Its this sentiment that has led to shareholders in MDMN being wiped out. If nobody protests not receiving shares over a 7 year period AND then becoming delisted, then they deserve owning a worthless stock. Anybody who is actively investing in the junior mining space will tell you, based on a wide swathe of comps, that AUMC is richly valued. Even if one assumes that they are able to produce 10koz next year at at low ASIC, they are expensive. If they stumble or experience significant delays in production or reaching profitability there’s meaningfull downside in the share price of AUMC. At the end of the day, MDMN shareholders deserve the shares in AUMC so that THEY can determine what to do with their shares. Given MDMN’s current trading status THEY have no option but to hold wortheless shares. AUMC paid for the assets with shares. They are obligated to make that payment. AUMC’s share price is just as likely to go down vs. up over the next year ….its time to make good on this obligation.

Really John! And you whine about BB’s comments!!

Pay no attention to him.

MDMN is getting ready to produce … real soon.

I agree with that, too. Even though we have several questions that I wish he would answer, I cannot deny the sacrifices MC has made to benefit MDMN shareholders so far. MC’s current lack of clear communication regarding some specifics is very frustrating, but I’m still confident MC will be fair with us regarding our MDMN holdings. Sometimes it’s best to step back and look at the whole picture instead of staying focused only on cherry-picked misteps. Ya gotta take the good with the bad, because good Jr. Miners will always have hurdles to overcome … the weaker ones just give up & fold.

I think the man is busier than a one-armed paper hanger … trying to get things lined up and prove people like Bald Eagle wrong. I think he’s gonna do it - and I think he likes under-promising and over-delivering. I’m happy to give this man some room.

![]()

I never heard that one before, lol.

You are a more patient man than most. It could be argued that eight years is a LOT of room. Nonetheless, the Q3 production forecast is creeping closer and it seems odd that there haven’t been more frequent updates on progress. They may be diligently sticking to their quarterly updates but, in my experience, companies are eager to update investors on good news. Especially when advancing to a transformational event. There are so many steps in the process. Most companies issue a flurry of PRs as each milestone is met. The absence of any news may be pointing to additional delays. You can guess what I would bet. Time will tell.

At this point, a lottery ticket owning MDMN. And expensive one. But it does not expire, is the only benefit. I hope!!!

Well, I’d respectfully suggest you have a better than even chance of getting your money back. AUMC is on record saying they’re getting ready to PRODUCE. Even if they star producing in January next year, that’s better odds than a lottety ticket. Just my honest opinion.

They’ve said a lot of things they were going to do but didn’t

Even if they do this time it doesn’t mean those of us with heavy mdmn shares will get anything unless share distribution is made.

I am not confident that will happen since it hasn’t yet.

The Wiz said July. Let’s see if he’s right. Not about the consolidation but production.

As I recall, the only thing wizard said was “Let’s talk in July.” I just need to say something about the frustrating doomsday scenarios posted that have little basis in reality. There’s no reason for some ppl here to get so worked up.

Nobody, including Auryn, has ever given a solid timeline regarding production or the distribution for our MDMN shares in limbo. Auryn’s April 2025 update stated:

“Construction of the Flotation Plant and associated facilities begins this month, April 2025. We anticipate initial plant operations in early Q3 2025, allowing us to conduct thorough testing and optimization of the mill using ore extracted from our ongoing operations. This period of operational testing and fine-tuning will generate measurable economic value and ensure the plant is fully optimized ahead of obtaining complete operational permitting, expected later in the third quarter of 2025.”

We know that MC has planned out required steps differently from other juniors, as was previously explained. No PRs after each step — for good reason.

Another complaint: “They’ve said a lot of things they were going to do but didn’t.” We’ve already forgotten the milestones they have achieved. They never promised specific dates for each milestone, but they DID happen, eventually.

Auryn also addressed concerns about the permitting process. Some here forget to note the adjectives & adverbs used before any month/day/year estimate is mentioned. Doing that can help ease tensions for those wanting to hang-on to specific dates, as if they were promised.

I’ll give you (or anybody else, including “Wiz”) 10 to 1 odds that they aren’t producing in July. You might as well make some side money while you wait for the fireworks.

They have been forecasting “production”, initially with the Caren mine for over 8 years. I don’t think anybody should be stressed about production in July or next January but its worth mentioning, the timeline has already been pushed many times. It’s not about “promosing” but rather delivering within a very wide timeframe based on timelines provided by the company.

Hell, I’ll give 10 to 1 odds that they aren’t producing in the third quarter. This next update better have a lot of details otherwise I’d be concerned about further “extensions”. More importantly than months or quarters, its imperative for investor to gain a better understanding of costs. Are they within budget? over? under? Building a facility these days takes a lot more time and money. I would guess the lenders would be willing to expand the debt facility if there are cost overruns but these are critical details. Permitting is the other big one. I’ve been involved with several South American mines who experience 6 month delays on basic permitting.

The next update will be a big one as most folks around here are smart enough to look beyond “promises.” Details, specific details and milestone in the production of the plant are all that really matters. A few pictures of a bunkroom with a $100 month subscription to Starlink, along with some equipment being prepared to ship do not support a $50M market cap.

They should be drowing investors with substanitive progress on all of the activity on the hill.

[…………edit]

Somewhat ironic that some of the posters here who are so confident in AUMC delivering, and so eager to attack those who question their ability to do so, aren’t willing to take 10 to 1 odds that the company is going to deliver on their forecasted timeline. All bark no bite.

Haha it’s Auryn Medinah we talking about here John! I rather be surprised! Wiz says let’s talk in July. He might take you up on those odds if he’s so confident. Happy Father’s Day!

Gold at $3,400 oz and this is supposed to be a WC deposit. Is Auryn capable of running this project?

I’m expecting a nothing burger on the next update

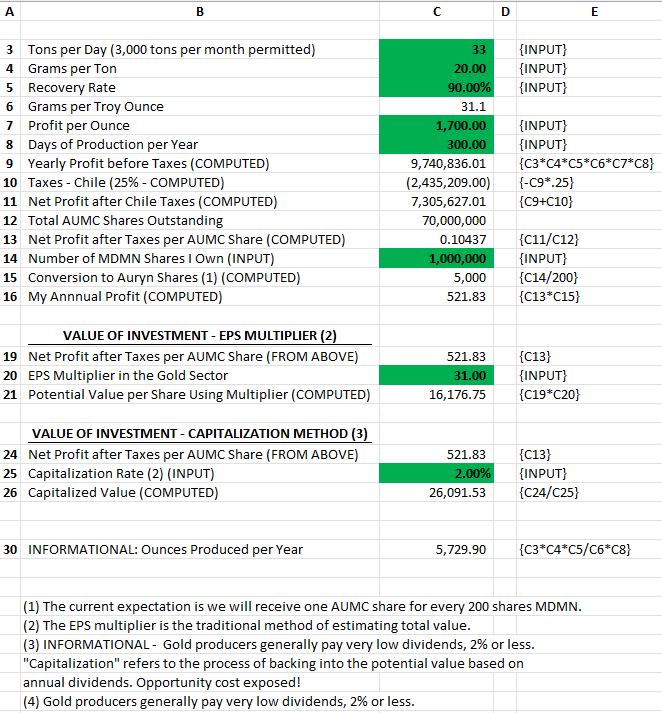

Here’s a spreadsheet I’ll be using when they start producing - it assumes production starts at 1,000 tons per month (33 tons/day), you own 1,000,000 MDMN, and that MDMN shareholders will receive 1 share of AUMC for every 200 MDMN. Let me know if you like it. Don’t be sad if production commences sometime in the 3rd quarter. Oh, and I have ZERO inside information, but I do trust MC more than Bald Eagle, and I like what Brecciaboy posts, because he knows a lot.

Do ya want some nuthin’ fries with that, too? ![]()

![]()

![]() jest jokn

jest jokn

Supersize it for me ![]()