MDMN/CDCH ratio getting closer to valuation parity.

Maybe we will get some volume/buying this week. I am ready for something/anything to happen…

Please reconsider the “anything” part of that thought.

Wow ! For about 10 years I’ve followed a Medinah chat forum. Never been this quiet. It was the first site I went to whenever I got on the computer. Now, I sometime check the site once a day or even forget to check completely. I guess my expectations are diminishing. Sad. Sure was exciting when the SP went to .19c . Thought I was on my way to millions. When the SP went down slowly, I could have still made a profit. I didn’t sell a share. My cost basis was under .03c . In the last year+ I’ve averaged down to about 2 cents. I still think I’m in good position to make some money, but this saga has gone on way too long. Sure would like to get some consistent periodic update info. Even if just a note saying: “Things are progressing, more to come, stay tuned.” This rant is therapy. Thanks for your indulgence. Note to Kevin: Thanks for all you’re doing!

Dear Hoopity,

Just a note for you and any others here who need to hear it.

“Things are progressing, more to come, stay tuned.”

Sincerely,

Members of the General Discussion board

“Thank you sir, may I have another?”

More work to be done? LP and PF must return shares. CDCH has yet to formalize their contract with Auryn, file their financials and get the stop sign removed. I would guess this to be reflected in the next filing period for both companies and coincide with Auryns attempt to go public. I’ll bet Kevin is working hard on all issues. JAWAG.

Here is the contact link to the Canadian Informant Leads Dept.http://www.cra-arc.gc.ca/leads/ ( Offshore Tax Informant Program (OTIP) )

If anyone is interested and have relevant information to add to his file, or wish to add your name as a victim to those on the file please don’t hesitate to call. 1-866-809-6841

Lead ID. # 833-0511

Is Les or anyone connected to MDMN on that file?

I believe that file /case # is specific to Les. It is an anonymous file and they will not give you any information. You can only add information and add your name to those who have been impacted by the actions of Les Price. I hope the Canadian authorities will pick up where MDMN left off.

I will second that request of another…

Large mining conference end of August in Santiago. Some heavy hitters attending.

Jenny McKibbin

Jenny McKibbinManager

Marketing Campaign Manager

South American mining leaders discuss their failures, success and the future of the industry

The 2nd Mining Strategic Excellence Conference/2a Conferencia: Excelencia Estratégica en la Minería is the only event to learn directly from the CEO’s of the South American mining industry.

With high level attendee and speaker participation, this is the conference to elevate your company’s productivity and strategic planning.

You are invited to join us at the conference on August 29-30 in Santiago, Chile.

The event will focus on strategic planning, financing, market trends, technological innovation and practical solutions for success.

I would advise looking over the agenda to understand our unique approach to the complex industry issues - Metal Bulletin is part of Fastmarkets - Fastmarkets

Known for its C-suite level speakers and delegation made up of industry decision makers, attendees have access to a unique collaborative networking opportunity.

Speakers include:

• Javier Córdova, Ministro de Minería, Gobierno de Ecuador

• Andrés Restrepo, Chairman, Grupo MINEROS

• Óscar Landerretche, Presidente, Codelco

• Daniel Meilán, Secretary of Mining in the Nation, Government of Argentina

• Aurora Williams, Minister of Mining, Government of Chile

• Ricardo Labó Fossa, Vice Minister of Mines, Government of Peru

• Víctor Gobitz, CEO, Buenaventura

• Iván Arriagada, CEO, Antofagasta Plc

• Susan Lasecki, Cluster Manager, BHP Billiton

See the full list of speakers - Metal Bulletin is part of Fastmarkets - Fastmarkets

With the market now showing signs of growth, it is crucial to form long term strategic plans and proactive innovation strategies to capitalize on being at this point of the commodity cycle. Presentations, roundtables and panel debates will demonstrate audience and speaker knowledge, research, opinions and experiences.

Please feel free to get in touch if you have any questions or want to chat about the event.

Best wishes,

Jenny McKibbin

Marketing Campaign Manager

Metal Bulletin EventsShow less

Anyone interested in putting up a poll for what percentage we ( Auryn ) would have to give up for a Major to team up with us

To advance the porphyries? We would need to give up all of the ownership but we would be given an NSR (1%-3%) which could generate decent cash flow. If this was the route the company decided to take I would hope they would “set aside” a few, lower capex, assets that could be pursued without the help/dilution of a major.

I give it 90% chance they already have a partner that is yet to be announced. It would partially explain the continued silence. (It started shortly after they mentioned Freeport was on the property.) It is unfortunately that Medinah ended up picking a partner that didn’t have the resources to tackle the Alto on their own but no point dwelling on that. On the other hand, a larger partner would have offered lesser terms for sure. Their new partner is probably Freeport. We know for sure they were there and actually mentioned in a news release. No chance that Freeport would walk away from the Alto unless that didn’t like working with Auryn. Auryn seems decent to work with so…when do they announce the Auryn/Freeport joint venture? Before or after the IPO?

What percentage do you think we had to give up for Freeport?

Could be more complicated than that. They might section off the porphyry portion of the mountain to develop with Freeport while keeping the epithermal portion for themselves or even with a separate partner.

Wow Mike 90% chance we have a Partner in Freeport I sure hope so

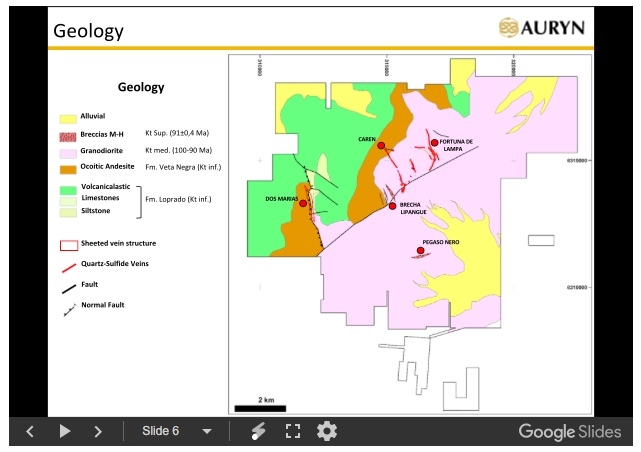

I would agree with this being the major reason or explanation for the silence from AURYN since early in the year. FCX may or may not be the the ultimate choice for a JV partner, but let us not forget that there are five major defined deposits of interest that AURYN outlined early on as shown in slide 6:

The Pegaso Nero would likely be the major asset to JV out early on due the large potential value and large CAPEX needed to successfully develop it. CHG noted this early on in his notes from the Oct 1, 2016 Informational Meeting:

C. The Pegaso Nero has the interest of 3 major companies, one of them being Freeport McMoran (the other 2 being “as big or bigger” than FM, but remained unnamed). Auryn expects / hopes to negotiate a JV deal for the PN hopefully as soon as Q1 2017. It will be a “standard” deal where the JV partner spends money to gain percentage of ownership, probably in 2 or 3 stages ending potentially in a PFS for the PN. Altogether it could be 7 to 10 years from JV to production should the PN be economic.

(bolded emphasis mine)

It is likely that AURYN intends to hold and develop at least several of the remaining areas it has explored, IMO, and possibly have more than just one JV partner to assist in this endeavor as several posters have already suggested.