He put that up at 09:30:17 EST.

I’ll guess it’s what he did not get filled from Tuesday’s 10.6M start.

This is through CSTI. Previously it was through CDEL and then NITE. IMO it’s a copycat trying to collect 2M in the same way that the other buyer was able to get 40M, 60M, whatever, at the same price.

Funny how it doesn’t work as well when you don’t have an arrangement for an 8M daily dump into your bid.

CHG can you post an l2 please

I’m traveling today but do see a bid of 455000 .0216

You are correct and it may be a different buyer altogether, but I can’t rule out CSTI only because in the past I have seen CSTI, CDEL, NITE, and ETRF all have the same bid and/or ask passed between them within seconds by a single buyer or seller while dangling the bait.

It was removed/withdrawn after about 4 minutes. ![]()

Bubba. Before you start throwing your price target darts again and congratulating those who have predicted dividends for the past decade, remember to separate opinions from reality. Those who think a TO or RTO is the outcome are offering their opinion. Those who think we are going to be become a dividend machine are offering another opinion. There’s no doubt the latter scenario is a more preferable option ,even for those looking for a “thoughtless exit” but it’s important to weigh the probabilities of this outcome as it relates to what makes the most economic sense to AMC and the undeniable fact that Chapin, Les, etc are looking for a liquidity event (just ask them).

The good news is that whatever the outcome, it looks like we will all know sooner rather than later as AMC is moving expeditiously.

Gold back up to $1220. Pretty nice stability / action after the recent up-ramp & then pullback.

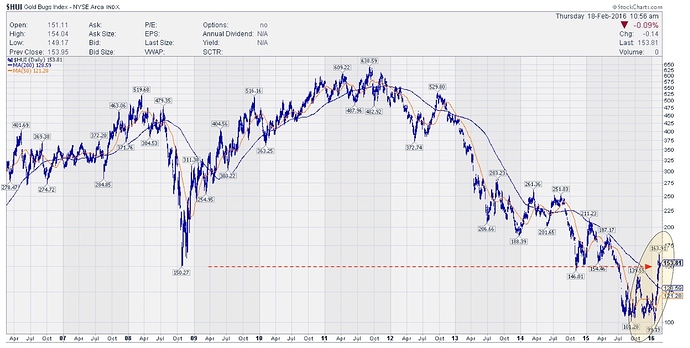

The mining shares are definitely seeing accumulation now. $HUI up 50% from its lows. But still only to the bottom of the 2008/2009 GFC. The pace seems deliberate now in the shares even when gold / silver are flat.

Related: Barrick announced yesterday they will reduce debt by another $2B by selling assets. Further:

“Our production will be measured by quality, not quantity,” Barrick said. “While we are producing fewer ounces today than we have in recent years, we are generating significantly more cash.” The company posted positive free cash flow in 2015 – $471-million for the full year – for the first time in four years.

The company said it will continue to cut expenses and expects all-in-sustaining costs at $775 to $825 an ounce this year. The costs fell to $831 in 2015 from $864 a year earlier, Barrick said.

The only way for them to do that is cut costs and focus on higher grades.

Investors are seeing the improvements in the behavior and performance of companies, not just Barrick, and are starting to take positions for the future.

Looks like Auryn to me

TDA only shows a total volume of 696K.

I don’t see any of those large sales on TDA or on IHUB.

The last trades I see on TDA are the same as those here on IHUB, 70K and 180K.

I did see that other 2M bid earlier. Looks like it is covered up now.

Still bid whacking going on

Please Sir, may I have another ?

Level 2, that is !

Thanks,

Rod

[quote=“Baldy, post:238, topic:929”]

The good news is that whatever the outcome, it looks like we will all know sooner rather than later as AMC is moving expeditiously.

[/quote]This is evident ever since AURYN came on board, but far too slowly for many that have been here 10 years or more, especially those that have either passed away, or had to liquidate before realizing a ROI. Things are looking as though things will finally come to a conclusive earlier agreement than the July 31, 2017 expiration date that has been discussed extensively. All shareholders are awaiting a detailed public news release of the details. Until we have official news all else is just rumor or speculation. The recent trading patterns indicate there is movement behind the curtain that will soon come to light. I still don’t believe AURYN needs a controlling interest in MDMN, but it is likely AURYN (AMC) is again “acquiring shares” on the open market. AURYN can successfully complete it’s long term plans without shutting down MDMN (the public company) via a TO. Any future TO will only involve the claims on the mountain and MDMN’s 15% equity interest in AURYN.