ll have to skip the commercials).

There is still much we as shareholders don’t know, but it is an exciting time as we draw nearer to hearing that permits have been attained, and an order for a Froth Floatation unit has been placed awaiting delivery and installation.

EZ

Hi Mrb and EZ,

Thanks for the recent posts; those have been very educational. What’s interesting about ore processing for refractory ores is that you’ve got a gazillion different paths you can go down after any particular ore processing modality has been deployed. It’s the job of the engineers to run a series of experiments in order to determine the most efficient FLOW SHEET resulting in the best ECONOMIC outcome. The different variables will involve things like grind size, the best concentration of the various reagents like xanthate, the ideal PH, thickness of the ore solution/”pulp”, optimum bubble size and speed, salinity, etc.

A lot of the “tweaking/fine tuning” occurs once the plant is completed. There’s only so much you can do on a “bench scale” in a lab. The rule of thumb is that if the value enhancement exceeds the COST of any given add-on procedure, then you do it.

One thing I’ve learned about Maurizio is that he does NOT want to make “guesstimates based on partial information” (his term). He is the consummate “underpromise and overdeliver” type of CEO. Some shareholders might prefer management to be more promotional than that. In the long run, I have the distinct feeling we’ll be glad he did it his way, but I admit it takes a little bit of getting used to.

Most management teams of junior explorers/developers/producers need to constantly sell shares to raise money in order to advance operations. In order to avoid DILUTION, management of these firms needs to keep a close eye on the share price and they might tend to put on their “promo hat” more often. With Maurizio paying the bills, he’s not under that pressure. Most management teams spend half of their day raising money by selling shares, Maurizio can concentrate on corporate matters.

From what I sense, most of us don’t appreciate the role that the Plenge Lab in Lima played. This is a well-renowned lab that mining folks respect. Smelting results for gold grades is right up there with “fire assays” in regards to accuracy and reliability. A smelting result of 128 gpt gold from the Plenge Lab should send a strong message.

Maurizio has made it clear that the Enami smelting results of 57 gpt gold, 978 gpt silver and 3.23% copper involved the very same ore as was sent to Plenge. Unfortunately, we don’t have the silver and copper numbers from the Plenge Lab smelting test. It’s not clear if they were never run or just not reported.

That 71 gpt gold differential between the Plenge Lab smelting facility and the Enami smelter (128 gpt minus 57 gpt) is obviously HUGE from an ECONOMICS point of view. As Maurizio stated in a press release, it was important that Auryn take over the ore processing for their ore in a situation like this. The Enami numbers were reported after Enami took out their fees and the penalties they assessed.

Do Maurizio and the Auryn geoscientists trust that Plenge Lab smelting return of 128 gpt gold (over 4 ounces per tonne)? The Auryn BOD made the unanimous decision to build their own FF plant based on that reading. I’m not sure if Enami was trying to “gouge” Auryn or not. Maybe they saw some huge grades and decided that nobody would notice if they goosed up their fees a bit. Who Knows? There are plenty of buyers of gold, copper and silver “concentrates” in Chile.

Auryn management spelled it out very clearly that it was the COMBINATION of the differential between the Plenge Lab smelting results (128 gpt gold) and the Enami “settlement offer” (57 gpt gold) AS WELL AS the “refractory” nature of the Auryn ore that IN COMBINATION dictated the need for Auryn to froth float their own ore on-site.

By itself, the “refractory” nature of the ore i.e. its not being “free-milling” and amenable to gravimetric concentration methodologies, determined the need for FROTH FLOTATION. Almost all mining operations use froth flotation nowadays. Everybody knows that FF is used when there are a lot of “fine” and “ultra-fine”-sized gold particles present like Aury’s ore features. These tiny gold particles like to grab onto the rising air bubbles in FF “cells” and ride them up to the surface. Heavier/denser gold particles, “coarse gold”, might fall off of the bubble on their way to the surface.

We also know that the Auryn ore has plenty of ARSENOPYRITE present. The presence of this “gold magnet” is probably why the grades are so off the chart in the first place. FF is also the treatment of choice for gold ore associated with ARSENOPYRITE. Luckily, we have the same solution for the two different shortcomings of the Auryn ore.

At the end of the day, we’re going to be multiplying the “recovery rate” for the gold in the FF process times the original grade of the gold found in the adit. This will tell us what percentage of that original intra adit gold was recoverable by FF. Then you need to factor in how well the FF process did in getting rid of the garbage/”gangue” associated with the gold within the gold ore. These are two different things i.e. recovering the good stuff and getting rid of the worthless stuff. The result will be the grade of the “FLOAT CONCENTRATE” which will be sold directly to a 3rd party or perhaps sent to a smelter.

Like Mrb mentioned, if you get rid of a bunch of the worthless gangue early on, and send it to the TSF (tailings storage facility), then the TRANSPORTATION COSTS, which are measured on a COST PER OUNCE OF GOLD SHIPPED from the property, will drop down considerably because the “tailings” never get TRANSPORTED anywhere. This will decrease the ALL IN SUSTAINING COST PER OUNCE OF GOLD PRODUCED (“AISC”) which will lead to greater profits.

If the next destination for the FLOAT CONCENTRATE is a smelter, whether Enami’s or somebody else’s, then because a lot of the worthless material has already been cast aside, the lesser SMELTING TONNAGES and therefore lesser SMELTING COSTS including “TREATMENT CHARGES” AND “REFINING CHARGES”, which are a lot more costly on a per tonne basis than FF costs (about $184 versus $10 per tonne), will also drive down the AISC (on a per ounce produced) basis.

Likewise, if you can get rid of the ARSENOPYRITE early on in the FF process and send it to the TSF, then the “SMELTING PENALTIES” will be a lot less also which will also drive down the AISC and increase profits. The ECONOMIC effects would include not only increased top line income from selling much more pure ore, but also less COSTS.

You also need to factor in the “INTRA ADIT MINING COSTS PER OUNCE OF GOLD DELIVERED” to the portal of the adit. These are sometimes referred to as “C-1 CASH COSTS”. The miners of “average” grade vein ore (4 gpt gold) and the miners of extremely high-grade gold ore (perhaps 40 gpt or so for Auryn), will both pay about the same COSTS PER TONNE OF GOLD MINED to blast the ore and scoop it up and deliver it to the plateau surface. Since each bucket load in a wheel loader of the high-grade miner will contain perhaps 10-TIMES as much gold, then the COST PER OUNCE DELIVERED TO THE PORTAL (outside opening) OF THE ADIT will be much less for the high-grade miner. This includes the all-important LABOR COSTS PER OUNCE MINED. Since 2013, the World Gold Council has pretty much mandated that all COSTS be reported based on a “per ounce” basis.

From an ECONOMICS point of view, the ultimate scenario would be a miner with extremely high-grade intra adit gold ore (with low mining “CASH” COSTS”), having its own FF plant on- site, that does a real good job at both RECOVERING the gold in the intra adit ore as well as efficiently getting rid of the worthless “gangue” material early on in the process so that it doesn’t need to be TRANSPORTED anywhere nor SMELTED and subjected to high smelting fees and high smelting penalties. A miner wants to be able to take advantage of the ARSENOPYRITE as being a “gold magnet” but not be subject to the SMELTING PENALTIES it is subject to if it is not removed early on in the process by FF.

We need to keep in mind that the geoscientists representing BOTH Auryn and the new financier have a vastly superior knowledge level of all of these concepts as well as vastly superior access to the critical data they have in their possession but we don’t have in ours. These parties need to make multi-million-dollar critical decisions based on this data which, in some regards, is preliminary in nature.

Once the FF plant has processed thousands of tonne of ore, at a 100 tonnes per day rate, and the various “tweaks” to the FLOW SHEET have been made in order to enhance the ECONOMICS, then would be the time to present economic projections to the shareholders and potential investors, that have a stronger basis in fact. I’d love for us to have access to this data NOW but I have to agree with Maurizio, that the proper time would be in the not-too-distant future when the body of information will be much greater and the details more complete.

Below are some links to articles on the processing of “refractory” ore. Almost all of the manufacturers of ore processing equipment have their own specialty lines of equipment designed for “refractory” ore. The purpose of some of these designs is to make the gold in the ore more amenable to standard ore processing methodologies like “CARBON IN LEACH” (CIL”) which might be deployed later. “CIL” is an extremely powerful method for concentrating gold ore via first dissolving the gold particles in a cyanide solution and then separating the gold-cyanide liquid mixture into gold and cyanide via the use of “activated carbon” which has a very strong affinity for gold atoms.

Complete process and equipment solutions for refractory gold treatment - Metso(POX,%2Dliquid%20separation%2C%20and%20neutralization.

https://www.sciencedirect.com/science/article/abs/pii/0892687591900816

Gold Leaching & Processing of Arsenic Ore

Mispickel (Arsenopyrite: FeAsS)

When this mineral occurs in a gold ore, a proportion of the gold is frequently in intimate association and only rendered open to cyanide attack (“CIL”) by previous roasting. With a “sweet” roast, the calcine usually yields a high gold extraction with low lime and cyanide consumption.

Refractory gold processes[edit]

A “refractory” gold ore is an ore that has ultra-fine gold particles disseminated throughout its gold occluded minerals. These ores are naturally resistant to recovery by standard cyanidation and carbon adsorption processes. These refractory ores require pre-treatment in order for cyanidation to be effective in recovery of the gold. A refractory ore generally contains sulphide minerals, organic carbon, or both. Sulphide minerals are impermeable minerals that occlude gold particles, making it difficult for the leach solution to form a complex with the gold. Organic carbon present in gold ore may adsorb dissolved gold-cyanide complexes in much the same way as activated carbon. This so-called “preg-robbing” carbon is washed away because it is significantly finer than the carbon recovery screens typically used to recover activated carbon.[3]

Pre-treatment options for refractory ores include:

Bio-oxidation, such as bacterial oxidation

The refractory ore treatment processes may be preceded by concentration (usually sulphide flotation). Roasting is used to oxidize both the sulphur and organic carbon at high temperatures using air and/or oxygen. Bio-oxidation involves the use of bacteria that promote oxidation reactions in an aqueous environment. Pressure oxidation is an aqueous process for sulphur removal carried out in a continuous autoclave, operating at high pressures and somewhat elevated temperatures. The Albion process utilises a combination of ultrafine grinding and atmospheric, auto-thermal, oxidative leaching.

In this FLOW SHEET, if you draw a straight line from step 1 (COMMINUTION/GRINDING) to step 10 you have what Enami refers to as “DIRECT SHIPPING” OR “DIRECT SMELTING” ore. Auryn experimented with this and found the fees and penalties to be somewhat usurious. Note that sometimes the ‘FLOAT CONCENTRATE” goes through another round of grinding in order to prep it for the next step. The next step might even be another trip through the FF process.

The complexity of the ore processing in the case of the Auryn ore is probably going to get a little more complex when you keep in mind that there are 3 “PAYABLES” involved here. The copper and the silver are of high enough grades that Auryn will be earning income via “by product credits”.

Certain ore processing methodologies will inhibit the recovery rates of these other sources of income while others may not. This is where the engineers and metallurgists earn their paycheck in order to maximize the ECONOMIC returns. As Auryn mines deeper into the vein structure, the role of COPPER will usually be more important especially if Auryn encounters naturally occurring extremely high-grade copper varieties that have been “hyper-concentrated” by Mother Nature herself. These include the forms of copper known as bornite and chalcocite, which Auryn has already encountered in the Antonino Adit. This phenomenon is referred to as “SUPERGENE ENRICHMENT”.

Very informative, as usual. Never even seen a typical flowsheet - and the one depicted seems to be quite an involved process. The German engineer will be able to do his tests to get us started down the right road, but from what you write I can see things changing along the way due to the composition of the ore, requiring more adjustments. This process involves quite a bit more than I ever envisioned - and I’m glad they’re taking their time to get it right up front!