Probably see something from Auryn but will need to wait a little longer to get something substantial.

Mike,

Your a valuable asset to this board. Your DD is awesome!

I can promise you that your assurances mean very little at this point in time. The only assurance that will mean anything to me will be coming from Auryn, and their assurance can go in many different ways. Everyone’s hope is that we get positive assurance. Until they execute whatever plan they have, its all speculation.

Really no need to be concerned with our investment. Everything is off and running to a conclusion. There is a couple possibilities on how this will wrap up but all good for Medinah.

Auryn has made amazing discoveries on the mountain. This is going to translate into success for shareholders.

Did we ever! And look what the snake oil salesmen brought us…

[quote=“Karl, post:99, topic:982”]

You can complain all you want, but I see no benefit in it.

[/quote]You’ve got that right!

The NOBO/OBO information has been presented previously. We don’t get Broadridge electronic voting without one being requested from the BOD. May have been cost prohibitive way back when the rumored shareholder base was 60K and there was cash only from the sale of treasury shares. We are in different times with a much reduced shareholder base. I would estimate only about 4K active shareholders, but that is only a WAG on my part. A requested list would set that straight. At the very least, I would expect a list for voting street shares if we are to have a GSM with real agenda items and shareholder participation. Previous “votes” have been a farce with only shareholders of record, and CEDE and company accounting for the bulk of all votes cast.

Requesting this in the past has been unrewarding. Not meant as a complaint, but perhaps more shareholders making the request would produce different results than in the past.

As always, the big question is…WHEN ?

When will we finally get our payday

The day Auryn excersises the option. Which we might have to sit here till August 2017 and stare at a SP that makes me sick to my stomach!

Thank you Lean your posts make too much sense

[quote=“leanandgreen, post:111, topic:982, full:true”]…

- The ADL has taken a backseat and thus the $100M

- AMC can now walk from the ADL w/less sunk cost

[/quote]

I am going to disagree with Wiz’ recent summary of the ADL option and its impression that the exercise of the ADL option is mostly if not entirely dependent upon results at Pegaso Nero. I think that idea is causing unneeded concern. Consider:

-

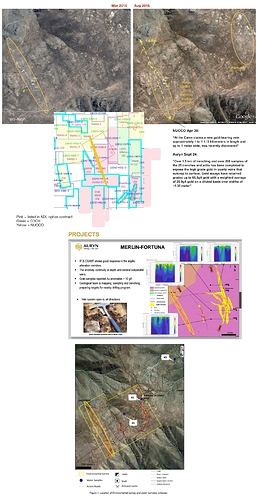

From the image I have presented before, clearly at least half, if not more (as per MG), of the Merlin 1 vein lies on MDMN property. See the image below. Other Merlin veins are mostly or entirely on MDMN claims.

In addition, MDMN property lies in the middle of everything including in between Fortuna and the Caren claim. Yes, in the short term (2016 / 2017) it is possible Auryn can keep to surface mining solely on Caren and Fortuna. But there is no long term future for mining those veins or what is below them, to depths of 200m or 300m without the MDMN claims. MDMN property is integral to the high grade gold. You can easily see this from Auryn’s Caren/Merlin map in their own presentation on their Projects page (see below). In addition you can see it from Auryn’s maps in their announcements about the Merlin veins. Also see below. -

Aside from all of that, there are only 516 days left till Aug 2017. The PN copper/moly porphyry may have a few holes drilled in it by then, but I guarantee it will not have enough definition to have enough reserves identified to justify a $100M price tag. There isn’t time. PN is the long term game, not the ADL option game.

-

If you followed my chart from last week re. how Auryn shares are being used to pay for NUOCO and Fortuna, at least for NUOCO I would say:

3A. It’s absurd to talk about NUOCO/LDM being worth 5% of Auryn and no cash, while the ADL is worth $100M and 15%. That makes no sense. And further look at the math. The conclusion is that this was pre-arranged. The 5% of AMC was the “price” of the option on NUOCO from the beginning. The LDM was always to be consolidated with the $100M price tag for the ADL. This was all laid out from the start, IMO. It was not the result of a trip to Chile, an afternoon of negotiations, followed by a rush to the notario.

3B. Obviously somehow, Auryn was able to take possession of NUOCO without exercising the ADL option. This was either by design, and this transaction is still somehow legally dependent upon exercise of the ADL option, or it was a change motivated by Auryn’s wish to get into production right away and maybe so they could use legal possession of those claims as part of their AMC/Masglas promotion / capital raise. Whichever the case, they need MDMN’s claims or their own claims are worth much less in the long term.

LNG. I don’t think you’re wrong on many of your points. However, I wouldn’t spend too much time or energy focusing on the nonsense related to Lett’s fiduciary responsibility or taking advantage of disconnects. Don’t fall into the same trap that many others have over the past two decades. A lot of emotional and financial suffering will result.

I don’t see any signs that AMC will not move forward with a tender or option exercise for the ADL. It’s highly unlikely they will move forward with early production opportunities on several surrounding claims (Fortuna, Caren, Nuoco) without the ultimate goal of controlling the entire mountain. Yes, our BOD should not be trusted and border on the line of criminality in most of their actions but that’s why we are trading at less than 2 cents.

For those who can see past the ridiculousness of "Vancouver’'s predictions for “next week” and the geo hobbyists “delusions on grandeur” there’s a tidy profit to be made here.

I can see it is not all good for you. We all have come from different places and we are all looking at our investment through the eyes that got us here. I can assure you, for me, It Is All Good!

As we approach what ever event it is going to take, that signals Auryn to exercise their purchase option of the ADL, we all have time to make our decisions on whether we Buy, Sell or just Hold onto what we have.

I haven’t been quiet about what I’ve been doing and am still doing. I trust our MDMN management team has negotiated a good future for us shareholder’s and I believe Auryn and MDMN have a good working business relationship that both will benefit from. The Mountain has a lot of promise of which all of us who are building our MDMN positions will benefit from.

I strongly believe all that, that is why I am here and still accumulating, and I like the way things are progressing and how it is all being handled. I have no complaints.

I understand the frustration that shareholders have (me included) but the situation is what it is and we are not gonna change it ranting about it.

So I want to thank CHG and Baldy for their EDUCATED guesses and perspective about our investment.

Honestly, I think you two should be the next presidential ticket!!

“-no disclosure on the Juan share issue”

I’m not sure what you are expecting but all of Juan’s shares are controlled by Les. Auryn still wants them but they no longer are holding back any of their plans.

“-no disclosure on Claro dumping”

Again Medinah has little or no visibility on who sells their shares and certainly can’t prevent them from doing so. It appears that the during the last big sell-a-thon-there might have been several sellers; not just one.

“-AMC gains leverage in Nuoco/Fortuna acquisition”

Yes-but isn’t that a good thing? It was essential for Auryn to acquire those and it makes them that much more invested in the mountain’s future. Even better, Juan was removed from the equation when those acquisitions happened…bonus for everyone.

“-No cash up front so far”

True.

“-pps consistent decline with Sr. Lett’s on BOD”

As far as I can tell, the Letts have little involvement in anything at this time.

“- Letts complicit in lack of disclosure(Claro)”

See Above.

“- Letts fails to facilitate a levering of the disconnect”

See above.

“- The ADL has taken a backseat and thus the $100M”

This is where things fall apart for you.

“- AMC can now walk from the ADL w/less sunk cost”

The last possible chance that Auryn would walk expired during the last trip in Chile when Juan was written out of the equation.

Thank you Lean! The unfortunate thing we have here is once Medinah stops acting like a penny stock the SP will adjust meaning more disclosure until then we will continue to be treated like a penny stock my .0163 worth

For those you who don’t follow Primero (SYMBOL “P” on Toronto). The stock was trading at $3.80, got an indication from the Mexican gov’t that they might renege on a tax ruling. The market responded by driving the price down to $2.20.

THE HIGHLIGHTED DRILL RESULTS ARE SOME OF THE BEST I’VE SEEN FROM ANY COMPANY FOR A LONG TIME. 7.7 g/t gold over 102.6 metres IS AMAZING.

Primero Provides Exploration Update; Black Fox

Froome Zone Expanded With Intersection of Significant Continuity; New

Vein Discovery at San Dimas

TORONTO, ON, Feb 29, 2016 (Marketwired via COMTEX News Network) --

Primero Mining Corp. (“Primero” or the “Company”) (TSX: P) (NYSE:

PPP) today announced the results of successful exploration programs

at the Company’s Black Fox mine located near Timmins, Ontario, Canada

and the San Dimas mine located in Durango, Mexico.

Black Fox Exploration Highlights:

-- Froome Zone Expands with Significant Continuity: Highlights from recent

drilling at the Froome zone, located 800 metres west of the Black Fox

deposit, include long mineralized intercepts of significant gold grades

of **5.0 grams per tonne ("g/t") gold over 42.9 metres** true width (15PR-

G011), **4.6 g/t gold over 35.3 metres** true width (15PR-G031) and 6.0 g/t

gold over 25.6 metres true width (15PR-G048). Primero also completed a

drill hole to test the down plunge extent and continuity of

mineralization, which featured notable intercepts of **6.1 g/t gold over**

**44.1 metres**, **7.2 g/t gold over 14.7 metres**, and **7.7 g/t gold over 102.6**

**metres** (15PR-G016).When Carl Icahn takes a big equity position in a company he usually tries to get at least 2-3 members of his team on their BOD. That position is to further his goals on a flip on the stock . Other shareholders usually are able to ride his coattails, but his fiduciary duty is really to himself for his company and his hedge fund, even though he pontificates always about shareholders rights, only because it furthers his efforts.

Many a JV requires partners from both side to sit on the BOD of the company in control… It is never to further shareholders intelligence or rights, but it is to assure that members of the BOD are all acting on the same page and in the best interest of each others position.

So it is Obvious why Letts sits on our BOD because Auryn wants to assure they know what we are doing and that it is also in their best interest.

Interesting 4 MM all lined up at .0163 ask this morning!