Note: his cost is “per tonne” not “per ounce”

Nope. … ![]()

Is it your assumption, that there was/is no “good faith” down payment coming before production or are you posting from knowledge?

[quote=“mangelsen, post:180, topic:952”]

I think it is great that Medinah took the initiative and released this update on their own, without following Auryn’s lead.

[/quote] Actually, most of the update sounds like what was promised a couple of years back a the last SHM. A report on what was found at the LDM was about ready for release. Was an NDA in effect preventing release until now?

Absolutely!!!

[quote=“leanandgreen, post:207, topic:952”]

Medinah could have demanded a “good faith” down payment on the option since they are letting them start production pre-exercise They failed to do so.

[/quote]If Medinah had demanded a down payment, Auryn would’ve demanded something upwards to 50% of the ownership of claims before sticking a shovel in the ground. That is the way traditional joint venture option agreements with an upfront payment are constructed. For a 20-year old cash-strapped company with a bloated share structure, MDMN got a great deal on their option agreement. About 18 months ago I did an exhaustive analysis on all the joint venture option agreements occurring in the Chile/Peru region over the previous 4 years. It was quite eye opening and I can assure you that Medinah’s JV terms were by far the best of the lot. I’d much rather they have the deal they have now then have one with an upfront payment that eats into MDMN’s ownership percentage of ADL. Because if Auryn paid something upfront and then walked from the deal, they’d still wind up with their ownership percentage of ADL, making any future progress and negotiations on the property quite sticky.

Just curious. …would mdmn be able to disclose their intention of what will happen to the 100 mill when they receive it? Or would that be against securities law and/or a tip off to the shorties to start covering before it is actually received?

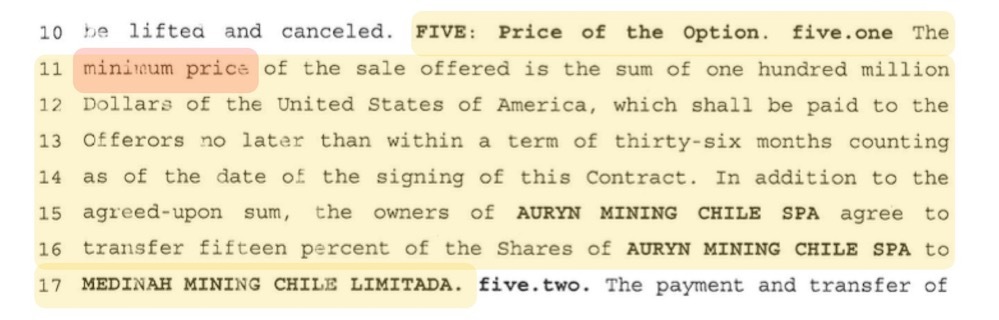

The word “minimum” comes from Section 5.1 of the ADL contract so Medinah’s previous usage of it comes from there. No clarity is given what that means or implies.

Montag,

There is no legal violation of them announcing their intentions with the money in a general sense (dividends, property acquisitions, share buybacks, etc.). Companies do this all the time. However, because them receiving the money is contingent upon Auryn exercising the option, making such an announcement would be ill-advised and akin to counting chickens before they’re hatched. Given the history of “done, done, done”, MDMN’s BOD would be wise to keep their mouths shut until the money is in the bank.

You are absolutely correct MikeGold. This is definitely one worth waiting for. Just need to be patient, let Auryn carry out their Business Plan, and one day/someday, MDMN share holder’s will be greatly rewarded!

I can’t recall the Co ever going out on a limb with a public comment like dividends. Les has but official communications by mdmn I can’t recall. In fact, this is the first time they appear to be giving something which could potentially be a pump!!

I just don’t think we will be seeing that check prior to the conclusion and analysis of the next Drilling Program. I’ve said it before and still stand by it. Auryn needs to find a bit more about the Mountain before making that decision. And MDMN also needs to see a bit more before they settle on the purchase amount they will be receiving from Auryn.

Both parties will benefit from more drilling and more knowledge of what the Mountain holds.

Important paragraph from today’s News

quote=“TheRod, post:157, topic:952”]

The most lucrative part of the contract will be the retained interest returning dividends for the entire life of the Altos de Lipangue mine properties.

[/quote

Nothing really new there with the dividends planning to be paid out, that’s been talked about and anticipated since the contract was first signed in 2014. Nice to see MDMN put it out in official news though.

Assuming your 5% amounts, here’s an alternative calculation:

If you add in the exploration $$$ to the cash portion of the deal you could alter the numbers somewhat but not in a major way.

My concern is once the option is done, who is going to get the check? Will it go into a bank that has sufficient resources to handle that amount of money or disappeares in the Cayman Islands. I’m not saying that will happens but I think there should be stated controls for that $100 million check.

Not likely that Billionaires would sign an option agreement offering $100million and then be sweating whether they can come up with it. They are not Ulander!