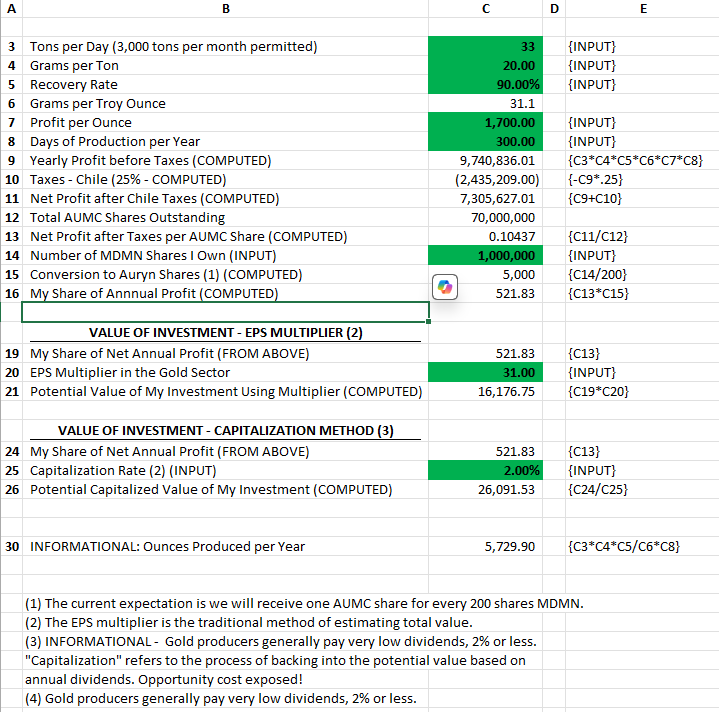

There is an error in your spreadsheet. At line 19 and 24 you were supposed to input line 13, instead you input line 16 which makes your calculate values about 5000 times to large.

Line 21 should be $3.24/share.

Thanks! I was trying to arrive at the potential value (on the stock market) of MY investment - the wording in the description Column B have been changed, but the numbers are the same. See below.

Isn’t it a pleasant surprise to be in the situation where you actually have to think about how much money you might make?

And all this thinking I’m sharing (albeit not perfect - I’m not a gold man) doesn’t even consider the potential for a naked short position. Hmmmmm … MC could give naked shorts a nice little spanking in the event we really do start making profits - the type of spanking that could make the price per share go up appreciably and thereby make it much easier to finance expansion.

I hope none of those who lurk here are not really … naked shorts.

AND yet you aren’t willing to take 10 to 1 odds that they are going to deliver? comical

always good to lean on a model…only tweaks I might suggest is bringing the gpt from 20 to 12-14gpt. One would hope that they won’t have to pay taxes for awhile but I’m less familiar with the Chilean NOL structure. You should also anticipate a “commissioning phase”. For a project of this size this shouldn’t last longer than 3-6 months but will involve considerablly lighter production vs. capacity. The PE multiple (30x) suggested on this board is laugable but we’ve already covered that point.

Before blowing up the balloons and predicting production for the umpteenth investors need to AT LEAST be updated on the status of permitting. While we can and should assume that all permits are in hand, its odd that there has not been confirmation of the same. It would also be helpful to receive a very detailed list of what has been completed and pending. While we can and should assume that they are nearing the completion of a fully constructed plant (based on guidance from the last update) its odd that there has not been confirmation of the same.

During such a pivotal period for the company it seems odd that AUMC is sticking with a qtrly PR schedule.

The simple truth is you doubted and even roundly criticized those who dared think these guys could do it on their own. You insisted nothing was possible unless and until they went the traditional route of drilling the place up for $30 Million (or whatever astronomical sum required), which of course they could not and would not do. I have the receipts. It has not gone unnoticed that you have softened your position over the last year or so - I guess because you’re seeing with your own eyes that they are actually executing, as opposed to the way it used to be under Mr. Price. Maybe you ought to re-evaluate your position even further. It’s happening, whether you like it or not. You shouldn’t let anger control you - and should take responsibility for your own actions.

Yes. Please provide evidence of your revisionist history. I’d love to see “the receipts”. In actual fact, I’ve been pretty accurate on most of my statements/predictions. And that accuracy has, thankfully, kept me on the sidelines, avoiding considerable losses that I would have incurred (in MDMN and AUMC) and allowed me to have particpated in a massive bull market across precious metals. I believe most folks here have been bullish (correctly) on gold. I would indeed be angry if I wasn’t been paid in for being right.

Its worth noting that its been over 8 years since Maurizio took the helm. Anybody who hasn’t doubted the journey can, at this point, be empirically classified as wrong. Also worth noting, they have NOT done “it” on their own. They have debt and a $25M encumberance as a reminder of the same.

As a last point, the “it” you are referring to has not occurred. I’ve tried to point out that this “it” will take longer than has been guided. I’ve been consistently right on this as well. What I’m currently suggesting is that nobody knows when “it” is going to happen. You can put together models and do victory laps all you want. This isn’t going to make production occur any earlier. Even reaching production is no guarantee of profitability. The sector is littered with plants on care and maintenace b/c the actual mining and/or recoveries were mismanaged. These are situations where the companies have actually drilled out a resource and knew where to “look” for gold.

Lots of “ifs” still remain on “it” but hopefully the next update will provide some clarity.

Maybe you anger and financial losses are giving you the illusion that I have some sort of emotional ties to this stock? I’m a very happy spectator and will be sure to let you know if I decide to get involved. As of today, this is not an investable stock.

Aren’t you the manager of an equity fund?

I wouldn’t want to post something that would diminish your character any more than that which you have already posted yourself - I’d rather save it for a rainy day.

No anger from me - if you actually started being supportive of MC and properly characterizing his aspirations/efforts (not promises), then I’d certainly be willing to move on. Until then, MC has done nothing to give a reasonable person even an inclination that he is doing anything other than trying to advance the good fortunes of this company.

That’s what I figured. No receipts. Don’t throw accusations that you can’t support. I speak to MC on a pretty regular basis and there’s nothing that I post here that I wouldn’t openly discuss with him. He’d be the first to admit that there have been several false starts and major pivots over the past 10 years. You need to be able to differentiate b/w what you consider personal attacks on MC’s character vs. criticsim on execution at the company level. He’s a standup guy who, until recently, has personaly funded the company’s ability to keep the lights on. That doesn’t mean the stock is a buy.

Hi MrB,

Thanks for all of the hard work you did on your spreadsheet. My investment group decided to go about the analysis in a different fashion and in more of a customized fashion because of Auryn’s significant stockpiling efforts. We’re keeping in mind that Auryn is on track to have 20,000 tonnes of ore stockpiled and ready to go on Day 1 for the commissioning of the froth flotation plant on or about July of 2025. Compare that to Auryn not doing any stockpiling prior to the commissioning of the FF plant and having to rely on daily production out of the adits to keep the FF plant busy.

So, I guess I respectfully disagree with your 33 tonnes per day input. The new Chilean “Small Miners Production Statute” allows intra adit production rates of 1,000 tonnes per month (33 tonnes per day) PER ADIT being mined. That’s a good reason to stockpile an additional 20,000 tonnes of high-grade DL2 Vein ore PRIOR TO the first day of the commissioning of the new froth flotation plant. From our point of view, one could argue that Auryn has essentially been “in production” for over 2 years. The question could be asked as to why they haven’t sold any of the raw ore they have successfully mined and brought to the surface. The answer is that they will receive a great deal more money if they first “froth float” the ore and then transport and sell the resultant “float concentrate”.

It’s critical to remember that the DL2 Vein ore is somewhat of a known commodity. It contains extremely high-grade ore. For example, the artisanal miners averaged 64 gpt gold over the course of 30 years of low volume production (a total of only 2,000 tonnes) from the DL2 Vein. The DL2 Vein ore sample Auryn sent to the Lima, Peru-based Plenge Lab came back at an average grade of 128 gpt gold without counting the silver and copper by-product credits.

The 2,200-pound sample sent to the Enami smelting facility came back with an average grade of 70 gpt “gold equivalent”. Note the “sample size” of 2,200 pounds, as it is significant. The point is that the 20,000 tonnes of ore taken from the DL2 Vein is likely to be of a very high grade especially being that a significant percentage of it was removed in a somewhat surgical “non-dilutive” fashion by percussion hammers/jack-leg drills.

The original throughput rating of the FF plant was 100 tpd, but then management mentioned that they added some individual “cells” to the original order, after the fact. They didn’t give us an updated throughput number. It will take a little bit of time to reach the “nameplate” throughput number as the initial fine-tuning process designing the optimal flow sheet, is carried out.

We think it will take about 10 months (about 300 days) to froth float that initial 20,000 tonnes of ore at an average rate of 67 tonnes per day. In the meantime, they will continue to produce from the DL2 Vein’s Antonino Adit and 2 adits that will be used to develop the Merlin 4 Vein. For the purpose of your analysis, I would isolate the 20,000 tonnes of stockpiled ore and follow it through the production process for 10 months. In essence, while Auryn is busy froth floating the initial 20,000 tonnes of ore, the intra adit miners will be busy establishing “stockpile #2” starting somewhere around 7/1/25. In reality, Auryn will probably be froth floating THE HIGHEST GRADE ORE from a combination of the 20,000 tonne initial stockpile and the more recent mining efforts. This should put upward pressure on the average grade figure for the ore being froth floated during that initial 20-month period. Keep in mind that Auryn now has its own on-site assay lab which will make it easy to monitor the grades of stockpiled ore.

The prior stockpiling of ore provides insurance just in case the intra adit mining rate does not keep up with the nameplate throughput of the FF plant. It also makes sense keeping in mind the new “Small mining producers statute”. The new statute provides lesser tax rates and much easier permitting to those “small” miners willing to voluntarily restrict their initial production rates to 1,000 tonnes per month per adit. The government still wants small miners to grow production, hire more Chilean workers, and develop into mid-tier miners, but I assume that the tax rates might go back to the original higher levels once production exceeds 1,000 TPM per adit.

The fine-tuning process for the FF plant will probably take several months as the engineers tinker with things like the idealized particle size (we’re guessing about 75 microns), the idealized concentration of ethyl xanthate to maximize recovery rates, the idealized temperatures, ph (acidity) and density of the pulp, agitation rate for the pulp contents, the ideal feed rate, idealized bubble size, etc., needed to maximize the recovery rate.

As far as the average grade of that initial 20,000 tonnes of already stockpiled ore, we need to keep in mind that during the stockpiling phase, for at least 270 days over the last couple of years, Auryn was mining via “percussion hammers/jack-leg drills” involving surgically removing only the extremely high-grade vein ore proper without blasting. They referred to this as “ORE REMOVAL WITH MINIMAL DILUTION”. The opposite of this is mining via blasting the ore which is more dilutive to the intra adit head grade since less well-mineralized wall rock will be mucked up from the adit floor post-blasting.

In their 10/30/24 update, in the paragraph labeled “LAB TESTING AND GRADE EXPECTATIONS”, management reviewed the results of the 2,200 pounds of DL2 Vein ore sent to the Enami smelter. The results came back with an average grade of 70 gpt “gold equivalent”. The exact figures were 57 gpt gold, 978 gpt silver, and 3.23% copper (totaling 70 gpt “gold equivalent”). This ore was also mined in a somewhat surgical fashion via “percussion hammers” without blasting, so the grades of the stockpiled ore might average much higher than those of the future ore that might be produced via blasting as part of the “sub level stoping” program. A quote from that update is critical to appreciate: “This sample (the 2,200 pounds sent to the Enami smelter) represents vein ore with minimal dilution, PROVIDING A SOLID BASELINE FOR GRADE EXPECTATIONS.”

This is exactly what we want i.e. “A SOLID BASELINE FOR GRADE EXPECTATIONS”. Note that this only applies to DL2 Vein ore THAT WAS SURGICALLY MINED WITH MINIMAL DILUTION VIA PERCUSSION HAMMERS/JACK-LEG DRILLS.

The problem is that we don’t know what percentage of the 20,000 tonnes of stockpiled ore falls into that “ore mined with minimal dilution” category. Thus, the earnings from that initial 10-month period might be skewed to the upside when compared to the ore being mined a couple of years from now. Sub level stoping involves high production levels involving blasting. The production rates in sub level stoping operations will likely be much higher than those involving the surgical removal of the ore with hand-held percussion hammers.

Note that in that same update cited above, management also said to expect average grades “OF AT LEAST 10 GPT GOLD” during normal course mining in the future. So, when referring to that initial 20,000 tonnes of already stockpiled ore, you can pencil in whatever grade you want in between “at least 10 gpt gold and 70 gpt “gold equivalent” depending on what percentage you feel was removed surgically “with minimal dilution”. MrB, your choice of penciling in 20 gpt gold seems fair but we need to wait for official results.

When addressing that initial 20,000 tonnes of stockpiled ore, I could see, for the sake of simplicity, where a person might want to pencil in 15.5 gpt gold equivalent as the average grade since this equals one-half ounce per tonne (31.1 grams equals one Troy ounce of gold) or perhaps 31.1 gpt (1 ounce per tonne) if you want to make the math extremely easy (again, written in pencil for now until the official results come in). 20,000 tonnes of ore times one-half ounce per tonne equals 10,000 ounces of gold in that first 10 or so months of production. At one ounce per tonne (31 gpt gold), this would result in 20,000 ounces in that first 10 months of production.

We’re penciling in an 80% froth flotation recovery rate as opposed to your 90% recovery rate. Thus, the 10,000 ounces of production in the first 10-months scenario gets knocked down to 8,000 ounces and the one ounce per tonne average grade would get knocked down to 16,000 ounces of gold being produced in that first 10-month period.

To annualize it out you would multiply those numbers by 1.2 since there are 12 months in a year and not 10. This would give you 9,600 ounces and 19,200 ounces of annual production in those two scenarios. Again, write this in pencil until the actual numbers are revealed.

We’ve got the ALL IN SUSTAINING COST (AISC) pegged at about $800 per ounce. By definition, extremely high-grade ore will be accompanied by extremely low ALL IN SUSTAINING COSTS (AISCs) to produce each ounce of gold. The derivation of this $800 estimate took me 9 pages of text to explain, so I’ll spare you the details. Unlike the majors that pretty much need to annually drill out as many new ounces of MR/MR as they mine annually, Auryn is not going to have to make these “Sustaining Capital Expenditures”. Also, with Maurizio’s willingness to advance the funds needed for development at zero interest cost, Auryn’s “Cost of Capital” will be de minimis.

The mining world is experiencing a huge lack of “float concentrate” available for smelting. China just greatly expanded their smelting capacity by spending many billions of dollars on new high-tech smelters. This has resulted in the “treatment charges” for smelting going from $80 to $100 per tonne to as low as $10 per tonne worldwide. A smelter is usually the next step for the processing of “float concentrates”.

At an average gold price of $3,100 per ounce (which I realize is lower than the current POG), this leaves a profit margin of about $2,300 per ounce. In the average grade of one-half ounce per tonne scenario, the total pre-tax profits for the first full year would be 9,600 ounces times $2,300 or $22.08 million. (In the one ounce per tonne average grade example, that figure would be twice that amount.)

Again, keep in mind that these numbers refer to that initial 20,000 tonnes of stockpiled ore which might have a higher average grade than that which will be realized in the out years.

I’m going to guess that Auryn has plenty of tax loss carry forward to offset your tax estimation. In the one-half ounce per tonne (15.5 gpt gold) scenario, $22.08 million represents 31.5-cents in earnings per share since there are 70million shares O/S. If you multiply that by the industry standard average “multiple” of 31.1 (NYU’s Stern College of Business analysis) you would get an expected share price of $9.79. THIS IS NOT A PREDICTION. For the one ounce per tonne scenario, you need to double that figure. The current share price of Auryn is about 60-cents per share. AGAIN, THIS IS NOT A PREDICTION, I’M JUST FOLLOWING THE DATA AVAILABLE UNTIL THE ACTUAL RESULTS ARE RELEASED.

There is no way, in my opinion, that Auryn is going to average one ounce per tonne or 31.1 gpt gold over the long haul but for the first 10-months I suppose it is a possibility depending on how much of those 20,000 tonnes were mined in a “non-dilutive” fashion. The average grade being mined worldwide in underground mining operations is 4.18 gpt gold which suggests that even the artisanal miners of the DL2 Vein, with minimal technology to deploy, did a decent job while averaging 64 gpt gold. So, even the statement provided by management of “at least 10 gpt gold” for the anticipated average grade in the long term is noteworthy especially when the price of gold is at or near all-time highs. I personally feel pretty comfortable with that 15.5 gpt average grade figure.

Thanks for the pointers, all understood - will adjust my figures accordingly.

So, if we are limited to 1,000 tonnes per month PER ADIT (from the beginning), then we could conceivably be processing:

Stockpile 67 tpd

DL2 33 tpd

2 Other Adits 67 tpd

Total 167 tpd

But, that depends on whether our froth flotation plant can handle that much business - and of course we would have some work to do (for a few months) to get production and processing optimized.

Oh, in my extensive Brecciaboy library, I see the answer as to throughput:

“They never indicated the “throughput” of these “individual units” so we don’t know what the actual “daily throughput” might end up being.”

Either way, it’ll take a few months to get everything tweaked - that 20,000-ton stockpile oughta keep’em busy for some months, and they’ll be creating stockpile #2 in the meantime.

Hi MrB,

I should have shared this information with you guys a gazillion years ago, but hopefully better late than never. Here are some thoughts to consider regarding the timing of investments in the junior mineral sector.

THE LASSONDE CURVE

In the history of the mining sector, no research or historical models have made more investors more money than what is known as “The Lassonde Curve”. It’s based on the concept that in the mining sector, the various participating junior explorers/developers go through a VERY PREDICTABLE pattern of development and share price change once a discovery is made. The “PREDICTABILITY” is the key for this investment approach.

Below is a link to a much better explanation than I could ever provide:

The “Lassonde Curve” was derived from studying the share price history of hundreds of junior mining corporations tied to the various stages of development achieved by that junior explorer/developer after making a legitimate discovery.

The share price is on the vertical (“Y”) axis of the curve and time is on the horizontal (“X”) axis. The curve takes the shape of a “forward-leaning” capital “N”. The left-hand portion of the 2 vertical parts of the “N” describes the share price appreciation typically associated with the “discovery” of a mineral deposit. This is often associated with a drill hole (the “discovery hole”) that hit a nice intersection. A NOTE: Always evaluate diamond drill hole intersections in terms of “gram-meters”. (For example: In a 400-meter-deep drill hole, if you have a 50-meter-long drill intercept that averaged 4 gpt gold within that 50-meters, then this represents a “200 gram-meter" intersection, which is a decent intersection.)

After this “Discovery” phase the share price often PREDICTABLY retraces to a lower level during the boring “Feasibility phase” which is symbolized by the downward sloping part of the “N” that links the 2 vertical members of the “N”. Smart investors often take profit after the “Discovery” phase knowing that the mining company probably now needs to raise a lot of money to do a variety of studies on the deposit (PEA, PFS, and BFS) and hopefully get the project permitted, financed, built and put into production.

Because of the massive expenses associated with this phase, and the typical need to sell shares to fund them, the share structure is likely to undergo significant “dilution” during this phase, which, of course, will drive the share price downwards, since the “market cap” has no reason to continue improving after the “discovery” has been made public. This phase is sometimes referred to as the “orphan phase” wherein the smart investors, aware of the pending dilution, fly the coop partly just in case the company is unsuccessful in raising the necessary funds or partly because the company might dilute itself to death in the process.

The right-hand side of the vertical component of the “N” is where things get interesting and the big money is made. It involves the company successfully getting funding, permitting, putting together an operations team, doing the engineering, procuring equipment, commencing construction (collectively referred to as “EPCM”), and being put into production. This is the “sweet spot” where the PREDICTABLE money can be made AS LONG AS THE SPECULATOR/INVESTOR CAN CONFIRM THAT THE JUNIOR EXPLORER/DEVELOPER IS INDEED GOING INTO PRODUCTION. If the price of gold just happens to be at or near all-time highs, then the effect can be greatly exaggerated. This is because, in this sector, incremental additions to the price of gold tend to drop straight to the bottom line.

As noted, this is known as the “sweet spot” for a mining investment. Why do so many “5- and 10-baggers" occur around this sweet spot? It’s because of 2 statistical realities. The first is that roughly 1-in-1,000 discoveries ever becomes a mine. Since RISK and REWARD are nearly always in balance in any investment sector, when a RISK that overwhelming has been successfully mitigated, then the expected REWARD can be significant. Otherwise, nobody would invest in this sector.

The second statistical reality is that even for that lucky 1-in-1,000 with a legitimate discovery, the average timeframe from the commencement of exploration until the first day of production is 24 to 27 years. It’s no wonder why smart speculators/investors sell after the “Discovery” phase. On the graph at the link given, keep in mind that the left-hand vertical part of the “N” will tend to be separated by a long period of time from the right-hand vertical line.

It’s critical to trust these seemingly incredible 2 statistics from the World Gold Council (WGC). These 2 statistics dictate the obvious sweet spot for investments in this sector. You need to patiently wait for PROOF that the company you are studying an investment in is indeed about to commence production. The biggest mistake that speculators/investors make is that they are too early. Wait for the CONSTRUCTION phase to commence.

Part of the problem in investing in this sector is the fact that there are currently about 3,000 juniors in this sector but there is a limited amount of money out there seeking investment opportunities at any given point in time. Attracting one-3-thousandth of the capital available for investment is not going to do anybody any good. The herd first needs to be thinned.

You need to keep your powder dry until AFTER a junior explorer/developer distinguishes itself from the others. How best to do this? Prove to the available investors that you really are about to commence production, and that you have already proven yourself to be one of the 1-in-1,000 and you’ve already put in the inordinate amount of time needed to transition into construction and then production. That pooling of 3,000 junior explorers/developers will whittle its way down to a handful rapidly.

With these 2 statistics being a reality, the question then arises as to why any of us would buy the shares of a junior explorer/developer post-discovery UNTIL IT BECAME OBVIOUS THAT THEY WERE ABOUT TO TRANSITION INTO PRODUCTION.

The well-respected mining analyst known as “Lobo Tigre” calls this buying of shares at the commencement of the “Construction” phase the “golden highway”. The key is the PREDICTABILITY. Junior explorer/developers can’t raise the money needed to go into production UNLESS VERY, VERY SMART MINING PEOPLE MAKE THAT MONEY AVAILABLE TO THEM. Note on the graph where it states that “INSTITUTIONAL INVESTORS” arrive at the time of “Construction”. In Auryn’s case, institutional investors funded CONSTRUCTION but interestingly, they still don’t own any shares. Maurizio kept the pledge he made back at the “informational meeting” held in Las Vegas wherein he stated that the 70 million shares outstanding figure was not likely to change, and it hasn’t.

I’ve learned that investors in this sector need to take on a sense of humility and realize just how specialized this sector is and just how little they really know about the geosciences. Investors need to follow the lead of the “SMART MONEY” that provides the financings for these junior “about to become producers”. Eric Sprott and his team would be a good example of the “smart money”. So too would be Rick Rule.

The left-hand vertical component of the “N” is also a potential place to make a 5- to a “10-bagger” but the problem is that, for most of us non-geoscientists, a significant drill intersection is not PREDICTABLE like the right-hand vertical component is when going into Construction. How are you going to successfully guess that a miner will hit a big drill hole during a drill campaign? You can’t unless you’re a professional geoscientist that has studied the project to death and even then, it would take a lot of luck.

A non-geoscientist can, however, read the tea leaves and confirm that a miner is indeed about to commence Construction and start heading into production. The “about to become producers” are going to have to check off on a series of boxes en route to going into the “Construction” phase and then production.

Auryn, for example, just completed the CONSTRUCTION of a work camp that houses the 50 workers needed to do all of the intra-adit mining and the running of the froth flotation plant. That’s a significant box to check off on because you just don’t do that unless you know you’re going into production. They also just purchased a froth flotation plant, a new ball mill, a new gyratory crusher, and they just built a new on-site lab facility.

They just hired a world-class mine operator known as Ashmore-Stracon-Dumas to run operations. They run 51 mining operations in Chile, Peru, Colombia, and Mexico. More and more juniors with a discovery will find it more economical to “outsource” mining “operations” to the pros. Stracon-Dumas is owned by “The Ashmore Group” which is a London-based group of funds that manages $65 billion worth of investments in the “emerging markets” sector. Auryn just got “adopted” by a very powerful mining conglomerate.

The question then arises as to whether or not this group can be counted on to fund the ramping up process that Auryn will probably want accelerated because gold is trading at or near all-time highs. There is a concept known as “LEVERAGE BETA” in the mining industry. When the price of gold is at or near all-time highs, a small amount of borrowed money can be significantly LEVERAGED. I don’t know the answer to this question. The free cash flow that Auryn is likely to start generating could serve to fund the ramping up process by itself, but Maurizio is a bit of an overachiever and I sense that this project is going to be fast-tracked.

Do you remember a while back when Dan Dumas was named as the new V.P. of Engineering for Auryn? This appointment should have hinted to us that Auryn was considering “outsourcing” their mining operations. “Dumas Contracting” is the “Dumas” in “Ashmore-Stracon-Dumas". Ashmore bought out Dan Dumas’ very successful mining operations firm, specializing in underground mining operations like that of Auryn/Medinah, over the last several years.

Recall that we were told that the fund that cut the $4 million “construction loan” check to Auryn was an “affiliate” of our new mine operator “Stracon”. Maurizio has been in bed with these guys for many years. Maurizio and Stracon just took over the second largest underground gold mine in Colombia in the “Antioquia” region of Colombia. What did they just do there? They just commenced production via putting in a froth flotation system. I’m hoping that the ramp up in production at this Colombian mine will serve as a template for us Auryn/Medinah shareholders to study. It would be very helpful to study the typical timing involved in the ramping up of the production process.

HOW CONVINCED SHOULD WE BE THAT AURYN/MEDINAH JUST ENTERED INTO THIS “SWEET SPOT” INVESTMENT ZONE?

In addition to the above accomplishments, Auryn just hired a specialty contractor that specializes in “sub level stoping” projects. They also just retained Robert Mayne-Nichols, who has run several different world class deposits including Los Pelambres and Collahuasi in Chile. “Sub level stoping” is the mining method that the big boys use to attack big projects.

Below is a link to a short video on SUB LEVEL STOPING:

Junior explorers rarely can land a debt financing with institutional investors, let alone, a $4 million one with favorable terms like “SOFR plus 4%”. “SOFR” is the new “LIBOR”.

How often does a junior explorer/developer land a debt financing with a “smart money” institutional lender? Not very often. The very favorable terms given to Auryn i.e. “SOFR plus 4%” (which amounts to a little over 8%), should send a message about the actual merits of this project which we non-geoscientists might not appreciate. The terms of any funding should serve as a yardstick for the merits of the mining operation.

I mentioned the name “Rick Rule” earlier. He used to run Sprott Capital, and he also provides funding to promising junior miners. He is currently fetching approximately 17% per annum on similar financings. The landing of a debt financing like this at a time in which the junior explorers/developers as a group are having an historically difficult time in getting projects funded, should not be overlooked.

Note on the graph of the Lassonde Curve that the lowest spot for the share price in that trough in between the 2 vertical legs of the “N” is where the “Construction” phase begins. This is precisely where Auryn is right now in its development.

DISCLAIMER: Do not make buy/sell decisions based on this information. This is one of the most incredibly RISKY sectors in the entire investment arena but as I mentioned RISK and REWARD must always be in balance otherwise there would be no investment sector dealing with the junior mineral explorers/developers.

Now that we’re riding on the “Golden Highway”, it makes me wonder why anybody could even think of FUDDING this investment …

BB: The video you cited above on stoping reminds of the “declining spiral” method you’ve mentioned before - with multiple levels in the case of mesothermal veins. I think you once said we can expect about 10-20 levels per mesothermal vein, but I won’t hold you to it. Since they’ve already confirmed 8 mesothermal veins, that bodes pretty well it seems to me - not to mention the potential 20+ other mesothermal veins I seem to recall they think they might have too.

I bet there’s a LOT of people who WISH they could invest in MDMN right about now.

Last I checked us mdmn shareholders ain’t got nothing

That’s because you read BB’s posts as factual. P/E multiples of 30x. 30gpt material.A $10 stock price equating to $700M market cap for a miner producing $5k-$10k ounces a year. Cheap debt financing b/c there is no consideration to the $20M sweetener embedded in the loan. These “opinions” have no basis in reality.

The exact same references to the Lassonde curve every other time MDMN was “imminently” starting production. Check the archives

Different decade, year, same old spin.

You keep going down your golden highway, lathered up by the same guy who hasn’t been correct in a single prediction. Orrrr wait to hear where the project actually is, what the potentially may turn out to be and hope your investment increases from $0.000.

Maurizio will provide some actual metrics to plug into your spreadsheet as they become available. Remember all of the models provided here with assumptions of $100gpt+ material? And nodody believed the “naysayers” until Maurizio had to come out and clarify that 10gpt was the goal. Baby steps

Speaking of FUDDING, it doesn’t help when Maurizio is repeatedly misquoted, or when other comments from TMP contributors are sometimes altered. One example is noted below …

In the OCT 2024’s Shareholder Notification, Maurizio spoke about the results from the DL2 Vein. That sample returned high gpt values & ‘provided a solid baseline for grade expectations.’

Immediately after sharing those high grade figures, Maurizio made a safe estimate of achieving at least 10 gpt head grade. No clarification needed. Maurizio never said that 10 gpt was the goal.

Quote from the OCT 2024 Notification:

“… AURYN recently submitted an experimental batch from the DL2 Vein to Enami’s smelting facilities, which returned promising results, showing 57 grams per tonne (gpt) of gold, 978 gpt of silver, and 3.23% copper in a one-tonne sample. This sample represents vein ore with minimal dilution, providing a solid baseline for grade expectations. While mining grades may vary due to natural dilution factors, we anticipate achieving a plant head grade of at least 10 gpt on average as we advance the project.”

Getting too personal again, fellas….

Fair enough although it does get a bit old to be constantly labeled (angry, jealous, ulterior motives) for simply stating an alternative view. A vigorous debate about the merits of the investment, or lack there of, is the basis for an investment forum.

With this being said, I’ll lay out my basic thesis, so that I can be held accountable (novel concept) and we can see how the cards play.

All IMHO.

AUMC is currently overvalued based on almost any metric or comp in the sector. Assigning any P/E multiple to a company with no mine life is nonsensical. Nor do investors in this space use a P/E multiple to assign valuations. NPVs are most commonly used. The 30 P/E referenced on this board is totally skewed as its a blend of companies with little to no earnings, together with the majors. Along those same lines, when assigning price targets it’s imporant to keep these in context. AUMC trading at $10 would equate to a $700M valuation. I would challenge anyone to find a company producing 20koz annually (let alone 5koz) with anywhere near that value. The only exception would be exploration companies with massive 10M+ ounce defined resource (AUMC has none).

If AUMC is able to execute and produce (profitably), and scale from 5 to 10 to 20k ounces the company will be able to “grow into” its current valuation, but it will take time. We will (hopefully) receive an abundance of details, as things progress, to properly assess this execution and, because of the rich valuation, investors will have plenty of time to add to this investment (at these levels) armed with facts vs. speculation.

AUMC being able to acheive an ASIC under $1k an ounce is a pipe dream. Even at hyper high grades the cost to produce, at this very small scale, on a bootstrapped budget, while blindly chasing a vein(s) will lead to ASICs north of $1500. Anyone who’s directly involved and/or actually invested in projects of this scale would understand this.

AUMC will likely be able to acheive 10-15gpt on average. While its nice to see that some of the exuberant predictions of 100gpt offered on this board have come back to reality (no apologies necessary), the lingering hopes of 60gpt+ material, even in the stockpiled material will also be proven wrong. Given the miniscule budget and long periods of “care & maintenance” I also think its a dangerous assumption that the stockpile is of the size and grade being discussed here. Remember the pages and pages on this forum with claims of a $5000 per ton economic impact?? Its amazing how some of these crazy predictions just seem to fade away with no acknowledgement of error.

I have questioned the timeline to production. After several delays already in hand I still don’t believe that the plant will be commissioned in July (or August or September). This is only speculation but without ANY details on the pivotal milestones needing to be hit, before commissioning the plant, I have to assume that production is most likely being pushed into the new year.

Even assuming excellent execution, I do not believe investors should expect any sort of distributions for at least two years. No sophistcated investors could warrant a position in AUMC until they provide specific details on all of the encumberances/liabilities/debt that AUMC is facing. The $20M “jump ball” owed to Stracon is the biggest factor and the debt financing has already been restructured once. There is no way to know what if any profits will be left over (assuming profitable production) until this is clarification on this point.

Before investors can expect to make any money, through an appreciating share price, AUMC needs to start acting like a “normal” company. Along with a very detailed update on the timeline of building the plant (permits, costs, power, water, key equipment installation, etc etc), they also need to/should provide specific guidance to all of the poor MDMN shareholders on the status of their dividend. Waiting on an expensive stock (uninvestable to most) that trades 1000 shares a day to “go higher” before a distribution doesn’t really cut it (or it shouldn’t). Especially when considering that the people having to wait are sitting in a delisted stock.

The “thank you sir may I have another” attitude of a loud minority does not serve to benefit the interests of the majority.

Hi MDMNJaded,

Regarding your re-posting of the quote from the 10/30/24 Auryn quarterly update where you cited:

Quote from the OCT 2024 Notification:

“LAB TESTING AND GRADE EXPECTATIONS

AURYN recently submitted an experimental batch from the DL2 Vein to Enami’s smelting facilities, which returned promising results, showing 57 grams per tonne (gpt) of gold, 978 gpt of silver, and 3.23% copper in a one-tonne sample. This sample represents vein ore with minimal dilution, providing a solid baseline for grade expectations. While mining grades may vary due to natural dilution factors, we anticipate achieving a plant head grade of at least 10 gpt on average as we advance the project.”

There is a lot to unpack in that one EXTREMELY IMPORTANT paragraph. In my mind, this is the most important press release Auryn has ever made except perhaps for the release of the 164 gpt and 150 gpt gold channel sample results at level 3 after the DL2 was first intersected.

First of all, note the paragraph heading i.e. “LAB TESTING AND GRADE EXPECTATIONS”. It was the “lab testing”, at both the Enami smelting test facility and the Lima-based Plenge Lab, that allowed management to release, for the first time, what they referred to as “GRADE EXPECTATIONS” for the ore within the DL2 VEIN PROPER.

NOTE RIGHT FROM THE START THAT THE 70 GPT “GOLD EQUIVALENT” AVERAGE GRADE FOR THE ORE WITHIN THE “VEIN PROPER” IS NOT EQUAL TO THE AVERAGE “PLANT HEAD GRADE” DELIVERED TO THE NEW CRUSHER, NEW BALL MILL AND NEW FF PLANT. THE DIFFERENTIAL HAS TO DO WITH WHAT IS REFERRED TO AS “DILUTION”. THE MINING PROCESS ITSELF INTRODUCES LESS WELL MINERALIZED WALL ROCK MATERIAL, WHICH WILL LESSEN/”DILUTE” THE GRADE OF THE APPROXIMATELY 70 GPT “GOLD EQUIVALENT” ORE WITHIN THE VEIN PROPER.

The good news is that the froth flotation plant will remove a significant percentage of that less well mineralized wall rock ore as well as some of the less well mineralized “gangue/valueless rocks” within the vein proper. Solid gold grades at out 1 million gpt. This means that even extremely high 70 gpt “gold equivalent” grade VEIN PROPER ore is 99% junk. This is OK if you have a very inexpensive (about $10 per tonne) junk remover.

Those making significant due diligence efforts on the ADL Mining District have been waiting for this moment for quite some time. We finally have some CLARITY on what kinds of grades to expect that represent “A SOLID BASELINE FOR GRADE EXPECTATIONS” within the DL2 VEIN PROPER, as it is being mined. Note that this 70 gpt “gold equivalent” is said to be a “BASELINE” figure, which I’m not sure how to interpret. We need to keep in mind that the grade of the vein proper (approximately 70 gpt “gold equivalent”) will be “diluted” (lessened) depending upon how much of the less well mineralized wall rock is incorporated into the mined ore being sent to the crusher, ball mill, and then froth flotation plant.

When I first read this press release/quarterly update, I immediately picked up the phone to Maurizio and told him that the shareholders’ heads are going to be spinning when they try to reconcile VEIN PROPER GRADES of 70 gpt “gold equivalent” somehow translating into “at least 10 gpt” anticipated “PLANT HEAD GRADE” over the normal course of mining. A “PLANT HEAD GRADE”, often known as a “MILL HEAD GRADE” is the grade of the ore delivered to the plant/mill. It is less than the VEIN PROPER grade because of “dilution”.

Maurizio explained to me that he and the Board of Directors took special efforts to articulate what needed to be articulated in order to check off on all of the boxes that proper corporate governance measures dictate. We chatted for about 65 minutes in total during that call. I preceded that call with an E-mail asking 14 different questions, almost all of which, according to Maurizio, will be answered in due time. What I learned is that management and the BOD are essentially walking what amounts to be a corporate governance tightrope.

By law, management has to release HISTORICAL MATERIAL FACTS to the owners of the company i.e. the shareholders, in a MATTER-OF-FACT fashion. That part is pretty straight forward. When it comes to voluntarily providing FORWARD-LOOKING GUIDANCE things get a lot trickier for management. Suffice it to say that HISTORICAL MATERIAL FACTS are pretty much written in stone, but releasing FORWARD-LOOKING GUIDANCE is very much a balancing act that needs to factor in “shareholder expectations” and the need to deliver on your guidance lest the market punish you.

As far as the HISTORICAL MATERIAL FACTS go, these would include HISTORICAL FACTS like the 70 gpt “gold equivalent” results from the Enami smelter test involving 2,200 pounds of ore as cited in this update. These would also include the 128 gpt gold results from the smelter test done by the Plenge Lab in Lima, Peru, SOURCED FROM THE VERY SAME SPOT AS THE ORE THAT WAS SENT TO ENAMI. Interestingly, this 128 gpt GOLD ONLY result DID NOT include the contributions made from the silver and copper “by-products” which would have put the actual result right at about 154 gpt “gold equivalent” versus the 70 gpt “gold equivalent” grade rendered by Enami. The discrepancy between what Enami was offering for just the gold component of the ore (57 gpt) and what this “second opinion” from the Plenge Lab said was the actual gold grade present (128 gpt), is what convinced Auryn to do their own ore processing on-site and store the tailings on-site in a “dry stack” TSF (Tailings Storage Facility).

Other HISTORICAL MATERIAL FACT results would include the channel sampling results from the area of the DL2 Vein where the Antonino Adit intersected the DL2 Vein at the new “Level 3” of the DL2 Mine. These results came in at 164 gpt for the first grouping of 4 separate channel samples and 150 gpt for the second grouping. These are, of course, “VEIN PROPER” figures with minimal dilution. These results were clearly more closely aligned with the Plenge Lab results.

The 64 gpt average grade achieved by the artisanal miners from 1940 to 1970 is another example of HISTORICAL MATERIAL FACTS. These were sourced from the Enami archives and provided to Rob Cinits at ACA Howe, who was tasked with authoring an NI 43-101 compliant report on the ADL Mining District by “Cerro Dorado”.

It’s critical to keep in mind that the 64 gpt gold results achieved by the artisanal miners of the DL2 Vein, involved the mining of levels 0,1, and 2. The grades found at the new “Level 3” FAR EXCEED THOSE FOUND AT LEVELS 0,1, AND 2.

So, the HISTORICAL MATERIAL FACTS include average grades of 70 gpt,128+ (silver and copper not included but if included would be about 154 gpt “gold equivalent”) gpt,164 gpt,150 gpt, and 64 gpt. The arithmetic average is about 120.4 gpt “gold equivalent” for the “VEIN PROPER” ore.

Since “sample size” is critical in geostatistics ,and the 70 gpt GE involved a significantly larger “sample size” of 2,200 pounds while the others were much less, I’d throw out that 120.4 HISTORICAL AVERAGE figure and go with the 70 gpt “gold equivalent” figure for the VEIN PROPER, as Auryn recommended in this 10/30/24 quarterly update. Just keep in mind that although a stellar grade by any measure, this 70 gpt “gold equivalent” figure is very much rounded down when compared to other HISTORICAL MATERIAL FACTS.

As Maurizio explained, management also has the fiduciary duty to responsibly manage FUTURE EXPECTATIONS associated with FORWARD-LOOKING GUIDANCE provided by management. This is especially true in lieu of what the Medinah shareholders were put through with Mr. Price and all of those “next weeks” they were promised. The result is back-to-back sentences, within this 10/30/24 update, saying that VEIN PROPER grades of 70 gpt “gold equivalent” do indeed “PROVIDE A SOLID BASELINE FOR GRADE EXPECTATIONS” based on HISTORICAL FACTS, but, but, but, FOR NOW, we are only comfortable with setting our OFFICIAL FORWARD-LOOKING GUIDANCE at “at least 10 gpt gold” until upcoming data collection allows Maurizio to be more definitive. In a more recent E-Mail with Maurizio, he stated to me, “I do not want to be guilty of putting out “FORWARD-LOOKING GUIDANCE BASED ON INCOMPLETE INFORMATION.” I agree 100%, and I now better appreciate the slippery slope they operate on.

So, the HISTORICAL RESULTS are cut and dried, and they are what they are. These are verified FACTS. As far as predicting the future, Maurizio is only comfortable AT THIS TIME with stating that management expects to average a PLANT HEAD GRADE (which includes normal rates of dilution from wall rock) of “AT LEAST 10 gpt gold”, with a very strong accent on the “AT LEAST”, in my opinion. The official operational results will be in hand soon enough. It only makes sense to do it Maurizio’s way. Why go out on a limb and risk punishment by the market if OPERATIONAL RESULTS, for some reason, don’t match FORWARD-LOOKING GUIDANCE? Most management teams prefer to tamp down FORWARD-LOOKING GUIDANCE expectations, so that they don’t risk “MISSING GUIDANCE”.

Why should the shareholders (of which management is by far and away the largest shareholder) take the risk of MISSING GUIDANCE? Note that the “AT LEAST 10 GPT” phraseology also covers Maurizio from being accused of UNDERSTATING the reality if OPERATIONAL RESULTS are much higher. I greatly appreciated Maurizio’s explanation and his candor. “At least” means just that, it draws a floor under the potential range of upcoming results.

After management runs large tonnages of stockpiled ore through the new crushers, the new ball mill, and then through the new FF plant, the CLARITY will be vastly superior to what it is now. Maurizio has stated to me that he is a huge fan of the “under-promise and overdeliver” school of corporate governance. He reminded me that Auryn’s taking what Kevin refers to as a “bootstrapping” approach, without formally delineating “Mineral Reserves”, does indeed result in a tiny number of shares outstanding BUT the trade-off is higher “geological uncertainty” levels. He addressed this towards the end of that 10/30/24 update by stating:

“Important Notice on Production without Mineral Reserves

The decision to begin production at the Fortuna de Lampa Project is based on economic models and management’s understanding of the property and EXISTING MINERAL RESOURCE ESTIMATES. Consequently, the project involves greater economic and technical uncertainties, including the potential for lower-than-expected mineral grades, unexpected construction or operational challenges and costs, and significant variability in production and economic factors due to the decision to proceed.”

Note that Auryn does indeed have in its possession “existing mineral resource estimates” but these do not equate to NI-43-101 compliant “MINERAL RESERVES” whose economic feasibility has already been established. But, the other side of that coin is that at $3,300 per ounce gold, “economic feasibility” of ore of that high of a grade, is not very tough to establish.

If Auryn would have sold boatloads of shares and raised perhaps $40 million to fully drill out the DL2 Vein, and perhaps another $30 million to do a PEA, PFS, and BFS (3 levels of studies) over the course of perhaps 4 years, they would indeed have higher levels of “GEOLOGIC CERTAINTY”. The problem is that they might also have 700 million shares outstanding instead of 70 million. This could have easily wiped-out Maurizio’s 62% CONTROL POSITION. This might help explain WHY Maurizio was willing to cut all of those checks personally, in order to put Auryn into production.

This lower level of “geological certainty” associated with adopting a “bootstrapping” approach makes it appropriate for Maurizio to be ultra-conservative in his FORWARD-LOOKING GUIDANCE, without having documented MINERAL RESERVES in hand, especially when the operational results are due in the near term.

It is the provider of financing that determines if a full-scale PRELIMINARY ECONOMIC ASSESSMENT (PEA), a PRELIMINARY FEASIBILITY STUDY (PFS), and a BANKABLE FEASIBILITY STUDY (BFS) need to be performed in order to “de-risk” the financier before he is willing to cut a check. These studies, that might cost upwards of $30 million and take perhaps 4 years to complete by an independent consulting firm, were not demanded by Maurizio prior to him being willing to cut the checks needed to advance the project all of the way into production.

He did, however, need key bits of information contained in those studies in order to make a “POSITIVE PRODUCTION DECISION” and he got that information. In a prior quarterly update, Auryn cited that they had in their possession “DETAILED FINANCIAL ANALYSES” regarding the mining operation at the DL2 Mine. After asking him if the shareholders could gain access to those analyses, he informed me that we will get those numbers after Auryn has run a certainfamount of tonnage through the new ore processing facility. Auryn’s new financiers that recently cut Auryn a $4 million check did have access to those analyses prior to cutting the check.

Auryn’s financiers that were willing to cut the $4 million check recently also needed to be “DERISKED” by the provision of whatever information their Board of Directors mandated prior to them being willing to cut their check. THE FACT THAT NEITHER MAURIZIO NOR AURYN’S INSTITUTIONAL FINANCIERS (which are “affiliates” of Stracon, Auryn’s new “Mine Operator”) DEMANDED THE EXECUTION OF FORMAL VERSIONS OF THESE REPORTS AND THE EXPENDITURE OF TENS OF MILLIONS OF DOLLARS AND APPROXIMATELY 4 YEARS OF TIME IN EXECUTING THEM, PRIOR TO THE CHECKS BEING CUT, IS A HUGE NET POSITIVE FOR AURYN BECAUSE OF THE MASSIVE AMOUNTS OF SHARE STRUCTURE DILUTION THAT WERE CIRCUMVENTED. The smaller shareholders of Auryn dodged a huge bullet in this regard. If you look at the grades present and the current price of gold, you can see how the issue of whether the deposit is “ECONOMICALLY FEASIBLE” or not, might have been a bit of a no-brainer. The only question remaining is just how large the profits will be.

Point #1: it’s a small point, but it really would have been nice if Maurizio would have done the math and presented the 57 gpt gold, 978 gpt silver, and 3.23% copper as “70 gpt “gold equivalent”. This is because a lot of the readers of the press release don’t know how to do the math involved in converting “by-product credits” into gold grades expressed in “grams per tonne”. Those levels of silver (978 gpt) and copper (3.23%) are easily “economic”, and the norm is to present that data in the format of 70 gpt “gold equivalent” for polymetallic deposits. This isn’t that big of a deal, however.

The proper benchmark reference, in order to provide some CONTEXT, would be that the average grade being mined worldwide in similar underground “narrow vein” operations is 4.18 gpt gold. Today, the miners of 4.18 gpt gold are making record profits. What might Auryn earn while mining the grade of gold they are mining? No matter what you participants of TheMiningPlay have been told over the years, THE DL2 VEIN REALLY IS A VERY WELL-STUDIED AND A VERY HIGH-GRADE VEIN, JUST ASK THE FINANCIERS. THE HISTORICAL FACTS ARE WHAT THEY ARE.

Point #2: You participants of TheMiningPlay investment forum have been told for years that these very impressive Enami smelting test results (70 gpt “gold equivalent”) should NOT be trusted and they should NOT be used as an expectation for future VEIN PROPER results because the sample size was based upon an insignificant “experimental batch” of ore probably not even weighing “a couple of hundred pounds”. It’s unfortunate that Maurizio opted to label a 2,200-pound sample as an “experimental batch”. This opened the door to unfounded criticisms by the resident naysayer that “only a couple of hundred pounds of ore were actually submitted for testing, so don’t trust these results”.

Now, what did Maurizio, in the 10/30/24 update ACTUALLY STATE with irrefutable CLARITY: He said that the sample size sent to the Enami smelter was actually 1 metric tonne which is 2,200 pounds (as opposed to 200 pounds, an 11-to-1 differential) and that these results do indeed “PROVIDE A SOLID BASELINE FOR GRADE EXPECTATIONS” for the ore contained WITHIN THE VEIN PROPER as long as the mining process involve mining with “minimal dilution” (a more surgical approach) via percussion hammers and not involving blasting. Blasting is a nonsurgical approach in which the grade of the vein proper material (approximately 70 gpt “gold equivalent”) gets diluted/lessened because some of the surrounding less well mineralized “wall rock” gets incorporated into the final product.

THE 20,000 TONNES OF STOCKPILED ORE

If you carefully read the 4 quarterly updates put out immediately before this 10/30/24 update, you’ll note how Auryn was bragging about how they were able to consistently mine the DL2 Vein “WITH MINIMAL DILUTION BY USING PERCUSSION HAMMERS/JACK-LEG DRILLS”. This ore was mined and brought to surface and stored in stockpiles pending the fabrication of a new ball mill and a new gyratory crusher by Lima-based “COMESA”, as well as a new froth flotation plant by an unknown manufacturer. The grade of the stockpiled ore mined in this non-dilutive manner should approximate 70 gpt “gold equivalent”. UNFORTUNATELY, WE DO NOT KNOW WHAT PERCENTAGE OF THE 20,000 TONNES OF STOCKPILED ORE SCHEDULED TO BE ON HAND ON DAY 1 FOR THE COMMISSIONING OF THE FF PLANT(somewhere in early Q3 of 2025), WAS MINED IN THIS “MINIMAL DILUTION” FASHION WITHOUT BLASTING. A thorough sampling of the stockpiled ore by an engineer would represent a wonderful gift for the shareholders and allow us to test that “at least 10 gpt” benchmark.

The new ball mill and gyratory crusher were completed by COMESA, inspected and checked off, and ready for shipment back in November of 2024. We have not had any updates on the fabrication and shipping of the new FF plant other than the most recent update stating that management thought that it would be “operable early in Q3 of 2025”, which I interpret as sometime in July i.e. very soon.

Point #3: The difference between announcing HISTORICAL FACTUAL RESULTS and the provision of FORWARD-LOOKING GUIDANCE is why Maurizio might risk confusing us with saying that the vein proper ore itself will probably average somewhere around 70 gpt “gold equivalent” but in normal course mining expect “AT LEAST 10 GPT GOLD” for the life of the mine? The 2 comments seem contradictory, but on careful inspection, they’re not really.

HOW CAN KNOWING WHAT GRADE OF ORE TO EXPECT WITHIN THE DL2 VEIN PROPER (APPROXIMATELY 70 GPT “GOLD EQUIVALENT”) HELP ADVANCE OUR DUE DILIGENCE EFFORTS?

There is one mining statistic that necessitates knowing the approximate “VEIN PROPER” grade that is independent upon mining methodology and dilution by wall rock. It’s known as “IN-SITU CONTAINED OUNCES”.

It’s important to know that 70 gpt “gold equivalent” number in order to very roughly estimate “in-situ contained ounces” of gold within the DL2 Vein. If you want to do a “back of the napkin” type estimation of how many ounces of gold might be contained WITHIN THE DL2 VEIN PROPER, what you do is multiply the known vein length “on strike” of 1,000-meters, by the known minimum vein depth (700-meters), by the average VEIN WIDTH (for now let’s pencil in about 1-meter).

This means that the “VOLUME” of ore within the DL2 Vein is about 700,000 cubic meters. We do know that the SPECIFIC GRAVITY/DENSITY of the granodiorite-hosted ore is about 2.7 tonnes per cubic meter. This means that those 700,000 cubic meters of pure vein ore will weigh in at about 1.89 MILLION TONNES OF THE “GOOD STUFF” i.e. just the VEIN PROPER ore without the less well mineralized wall rock.

If the average grade of the “just the good stuff vein ore” is 70 gpt “gold equivalent”, which is equivalent to 2.25 ounces per tonne since there are 31.1 grams per Troy ounce of gold, then the total number of “in-situ contained ounces” should be somewhere around 4.25 million ounces of “gold equivalent”. Again, “gold equivalent” includes the “by-product contributions” from copper and silver. Note that this is an “IF…THEN” type of analysis. IF the strike length and depth figures as well as the average width hold up, and IF the 70 gpt GE figure holds up THEN there’s somewhere around 4.25 million ounces of gold present “in situ” or in place within just the DL2 Vein. This 4.25 million ounces “in-situ” figure has nothing to do with the economics of mining and selling that ore. Don’t forget also that there are 6 or 7 other “Main Veins” contained within this same “Vein Set”.

Note the critical role of AVERAGE VEIN WIDTH in the economic analysis. If the DL2 Vein continues to widen with depth as it clearly has in the past, and if the AVERAGE VEIN WIDTH were to double to, let’s say, 2-meters, then that 4.25-million-ounce estimate, which is clearly an EXTREMELY ROUGH FIGURE, needs to be doubled.

I personally don’t trust that 4.25 million ounce “in-situ” figure that much, but I do know that it is important to “DO THE MATH” with the most accurate HISTORICAL DATA that you have at the time. I use the “in-situ contained ounces” figure as a screening tool in order to determine if it is worth my time to do extensive due diligence on a project. If that figure is less than 500,000 ounces then I’m not interested.

Write that 4.25-million-ounce number “in pencil” for now and keep a close eye on the VEIN WIDTHS found at levels 4 and 5. Throughout time, we’ll be able to see how the input variables hold up. Don’t think for a minute that Auryn is going to be able to mine and sell 4.25 million ounces of gold from the DL2 Vein. An “in-situ contained ounces” figure is, by definition, very much a “back of the napkin” type of estimate with very little geostatistical validity. A major miner might look at a figure like that as a screening tool to determine if they might have any interest at all. Most majors won’t give you the time of day if they don’t sense at least 2 million ounces of gold being present.

NOTE THAT THIS IS A VERY, VERY, VERY, ROUGH “BACK OF THE NAPKIN” ESTIMATE OF “IN SITU CONTAINED OUNCES” FOR JUST THE DL2 VEIN BASED UPON 70 GPT GOLD EQUIVALENT “PROVIDING A SOLID BASELINE FOR GRADE EXPECTATIONS”.

At this moment in time, I personally would boil down the above statement to “the DL2 Vein, by itself, PROBABLY has well over 1 million ounces of “in-situ contained gold”. I am ecstatic that Maurizio didn’t sell a couple of hundred million shares in order to find out the exact number of ounces contained. I don’t mind a little bit of “geological uncertainty” being swapped out for a heck of a lot fewer shares outstanding. The “operational results” are going to be what they’re going to be, and we’ll know those soon enough.

I do recall Auryn’s P. Geo Luciano Bocanegro’s preliminary resource estimate citing the existence of 686,000 ounces of gold just in the upper portion of the DL2 and Merlin 1 veins. This is not a MINERAL RESERVE figure, by any means. What I’m very confident in is the existence of a significant “mine life” attributed to the 7 or 8 “Main Veins” within this “Vein Set”. A Vein Set” is an accumulation of mostly parallel veins located in close proximity to each other and share similar grades, widths, gangue material, mineralization types, a common progenitor magma chamber, etc.

SOME CONTEXT: The DL2 Vein is one of about 7 or 8 “Main Veins” present at the ADL Mining District. We don’t know as much about the other veins as we do the DL2 Vein. We do know that the Merlin 1 Vein, for instance, has a known strike length of about 1.9 Km, almost twice that of the DL2 Vein. The Merlin 1 Vein grades found AT SURFACE during Auryn’s exhaustive trenching program were even higher than those of the DL2 Vein. Auryn management has made it clear that they’re going after all of the mineralized assets at the ADL.

SOME THOUGHTS:

The artisanal miners of the DL2 Vein (then called the “Fortuna Centro Vein”) averaged 64 gpt gold over the course of 30 years (1940 to 1970) without any on-site beneficiation technologies other than visual sorting. They were mining ore from levels 0,1, and 2 whose grades were vastly exceeded by the results obtained at level 3, where Auryn is currently mining. Admittedly, they only mined approximately 2,000 tonnes during that timeframe, but 2,000 tonnes is a decent “sample size”. I’m going to guess that their mining methodology involved blasting so this 64 gpt figure would represent a PLANT HEAD GRADE figure that just happens to be a lot larger than “at least 10 gpt”.

When Auryn intersected the DL2 Vein via the Antonino Adit, they did 2 sets of “channel samples”. The results came in at 164 gpt gold for grouping #1 and 150 gpt gold for grouping #2. “Channel samples” definitely use more of a surgical approach, sampling only VEIN PROPER ore with minimal dilution.

Auryn sent a sample of unknown size to the Lima-based Plenge Lab’s smelting test facility. IT WAS SOURCED FROM THE SAME AREA AS THE ENAMI SMELTER TEST ORE IN LEVEL 3 NEAR THE INTERSECTION POINT OF THE ANTONINO ADIT AND THE DL2 VEIN. The results came back with an average of 128 gpt gold JUST FOR THE GOLD COMPONENT OF THE SAMPLE. Note that Enami was only willing to pay 57 gpt gold for their smelting test even though the actual grade appears to have been 2.2-times that. This is why Auryn chose NOT to accept Enami’s seemingly generous 70 gpt “gold equivalent” deal but instead opted to process their own ore on-site via froth flotation prior to selling the resultant “float concentrate”.

According to ACA Howe’s Rob Cinits and world-renowned geologist Richard Sillitoe, the grades of the ore and the width of the DL2 Vein are BOTH improving with depth which is the norm for “mesothermal veins”. The “MESO’S” form deep in the earth’s crust where the pressures and temperatures are extremely high. The question becomes, what might the AVERAGE GRADES and AVERAGE WIDTH be at levels 4,5,6, etc. “Mesothermal Veins” are much wider and extend much deeper than the more common “Epithermal Veins”. The ADL Mining District sits in a “belt” of Chilean Mesothermal Veins extending from the Curacavi Mining District, which borders the ADL to the south, and the Empressa Caballo Mine bordering the ADL to the north, part of which is already owned by Maurizio, in one of his other companies.

THOUGHTS

Yes, at first glance, assuming that the grade of the vein material itself (not including the surrounding wall rock) will average 70 gpt seems like a pipe dream but the GEOLOGICAL FACTS obtained to date, suggest that a wait and see approach might be warranted before dismissing this possibility. The phraseology “AT LEAST 10 GPT” leaves a lot of wiggle room for potential upside surprises without anybody having the right to criticize management for understating the potential for the mine.

A scary thought might be what might happen if the average vein grade levels at level 3 are around 70 gpt “gold equivalent” and BOTH THE AVERAGE GRADE AND AVERAGE VEIN WIDTH IMPROVE WITH DEPTH SIMULTANEOUSLY. That seems like a very powerful potential combination releasing some serious synergies. I’m anxious to see what is going on at levels 4 and 5 in regard to AVERAGE GRADE and AVERAGE VEIN WIDTH. What if 70 gpt “gold equivalent” and a 1-meter width at Level 3 gave way to 90 gpt and a 2-meter average width at Level 5 i.e. 70 “gram-meters” versus 180 “gram-meters”? What if this occurred when the price of gold was trading at or near all-time highs? No promises, of course, but it’s something to think about.

WHAT EXACTLY IS “BOOTSTRAPPING” ALL ABOUT AND WHAT SHOULD AN INVESTOR THAT OWNS SHARES IN A MINING FIRM BEING DEVELOPED VIA “BOOTSTRAPPING” BE EXPECTING?

“Bootstrapping” a mining firm means that the founders opted to NOT go outside of the company in order to raise capital to further the development of the company. First of all, “bootstrapping” is EXTREMELY RARE. I’ve been active in the mining sector for 45 years and this is the first time I’ve witnessed it. I’ve tried my best, but I can’t find a “market comp” anywhere in sight. I sense that we are in uncharted waters in this regard.

Maurizio already owns 62% of the shares of Auryn. If he were to raise capital the usual way, by selling shares to outsiders via “equity raises”, he would have the most to lose via dilution. That 62% ownership position could be 20% in a heartbeat. If he thinks that “the market” has undervalued his company, the last thing in the world he would want to do is to sell boatloads of shares at often steep discounts to the current undervalued share price in order to raise the capital needed to develop the company.

“Bootstrappers” with significant financial means of their own can maintain CONTROL if they volunteer to cut the checks needed to advance the corporation. “Bootstrapping” might represent a “vote” by management that the current share price is inadequate, and he doesn’t want a bunch of strangers to get ultra-cheap shares on the back of his efforts. As far as “bootstrappers” like Maurizio that advance cash while charging ZERO interest, well, that’s just weird. He could have easily charged 10% to 12% interest without anybody thinking any less of him. He could have also sold himself shares and increased his ownership position from perhaps 62% to 92%, but he didn’t. Perhaps “bootstrapping” indicates an extremely high level of certainty about the chances for success of a corporation.

As an investor in a mining firm being developed via “bootstrapping”, I would take comfort in the fact that management’s financial incentives are EXTREMELY CLOSELY ALIGNED with my own. I wouldn’t expect exorbitant pay packages for management members or the employees. I would take solace that the “cost of capital”, during the formative years, approaches ZERO. I would also assume that the chances for further dilution of my percentage of ownership, after going into production, is pretty much nonexistent. There are a lot of things that I wouldn’t lose any sleep over.

I would expect that management would not find the need to be overly promotional especially if the share price continued to lag. Management teams that constantly need to sell shares into the market have a lot of pressure to keep the share price propped up, in order to minimize share structure DILUTION. I would have to dial back my expectations for immediate gratification and assume that there will be a trade-off in effect that my rewards will be enhanced due to the lack of dilution but perhaps delayed due to the lack of a need for constant promotion by management.