Do you think we will get news this week??? I think for them to properly put together what happened last week, will take time. Plus if they will be putting out a series of news releases, it needs to be well written and coordinated.

Some of the Boyz’s did not return from travel until last night so some patience is probably in order.

Are we still working with CHF Relations??? (I think that was the company) Ugly trading day so far for us…

Yes…they are still involved.

Thanks Mike. Nobody has mentioned them in quite awhile. I hope we get to put them to work…

There was a poster with the name TSX and he mentioned that soon will be on the TSX I hope he reads this and can elaborate more on this topic

Truer words have never been spoken. This is exactly why chasing “next week” based on the latest rumour from Les has caused so much frustration. Nobody should worry about the “when” but rather the “what.”

CHF hasn’t been working with/for MDMN for many months, they ARE working with Auryn. FWIW

The distinction between Medinah and Auryn gets a little fuzzier every day.

I think this new SERNAGEOMIN finding presents us with a new batch of puzzle pieces that are starting to fit in very nicely. AMC just acquired some “ownership”. In order to go public on the TSX.V, AMC would need to obtain "a material interest in a Tier 1 property or a 50% ownership in a ‘qualifying’ property’ ". A “Tier 1” property is one that has had a bunch of work done on it. You also need to have a “technical report” completed in accordance with NI 43-101. Thus you need to “own” a material interest in a property with an NI 43-101 technical report done on it in order to access Canada’s largest exchanges like the TSX or TSX.V. That’s partly why a completed 43-101 adds a lot of “value” to a property. These exhaustive reports can fulfill the requirements needed to go public on Canada’s biggest exchanges which are very mining friendly and mining oriented. My gut is that CHFIR was retained in order to streamline the listing process for AMC or Masglow. Recall that Medinah is the only OTCMarkets Pink Sheet issuer they represent.

Holding a mere “option” on a Tier 1 property doesn’t quite cut it for listing purposes you need “ownership” and “ownership” of something that has had a lot of geological work done on it. There appears to be a quid pro quo here in which Medinah waived the typical noncircumvention agreement barring AMC from sneaking around and tieing down strategic properties in the neighborhood. In exchange, it appears that Medinah probably gets a “free” 15% stake in the property as it gets incorporated into the overall ADL option agreement. AMC has a lady team member that does all of the annexation work probably in a much more efficient manner than Medinah could.

Going public is a double-edged sword in that you have the reporting hassles and expenses but it does provide a new spigot to raise big bucks and gain access to liquidity for the early donors to Masglas and perhaps even Medinah’s shareholders. The environment for attaching an IPO to going public is starting to look a little better but not all that great. I get the distinct feeling that Masglas/AMC does not need an IPO in order to cash out Medinah but I’m sure the option is nice to have nonetheless. They could always do a secondary offering later perhaps in a better mining environment. I would think that the early production opportunities would have an extremely beneficial effect on the market’s valuation of AMC should they go public especially if they’re raking in 85% of the profit in the post-option exercising era.

It’s kind of fun to read about these new developments and then go back through the items on your “doesn’t quite make sense yet” list and check them off. Reading about developments like this on the official SERNAGEOMIN website and noting new developments on Google earth images like the path of the Merlin 1 Vein and how it goes across the plateau and down the northern downslope off of the plateau is very refreshing because it comes from a nonmanagement source and it can corroborate what we’ve been hearing all along.

Doesn’t look like JJ shares have been settled in these meetings as we keep having unlimited amount of shares thrown on the ASK.

So we can take that off our list

If anyone is interested in the listing requirements for the TSX-V, look at page 21 of the following link. Also, Masglas already meets listing requirements due to its acquisition of the First Quantum/Inmet properties which had $15MM of exploration work on them. So they don’t need to exercise the option to go public.

file:///C:/Users/Owner/Downloads/guide-to-listing-2015-08-14-en.pdf

That link may not work, go to TMX TSX | TSXV - Listing Guides and click on Listing guidelines, the pdf will load and go to page 21

We have some NEWS on the Auryn web site…At least we will have something new to discuss!!!

There is indeed news on Auryn’s website, but it’s a bit of a snoozer. Wake me up when Juan heads for the exit.

Update on bonanza gold grades in Caren mine, have returned over 100 g/t Au at Fortuna – Merlin system in the Altos de Lipangue project, Chile.

(January 27 th at 12:36:00 pm)

HIGHLIGHTS

Gravimetric Fire Assay results confirmed bonanza grades up to 124 g/t Au.

Geochemistry and vein textures confirmed preserved low sulphidation epithermal system.

AURYN Mining Chile SpA is pleased to announce the completion and update of geochemistry results from bonanza gold grades (>100 g/t) at Merlin I vein in the Caren Mine sector within the Altos de Lipangue Project.

These important results in precious and base metals encourage the company to advance in the early production evaluation opportunity.

In the News Release of January 06, 2015, two samples (34857 and 34860) returned with the maximum values of the Fire Assay analysis method of 50 g/t Au. ICP mass results from the batch sent to laboratory from sample 34854 to 34861 were pending. The samples 34857 and 34860 were re-analyzed by gravimetric Fire Assay method with intention to obtain an accurate gold value. ICP pending results were received from 3A Laboratory. The updated results are shown in Table 1.

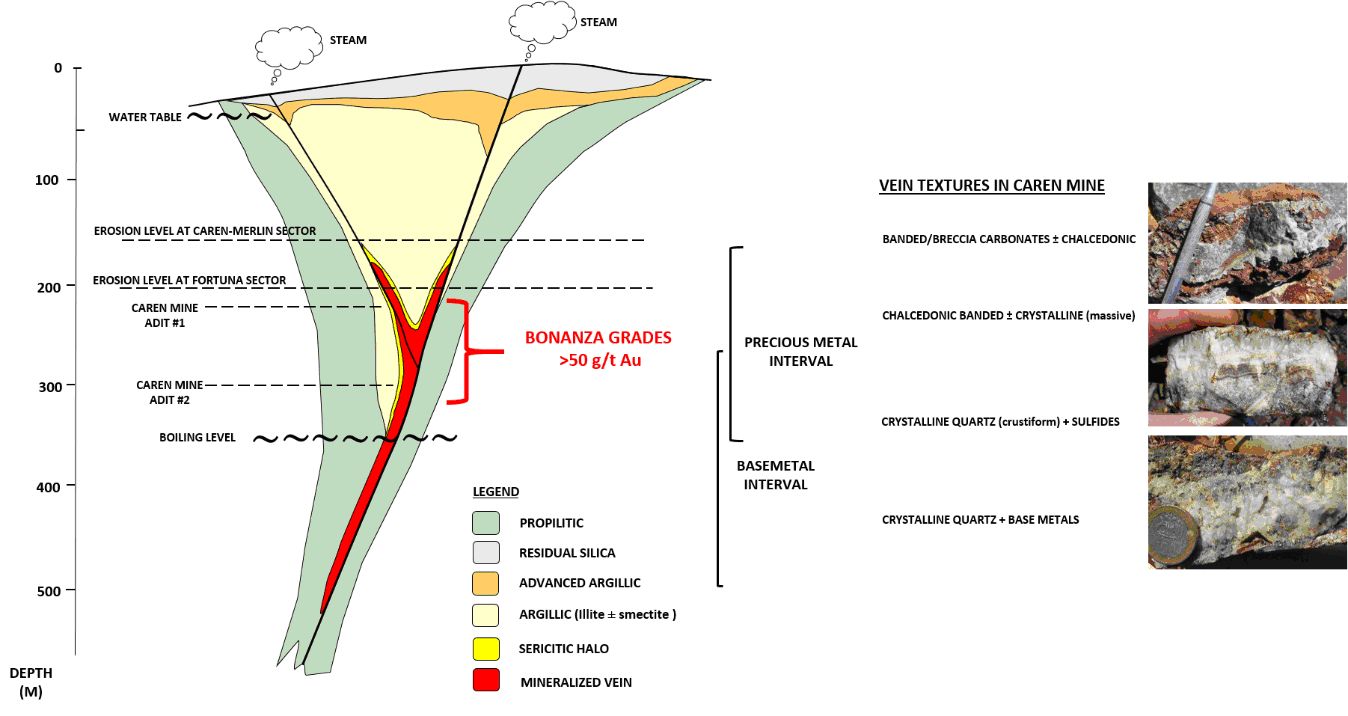

Adding to this, as was anticipated in the mentioned News Release, there were recognized quartz-carbonate textures and geochemistry vertical zonation in Caren mine.

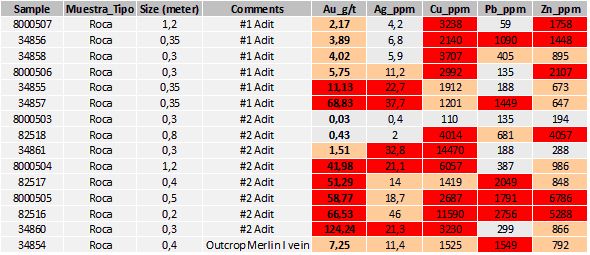

Table 1. Sampling results of adits in Caren mine.

Table 1 shows that the main bonanza grades are in samples collected in the Adit #2 at meter level 1,840 and in Adit #1 at meter level 1,875. Adit #1 is highly anomalous in Au, with samples up to 68.83 g/t Au. Also a good correlation is observed with Ag where the main anomalous samples belong to deeper levels, including values up to 46 g/t Ag.

Even the anomalies in base metals (Cu, Pb and Zn) are increasing their values in deeper samples suggesting the location in the mixture zone between precious metals and base metal zone.

In addition to the geochemical evidence, the quartz-carbonate textures correspond with typical zonation demonstrated in low sulphidation epithermal systems. To illustrate this analogy a schematic section is shown in Figure 1.

Figure 1. Schematic section at Caren mine, vertical textures zonation and exposed levels in Caren and Fortuna de Lampa mines. Modified after Buchanan (1981).

« Positive Results in the Environmental Survey at Caren-Merlin-Fortuna Area in the Altos de Lipangue Project