gold spikes to $1370 / Oz

silver drifting back up to $20.50

Looking at this picture reminds me how far we have come and how far we have to go. Patience is an understated virtue for Medinah shareholders.

What is “Entrance Conditioning”?

Portal in under ground apps.

[quote=“Baldy, post:14, topic:1377”]

This bizarre notion that AMC is going to provide MDMN with near term liquidity to buyback shares has no basis in reality.[/quote] I know you rarely like engaging my contrarian views of where we are headed. We both have very firm convictions and narrow focus of how this will unfold. Your best guess may or may not be correct as you acknowledge.

Even though MASGLAS has acquired a pipeline of other mining claims/projects very cheaply, one may want to take into account the expenses involved in maintaining, and eventually developing them into an asset that nets a positive cashflow instead of a cash drain.

MASGLAS PROJECTS:

AGUILUCHO

CONDOR

FORTUNA

LLANO

MALI

PLATON

POSEIDON

TESEO

TRISKELION

AURYN has released a great deal of information to date. There is such a volume of information that shareholders have a difficult time digesting it all. I know I do; I appreciate Cornhusker’s frequent attempts to summarize and clarify it.

MDMN discussion for week beginning Continuing the discussion from

MDMN - 2016-05-16 Weekly Discussion:

[quote=“cornhuskergold, post:1044, topic:1280”]

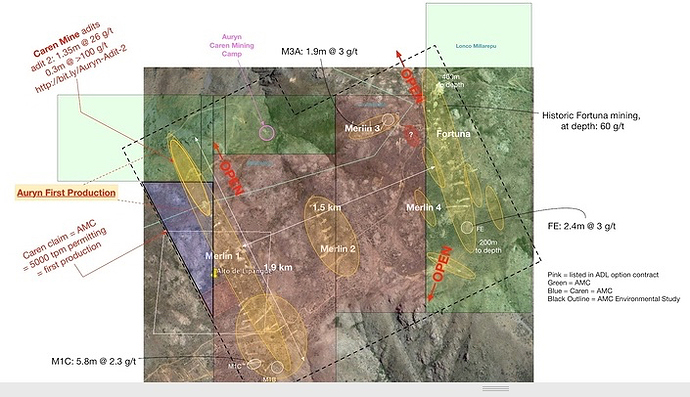

Also recall this diagram from some time ago.

It is easy to forget the detail of what Medinah/AURYN released in December of 2015. It is worth noting that the Altos de Lipangue is the most advanced project for MASGLAS. As we are so often reminded, time is money, and MASGLAS may have limited deep pockets. Included are diagrams of the trenching and summaries of the sample results on Caren Mine, Merlin 1&2, and the Fortuna claim areas. One thing I found particularly interesting was the revelation: “In the mineralized calculations the cut-off grade considered to build is >0.1 g/t Au.” This clearly is a preliminary assessment needed for open pit operations on surface claims:

http://www.otcmarkets.com/otciq/ajax/showNewsReleaseDocumentById.pdf?id=18449

(see) Shareholder Update - December 28, 2015.pdf

Accelerated permitting applications, initially using gravitational concentrator methods (known to be environmentally friendly), would allow selective smaller scale open pit operations to unfold. Will we see something headed in this direction at the AURYN presentation/SHM? An increased cash flow from that already projected for only the Caren mine would certainly qualify as a pleasant surprise. I would think MASGLAS might not mind:

… and allocation of future profits toward share buybacks and / or shareholder dividends.

We look forward to a long and successful relationship with AURYN and to sharing more details regarding these objectives at our next shareholder meeting.

http://medinah-minerals.com

Circular ownership, with it’s limited transparency, has certain hidden advantages that largely escape many investors. With a nice appreciation of PPS, accompanied by a dividend from MDMN, MASGLAS, with a 65% position in MDMN (via AURYN), could pay expenses and accelerate monetization of it’s 9 other projects . A share buyback and dividend, when cash flow and funds allow, would be synergistic in attaining long-term monetization goals expediently while remaining largely under the radar for the investors currently owning MASGLAS. Does MASGLAS have eventual plans for a listing once it’s other projects get further advanced in exploration/exploitation? I also have no urgency to bail on this investment. This is largely my best guess, which also, may or may not be correct.

There doesn’t seem to be anything narrow nor contrarian in your viewpoint.

If this stock does nothing in the next few days, I will need to take a serious look at getting out and put it something like MUX and come back later. It’s dead money, and has gone no where as gold sets its eyes on $1400. Some say Silver may correct to $18 and then take off, might be my trigger to do this as a small correction in miners may take place.

Market is about to tank…

All this talk is 1 to 2 years out, I have reached my limit on this thing.

We all have to consider this, as we are losing out on a bull run else where.

It’s sickening, as I loose my mother this week… Here in Canada now for an extended vacation for a funeral.

Tdk

I know the entrance area to the Caren adit is very steep. I would think they would need to change the grade above it/remove large boulders so there isn’t a slide over the entrance going forward.

The weather continues to look decent for the next week with most of the snow remaining to the East in the Andes.

I think people need to put all of the old BS from old the Medinah out of their minds and begin to look at this differently. Forget about anything you thought you knew or you thought should happen based on the old Vancouver mill. Take a look at MASGLAS and AURYN. They are developing a normal mining company and MEDINAH is part of it.

Forget all the penny stock hype and related stories. Forget ideas about immediate cash flow and dividends and buybacks to trap the shorts. This is not a penny stock naked short squeeze story. This is a real mining company with an very, very exciting project in the ADL!

Give AURYN and the new MEDINAH a chance to start developing the project, scrutinizing the books and reporting accordingly. Penny flipping hands and crazy investors who dream of 50% moves every other day will leave and real investors will start to take notice.

I don’t think we’ll need to wait until dividends are being paid for the stock to react. But I do I think we need to wait more than the week or two it’s been since AURYN took control. For goodness sake, they just started preparing the Caren mine 10-15 days ago. Show some patience.

Many of us bought in here on hype that had NO substance behind it. That’s not AURYN’s fault. Now that we have real work being done, I’m willing to wait and let the normal market forces and AURYN’s professionalism carry the day.

PS. I recognize others have invested here for different purposes. If you are still here for a “5 bagger in 2 weeks” forget everything I said about showing patience. I don’t think you’ll get that kind of return here and you may be better off with another investment or the roulette wheel.

I like this " permitted to produce up to 5,000tpm @ 15g/t Au but capacity

could be lifted within 6-8 months. "

Auryn Mining Chile SpA (private)

Has begun the preparation of a mine located on the Caren property, part of its Alto de Lipangue project in the Metropolitan Region. The work, which is being led by Peruvian specialists, will take approxi-mately two months to complete and after which production will begin. Auryn Mining Chile SpA acquired 100% of the mining rights in exchange for 25M shares as agreed under a MoU signed with Medi-nah Mining Chile and Medinah Minerals (OTCBB-Pink: MDMN). The mine is permitted to produce up to 5,000tpm @ 15g/t Au but capaci-ty could be lifted within 6-8 months. Auryn plans to produce 5,000oz Au by end-2016 and 25,000oz Au in 2017. Revenue from the Caren mine will provide the funds to advance exploration work at Pegaso Negro and drilling work on the Merlin-Fortuna targets. Meanwhile, Gary Goodin, lawyer and director of MDMN has been named to board of Auryn Minería Chile SpA. MDMN owns 25% of Auryn Minería Chile SpA.

Someone must have decided to take a small leap of faith for the future.

Notice the section on Codelco exploration:

Plans to drill around 120,000m around its El Teniente division in Re- gion VI to detect and con rm the existence of mineral resources which could jus fy the development of new projects in the district. The work is expected to cost US$50M and take 10 years to complete with drilling beginning next December.

This is a point I have made before and pertains to the never-ending debate about dividends or no-dividends, profits for exploration or not, etc. etc. etc.

My points:

-

yes Auryn will use profits for exploration - they have said so themselves. This will come first.

-

@ $800 / OZ production cost & 25,000 Oz at $1350 POG, this indicates > $11M profit / year for the operation. I think they have a very good chance of doing better than $800 / OZ with a grade cut-off of 15 g/t.

-

Even Codelco in a major exploration effort in an area they are very familiar with is going to spend $5M / yr for around 12Km of drilling on average over 10 years. So my main point: imo, Auryn will not spend more than $5M to $8M / yr on exploration for the next several years. You just can not process the information fast enough to make it cost effective. (See Note 1)

-

If production increases, profits will increase but exploration expenses will not increase because this is gated, as I said, by the usability of the data generated. So increased profits from increased production will just add to the bottom line.

-

This implies, via simple math, that there will be excess profits even after exploration expenses even with the initial production rates suggested by Auryn with explicit goals published that these will increase.

Will all these profits be distributed so that Medinah has money for their claimed “buybacks or dividends” instead of saved for future expenses? That remains to be seen.

And the caveat, once they are faced with construction of something more ambitious, like a larger open pit or maybe deeper or larger underground mining, construction expenses could become quite large compared to cash flow from easy mining, then the above argument needs to be revisited in light of those capital needs. It is likely imo, that by that time Medinah, and maybe even Auryn, will not be around,but this could also definitely be 5 years+ into the future. As long as they are self funding and they are not facing gargantuan construction capital requirements it is to Medinah’s and Auryn’s advantage to just keep the show going and take exploration as far as they are able.

Note 1: Yes, in an open pit resource, once you have an initial resource outlined, an all out “in fill” drilling effort can eclipse this expense by a long way. But anything like that is several years in the future, not for 2016, 2017, or probably 2018. You have to really know what your target is for that and the justification is to move resources to reserves and this historically, though not necessarily recently, would be rewarded by investors moving the SP up.

IMO, Auryn is going to use dividends to move money out of the Company and into Masglas so Masglas can explore/develop their other properties. Medinah will get their share of the dividends at the same time. Your exploration numbers sound reasonable to me. There should be more than enough money to go around if they reach or exceed their targets. There is almost no chance of any dilution in Auryn(or further dilution of Medinah) in the foreseeable future.