I for one, like the polls. If I object to one as being inappropriate, I’ll flag it. Isn’t that what we are supposed to do?

You have to be sadistic to still be reading something that gives you so much pain. Just be leery of Big Blue Dots with B’s in them if they bother you.

I’m not sure why it was deleted, but I’ll check. FYI . . . I’ve already posted 2 or 3 times to the board showing people how to create polls.

http://blog.discourse.org/2015/08/improved-polls-in-discourse/

I doubt, anyone would be insulted, nor would they consider you condescending, for having an opinion that several open pit mines will be constructed. As opposed to one Big Open Pit mine. Sounds like 6 one way, vs, half a dozen the other.

Plus I would say, all agree, that Gold is the target.

But what is important. Is that early production targets. Are on Auryn’s agenda. And that means, money will be spent and revenues will be created. Both of which will push Auryn closer to exercising their $100 Million Dollar Minimum Purchase Option.

Not that other events, such as JJ and Family shares, getting settled, won’t help move our share price in the right direction. But generating revenues and receiving $100 Million Plus Dollars, will definitely get MDMN’s share price moving in the right direction, in a big way. IMHO

[quote=“mdmnholder, post:257, topic:766, full:true”]

CHG, you and I are on the same page.[/quote]

Yeah, I think I have come to agree with you:

Facts to be considered:

-

only 561 days maximum before we are post JV: https://countingdownto.com/countdown/signing-date-for-nuoco-auryn-jv-countdown-clock

-

According to the Howe reports and from the evidence from the assays from the adits on the north side of the mountain, the “leach cap” on the plateau averages between 25m and 50m. A 150ft hole is a pretty big hole and that’s the top of the high grade ore.

-

There just is not time to build even a “small open pit” and facilities to mine most of that high grade ore within the scope of the ADL Option contract. A large heap facility will take too much time to permit and construct to fit into the timeline of #1.

-

Auryn keeps talking about “early production”. “Early” could mean “post Option” but pre-massive $B copper mine. But the rumor keeps popping up that Auryn is negotiating percentage rights to mining profits with MDMN - and this only makes sense if you are expecting revenues in a pre-option period (i.e. the period we are in right now). Let’s assume this rumor is true for the sake of argument.

How can you reconcile the above?

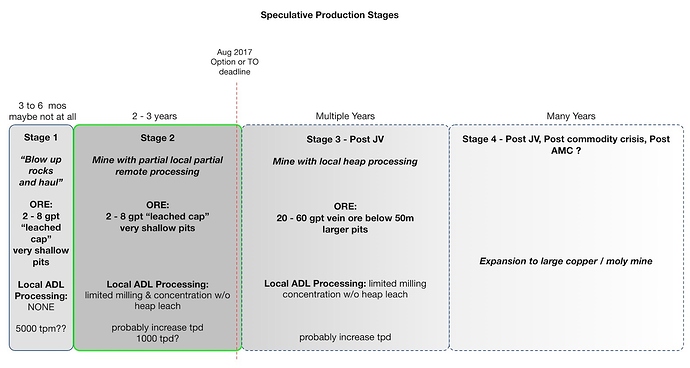

I propose there are these speculative 4 stages of production. I did not really realize that Stage 2 was a realistic option until your comments:

So my conclusions are:

-

anything that occurs before Aug 2017 will be “surface mining” with very small “pits” and will only attack ore in the near surface leached area, probably 2 gpt to maybe 8 gpt (see the Merlin 3 results).

-

They could just haul that rock but they will not want to do that for long. It’s not rich enough.

-

If they could quickly move a mill and partial concentration process (non-heap leach) to the plateau quickly they could mine, partially concentrate 2 gpt to 8 gpt ore to something much higher, then haul that for remote processing.

That seems likely to be the best ‘sweet spot’ available in the time allotted. Maybe they could live with that for years. Or perhaps they push forward move to Stage 3 and permit and construct a heap leach process locally. But it will be operational only after we see how the JV / Option turns out.

As a side note, already alluded to by BE:

If MDMN makes Stage 2 too easy and comfortable and profitable for Auryn it will remove incentive to move forward with the the Option or a TO (“why buy the cow if you can have the milk for free”). So if Stage 2 is what Auryn has in mind, our end game timing could depend on how MDMN and Auryn split the goods in Stage 2, IMO. MDMN needs to incentivize Auryn to move forward.

Doc, I am sure you have read the conversation between CHG and MDMNHOLDER.

We are so used to your week-ending commentary (no matter how long) that the above exchange should give you a good opportunity to come in with your 2 cents on the subject.

Hi Albireo,

First of all, we shareholders don’t know much about the metallurgy defined by the recent “bulk testing” exercise. So we’re flying blind a bit. There seems to be a fairly smooth gradient of higher gold grades at the Merlin 1 from the surface grades of maybe 4 gpt gold to about 45 gpt gold at the 85 meter depth level at adit #2. I could see AMC drifting a decline from the plateau surface there to mine what’s there just to get the cash flowing and the ability to market the project as being “in production”. The production levels will undoubtedly ramp up with time.

The design of the recently completed environmental report suggests to me that at some point a heap leach pad is going in near test sites 1 and 2. The streams tested all drain that common area. Where the traces of the surface veins coalesce together like at M-3 and the Fortuna Oeste I could imagine a small pit operation there. The upcoming or current drill program should help a lot as well as the follow up IP/IRs done after the aeromag survey. AMC suggested the likelihood of blind veins and perhaps breccias not making it to surface.

The development of this property complex is going to occur in many, many “phases”. I seriousIy doubt Medinah will be around for many of them. I can’t overemphasize the importance of high grade near surface early production opportunities and the leverage that this might bring to Medinah because of that “no ownership until you exercise the option” clause. I don’t think it would ever happen but could Medinah theoretically go into production with a contracted miner NOW at the ADL and keep 100% of the ADL profits and tell AMC to just let us know when they make up their minds about the option exercising? Right now there is theoretically only an offeror/optionee relationship in place. I’m not sure that the original option ever foresaw this many early production opportunities or those kinds of gold grades that shallow. I’m extremely curious as to how the early production opportunities factor into the agreed upon formula to determine the cash amount of the purchase price.

The exact timing of the option exercising is obviously anybody’s guess but I feel that the 99 to 100% certainty level of AMC exercising the option is going to be upon us a whole lot quicker if you’re not already there now. From a due diligence point of view, I think the key now is to get a feel for the probable cash flow associated with these early production opportunities and compare that to the $100 million-plus “buy-in”.

Here’s a paper on heap leaching in Chile. Recall that the “Lo Aguirre” deposit (about a drive and a 5 iron south of us in the exact same Veta Negro/Lo Prado rock formation) mirrors what Nuoco just found at the 70 meter level at the LDM i.e. 10-15 MT of stratabound (manto style) very high grade Cu featuring 3 of the high octane varieties of Cu: chalcocite, malachite and bornite.

Clip from Brent Cook…FWIW

"For explorers, the emphasis is on the deposit analogue (how big can it be?), prospectivity (right structure, right rocks?) and size of the land package (is it big enough?), and the exploration team (relevant experience and past history of real success)? "

Indeed, A must read. It’s a wasteland out there in junior land. It may make this jewel look a little more obvious when the time for attention comes.

Hi Bobster,

I’ve been in the sector for over 35 years and I can’t recall a time when the ratio of majors desperately needing to replace reserves or DIE compared to the number of new viable discoveries was this high. If you factor in discoveries with high grade near surface early production opportunities with aweseome infrastructures in geopolitically safe regions it goes through the roof.

The odds of already having all of the above in addition to a tight relationship with miners as sophisticated and deep-pocketed as AMC who have aggressively bought and aggressively pursue huge blocks of your shares are infinitesimally low. Now throw in the terms of our option deal and the overwhelming probability that AMC is going to exercise the option and then look at our market cap and you have an enigma.

AMC is in the catbird seat and is not going to have any problem whatsoever attracting a huge partner/operator if that is their goal. The best fit to me is one of the giant moly miners. Any new players are going to need an equity stake in AMC and I believe that Medinah management would be more than willing to talk turkey with any such party in regards to their post-option exercising 15% stake. The combination of AMC plus any new mega-player would bode well for a new exchange listing.

With all the potential “positives” that we possess, are we still back to the resolution of JJ’s shares, before we see any significant stock price movement???

It’s always been Rocky. As soon as JJ gets out of the way Auryn takes control price moves up until then we will sit here

Maybe while the boys are in Chile they can talk some sense with JJ and his family on Tuesday. I doubt it, but there is always a chance. Either way I think we get a Corporate update from Auryn mid or later in the week. Just a guess based on what I’ve heard.

So are we all in agreement, that no matter what the update contains, with the exception of a buyout, that our price will remain stagnate, until the transfer of shares are finalized???

Seems like you are seeking a straight course of action. If you find it, let me know.

No, we’re not all in agreement. It seems like you keep seeking out and relying on everyone else’s opinion for your actions. You’re on your own in this, friend, just like all of us.

Knowledge is power…I am very interested in what anyone on this board has to say. Isn’t that the purpose of this format? Besides, I am still on the fence, as to whether or not I will be adding to my position…

It may be adits #1&2 are the earliest production targets suitable for trucking material directly for processing. Employing concentrating methods, making surface mining in very small pits profitable, may come after. AURYN will exercise the option agreements (or TO) sooner, rather than later, for reasons already discussed extensively in the forum, IMO. Negotiating the “split” pre-option and consolidating/modifying the current option agreement contracts may be the main topics of the scheduled meeting that could see the start of some actual cash flow.

These results opens the possibility for AURYN Mining Chile SpA to evaluate the early production in the Caren Mine, moreover the company owns the exploitation permissions up to 5,000 Tn/month. … Over 15 samples were collected in adit #1, adit #2 and outcrops where it was possible to have safe access.

Jan 6 update

Also, could the reason for AURYN no longer listing BOD/management on their website be due to an NDA with deep-pocket investors already lined up to back this project and move it forward to monetization?

A little more week-end reading material for those interested. I found this article useful in understanding the material presented in the last three AURYN updates beginning Dec. 28.

http://www.icmj.com/article-printing.php?id=660&keywords=Understanding_Sampling_Techniques

Channel samples consist of small chips of rock collected over a specified linear interval. Channel sampling is used for veins and other structures exposed on the surface. The objective is to cut a linear channel across the vein or orebody in order to obtain the most representative sample possible for the designated interval. Most of the time, chip channel samples are collected in succession along a sample line that is laid out in advance using a tape measure, and is designed to parallel the true width of the deposit. Often the chip channel samples are collected along surface trenches or the floors or walls of various underground workings.

When chip channel sampling is conducted along a rock face, often a piece of canvas or plastic is laid out for the material to fall on so as to avoid contamination and make the collection of the sample easier. Sample intervals are set at a specified width, usually ranging from 1 to 20 feet, commonly 5 feet. Similarly, with rotary drilling, the geologist can capture a certain length of the chips collected along a drill hole length, and produce a composited chip sample out of a drill hole.

Grab samples are samples of rock material from a small area, often just a few pieces or even a single piece of rock “grabbed” from a face, dump or outcrop. These are the most common types of samples collected when surveying an area or beginning exploration for hardrock deposits in the field. The sample usually consists of material that is taken to be representative of a specific type of rock or mineralization. It is more associated with exploration programs.

Geochemical sampling involves collecting and analyzing things like soils, stream sediments and rocks, and testing for certain chemical elements that are associated with valuable mineral deposits. These methods are extremely efficient exploration tools and a few well-located sediment samples can be used to test vast areas for potential mineral deposits. The presence of these trace elements can be nearly impossible to recognize in a hand specimen, but lab analysis by methods such as Atomic Absorption (AA) can reveal elevated levels that are only in the parts per million range. Many well-known ore deposits were discovered using these methods.

Geochemical sampling works because it is fairly normal that large hardrock gold and silver deposits have a surrounding envelope of weak mineralization, also known as a dispersion halo. They are formed by “leakage” of mineralizing fluids into the surrounding rocks, and are best developed around large bulk-type deposits and those deposits that form in rocks that are porous enough to allow for fluid flow. These halo areas have elevated concentrations of metals commonly found in association with gold deposits. The concentrations are low, but significantly higher than the normal background levels found in unmineralized rock. A variety of elements can be analyzed, typically focusing on expected elements that commonly associate with known deposits. As an example, typical elevated elements that may be found around epithermal gold or silver deposits include mercury, antimony and arsenic. Knowledge of these pathfinder elements and which elements are associated with certain types of deposits is critical for interpreting geochemical test results.

Even after the discovery of a possible new deposit, geochemical sampling is important in delineating the areas of mineralization. For example, geochemical sampling of soils is often employed to outline the general area of mineralization at shallow depths where outcrops of bedrock are minimal or nonexistent. This can then be used in designing drilling programs. Sample results for certain elements are often plotted on a map to locate regions of elevated concentration.