BB, It looks like some of the trenches they dug have become ponds.

I would advise anyone to avoid spending too much time hitting the refresh button on that one. AUMC will be pursuing “Dry Stacking”. There won’t be tailings ponds. Dry stacking will be a good option to cut down on the environmental permitting phase and is well suited for small mine projects. This option can be more expensive but it improves the strucutural stability of the material storage. Again, I wouldn’t be monitoring Google maps for pictures of any dry stacking as you won’t see much until they have actually begun production (estimated 8-12 months away) and have something to “stack.”

AURYN’S ESG COMPLIANCE ACTIVITIES

In recently learning that Auryn has opted to use “dry stacking” for storing the discards/”tailings” resulting from their froth flotation ore processing activities, a pattern is clearly being established that Auryn is very interested in things like environmental sustainability and other “ESG” related approaches to mine management. In today’s mining industry, everything is all about “sustainability” and ESG compliance. Mining firms might as well embrace it now if they want to be around for very long. Below is a link to a good article on the “dry stacking” of the discards/”tailings” from an ore processing facility:

www.twin-metals.com/learning-center/dry-stack-tailings-storage/

The standard approach to tailings storage has always been the construction of a “tailings pond”. The discards from an ore processing facility like a froth flotation plant would be pumped as a wet slurry to what amounts to be a hewn-out concavity within the earth’s surface. Berms made out of nearby dirt and rock would be created to keep the fluids in one place. There have been several environmental catastrophes involving the walls of these “dams” breaking and releasing the contents of the pond into the surrounding lakes and rivers. “Mt. Polley” is a recent example of this type of tragedy.

“Dry stacking” is much more environmentally responsible. First of all, the water that is contained within the froth flotation “cells” which are arranged in “banks”, is recycled and re-used/”repurposed” for the next batch of ore to be treated. In Chilean mining, water scarcity is a terrible problem for the miners. In “dry stacking” the discards/”tailings” are dried and compacted into a mound on rubber-lined areas of the nearby landscape. Dirt and local vegetation is introduced into these compacted mounds. This eliminates the issues associated with “acid rock drainage” when the tailings are kept wet. The local environmentalists are very happy with this process and the permitting authorities are very much pleased with this ESG compliant approach to what used to be a very environmentally risky process.

There is a new breed of mining lenders that will give favorable terms to miners with high “ESG rankings” and low “carbon footprint” policies. There are even institutional investors that will only invest in miners that are in strict compliance with ESG mandates. The purchasers of ore mined in a “green” fashion are often willing to pay extra for ore mined responsibly. It is a lot cheaper to start out a mining project in compliance with these new mandates than to convert a “dirty” project into a “clean” one.

If you’ve read much about Maurizio, he is very much into the ESG movement as is his wife Amparo that was recently appointed to the BOD, perhaps as Auryn’s new ESG representative. This is just a guess. Previous Auryn quarterly updates have cited how the University of San Sebastian was assigned the task of calculating Auryn’s “carbon footprint” in regards to their mining activities. Prior to the Covid 19 outbreak, Auryn was in the process of setting up community relations with the locals in regards to ESG compliance. Auryn’s quarterly updates are covered with statements about Auryn’s willingness to mine in an environmentally responsible fashion.

THE RECENT ANNOUNCEMENT OF THE FUNDING AGREEMENT FOR THE FROTH FLOTATION ORE PROCESSING PLANT PROVIDED SOME ANSWERS BUT ALSO RAISED SOME QUESTIONS

There was mention of the two parts to the overall funding. There was a fairly straight forward “LOAN PROVISION” but there was also mention of a more complex “EQUITY FINANCING”. Things got even more complex when the fact was established that the “EQUITY FINANCING” did not involve any dilution whatsoever to the share structure of Auryn with its 70 million shares outstanding. I regard Auryn’s only having 70 million shares outstanding at the time of going into extremely high-grade gold, silver and copper production at time when gold is trading near all-time-highs as its “crown jewel”.

To many, the term “EQUITY FINANCING” automatically implies DILUTION of the share structure. The reality is that these things called “PREFERRED SHARES” are often used in designing deals. They provide a great deal of utility in bringing about a desired result. FROM A LEGAL POINT OF VIEW, “PREFERRED SHARES” ARE TECHNICALLY A FORM OF “EQUITY”, EVEN THOUGH THEY MAY NOT BE “CONVERTIBLE” INTO COMMON SHARES. So, yes, this is technically an “EQUITY FINANCING”, but it does not lead to any share structure dilution involving the common shares of Auryn. Maurizio has indicated in many of the quarterly updates not to expect any changes in that 70-million-shares outstanding figure i.e. in Auryn’s “crown jewel”.

In this deal, the funders will be able to TEMPORARILY share in cash dividends distributed by Auryn for a period of up to 5 years and there will be a “cap” placed at $20 million in reimbursement for providing the loan. I wouldn’t expect the salient details of this “EQUITY FINANCING” until the deal formally closes. You can imagine what might happen if the details were released and the share price of Auryn increased and then a hiccup occurred and a retraction had to be made. Kevin, the ex-CEO of Medinah and a close confidant of Maurizio recently opined on “THEMININGPLAY” investment forum, “If the funders were to receive the full $20 million, then imagine what we shareholders would have received.” I don’t know with 100% certainty how to interpret that, but it suggests that perhaps we shareholders will share in cash dividend distributions as the lenders are getting reimbursed. I would suggest waiting on the details of the deal. The key for me is NO COMMON SHARE DILUTION.

HOW DOES NO COMMON SHARE DILUTION ON THIS DEAL AND LOOKING UPON AURYN’S 70 MILLION SHARES OUTSTANDING AS BEING THE “CROWN JEWEL” MAKE SENSE?

If you study what we do know about the structure of this deal, you can see that the design, for a mining deal, is HIGHLY ATYPICAL. In a “streaming” deal in this sector, we’ve all seen how the lenders are interested in a “stream” of perhaps gold production after they provided the funds to build a mine. I don’t think they’re particularly interested in the PROFITS of the miner they are funding. They want operations to proceed smoothly and they want their flow of gold ounces.

In a debt facility, a bank lender wants to be repaid and earn some interest income in the process. If the miner can’t pay the loan back then the banker typically has a “claim on assets in the case of dissolution” and has some risk mitigation through that.

In a deal like Auryn’s, the lender is betting on the AURYN CORPORATION being profitable and able to fund the cash dividends owed to the lender through the preferred shares. The lender is placing a bet on management’s capabilities in generating profits. This type of lender is highly motivated to help make Auryn not only profitable, but profitable in as short of a time period as possible. There appears to be plenty of incentive being spread around with this deal structure. I could easily see the lender as insisting upon board representation. If the lender is a mining group, there could be some technical expertise being tapped into similar to how a PRIVATE EQUITY group might become “hands on” in operations.

Auryn has a lot of mineral assets in which “the market” is currently ascribing ZERO value to. The lender would want to get those assets “on line” as soon as possible. A recent quarterly update by Auryn cited “a new mining operation about to be commenced at Lipangue” over and above the DL2 Mine we’ve all been following. I would assume that they would be using the same ore processing facility to process that ore. If I were the lender in a deal like this, I’d be motivated to do everything in my power to flood that new froth flotation facility with “feed” and regularly increase its “throughput” by adding new froth flotation “cells” periodically.

What’s interesting in this funding is that what is being funded, an FF plant, is DIRECTLY capable of IMMEDIATELY generating the profits needed to pay back the funders. Compare this to a deal funding a diamond drill program, that may or may not be successful, and even if successful it might not generate a penny of profits for 5 to 10 years.

Below is a link to an article on ESG in the mining industry:

ESG in the Mining Industry: Meeting Investor & Economic Demands (panafricanresources.com)

Here’s an additional consideration to rapidly fund the FF plant in a most economical fashion. As you may surmise, I’m always open to pleasant surprises. As recently as the 8th of June, I mentioned the possibility of producing a very hi-grade concentrate using gravitational concentrators. In support of this possibility, I looked at the following excerpt in the article cited below.

Gold extraction involving flotation can be split into four categories, free milling gold ores, copper gold ores, refractory gold ores and partially refractory gold ores. It may be beneficial for those circuits where free gold is present, to involve selective flotation of the free gold to improve the overall gold recovery. A problem with copper-gold ores is the high cyanide consumption. A better option is to float a copper-gold concentrate and sell this to a smelter. If pyrite is also present then the copper has to be selectively floated from the pyrite. This is normally achieved at high pH. Many references in the literature refer to the depression of gold at high pH, however it is not clear if this is due to depression of gold associated with pyrite or poor free gold recovery. Specific collectors are used to enhance gold recovery in this region.

The coarse gold fraction is easily removed by gravity concentration with the use of equipment such as Knelson and Falcon concentrators.

Again, in my June 8th post I cited numerous Sepro links and included this excerpt.

“ Maximum tolerable feed size is 6mm, however we strongly recommend a feed size of no more than 2mm for the highest recoveries and lowest operating costs.”

Rather than incorporating this gravitational feed directly into the completed FF circuit, I envision something a little different might be considered. The use of a standalone gravitational concentrator to separate an optimized coarse grind size to separate the visible coarse gold would result in a very high concentrate, leaving the greater bulk of ore untouched. This “preprocessed” bulk ore with free gold removed would be stored and fed later into the commissioned FF plant.

Earlier when discussing this possibility, it was mentioned that grinding to the much finer size used in flotation, free gold would be flattened into flakes and actually hamper recovery by flotation, and possibly damage the circuit. While this gravitational method alone may only recover 50% (or actually much more depending on the amount of free gold present) of the contained gold, the fines would later be recovered appropriately in the FF circuit, thus optimizing profitability. The advantage of using this gravitational method first before flotation would be a very rapid ramp up in cash flow, while greatly reducing the transportation cost as a result of debulking the ore to a nearly highly refined doré concentrate. Additionally, could a single gravitational unit process ore from the existing Larissa Adit or other areas on the ADL? I would expect an answer to this possibility in an upcoming PR. Using gravitational recovery on a first pass of coarse grind ore would be a less expensive and highly profitable method of paying the full cost of building and commissioning an FF plant.

First, we are awaiting to hear approval of all regulatory requirements and permits. Again, if this method is feasible, it will be considered and decided by the experts employed by management.

EZ

Why would you be expecting this? The company isn’t considering this option (for several reasons) and hasn’t mentioned anything along these lines in previous PRs. Given that we are knocking on the door of August, I would simpy expect a brief update on the use of proceeds on the ($500k-$1M) drawn down on the loan. One would think that they would have announced a binding agreement if it were alredy in hand and that they were probably trying to get that done before the normally scheduled updates. Doesn’t appear to have happened but there’s no reason to presume it won’t at some point over the next couple months. This shouldn’t be much more complicated than what they have forecasted: an attempt to close the financing on a small-scall FF plant with hopes of reaching production at some point in the first half of next year.

There’s no doubt that dry stacking is a friendier, environmental approach but I think its safe to say that there number one priority at that moment is generating a profit, paying down a heap of debt and becoming a viabile mining entity. ESG aspirations come down the line.

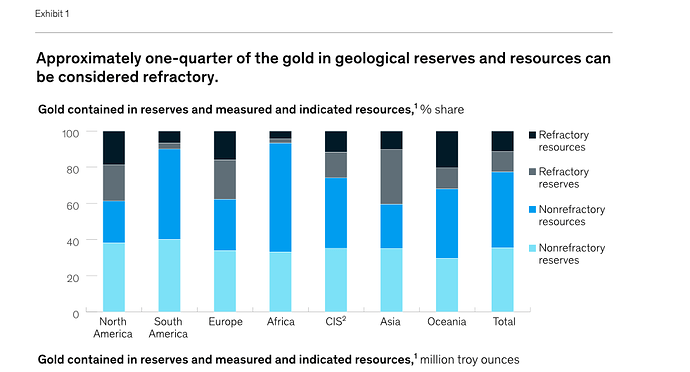

How can you be so sure the company isn’t considering this option as part of an optimal solution? Considering better than 80% of gold in SA is nonrefractory and only 25% is refractory, why would gravitational recovery not be a major component of any economic refining process? BB had a link (I’ll assume you didn’t look at it) that contained the following information.

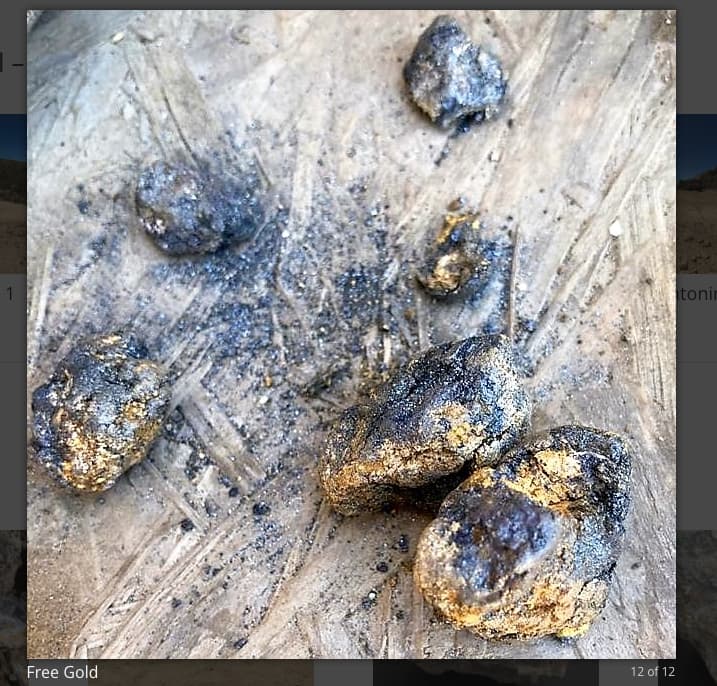

I noted from that graph that there is only a small fraction of refinable refractory gold ore mined. That leaves the largest percentage as nonrefractory gold amicable to gravitational collection. We’ve been shown that certain zones on the ADL do indeed have a large component of visible gold, including those in the Larissa Adit, as well as the the Fortuna (levels 3 & 2 of Antonino Tunnel) .

It’s been noted that free gold in a refractory deposit requires special handling. It was also shown in several articles and links, notably those by Falcon Sepro, that free gold when flattened by over grinding can reduce recovery by FF, actually damaging equipment used in the process. I merely presented one possibility that may ultimately be considered as a component of the overall most economical recovery of ore across the ADL in the quickest way possible for money flow to finance the cost of building the FF circuit that will recover the most refractory component of the ore present, including supergene enrichment zones containing CU. I have an open mind as to what might prove to be feasible. I’m also open, though not overly expectant, of pleasant surprises in upcoming company informational releases. I’m sure those working on the project will look at all possibilities and come up with what works best.

GLTA

EZ

Because I speak with them. Same reason why I referred to dry stacking when others are talking about tailing ponds and dividends at the end of a rainbows. This isn’t inside information stuff. Just basic due diligence while seeking to maintain an active dialogue with management to ensure I have some sort of semblance of what is ACTUALLY going on.

Admittedly, the topic of gravitational concentrators has never come up. Nor did the concept of building a rollercoaster on the top of the hill but, AUMC is telling you what they are attempting to build on a very tight budget. You are not invested in a company that has the luxury of pleasant suprises or " throwing noodles against a wall" to see what sticks (nor one that is considering ESG strategies!)

One shot on goal. It’s a smart shot with binary consequences but maybe they will read your post and reconsider their mine plan ![]()

Hi EZ,

Lots of good points as usual. Gravity concentration will no doubt be a large component of the ore processing at the ADL over time. Those 6 Main Veins at the ADL contain a lot of free-milling oxide ore that has never been touched. Recall how at the Merlin 1 Vein, the Sepro-Falconer gravity system got over 90% recovery from that ore.

The key is that BOTH gravity concentration and froth flotation are inexpensive ways to separate the sought-after metals from the gangue and leave the gangue/discards on-site so that they never need to be transported, which costs money, or smelted at great expense. That, and the extremely high-grade nature of the ore is where the superior ECONOMICS come in for this project.

In mining, you want to get rid of the crummy stuff first via inexpensive methodologies, so that later, less ore needs to be TRANSPORTED to the location of the more expensive ore processing methodologies. What you need to remember is that you multiply the intra adit head grade by the “recovery rate” in order to calculate the amount of recovered gold. If you start out with extremely high intra adit head grades, then you don’t need to have a 99% recovery rate to make a lot of money. You also need to keep in mind that at the DL2 Vein there are 3 “payable” metals of a high enough concentration to get paid for.

A while back I got to follow the proceedings, via the Internet, from a froth flotation symposium held in Cape Town, South Africa. There were dozens of papers offered by the attendees thereof. It’s almost like the refractory nature of sulphide ore is slowly becoming a non-event anymore because of the vast array of new solutions to deal with it. A lot of the research has been on gold-copper ores associated with arsenopyrite, like Auryn has. That’s because that’s where the money is. With arsenopyrite being literally a “gold magnet”, the intra adit head grades are very high, like that at the ADL , but the issue has always been that this ore contains “ultra-fine-sized” particles of gold (“Invisible Gold”) that has had a history of being tough to recover especially with gravity concentration methodologies. At the ADL, the gold tends to be associated with arsenopyrite (and pyrite) located just inside the outer borders of the vein proper near the “selvage”. The “selvage” is that area where the vein borders the surrounding wall rock which, in the case of the DL2 Vein, has a lot of “sericitic” alteration containing mica.

The solution for maximum recovery ends up being froth flotation using a variety of “collectors”, like xanthate, in certain concentrations, at a certain PH, and with a “pulp density” found to be the most economic (about 35%).

The metallurgists can design pretty accurate “flow sheets” to determine how to MOST ECONOMICALLY treat the ore and in what sequence, but at first this is only on a “bench scale”, with small sample sizes. Once you can run a bunch of tonnage through the FF plant, then the tinkering with the flow sheet can bring about great results. One of the papers presented at that symposium dealt with how tough it is to make economic projections UNTIL an FF plant is cranking away significant tonnage. Maurizio has made it clear to me that in regards to the economic projections he has promised to us, he “does not want to make guesstimates based on incomplete data.”

Compare what we now know about froth flotation to what the artisanal miners of the DL2 Vein were up against. They managed to average a stellar 64 got gold AFTER ENAMI TOOK OUT THEIR FEES but they had a terrible time recovering the “ultra-fine” gold-particled ore. The discards from their operations were running at 14 gpt gold, which is over 3-times the average grade being mined today in vein deposits. Figure that one out. Those valuable “discards” are on-site today. Just think of what the intra adit head grade of that ore must have been if you reintroduce Enami’s fees and the 14 gpt discards. The widths being mined way back then were only about 0.2-meters, so a lot of the working face in those adits was wall rock and not so much “vein rock”.

As Rob Cinits of ACA Howe reported, where the artisanal miners were mining there wasn’t any “visible gold” to speak of. They couldn’t sort out well-mineralized visible gold from the barren wall rock. The gold associated with arsenopyrite is known as “invisible gold” because of how tiny the particles are. In mining, a lot of the time the ugliest ore around is the richest in gold. Those pictures of the gold “stringers” amidst bright white quartz like you see at the Homestake Mine does not apply here.

The grades at the DL2 Vein are obviously wonderful and the vein is getting both richer and wider with depth as Sillitoe and Rob Cinits of ACA Howe have both told us, but for me, what is going to be interesting is the Merlin 1 Vein. It was averaging 26.9 gpt gold (a weighted average over 1.35-meter vein widths, involving over 200 samples from 25 trenches) AT THE VERY SURFACE as shown during the trench sampling program.

Averaging 26.9 gpt gold AT SURFACE is absolutely insane but you do need to keep in mind that the current surface is not the original/”paleo” surface because of erosion. One of the press releases made a while back stated that the geoscientists had determined that the entire vein system is INTERCONNECTED mainly by the east to west striking Merlin 3 Vein. This implies that all of the veins might be “juiced” similarly as you would expect for a “vein set”. Dr. Mischo will be, or perhaps already has, presented management with a mine plan as to which production opportunities should be pursued and in which order. Right now, it’s like a buffet table with way too many options. The timeframe needed to monetize those other veins will be greatly curtailed by the presence of a functioning FF plant.

The implications are for a potentially very long mine life not to mention how long assets like the Pegaso Nero or LDM might be in operation if deemed economic. An extended mine life is why it’s so important NOT to give any funders common shares NOW as part of a funding deal. If you include common shares in a funding NOW, then the funders would get a percentage interest in all of those other assets throughout all of that potential mine life. If the funders want exposure to all of those assets over all of that timespan, then they’ll have to figure out where to find common shares.

At the ADL Mining District, the exhaustive trenching program carried out by Auryn in 2015 revealed over 5,000-meters of gold-bearing veins that made it all of the way to the current surface. That is an insanely important revelation in regards to ECONOMICS. During the drifting of the Antonino Adit, another 24 “veins/structures” were uncovered which might further extend the mine life.

There are 6 main veins. We have the most amount of data on 2 of these, the DL2 Vein, which used to be called the Fortuna Centro Vein and the Merlin 1 Vein. The grades at both are off the charts. Until proven otherwise, the supposition might be that the other 4 Main Veins are similarly mineralized but we won’t know that with certainty until they are explored.

From a VALUATION point of view, when the new froth flotation ore processing facility is in operation, the VALUE of all of these 6 Main Veins will increase markedly. The monetization of these other veins will not have to be delayed for inordinate amounts of time while waiting for financing arrangements, regulatory approval from COCHILCO, permitting approval from SERNAGEOMIN, etc. The commissioning of the FF Plant, might be looked upon as the toppling of that first domino needing to be toppled in order to unlock the value in the string of other dominos already in place.

Contrast Auryn’s completed trenching program with a hypothetical trenching program revealing a total of 50 lineal meters of veins (versus 5,000-meters) making it to surface as one vein instead of 6. Pretend that this one short vein was only traceable for 50-meters of depth INSTEAD OF THE 700-METERS THAT THE DL 2 VEIN HAS ALREADY BEEN TRACED DOWN TO. The VALUE added to this tiny vein by the building of a FF plant would be significant, but nowhere near the VALUE being added in a scenario like Auryn currently enjoys. Think of it in terms of extended mine life.

This is a very significant nexus of veins that suggests a vast hydrothermal system perhaps including a copper-moly porphyry system from which the veins have telescoped out of. The evidence of an underlying copper-moly porphyry system is compelling because of the results of Auryn’s ridge crest sampling program completed on the southern downslope off of the plateau.

The findings here are very much in line with the findings of C.S. Perez when he did his hyperspectral satellite imaging study (CSAMT) which revealed a 7 Km swath of about a dozen intrusives, oriented in a SSW to NNE direction across this southern downslope off of the plateau. The ridge crest sampling program revealed high-grade molybdenite RIGHT AT SURFACE. Moly is typically only found near the center of a porphyry system amidst potassic alteration. The implication is that if there is an economic porphyry deposit present, it is very close to the surface.

Hey Baldy, since you appear to have a connection with management, can you do the rest of us a favor? Since they are not providing you with insider information but are willing to provide you with specific details as to what is actually going on, and don’t seem to want to share it with their actual shareholders, could you provide us with the details they provide to you, when you get it? Kind of like be a liaison between management and the shareholders. We would all very much appreciate it. Thanks in advance!

So,basically what I have already been doing for the past several years?

That’s an easy request to fullfill.

No, not the way you’ve been doing it because we only learn of what you’ve been told when you are countering someone’s idea or suggestion like you just did with Easy.

Rather, let us know what you’ve been told when the communication takes place and who you communicated with. Agree?

Z. Its very sweet you are aksing for someone to hold your hand. However, I’m sensing some sarcasm. Unless, my posts contain posiitive updates/opinions they are attacked and then ignored (when they come true).

It appears as though you already have a inside mole in the company. A few months ago, a code appeared to be cracked:

I confirmed with Maurizio yesterday that Auryn will be producing and selling what is known as a “froth flotation concentrate” or “float

A froth floatation plant producing a floath concentrate??! What more do you need for inside information?

Have a nice morning, I’m headed down to the shoe store, where I believe they sell shoes.

No sarcasm Baldy. It’s a simple request, when you communicate with management just share what you were told on this board. Others on this board do it because they know it helps all of us understand better.

Baldy, I have to admire your great sense of humor here on this forum! I can’t imagine a company, after publicly releasing it is actively pursuing the financing to build a Froth Flotation plant, intends to profit from selling the float concentrate of three economical minerals on the ADL, is somehow keeping a big secret. That kind of information is so obviously inside information! Clasic, should the SEC be notified?!!! ![]()

At least we can be assured your non-Disclosure Agreement is completely safe and not in any way being misused to advantage. ![]()

EZ

If you compare the development of the ADL Mining District with that of other mining districts, you can see some similarities as to how things tend to play out. Early on, mining entrepreneurs acquire control of a corporate shell, raise money and decide on an area to explore and which metals to go after. If the early sampling and geophysical results are promising, then it becomes time to spend some money on staking nearby mining concessions that might be available or consolidate the nearby mining concessions held by others, in exchange for shares. At the ADL, Quijano started the process a couple of decades ago and then Medinah came onto the scene later Maurizio, with superior financial and technical resources, came along and was able to finally consolidate all of the previously disparate mining concessions.

Fast forward to today, Auryn now owns a 100% stake in a long list of mineral deposits and prospects in the 10,500 hectare ADL Mining District. My list of Auryn assets has about 14 components with the last one being “and all future discoveries made by either exploration or during production activities”. Now the task becomes to MONETIZE them. When you have that many identified deposit types or prospects, and you have identified near surface, high-grade, EARLY PRODUCTION OPPORTUNITIES, then your options become to sell your production to an entity like Enami on a “tolling agreement” basis and essentially “rent” their facilities and staff, or you take the plunge and build your own ore processing facility in a “vertical integration” fashion.

When you have that many mineral assets in close proximity, the permitting, funding and construction of your own ore processing facility WILL GREATLY ENHANCE THE VALUE OF EACH INDIVIDUAL MINERAL ASSET. This is because the pathway to MONETIZING ALL OF THESE INDIVIDUAL ASSETS, just got a lot shorter. “Main Vein #5 of 6”, for example, does not need to negotiate all of the hoops and hurdles that recently did for the FF plant. The permitting, funding, and construction of the facility is a long-drawn-out process but once completed all of the various individual assets benefit. When you have a long list of viable mineral assets, the enhancement of the VALUE, in the aggregate, can be considerable. The key concept is to SHORTEN THE PATHWAY TO MONETIZATION from a time point of view and to decrease the financial commitment needed for these other assets to become MONETIZED. The building of an FF plant becomes the CATALYST to UNLOCK the value contained in these other assets. I can’t give you any firm numbers, but if the CAPEX for the FF plant comes in at $3 million, the combined increase in value for these other assets, in the aggregate, will be a heck of a lot more than $3 million.

You eventually hit a point in the development of a long list of viable assets when management decides that they’d rather own, perhaps, 70% of a soon to be PRODUCING ASSET, than 100% of an asset that may not be MONETIZED for another 5 years. This is especially true if the price of gold is currently near all-time-highs and who knows where it will be in 5 years. So, the timeframe until MONETIZATION becomes critical. There is a time value of money which rewards the moving up of the MONETIZATION timeline but there might also be a TEMPORARY window of opportunity, in which the ability to make some serious bucks exists, when the POG is where it is. This goes too for any mining major or mid-tier that might have an interest in any of these assets. If the price of gold was in the toilet, then there is less of a hurry to MONETIZE the assets.

You recall how Maurizio recently said we’re going to drop everything, like the mining and stockpiling efforts, and do what is necessary to permit, finance, and build the froth flotation plant. Mineral assets that surround a new, state of the art, ore processing facility are sometimes referred to as “brown-field” assets. “Green-field” assets are mineral assets located way out in the “boonies” that have no quick MONETIZATION opportunities. The disadvantage of “green-field” assets has to do with the amount of money needing to be successfully raised and spent to MONETIZE the asset as well as the TIME it takes to make all of that happen.

The “VALUE” of “brown-field” assets greatly exceeds that of “green-field” assets because, in the case of “brown-field” assets, somebody has already waited the inordinate amount of TIME, needed to permit, finance, and build the ore processing facility. The RISK of not being able to secure financing has already been mitigated. Again, TIME is MONEY, and some poor saps, like us Auryn/Medinah shareholders, have already paid that bill and endured that pain.

DON’T FORGET THE INCREDIBLE “VALUE” OF AN ON-SITE ASSAY LAB IN STREAMLINING BOTH PRODUCTION AND EXPLORATION

One of the underappreciated assets that are a component of this ore processing facility is the on-site assay lab. For miners without one, the assaying procedure involves taking samples, transporting them to the nearest reputable assay lab, dumping them off and then “taking a number”, like you do when you go to the DMV. All of the assay samples submitted before yours will take precedence over yours. The problem is that in the mining sector decisions need to be made “on the fly”. If you’ve got a group of exploration geologists out in the field trying to figure out if the grades are getting better towards the east or towards the west, it would be nice to have access to that information in a timely manner.

The same is true in ore processing facilities. If the engineers and metallurgists are busy tweaking the “flow sheet” for the froth flotation facility, it would be nice to know, in a timely manner, if increasing the concentration of a certain reagent, improved or didn’t improve the grade of the “float concentrate” being produced. TIMELY access to assay results streamlines both production and exploration efforts. If I were a mining major or a mid-tier interested in a potential JV on an asset like the Pegaso Nero, I’d almost insist on Auryn building an on-site assay lab first.

For me, the “elephant in the room”, from an asset valuation point of view, is the Pegaso Nero copper-moly porphyry prospect. If deemed economic, this would probably end up being an open pit project necessitating a very large CAPEX commitment and a long lead time until MONETIZATION. An attractive deal here might involve Auryn giving a major miner favorable terms on a JV strategic alliance, in exchange for the major helping Auryn MONETIZE Auryn’s mineral assets with shorter lead times. The majors typically think in terms of the long-term consequences of business decisions, rather than in short term consequences. They don’t mind spending serious amounts of money, but they want extended mine lives.

Open pit deposits necessitate a vast amount of diamond drilling that is very expensive. After going through what they have gone through, the last thing that the Auryn and Medinah shareholders want to see is Auryn taking the profits from production and spending them on projects with exceedingly long lead times prior to them being MONETIZED. Auryn and their shareholders just slayed that dragon.

I mentioned recently that the “crown jewel” of Auryn is not just the extremely high grades but it’s also the fact that they are about to enter into high-grade production at a time when the price of gold is near all-time-highs AND DOING THAT WITH ONLY 70 MILLION SHARES OUTSTANDING.

In retrospect, I think I should have recognized, a long time ago, that this investment was going to be a CASH DIVIDEND PLAY. Management owns 64% of the shares but due to Rule 144, they are semi-restricted from resale. “RESTRICTED” or “CONTROL” shares like these do, however, earn cash dividends. Maurizio’s shot at a “LIQUIDITY EVENT” come through either a tender offer or through CASH DIVIDENDS. With only 70 million shares outstanding, even a moderate level of earnings will result in robust EARNINGS PER SHARE. With the POG where it is, Auryn could do that with their eyes closed.

Robust EARNINGS PER SHARE can be synonymous with robust CASH DIVIDENDS PER SHARE if Auryn is not silly enough to try to develop an asset like the Pegaso Nero by itself, which I’ve already been convinced they are not. The favorable tax treatment of “qualified cash dividends” could be used as a powerful promotional point and incentive for existing shareholders to hold on to their shares for the long term. I’m going to guess that the fact that the funders wanted to be paid back via “CASH DIVIDENDS” attached to preferred shares and not principal and interest might have something to do with the tax treatment of the reimbursement. Preferred shares also offer a tremendous amount of flexibility in designing fundings that meet the needs of BOTH the funders and the recipients of the funding.

BB,

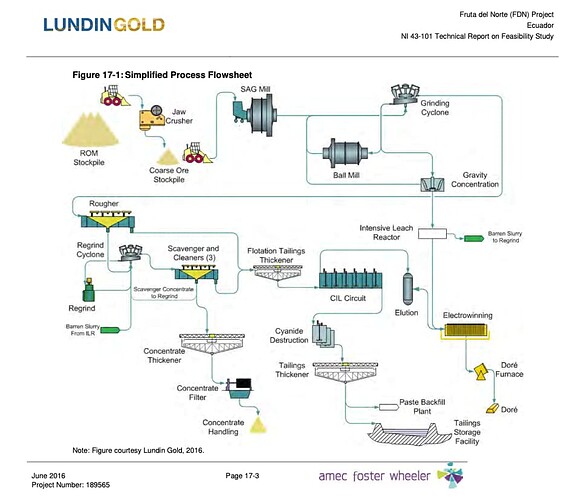

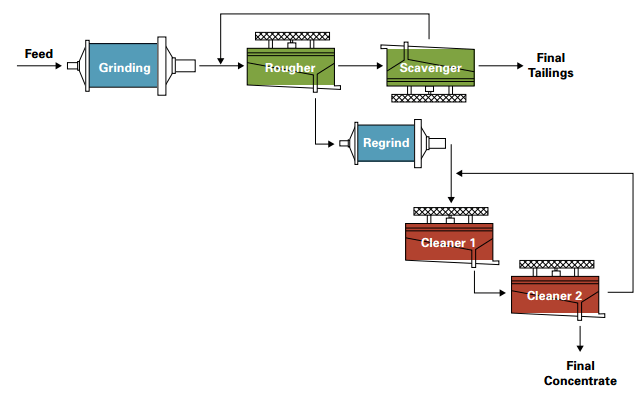

Appreciated is the detail and vision you add to this investment, albeit still very speculative at this stage of development. Rather than go into further long discussion, I’ll suggest that a picture can be worth a thousand words. I don’t know what our FF plant wit]ill eventually look like when built, but this simplified process flow sheet from the Fruita del Norte deposit may offer a good visualization of what the final plant may look like for the ADL.

The above design was applied to ore described as shown in the excerpt below:

The mineralogy of FDN consists of chalcedonic to crystalline quartz, manganese-carbonates, calcite, adularia, barite, marcasite, and pyrite, as well as subordinate sphalerite, galena, and chalcopyrite, and traces of tetrahedrite and silver sulphosalts. The bulk of the gold is microscopic and associated with quartz, carbonates and sulphides. Much of the gold is free milling, but the mineralization is moderately refractory, with approximately 40% of the gold locked in sulphides. However, coarse visible gold is commonly observed. Individual gold grains range from discrete specks less than 0.1 mm in size to broccoli-like, arborescent crystals >10 mm across. Visible gold occurs in all mineralized zones, in quartz or carbonate, as well as within pyrite or silver sulphosalt clusters.

I think it is very helpful to see the general FF plant design employed, although some details have likely been improved upon since 2016. A detailed metallurgical recovery flow sheet will be developed specifically for the ore extracted at the ADL and an FF plant designed to process it.

EZ

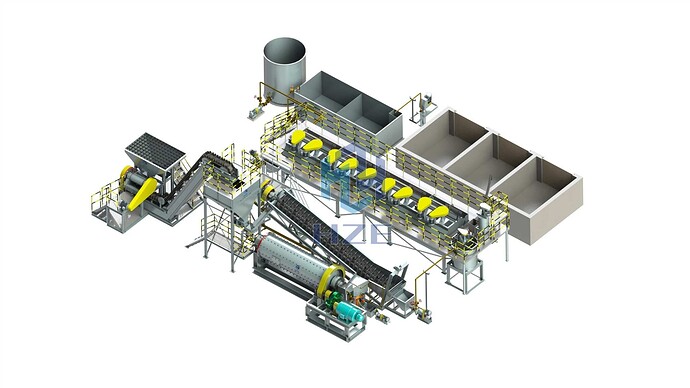

If very lucky, something more like this (although I don’t think this can be built for as little at $3M given today’s prices…probably closer to $10M)…Sag mills start at $3M (up to $10M)…might be able to afford a small ball mill::

You left out one of the most important components in reducing the bulk of the final concentrate. A gravitational concentration spits out the lightest material very early in the process, otherwise a very nice simplified diagram. It would be nice if it were that simple!

EZ

OK Easy. I’m going to try to be delicate here but that diagram you referenced for Lundin will look NOTHING like a $3M FF plant. There’s no room for bells and whistles here let alone electrowinning and dore production!!

You are providing a masterpiece by Picasso in the Lundin flow sheet. AUMC is still dabbling in finger painting on a comparitive basis. Even a gravitational split will most likely not been in the budget. Don’t fall into the trap of elevating expectations when the simple delivering/executing on already stated goals would be a very welcome win here.