Hochschilds up to something…

Canada’s Atex to acquire copper-gold project in Chile

MINING.COM Staff Writer | September 24, 2019 | 6:20 am Exploration Latin America Copper Gold

Atex team working in Chile. Image by Atex Resources.

Atex Resources (TSXV: ATX) announced that it entered into an option agreement to acquire the 3,705-hectare Valeriano copper-gold property located in the northern portion of Chile’s El Indio belt.

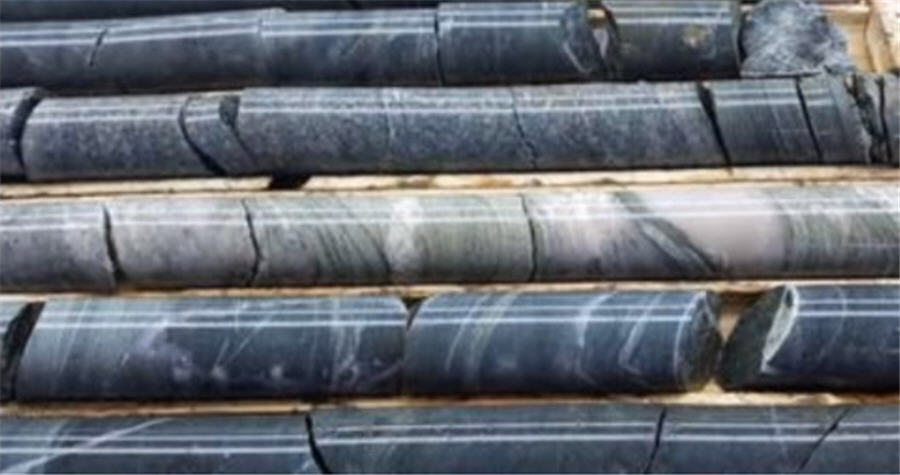

In a press release, the Vancouver-based miner said the Valeriano concessions overlie a large copper-gold-molybdenum-bearing porphyry system which has been only partially tested by three diamond drill holes completed in 2013 by Hochschild Mining.

THE VALERIANO PROPERTY IS UNDERLAIN BY ALTERED FELSIC VOLCANICS WHICH AT DEPTH HAVE BEEN INTRUDED BY A MULTI-PHASE GRANODIORITE PORPHYRY

According to Atex, historical information revealed that two of the drill holes intersected a potassic altered granodiorite porphyry including drill hole VAL13-14 which returned 1,194 metres grading 0.52% copper, 0.24 grams per tonne gold and 36 parts per million molybdenum.

“While prior operators focussed largely on the near-surface potential, it wasn’t until recently that the porphyry potential of the property was recognized,” Carl Hansen, Atex CEO, said in the media brief. “Deeper seated systems, such as Valeriano, represent the next stage in copper-gold porphyry mine development with major mining companies now exploring and developing bulk tonnage underground mines. We are eager to start a systematic exploration campaign with the goal of defining the full potential of the Valeriano copper-gold property.”

Hansen said that Atex has committed to invest $15 million on the project over a four-year term. At least 8,000 metres have to be drilled in the first two years.

The Canadian company also has to pay $12 million over four years in order to acquire 100% of the Valeriano concessions, currently owned by Sociedad Contractual Minera Valleno, an arm’s-length Chilean corporation.

1259 0

- Share

MINING.COM RECOMMENDS

QMX Gold hits bonanza grades at Bevcon, shares up

QMX’s stock was up over 15% at market open Tuesday.

MINING.COM Staff Writer | September 24, 2019 | 3:37 pm

Quebec Snapshot: Eight companies to watch

Mining companies spend an average of $8.5 billion a year in the Canadian province.

Northern Miner Staff | September 24, 2019 | 3:21 pm

After dumping Vale, Church of England says miner has ‘way to go’

The church has also blocked investments in the miner through an ethical exclusion process.

Jackson Chen | September 24, 2019 | 3:09 pm

Brazil to push forward mining on indigenous land amid opposition

President Jair Bolsonaro has repeatedly criticized the size of territories occupied by indigenous groups.

Jackson Chen | September 24, 2019 | 3:03 pm

COMMENTS

This site uses Akismet to reduce spam. Learn how your comment data is processed.

More Latin America News

Quebec Snapshot: Eight companies to watch

Northern Miner Staff | September 24, 2019 | 3:21 pm

Rising resource nationalism in Africa ups stakes for miners — report

MINING.com Editor | September 24, 2019 | 2:30 pm

Global copper deficit deepens as Chile, Indonesia production drops

Cecilia Jamasmie | September 24, 2019 | 3:56 am

Highland Copper announces positive PEA for White Pine North project

MINING.COM Staff Writer | September 23, 2019 | 1:02 pm

© 2019 Glacier Media Group, All Rights Reserved