Will anybody be adding to their position this month…I am thinking about it…

![]()

[quote=“leanandgreen, post:3, topic:785, full:true”]

So here we stand with another GOLDEN OPPORTUNITY for our management to bring this thing home now! “Now” meaning don’t come back from Chile without an OPTION EXERCISE or a TENDER OFFER. Seriously, don’t bother coming back or reporting some BS early production agreement where Auryn pockets revenue and stretches this out another 18 months. [/quote]

You’re going to be sorely disappointed if this is your expectation for the outcome of the upcoming trip and as in the past you’re just throwing crap against the wall to see what sticks without thinking things through.

Like it or not the current contract still calls for another 18 months before expiration so it is both unreasonable and untenable for you to put some kind of ultimatum down that Medinah must abandon the terms of the contract because some shareholder is impatient or anxious or whatever. Nobody knows enough about the terms of the existing agreement to force your wishlist of ultimatums. We also don’t know how far Auryn is with regards to their plan to both monetize ADL and make good on the option. We also don’t know exactly what Auryn has found on ADL other than what has been reported. And it seems like you keep forgetting that Letts is on the current BOD of MDMN. While he doesn’t hold a majority position, I’m willing to wager that he has a very influential role given his position in both companies. There is no way he’s going to strong-arm himself.

It’s really quite simple - Medinah doesn’t have the money, means or experience to monetize the mountain. Auryn does. And if you’ve been reading and/or paying attention to the industry, the price of gold, and media articles that various posters have been providing, you would know that the PM market is in the crapper right now and majors are not spending anything on exploration. The people with the money call the shots…like it or not. Do you realize how lucky Medinah is right now to have the option agreement they have? Shareholders should be freakin’ ecstatic about it! I know I am because I have other very promising exploration investments that are simply on hold and companies are only spending money to keep the claims current. And you think that Medinah should be demanding a 99% of a production split with Auryn? LOL…come on man, get real.

Yes, Medinah holds the majority of the claims. And they also hold the future potential 15% of Auryn via the option agreement. Those are the key counter-balances of the agreement. The two entities are tied to the hip so it does no good for either side to strong-arm the other while the option agreement is in effect. And by all counts the two do not have an adversarial relationship so what good does it do Medinah to “force an exercise or tender” prematurely because a few shareholders are anxious to move on with their investment?

Lean…If accumulating up to .10 is a no- brainer, why is the volume so low? I understand we are all tapped out, and there are still sellers. But I think if that was the case, there would be more buying. You can purchase one million shares for under 20k. I do believe the risk/reward is more enticing at these prices. I don’t mind the wait. But it is still Medinahland and we have all learned to expect the unexpected. Or in our case…Nothing…I remain undecided, which is why I pose the question. Thanks for your feedback…

I would agree with HRick, MDMN has no money to explore anything nor the expertise to mine anything. This is just a fact. Auryn has both the expertise and money. If I recall, what was made public about the option agreement is the Auryn had to spend a couple of million in exploration to meet the terms on the ADL option agreement. They have, to date, far exceeded that.

One has to understand, this is a large property that has double in size since Auryn has arrived. They are methodically evaluating all the different opportunites by doing just enough exploration to understand what is there and what is not. Once that is done, then they evaluate what opportunites are there and the order in which to proceed with or without partners.

In terms of percentage of early production, I still contend there won’t be any prior to expiration. However, if there were, look at from this perspective. Company is has an option to buy a building, in the meantime they are investing in the building and set up a shop at their own expense. The shop generates significant cash flow. Should the company that provided the option to sell benenfit from all the money and work that the optionee puts into it. I think not.

Unless this was addressed in one of the agreements. If so, If I were Auryn why spend the money and time to put something into production only to split the profits, unless is was nominal. Personally, I would wait until the last minute (i.e. option expiration/exercise). Which is 18 months, give or take. 18 months is nothing in mining.

I think one has to go to the contractual agreements to get the answer you are seeking. Plus in most transactions, the buyer, the party with the money, usually dictates how things will proceed. Not to lose fact that in this case, the experience and knowledge and where with all to explore and mine the property is of extreme value. And Auryn is the party with those attributes. I think things will unfold per Auryn’s time line and dictation as opposed to MDMN’s.

I know I will have orders in to buy. I still feel these prices, under .07ish offer a good opportunity for a great ROI. All IMHO of course.

For whatever it’s worth, here is the answer I would respond to this for anyone at any time with any investment:

The fact that you’re even posing this question means that you have doubts. If you’re not completely certain within your own heart and mind that buying/adding is the thing to do, if you have any question about doing so whatsoever no matter how seemingly insignificant, then the odds are great that you should do nothing until you KNOW that it’s time to take action, imo.

No one knows what the impacts of these meetings will have however these meetings were referenced in official update so I would think there will be something significant coming out of them.

Also, with what appears to be on the near horizon with at least gold prices, the longer this takes to wrap up the more potential value for the gold and increased preceived value from ongoing drill results which should increase any buyout value for us

Another factor prior to exercising the option will be aggressive buying by Auryn which should increase price as well

Should Auryn acquire the necessary shares to have control, they would stand to make a lot of money on mdmn share price appreciation with the ownership they have

I’m also of the belief the real number of owned shares in in excess of 3B and possibly 4B

The 1.2B shares owned by 400 attending shareholders at previous shareholder meeting should be a good sign a large short position exists

Some will argue that was in the past and no longer exists while I would argue it still exists and is worst now.

If we could only take early production revenue and use as a cash dividend, I think we’d find out pretty quick what the short status really is

I always find the irony of the Neverending story in both the name Auryn from that story as well as the Talismen symbol/ Medallion of the snakes that Auryn uses for its company.

I can’t imagine that is a coincidence!

Thanks Rick for setting the picture straight. Too many vacuums when it comes to what MDMN should be doing in light of current crapper environment in PM,

L&G, the reality as I see it:

-

Why would Auryn give/loan any money to MDMN when it does nothing for them. A cash dividend is the worst use of capital, particularly in a cash starved industry.

-

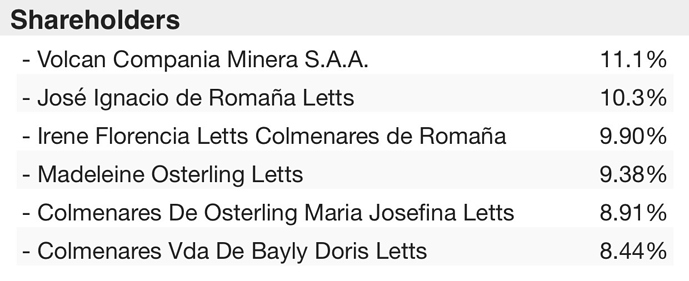

As Baldy pointed out in Volcan’s chart, Volcan has lost billions of market cap in the last two years. Its credit rating are the lowest rung of investment grade, mostly likely with a negative outlook, meaning the credit rating is probably headed for junk bond status. That means that raising capital for Volcan will be more expensive and difficult. Just look at their November investor presentation, their free cash flow is significantly down, cap ex has been cut to the bone and they need to invest in efficiency in their existing producing assets.

-

JMO, but I would imagine that our BOD did such a lousy job at negotiating the original contracts, MDMN has no leverage.

Again, JMO, might as well just sit back and wait and be thankful that this time, MDMN has real people doing real exploration work and it is not costing the Company a dime.

Yes, share price sucks, but quite frankly, and this is the only compliment I will give Les, is that he has kept the interest in the stock over a long period of time. This could easily be trading welll below a penny as all they were doing was shuffling properties around and shouting 'world class deposit". Nothing was being accomplished other than a bloated o/s.

I am thankful that we have a partner that knows what they are doing and appears to be following a fairly well laid out game plan. The only thing that scares me anymore is that contracts in Chile seems to hold little water. At least as far as the ones that JJ is involved in. I hope that he is smart enough to stay out of the way and let this thing finally happen but I have no faith that he won’t botch the deal once again. It’s not a matter of how much Auryn wants the property it’s how greedy JJ is. Of course I would assume that he is at least smart enough to know what will happen if he does screw this up.

Spot on. You have to keep in mind that many shareholders have been here so long they have a difficulty time looking outside of the MDMN vacuum. Blaming market makers or lack of PR, or inadequate levels of due diligence for our current “disconnect” is beyond amateurish from an investment standpoint. Claiming that majors are scrambling to find new discoveries in an environment where massive projects are being shuttered and exploration budgets slashed is delusional from an investment standpoint.

Bottom line: a basic analysis of Volcan concludes there is a real possibility that the company could go under if base metals don’t recover in the short-medium terms (I’m guessing we are only in the 6th-7th inning of this sell off in everything outside of precious metals).

But, by all means, people can ignore these realities and speculate about cash dividends and leveraging disconnects while billionaires become millionaires.