etc.

Your post comes off like more rumors from Les and I VERY MUCH do not understand why this board continues to allow them.

All of the negative perception of this “investment” begins right here.

Hey censor, how about a new year’s resolution?

etc.

Your post comes off like more rumors from Les and I VERY MUCH do not understand why this board continues to allow them.

All of the negative perception of this “investment” begins right here.

Hey censor, how about a new year’s resolution?

Unless anyone is of the opinion that MDMN/Auryn will actually be able to IPO this year (0% chance), there is no incentive for Auryn to drive the price of MDMN shares higher before a reverse merger into a clean shell. RTO’s typically do not require outside funds. As as been opined on this board, the working capital for the new entity could be the $100M from the exercise. Obviously a TO would take everything private.

There is no doubt that I lack the imagination of some of the other participants on this board and that probably explains whey I’m still having a very hard time coming up with any scenario where Auryn wants the share price higher until A) they have secured JJ’s shares and B) they have secured a controlling interest. The latter will clearly drive the price higher but I don’t see that happening until the former is reconciled.

If the JJ share fiasco is in arbitration it really doesn’t matter what JJ or Auryn want, the arbitrator makes a decision and it cannot be appealed. (one of the biggest differences b/w arbitration and mediation). When two parties agree to an arbitration process to remedy any disagreements they also agree to accept the decision of the arbitrator, uncontested. FYI. This garbage about “having another go at it when they are back in Chile”, once again, sounds like it’s coming from a source who lacks a basic understanding of the matter being discussed.

There are 2 other Medinah boards with iSCUM that would make it 3, why do you bother posting here if some posters bother you?

You are making all kinds of assumptions and then speculating beyond that based on nothing coming from Medinah or Les or any source in Chile/Peru.

In any case, I suggest that you carefully read Auryn’s pending corporate update and watch the share price.

Silly! If my posts bother you, why do you bother posting here?

“You are making all kinds of assumptions and then speculating beyond that based on nothing coming from Medinah or Les or any source in Chile/Peru.”

You said this like it was a negative. No one has been more wrong than Les and more correct than BE. Fact.

Fiction…

The only real credit Baldy deserves was quickly determining that Mr. U was a con man. Most of what he has posted since has been just entertainment, or Management bashing which is always popular with many folks here for obvious reasons.

Will do. The updates from Auryn are the only things I have and will continue to read carefully. I wish they came out more frequently as everything else has been background noise.

That’s not nice. I won’t try to compete with the “next week” every week contributions of some but I’ve taken a strong position on the FCI vs. Equity debate (debate over), the inevitability of updates on the auxiliary agreements (pending), the probability of a TO vs. Option Exercise (pending), IPO .vs RTO (pending), price targets (pending), the source of selling/insiders (debate over), whether Auryn has been buying over the past six months (debate over), helping CDCH “adjust” their financials (done), helping MDMN find an office that doesn’t require forking over millions of shares to an insider (done)…etc, etc.

I’m not sure if these matters are entertaining or just unavoidable headaches that come with the type of Management we are stuck with (see: bashing).

It is true you seem quite knowledgeable in those areas and it is my hope that when Auryn actually releases some facts that you will be able to narrow down the possibilities for use to something useful to consider seriously.

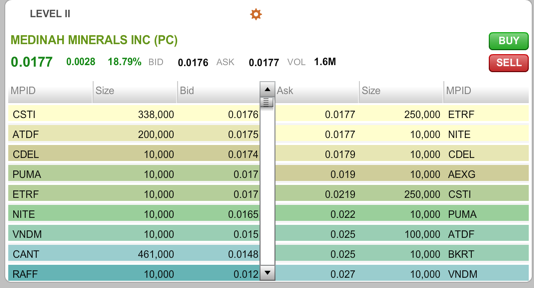

Can someone post a L2. Thanks

I’m not even sure who I’m rooting for prevailing in the legal skirmish between AMC and JJ and the Uncle. Although I doubt it would occur, if JJ wins then AMC is going to need to buy that many more shares out of the open market in order to gain VOTING CONTROL if that is their goal. JJ’s contesting of the July contract tells me that if he wins, those shares won’t be for sale until much higher than the agreed upon share price which I’m guessing is near a dime or there would have never been a contract agreed to in the first place. Let’s say that JJ holds out for 15-cents before starting to sell those shares. If your exit point is short of that then for all intents and purposes those shares have been cancelled and for you they are no longer part of the readily sellable “float”.

Meanwhile everything that AMC buys is getting tucked away for CONTROL purposes so our “float” of readily sellable securities should skinny up considerably between the 2 concurrent phenomena if JJ were to prevail which again I doubt.

One would think that with the level of distrust between these 2 families that the July contract would have been airtight. Since 60 million shares did get successfully delivered, I would assume that those shares were tucked into an escrow or trust account by JJ and the corresponding amount of money tucked into a second trust a/c by AMC. I would assume that JJ cannot access the majority of that cash until the share price exceeds the agreed upon sales price or else JJ might take the cash and buy back those shares and more making him a bigger pain in AMC’s behind than he previously was. Some “good faith” money was probably provided by AMC.

I’m assuming that the 170 million “missing” shares did NOT get tucked into a trust a/c or the deal would have been consummated alongside of the 60 million share deal. Shortly after agreeing to the deal in July, I would assume that either JJ or the lawyers demanded delivery of the missing shares from whichever brokerage firm or trust facility acting as the custodian for them. I’m assuming they went into “street name” otherwise the certs would have been available to place into the trust a/c.

There appears to be a side story here involving JJ’s Uncle who apparently co-owned the corporation holding the Medinah shares paid for the mining concessions previously held in that corporation. The rumor is that JJ signed over the Medinah shares to AMC but the Uncle cried foul because he wanted a higher share price. If JJ is the majority owner of the corporation does he have the right to sign off on the sale of assets and FORCE the Uncle into a sale??? Wouldn’t it be pretty easy to just divide the Medinah shares and let JJ and the Uncle do their own thing? JJ would have no right to the proceeds of the sale of the Uncle’s portion of the shares. This is such a no-brainer of a solution that I would think that the delivering of the shares to the trust a/c might be the hangup because the “do your own thing” solution is so obvious. I would think that if the shares were in trust then JJ wouldn’t have had the ability to reneg on the deal. We’re obviously missing some puzzle pieces so who the heck knows but I do get the sense that we’ll all be happy campers no matter which way it gets resolved.

If we’re waiting on a legal ruling on whether or not the July contract was binding, that judgment will be what it’s going to be no matter where the share price is sitting at the time. So from AMC’s point of view I would say full speed ahead and the fate of that block of shares will be what it will be. The fact that the process has taken this long suggests EITHER that there might have been some previously agreed to appeals process to whatever the first arbiter/mediator came up with OR the issue has to do with some entity delivering those shares to the trust a/c.

As far as the predicting of when AMC might reappear in the market, one issue might have to do with whether or not their counsel feels that they are in possession of enough material nonpublic information to trigger insider selling issues. Other than that, since even if they do get the Quijano 170 million share block I believe they still have a long way to go to gain VOTING CONTROL and would just as soon do that as inexpensively as possible. If they are contemplating going public soon then there might be exchange related issues that need to be considered.

I am new and worried about the true pennyness of the company

Is it not true that once Auyran gets controlling interest they can just say see yah to MDMN shareholders and leave you with nothing

I highly doubt Auyan cares about us as shareholders Don’t underestimate the power of the greedy

If you’re really ‘new’ and worried about that…I’m not clear why you took the leap. Maybe time to rethink your choices…some folks simply don’t have the wiring harness to handle this kind of uncertainty and ups and downs…nothing wrong with that…just the way we’re put together.

Chart looks pretty good. Slightly outside upper Bollie so maybe expect a small pullback tomorrow. If we stay above the 50MA should continue momentum north IMO

Thanks Doc for further explaining and sharing the intricacies of the Juan share issue , which I was asking about this morning. Don’t know what we would do without your substantive perspective. No disrespect meant to the other major contributors on this forum.

Just another point of view

Thank for the article which already confirms everything I have been hearing from other sources.