Im sure they are all dead that list was a 20 year old list Im sure… HE was full of shit then and still is

ohhh so true.

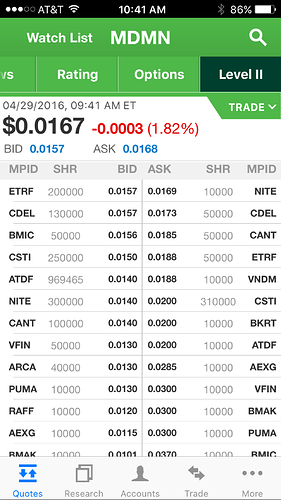

Don or anyone else L2 please

Gold moving closer to 1300

Doesn’t matter we’re capped at a TO of $.10-$.20

My apologies if this was already posted, but found this article dated yesterday.

Google translation as follows:

The recovery of copper prices is back in after falling for a third day. One of the main factors behind the downward trend is the fear of a weakening in demand from China, central player market.

Follow @PortafolioECpe

In this context, Freeport-McMoRan Inc -a company owned Cerro Verde and producer of the world traded largest copper, announced this week that it expects to have sold about US $ 3 billion in assets of the company before mid this year.

Peru is an important player in the copper market, since we occupy the third place in terms of copper reserves worldwide and more than half of our mining production is based on this mineral. Thus their rise or fall is highly relevant to our economy.

“Copper is a very high risk business in which huge amounts of capital are required,” says Maurizio Cordova, chairman and Auryn Masglas Mining. He argues that in addition to this factor, consider that a new copper mine takes between five and seven years to start operation.

In this context, the industry focuses on those operating costs you can control.

The trend in the mining world at international level will be to find efficiencies through technology and adapt to the “new normal” that has marked the crisis still underway, says Philip Hopwood, Global Mining Leader at Deloitte.

Adapting to change

Peruvian copper mines are among the most cost-efficient at the global level, so they can keep their production in a context of low prices for a long time, says Bruce Alway, area manager of Thomson Reuters base metals. However, some of the questions that are put on the table are: how long can you sustain the industry under this scheme and what costs should sacrifice internally.

While technology generates a significant reduction in operating costs, finding this mostly efficiency requires additional investment, in this context companies in the sector could not prioritize.

On the other hand, 40% or 50% of mining costs are associated with labor, according to the Deloitte report.

In Peru, layoffs should be treated very carefully, as this could increase the level of conflict with neighboring communities, said Cordova. In Chile, he adds, while labor laws are flexible, unions are very strong in negotiating working conditions.

The fall in prices is a disincentive to attract mining investment in the country, a trend that Deloitte confirmed in the sector this year. Cordova argues that the Peruvian copper industry has greater potential geological Chile, since copper mines in this country have low grade, while Peru still has much ground to explore.

However, the suspension of mining projects would create a precedent out wrong. Experts agree that requires the state is a guarantor of the viability of the projects, since these have the necessary permits and studies.

Could be but who knows for sure.

No one. Least of all anyone here.

Is next week “FINALLY” the week??? Is there ever in the history of the the stock market, a group of investors, that have “earned it” and “deserve it” more than us??? I do not think so!!!

Let’s hope.

Does anyone know if management finish conducting business and are still leaving tomorrow?

Who will announce first, Medina or Auryn?

Yes. Flying out tonight.

Out of curiosity, what are people expecting to see in the upcoming announcement? Assuming the definitive docs are signed we should see confirmation of the terms previously announced. I’d love to see some additional commentary on AMC’s plans for early production and exploration but I can’t see much beyond these details. I’m hoping people aren’t still under the assumption we’ll be receiving upfront monies or royalties on early production but it’s always dangerous to assume with this group. Finality of the deal is a net positive either way.

My guess is that the commentary would be all over the map, much like opinions, that would just offer up an opportunity for someone to start calling someone else names. Why don’t we just set back and wait until we can read Auryn’s update followed by a copy of the published English version of the newly signed contract. ![]()

The commentary on AMC’s plans for early production and exploration will best come from AMC first. ![]()

It doesn’t matter who announces first. The terms are already specified and published.

I am looking forward to see AMC get to work on the property in the coming months. It will take some time, but I believe you’ll start to see a new MDMN. The old way of doing business simply isn’t going to stand any longer.

Fresh air and fresh investors will come with clarity, transparency, and actual exploration and results. I expect a nice steady increase in the share price over the coming months and perhaps the occasional blip up or down as momo players do their thing or an investor of size decides to get in or out.

That’s my $0.02. (almost)

Yes, “this group” can always count on John to start the week-end on a high note! ![]() [quote=“Wizard, post:195, topic:1213”]

[quote=“Wizard, post:195, topic:1213”]

Fresh air and fresh investors will come with clarity, transparency, and actual exploration and results.

[/quote]

Thank You Kevin!