My guess is that Auryn should be valued at somewhere between $20M-$30M based on what has been publicly disclosed to date. This number ($500M+) is certainly possible but will take time, patience and some very solid developments on the mountain (30k+ ounces of annual production would help). I’d speculate that Auryn will be able to IPO with a $50M-$75M market cap as long as they produce some encouraging numbers on the current vein they are attacking.

thanks. Too bad, we are already assuming non recovery of the 1.5 Billion stolen shares and we are dividing all numbers with 3 Billion…

Do not assume anything until you here it from the horse’s mouth.

Ok, where is the horse?

Or better yet who is the horse. Pretty sure our better halfs think we’re the horse’s azz for be in this stock and not selling at the highs😳

Oh yes those highs! Although after all these years my memory has slowly shrank some how those highs are still so clear in my mind. We have not heard from the company what the actual share claw back is as of today so people making assumptions is just that nothing more.

I remember when we were hitting those highs at one point I looked at my portfolio and had over 4M in profits. You may feel like the horse’s ass, but when I really dwell on it I think I feel more like what comes out of it. Lessons can come really hard sometimes. Fortunately, I still have my health and a great life.

Technicals my a$$

Down 22 percent on $5 trade

That is what we get in the penny stocks corruption from all angles.

Auryn where’s the News?

They are way overdue, really.

You’re not alone in the lofty numbers. Along with how you’re looking at it, one way I’m approaching it is to recognize that if I had sold, others would be sitting on millions in losses from my gain off a stock that never really should have been valued so high. They might not be as functional to deal with it psychologically. We have enough unstable people here as it is.

I thought there would be enough things happening, to have regular updates.

To be completely fair, WIZ, I wasn’t t quite that altruistic. There was another way I was looking at it that would be rewarding for all, especially those taking a risk and getting in early. I was not looking for a quick flip. I was looking for the company to develop into a long term sustainable and profitable mining company. The thinking was with such a promising conglomeration of mining concessions this could be very rewarding in the long run. I wanted to see that day and I wanted to be a shareholder when that happened. The “long run” is much longer and punishing than anticipated with all the negative twists and turns. That’s why I’m still here after more than 10 years. Thanks for being here and working to turn this back on track.

For peace of mind’s sake, I think we need to keep in mind that the lower the valuation for AMC is FOR THE PURPOSES OF THIS CASH CALL ONLY, the greater is the amount we can clawback if one or more of the AMC shareholders (like Les) can’t make the cash call. AMC’s valuation only needs to be legally defensible. One school of thought on mineral deposit valuation suggests only counting the money spent to date on the deposit that was prudently spent.

It appears that AMC has spent about $7.5 million to date on exploration and development. They could argue that Medinah’s previous expenditures were not worthy of counting for valuation purposes and the records are unreliable so that only AMC’s $7.5 million should count towards dollars spent. This might be defensible. At this particular stage of development, acceptable valuations could fit within an ENORMOUS range.

If I were commissioned to present the case that the ADL mining district is actually worth closer to $600 million I would probably present it thusly. With AMC being able to operate as a privately held company able to lever that advantage in this secrecy-obsessed industry I would assert that the proper valuation approach would involve taking an “indirect” approach because of the darkness. In using this type of approach you identify the parties with the best visibility of the playing field and with a clearly superior level of understanding of this ultra-complex industry. I’d say AHC and their geoscientific team would fit the bill. Then what you do is study their actions and see if any of them can be applied as a valuation metric.

Not that long ago they were paying 10-cents per Medinah share when they thought the market cap was $135 million. Since Medinah at the time held a 25% stake in AMC then this valued 100% of AMC at $540 million. Since that buying was done a significant amount of good exploration results have been released so let’s round that $540 million up to $600 million. Do I think that the deposit is worth $600 million today? No, not yet. The point is that valuation models can be used to put the value at any level the valuator wants them to be. In this case you can see an 80-to-1 differential in valuations ($7.5 million versus $600 million) that could both be defended.

In a somewhat “dark” environment like ours, I think that the case for taking an “indirect” approach like this has a great deal of merit. Be careful of “valuator bias”. Valuing mineral deposits is nothing at all like valuing real estate wherein fairly close “comps” can be located within neighborhoods with similar styles of houses with similar square foot measurements.

There are 3 industry accepted classes of methodologies used to value mineral deposits. They are COST, INCOME and MARKET methodologies. Note that the initials “CIM” also apply to the institution that approves of proper mineral valuation methodologies also known as “CIM” i.e. the Canadian Institute of mining, Metallurgy and petroleum.

Many mining professionals also recognize 3 stages of mineral deposit development prior to production: exploration, marginal development and development. INCOME methodologies like DCF (discounted cash flow) and option pricing obviously aren’t recommended for EXPLORATION properties that are not generating INCOME. Accetable COST methodologies like “appraised value” or “geoscience factor” as well as acceptable MARKET valuation methodologies like “comparable transactions” and “option agreement terms” might apply nicely at our stage of development.

With an IPO around the corner, perhaps a JV around the corner and meaningful cash flow from production perhaps around the corner I’d HOLD OFF ON AMC VALUATION ANALYSES for just a while longer until we get flooded with valuation data. When you factor in the recent what appears to be a “moratorium” on press releases plus the $7.5 million valuation for AMC for the cash call purposes then I think you might be able to read between the lines that the gloves are off in the battle between AMC and Les/JJ. The efforts made by AHC to help out Medinah and to a lesser degree Cerro in making the cash call speak volumes as to the ethics of AHC. I’m going to go way out on a limb and guess that those generous terms are not available to Les and/or JJ.

Don’t be an OCD geo-geek and crank out a 37 page valuation analysis on Medinah/AMC like somebody I see every morning while shaving. That’s insane. However, if you’re going to attempt a valuation analysis do try to follow the CIM basics. One of these is to put in as much time choosing the appropriate valuation methodology as you do crunching the numbers. With this mining district I would recommend breaking the district into its 6 main subdivisions and doing 6 separate analyses. It’s too large and unwieldy to address in one analysis.

Another basic step in mineral deposit valuations is to wait for a “TRANSACTION” BETWEEN WELL INFORMED PARTIES KNOWLEDGEABLE ABOUT VALUATION METHODOLOGIES. The terms of a JV might qualify here as might an IPO with an accompanying prospectus carefully detailing all risks.

Define your goal right up front. If you’re trying to judge the appropriateness of a market cap of a corporation like Medinah you’re going to have to introduce a group of intangibles and attempt to value them aside from the mineral deposit. For example, I would argue that one of Medinah’s most valuable assets is their relationship with AHC and associates who appear to own a little over 500 million Medinah shares. AHC’s commitment to “carry” Medinah’s pro rata share of exploration/development costs UNTIL Medinah is cash flow positive is worth a fortune.

For the average junior explorer with a significant discovery, the time period in between cutting a deal with an AMC like company and the commencement of cash flow is subject to enormous dilution of the junior explorer’s stake in the project. AHC and associates immense equity stake in Medinah has apparently motivated them to “carry” Medinah on their broad shoulders through this time period without suffering any dilution. The terms are beyond generous. What “valuation” would you assign to Medinah’s indirect access to huge sums of money every time money is needed?

This is a very tough valuation case because there is no clearly separate “Medinah” and “AMC” any longer. Medinah’s Gary Goodin is on the AMC BOD and Medinah’s CEO Kevin Tupper doubles as AMC’s communication director. AMC’s Italo and Raul are Medinah BOD members. Where does Medinah end and where does AMC start? “Medinah” is clearly in a hybrid/transition zone probably ending up in free trading AMC shares landing in the hands of Medinah shareholders and the Medinah shell going poof once all of the legal activities are completed.

Part of a valuation analysis has to take in the playing field on a macro view. What is the current supply and demand for mining districts of this description? The “supply” of new mineral discoveries is about as low as it has historically ever been. The necessity of major and mid tier miners to replace their dwindling reserves/resources keeps the “demand” variable high.

Risk/reward analyses need to be a part of any valuation attempt. What are the typical risks for a Medinah type company and how many of them have been successfully mitigated? Replacement scenarios also need to be taken into account. What would it cost a mining major (in terms of time and money) to start from scratch and consolidate a 10,500 hectare mining district with this infrastructure in a country like Chile? What “value” do we assign to this mining district now that it has been confirmed to be the new southern terminus of the 91 million year old “Early Cretaceous Porphyry Belt” in Chile’s Coastal Cordillera? How do you put a price on the ability to study “comparable” deposits for geomodeling purposes in this north to south alignment of about 9 large deposits?

“To a lesser degree Cerro”?? They haven’t offered any terms to Cerro and are forcing a cram down based on, to your point, a ridiculous valuation of $7.5M ($500M-$600M is even more ridiculous). Taking down 1000 CDCH shareholders to hit JJ and Les would only be considered generous in your world Jim but I’m not blaming anyone, as the saying goes, “don’t hate the player, hate the game.” Patrick via Les via Hoffman let the company slide into comatose company.

Let’s hope MDMN doesn’t do something to “upset” AMC b/c they can, at any point, dilute MDMN down to zero with a capital call. Will it happen? Not likely but AMC’s stake in MDMN is the ONLY think that prevented them from “generously” providing terms to bail out MDMN shareholders (and much credit owed to Kevin). If anybody expects legitimate investors to come up with $300k for CDCH or come into the market to buy shares of MDMN with the overhang risk of AMC issuing another cram down capital call (which means a zero for MDMN) you ain’t seeing the ball clearly. This is exactly why MDMN won’t go anywhere until Auryn IPOs/issues shares/and closes the doors on MDMN.

My hope is that Maurizio agrees to work with CDCH but that’s going to take a lot of work and willingness of the existing BOD to concede control of the CDCH “shell” and/or a smart alternative to spinning out the 5% of AMC on somewhat non-dilutive basis.

My other hope is that there is some reassurance that AMC won’t pick an arbitrary valuatoion and initiate another capital call for CDCH or MDMN. The unfortunate reality of the capital call is that this is dead money until then. I would have thought there were plenty of other ways to deal with JJ and Les without the terrible optics.

Your post is right to the point, John. While I agree with much of DOC’s post, I believe MASGLAS has limited deep pockets.

I mentioned this way back.

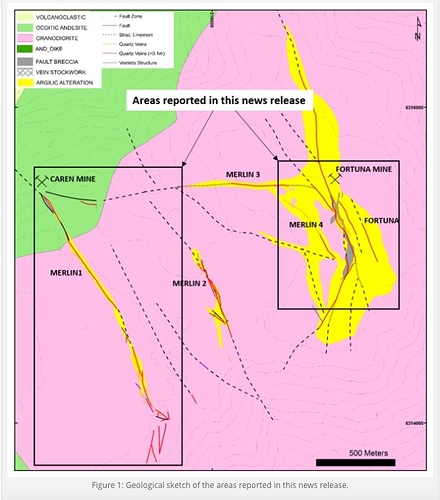

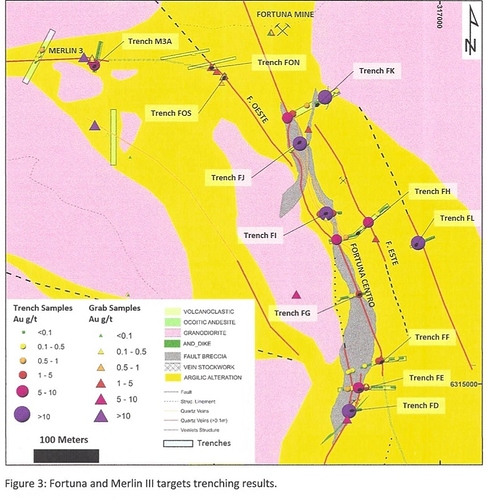

See and read the complete post referenced below in Q3 2016 (as recovered). It is why I asked at the informational meeting if the Fortuna was moving ahead to open pit the surface veins in this area and use a gravimetric concentrator as was originally alluded to. I was surprised that Maurizio said that determination had not yet been made. Cordova added that by using a gravimetric concentrator the gold content would increase 100 fold. The Fortuna will be very profitable in time. I believe they eventually will open pit this claim area, but may have delayed this due to the expense and lack of available funding.

Medinah’s loan is definitely advantageous for reasons already stated here on this thread, wheras CERRO’s loan should be considered predatory, IMO. I think MASGLAS is acting legally, but unethically in taking advantage of current CERRO shareholders. I see that MASGLAS is taking the Fortuna as cheaply as it can, and definitely at the expense of CERRO shareholders. This is to the advantage of future AURYN shareholders, but adding insult to injury to those not holding certificate shares of CERRO. A liquidity event will only reward certificate holders, IMO. Just remember that it does not appear that AURYN is still a wholly owned subsidiary of MASGLAS. It appears that in preparation of an IPO AURYN has become a stand alone private company and is eliminating all debt on the books by issuing the cash call. It is a good move for AURYN to separate itself from the complexities of remaining a subsidiary of MASGLAS before applying for an F-1 in preparation of an IPO. AURYN will use all means available to reward it’s original MASGLAS investors. MASGLAS carries a large monetary obligation in maintaining it’s other mining properties. Also, review the initial news in the January 2016 Chile Explore Report (note: this is no longer in the media section on AURYN’s website - ask yourself why?):

A buyer’s market

Industry crisis creating opportunities for newcomers

…The nine projects are either too small or not suffciently advanced to interest FQM. But they could offer opportunities to patient capital prepared to wait for the promised recovery.

… Masglas now plans to send its geologists to carry out preliminary field assessments over the coming weeks with the aim of determining potential drill targets for 2016.

The team also has to work through an immense quantity of data for the portfolio. Cordova estimates that Inmet and predecessors invested in excess of US$15M exploring the projects, or several times the amount he agreed to pay for them.

The Inmet portfolio is not the only project on Masglas’s books.

“People are letting go of some really excellent opportunities.” Maurizio Cordova, Masglas America

Working through 100%-owned subsidiary Auryn Mining Chile, the group is also assessing the mineral potential of the Altos de Lipangue property in the Metropolitan Region.

http://cexr.cl/wp-content/uploads/2016/01/CER34-ENG-SAMPLE.pdf

Continuing the discussion from Medinah Minerals (MDMN) - 2016 Q3 - General Discussion (recovered):

This was considered to be a slam dunk for an open pit when first released ( December 28, 2015).

http://aurynmining.com/mapping-and-trenching-program-results-indicate-high-grade-gold-mineralization-in-the-epithermal-vein-system-at-merlin-and-fortuna-targets-in-the-altos-de-lipangue-project/

This investment has become an epic saga with much future potential, too many details to recount all that have surfaced in past years, and far too much heartache and disappointment for most investors still on board for any length of time.

Auryn is going to have a conundrum on their hands when the IPO comes out at a significantly higher amount than $7.5million. To Doc’s point, there are three ways to value a company. They cannot choose the dollars invested to date method to determine dilution for failure to meet the cash call and then within 8 months choose another method to arrive at a higher value for IPO purposes. Its one or the other.

You can’t have your cake and eat it to!!!

Agree with John, no way they can raise the $300,000 so we better get this worked out.

Whatever happened to the Private investors 3% did they meet the cash call?

AMNP…FYI