MDMN discussion for week beginning 2015-12-28

In Central America enjoying the holidays but making a brief appearance to mention yet another rumor of news today. For entertainment purposes only.

Another short week… still… would be nice to get some news…

Should be a good 2016. Happy New Year all!

Mapping and Trenching Program Results Indicate High Grade Gold Mineralization in the Epithermal Vein System at Merlin and Fortuna targets in the Altos de Lipangue Project

nice results. nothing happening to the stock though. we need share price action!

Let’s see if Medinah uses the PR firm to get this news out. Time for the market to give us a fair value cause I know this mountain is worth more than .014

Nice! Hopefully the results at the deeper Caren mine are representive of the epithermal system compared to the leached surface results.

When do they drill to confirm grade etc? About January 15???

Nice to see buy orders starting to line up instead of sell orders, just hope it holds.

Good question. Nothing about drilling at all. And nothing like getting a Q4 update on Dec 28th during the Christmas / New Year holiday week. hmmmm.

Summary:

They are finding veins all over the place between Merlin I and the Fortuna properties

The veins are rather narrow, decent but not shocking grades at the leached surface.

It is impossible from this report to generalize or draw large scale conclusions like reserve guesstimates.

Our attempts to model the 26.7 g/t across the vein length based upon the early report is not supported or disproved by this data. It was a little too preliminary an effort.

Under the Merlin 1 results read:

In the northwestern extension of Merlin I vein, at old Caren Mine, almost three underground adits were recognized, but only two of them is possible to have partial access today. In the first sampling completed of grab samples returned up to 66.5 g/t Au, and channel samples confirmed high-grade mineralization, with 1.2 m @ 26 g/t Au, 0.27 %Cu, 0.14 %Pb, 0.25 %Zn, including 0.4 m @ 51 g/t Au.

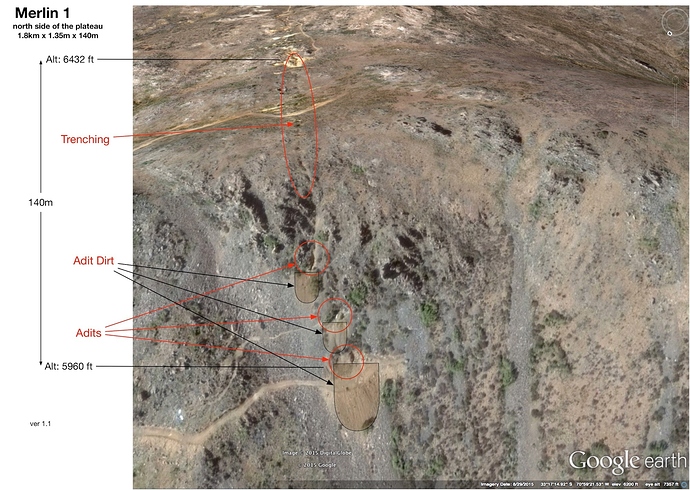

This is a reference to the adits on the north side of the plateau shown in images in previous posts (see pic attached). This is also where the data for 1) NUOCO’s April 2015 report (66.5 g/t Au) and 2) the earlier 26 g/t Auryn report of Sept 2015 came from. This is from sampling the vein underground getting access via the old Caren mine adits. So as MG pointed out, the underground results are the most promising in terms of grade. The width appears to be similar to Fortuna, narrow in places down to 0.25m up to 2m in places. (this agrees with the recent presentation information)

Note they had first results back before April when the NUOCO report came out. Now in Dec. we are told 9 mos later:

Systematic sample at different adits levels was done and results are pending.

Additionally they are excited about that area just to the west of Fortuna in between the 3 veins: Merlin 3, Fortuna East, and Fortuna Central, which is that area Doc and I discussed last week where there was the bright red response on the 5500m IP line on slide 11 in Auryn’s presentation. This is a definite drill target.

Re. drilling: IMO it would not be surprising now that they gave us “results” of the last quarter (or more like 6 mos) that they give us another release about the 2016 exploration plan just as they did last year about this time. And it will include drilling probably enough to meet the option requirements, at a minimum for Fortuna. Also recall, the Fortuna option required 3000m of drilling plus $1.5M. It is likely, IMO, that they will do the 3000m right now and they probably have or will soon have spent the $1.5M in all this trenching and IP/CSAMT work so it is quite likely the Fortuna obligations will have been met by late spring (U.S/CAN).

IMO: They are being methodical and deliberate and are in no particular rush on all fronts: exploration, the acquisition of shares / control, etc. It’s clear where it is all going to end up and before when (Aug 2017). It’s not as clear exactly when or exactly how.

Today’s news is only a web site release…Not a “wire” release…Any guesses why???

Auryn doesn’t put out wire releases. They are a private company.

If things follow the pattern of all the previous Auryn updates, Medinah will release something via the news wires calling attention to the Auryn update.

Thanks Cornhusker…So, I guess my question should be, would Medinah consider this significant enough news, to make it a wire release. And how long would this take. I realize nobody knows the answer, but a web site release will not attract new investors, nor absorb the shares that are still being sold. I can’t imagine, why they would not. Our last news wire release was an appointment to the BOD. Isn’t this much more significant than that???

As with all Medinah timing predictions, time will tell.

But since:

- they have pending assay results for “systematic sample(s) at different adits levels” taken on Merlin 1 to release

- samples from this vein in these adits have given individual 66.5 g/t and 26 g/t sample results already

- this vein has now been traced across 1.9km at surface

- this vein is attached to a historically mined vein system that averaged about 60 g/t in the past

- they have mapped 5 km of these veins at surface in this system and continue to find more as the system is open in all directions

- they have a “highly prospective” drill target area in the middle of this vein system, have a 3,000m drilling requirement for the Fortuna Option, and should start drilling in Q1 (IMO)

If they are going to buy in the open market, now would be their time to buy, now that they caught us up to date on information and before they discover or have to say too much more.

The Option timeline along with exploration and reporting requirements are starting to funnel Auryn to a point of action whether it is this week or in the weeks to follow

Auryn Sept 17 web site report: http://aurynmining.com/auryn-mining-chile-spa-unveils-weighted-average-of-26-9-gt-gold-in-200-samples-bonanza-grades-of-up-to-66-5-gt-gold/

Medinah’s Sept 17 Accesswire release: https://finance.yahoo.com/news/medinahs-option-agreement-partner-auryn-152900646.html

I would expect it today or tomorrow unless Medinah is going to enjoy a long winter’s nap all this week (part of Auryn’s timing?). In that case, it will be next week. I would not expect it to have a major immediate impact on SP in and of itself.

Auryn entering the market and buying will move us up, should it happen.

My sense is that this release of information would qualify for AMC to rid itself of material nonpublic information precluding them from market activity. The absolute no-brainer in this entire scenario is AMC buying truckloads of Medinah shares while the DISCONNECT is in place. If you feel that ten seconds after the ink dries on the ADL option exercising, which finally gives AMC some “ownership” in the concessions, that the combination of the $100 million MINIMUM cash portion of the purchase price plus the 15% AMC stake is worth somewhere around $200 million (use whatever numbers your geo-mentors suggest) then AMC knows for a fact that every dollar’s worth of Medinah shares they buy at these levels is worth 11 TIMES THAT AMOUNT IN CASH SAVINGS IN REGARDS TO THE CASH PORTION OF THE PURCHASE PRICE AND 11 TIMES THAT AMOUNT IN “CLAWBACKS” TOWARDS AMC’S PORTION OF THAT 15% STAKE. That is a lot of free leverage for AMC. The concept of an 11-to-1 DISCONNECT is insane but our markets really are that corrupt. My own opinion is that there is perhaps a 99% probability that AMC exercises the option but this particular market is going to need the 2 by 4 to the head (an option exercising) to get the message which is just fine.

Put yourself into AMC’s shoes, they know what their plans are in regards to exercising the option. They know the formula for the cash amount and what that translates to today. They know the minimum amount that a 15% stake in AMC is going to be worth as the developments play out. Picture perhaps a 30 year mine life with tons of early production opportunities. Admittedly they’re scratching their head at Medinah’s $18 million market cap but they’re not stupid.

What’s tough to get a grasp of is that we shareholders shouldn’t really care how much they pay for Medinah shares. Of course part of us wishes they would push the price up to the moon in the process of gaining control. We just want to own our little percentage of the post-option exercising “Medinah” with all of that cash and that 15% stake. That’s when the investment world learns about the size of this DISCONNECT. It’s the option exercising that confirms the DISCONNECT. If you’re still not convinced that they’re going to exercise the option then wait until they buy another gazillion Medinah shares and their NET cost (after these “discounts” and “clawbacks” is a pittance. AMC will exercise the option if it is economically feasible to do so. They need to cover the NET purchase price and the CAPEX. If the cut off grade at the Merlin-Fortuna is only 0.1 gpt gold, then there isn’t a lot of CAPEX there for the years and years where that area will be the focus of attention. It’s the superior infrastructure that makes gold that low of a grade “economical”.

Of course the grades we’re waiting on is those found in those 3 Merlin 1 adits BELOW THE HIGHLY WEATHERED, OXIDIZED AND LEACHED SURFACE. The drilling and adit samples we’re waiting on will tell us that information. We now have a nice surface map to guide the drilling. A long time ago ACA Howe told us that there were approximately 24 vein systems across the plateau. All except the Fortuna Vein had barely been scratched by the artisanal miners. The density of the veins and the fact that the cut off grade is 0.1 gpt gold suggests that they are clearly open pitable.

Wow…traffic continues to increase on the site. We may need to upgrade soon to the $100 per month server plan. Thank you to those who spread the word.