Thank you TSX for your response.

Quote:

"I am flat out of reasons why we are trading at these levels.** Does anyone have our backs"?

I think there are a number of reasons we are trading at these levels:

-

We were trading around .015 when we found out there were twice as many shares outstanding. Simple math tells us we should end up at half that level, if nothing else changed. And really, nothing has changed since then.

-

We own 26% of a private company. Not an attractive asset to invest in. We can thank Juan and Les for this.

-

The private company we are invested in has not done a good job of keeping the investment community informed. The investment community was told on June 16th that mine preparation would start and would take two months to complete. Here we are four months latter and the investment community has had one update, stating an additional audit was uncovered. Not very impressive in terms of generating excitement. No news about grades, that production started, etc. Almost reminds me of how MDMN has behaved in the past.

-

Mdmn management has a history of under performing. Now we have the stigma of fraud and thievery, along with a major unknown…how many shares are outstanding?

Just based on these simple facts, why would anyone want to invest here? Why would anyone want to “have our backs?”

I’m not surprised we are trading at these levels.

I’m really not being pessimistic, just stating what I believe are facts. I hope time and performance will change some of these facts. I wish I could say next week, but I’m afraid it might be next year or the year after that.

Bottom line is, the only way we survive is through Auryn, and we don’t even know who they are.…that’s scary in its own right.

I understand that an informational meeting was held. But the investment community has heard almost nothing, except that our share count doubled and our management was a bunch of crooks.

Juan suing Masglas…Absolutely mind blowing!

Auryn indicated production news by end of October. Hoping we hear something very good in the next week.

Not so sure the math is that simple. The OS may be correct, but the free trading shares are more than doubled. Presumably 1.5 B additional shares are included in the DTC free trading shares count. This revelation was a shock from what shareholders assumed were less than 1 B shares in the float. This reasonably explains how we drifted from a “fair” 8-10 cent level to where we are today, along with some of the other more pessimistic points you make. I share your hope, and firmly believe that time and performance will overcome the sordid past miserable history of this company. The new BOD does have our backs, but will need a cash infusion to overcome the damage already done by the misdeeds under the not so watchful eye of past BOD members. It would not surprise me if selling a small percentage of our AURYN equity interest back to MASGLAS (the primary financer for AURYN), or some other entity, is required to keep the necessary operations of the company moving forward.

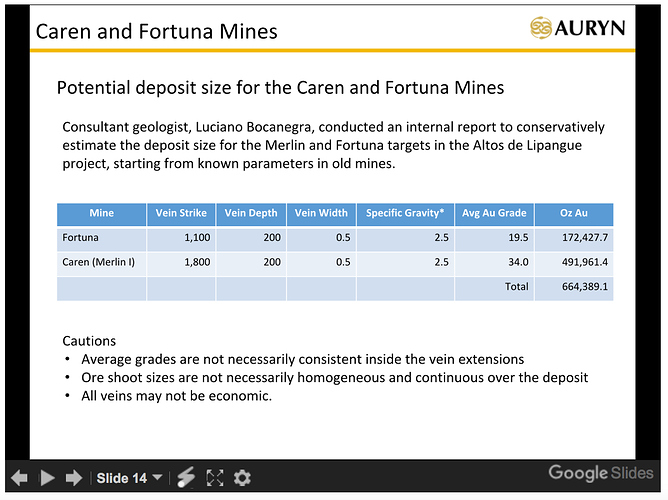

If you believe the valuation of our equity interest in AURYN is somewhere around $36 M, then with the current float (shares in street name) of 2.2 B shares (which will come down somewhat with clawbacks), then we should be trading somewhere around 0.0165 IMO. The difference can be attributed to the pessimism due to the reasons you so ably verbalized. It is my expectation that news of positive mining production results, and progress toward sorting out the legal hindrances and entanglements, will restore share price to much higher levels than we are currently experiencing.

Oh, and the grades were better than good!

I expect we’ll hear news of early production figures in the not too distant future.

FYI - It looks like Freeport is raising money. See the following EXCERPT from news released this morning. :

PHOENIX–(BUSINESS WIRE)-- Freeport-McMoRan Inc. (NYSE: FCX):

…

• FCX expects to receive $5.2 billion in gross proceeds during fourth-quarter 2016 in connection with previously announced asset sale transactions.

• In July 2016, FCX commenced a registered at-the-market offering of up to $1.5 billion of common stock. Through October 24, 2016, FCX has sold 33.5 million shares of its common stock for gross proceeds of $415 million ($12.39 per share average price).

FYI - New pic of Auryn stockpiling ore on Facebook page.

Thank you HR. One photo after a month of production? Why are they stock piling? A photo of the ore being processed would be nice.

Possibly because when you are removing product from a mine you don’t pay for trucks to set there to be filled one bucket at a time as it comes out of the mine and you don’t send the product to be processed one truck at a time. The efficient process might be to stock pile until you have adequate material to send as many trucks as necessary to move all the product to be processed as a cost effective package. It would appear they are looking to be cost effective rather than not.

As mentioned at the Informational Meeting, and reported by CHK a while back, the 1st 3 truckloads of ore will be analyzed to determine the most efficient way to process the ore. AURYN may use gravimetric processing on site if economical, or simply truck raw ore for processing to one of the nearby processing plants. They need to determine the best way to process it first.

Does anyone know what happened to Roberto our IR personal?

Probably our new president just trimming overhead and deadwood.

Accountant, Lawyer and all of Les’s other appointees are liable…

Medinah sued by ex-CEO Price’s company

Medinah Minerals Inc (U:MDMN)

Shares Issued 249,475,716

Tuesday October 25 2016 - Street Wire

by Mike Caswell

Medinah Minerals Inc., the pink sheets listing once run by North Vancouver accountant Les Price, is facing a lawsuit in the Supreme Court of British Columbia over a $2,017,066 unpaid debt. (All figures are in U.S. dollars.) The suit was filed by GXK Ventures Inc., a private entity that Mr. Price controls. GXK claims that it paid Medinah’s bills over a nine-year period, but the company has not reimbursed the money.

The allegations are contained in a notice of claim filed at the Vancouver courthouse on Oct 18, 2016. According to the suit, GXK entered into an oral agreement with Medinah in April, 2007, in which GXK would make payments on behalf of Medinah and would pay Medinah’s debts. GXK expected that it would be reimbursed for any amounts owing, plus interest of 10 per cent per year. According to the suit, the deal was made between Mr. Price and three officers and directors of Medinah.

In the first 15 months of that agreement, GXK spent $794,106 of its own money on Medinah’s expenses, the suit states. GXK claims that Medinah acknowledged this debt through a promissory note dated Aug. 17, 2008. According to the suit, GXK continued to pay Medinah’s debts and made other payments on its behalf up to June 30, 2016. Medinah repaid part of the money from time to time, but never the full amount.

The amount owing as of June 30, 2016, is $2,017,066, the suit states. GXK is seeking the court-ordered payment of that money, plus interest at 10 per cent. Vancouver lawyer Ori Kowarsky of Kowarsky Ritson LLP filed the lawsuit on GXK’s behalf.

Medinah has not yet filed a response. The stock is still an active trader, but has been in subpenny territory for about two months. It closed Tuesday at 0.85 cent.

Mr. Price was the chief executive officer of Medinah until 2001, and (as is apparent from the lawsuit) remained

What is this garbage?!

A news release from Stockwatch

Sometimes the best defence is go on the offense…keep them off balance. He’s a piece of work. Still trying to milk the company!

Very sad that this mountain fell in the hands of A Con Man.