KRR rocks…

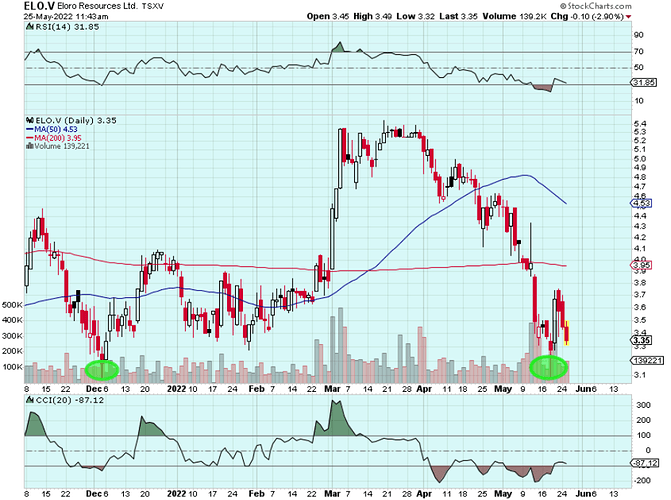

Karora Resources Announces Beta Hunt Second Decline Progressing Ahead of Schedule, the Discovery of a New Shear Zone and New Drilling Results Including 198.5 g/t over 4.5 metres

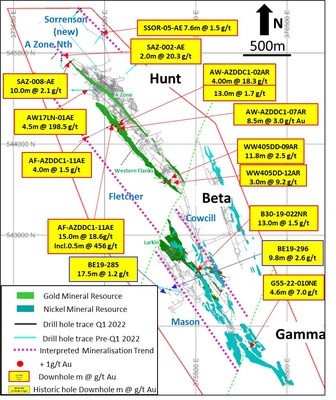

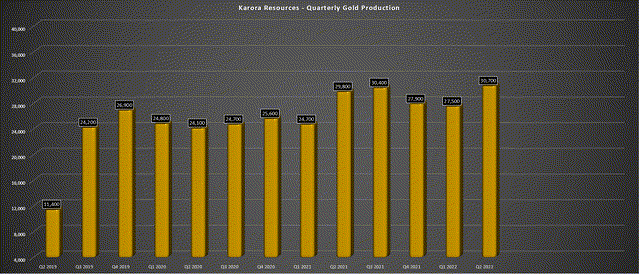

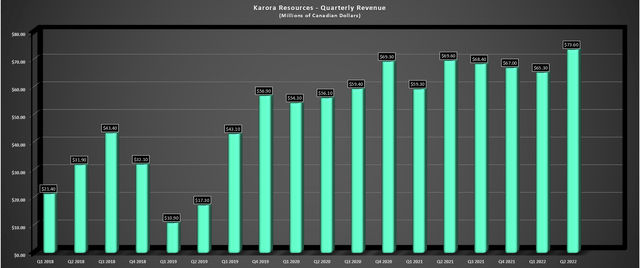

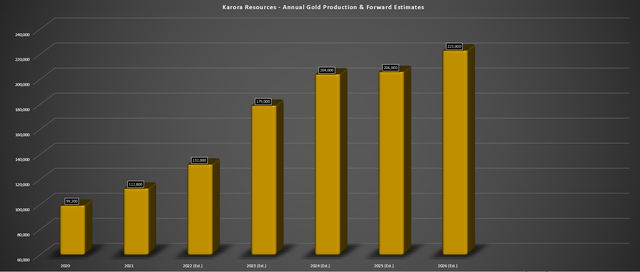

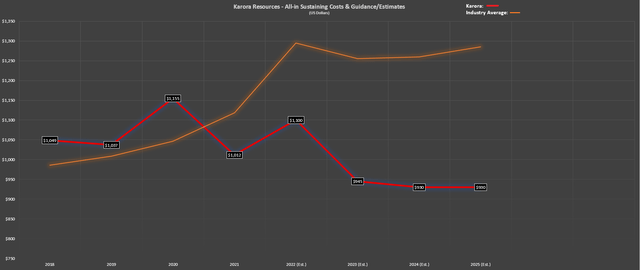

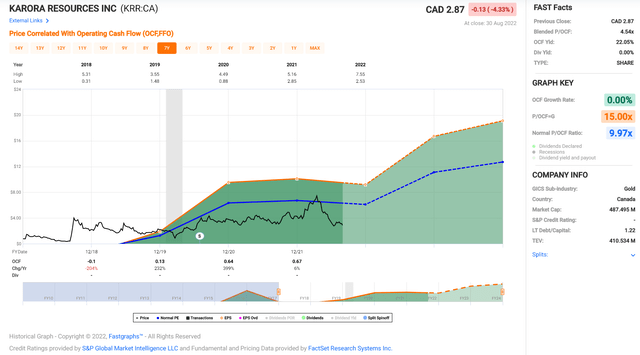

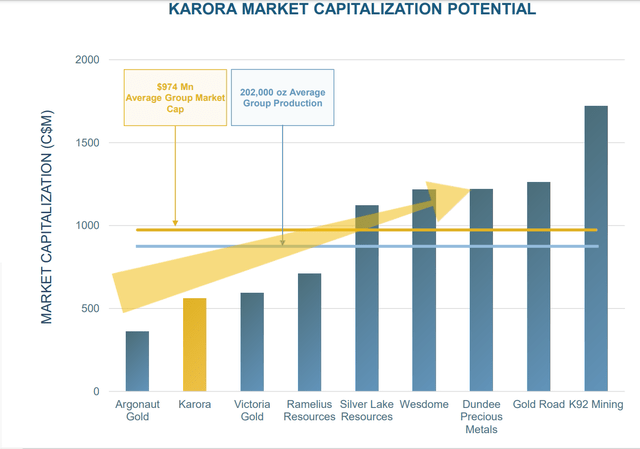

TORONTO, May 24, 2022 /CNW/ - Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) (“Karora” or the “Corporation”) is pleased to announce that development of the second decline at Beta Hunt is tracking on cost and ahead of schedule with the estimated completion date now brought forward to Q1 2023 from mid-2023. The second decline at Beta Hunt is integral to Karora’s production growth plan to double throughput at Beta Hunt to 2 Mtpa and increase gold production to between 185,000 and 205,000 ounces by 2024.

- 198.5 g/t over 4.5 metres (AW17LN-01AE);

- 18.6 g/t over 15.0 metres (AF-AZDDC1-11AE); and

- 18.3 g/t over 4.0 metres (AW-AZDDC1-02AR).

Interval lengths are downhole widths. Estimated true widths cannot be determined with currently available information

Results from the surface drilling program also supports the interpretation of a newly discovered shear zone named ‘Sorrenson’, located to the east and parallel to A Zone and Western Flanks. The discovery of the Sorrenson shear zone follows the success of the Larkin and Fletcher shear zone discoveries, adding to the rapidly expanding mineralized system at Beta Hunt.

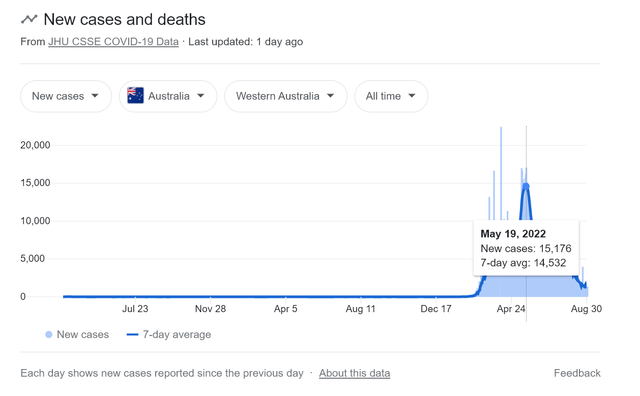

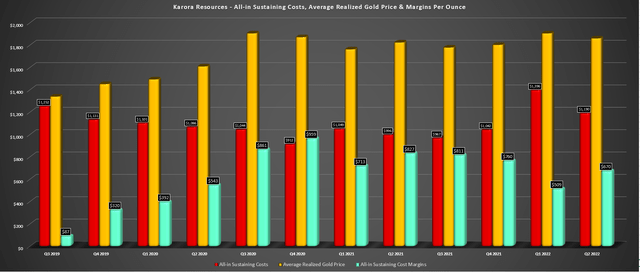

Paul Andre Huet, Chairman & CEO, commented: "I am thrilled with the progress made to-date by our teams to significantly progress development of the second decline ahead of schedule at the Beta Hunt Mine. The efforts to secure the DMIRs permits followed by rapid execution of our decline development plan, all while tracking on budget, is a tremendous achievement in light of the current inflationary environment negatively impacting many operations and development projects across our sector. A job well done.

I am also extremely pleased with the drilling results at Western Flanks, A Zone North, Fletcher and the newly interpreted Sorrenson shear zone which further validates the tremendous growth potential of Beta Hunt. With our aggressive exploration drill program, we continue to identify new shear zones and, as exemplified with the success of Larkin, convert them into resource inventory. The continued discovery of these new shear zones is one of many reasons we are excited about the long-life potential of the Beta Hunt operation.

Overall, we continue to build upon the world class exploration potential of Beta Hunt, while our development teams execute on our second decline plans to double throughput to 2 Mtpa."

Exploration drilling at Western Flanks returned significant high grade results of 198.5 g/t over 4.5 metres in hole AW17LN-01AE in drilling designed to test the northern extension of the zone and 18.6 g/t over 15.0 meters in hole AF-AZDDC1-11AE and 18.3 g/t over 4.0 metres in hole AW-AZDDC1-02AR in drilling designed to support and expand the existing Mineral Resource.

Recent exploration drill results at A Zone North include a 20.3 g/t over 2.0 metres intercept in hole SAZ-002-AE supporting A Zone North’s extension. Importantly, this extension is proximal to the location of the second decline and is expected to provide early access to potential near-surface mining blocks in support of the growth plan.

Beta Hunt Second Decline Progress

Following final approvals received from Department of Mines, Industry Regulation and Safety (“DMIRS”) for the surface collaring and box cut development work, decline development from underground has advanced approximately 500 metres since commencement, with the main vent access drive on the 801 level being within 15 metres of completion. Surface portal construction is approximately 70% complete with surface decline development expected to commence Q3 2022.

Beta Hunt Drilling Update

From January 1, 2022 to April 30, 2022, a total of 49 gold resource definition and exploration holes were drilled at Beta Hunt for 10,647 metres. Drilling focused on testing A Zone North, extending and infilling Western Flanks and testing the down-dip position of the Fletcher Zone. Encouraging initial drilling results were received from the newly interpreted mineralized shear zone known as Sorrenson, which is located to the east and parallel to A Zone and Western Flanks. Figure 2 below summarizes significant drilling results and their location over this period.

Gold Focused Drilling

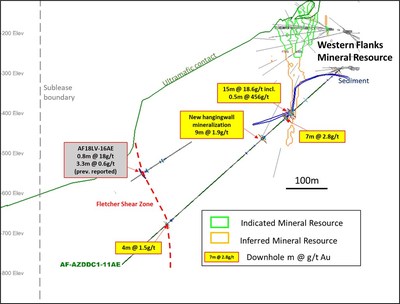

Western Flanks: As part of the program to upgrade the existing Inferred Mineral Resource, drilling targeted both Western Flanks Central and South. Results support, and in some cases expand, upon the existing interpreted mineralization. For example, hole AF-AZDDC1-11AE returned 18.6 g/t over 15.0 metres (See figure 3).

Drilling also tested the northern strike extension of Western Flanks with drill hole AW17LN-01AE returning 198.5 g/t over 4.5 metres. The intersection occurs in the footwall of Western Flanks and is associated with pyrrhotite-rich sediment and altered porphyry. Further follow-up drilling is planned for this area. Significant results1 from the Western Flanks resource definition and exploration drilling are listed below:

- AW17LN-01AE: 198.5 g/t over 4.5 metres

- AF-AZDDC1-11AE: 18.6g/t over 15.0 metres

- AW-AZDDC1-02AR: 18.3 g/t over 4.0 metres

- WW405DD-09AR: 2.5 g/t over 11.8 metres

- WW405DD-12AR: 9.2 g/t over 3.0 metres

- Interval lengths are downhole widths. Estimated true widths cannot be determined with currently available information

A Zone North: Significant results were returned from A-Zone North and continue to provide encouragement for an extension to the current mineral resource and the opportunity to exploit mineralization from the new second decline. Significant results1. include:

- SAZ-002-AE: 20.3 g/t over 2.0 metres

- SAZ-008-AE: 2.1 g/t over 10.0 metres

- Interval lengths are downhole widths. Estimated true widths cannot be determined with available information

Sorrenson: Initial results received from testing the interpreted Sorrenson shear zone support its existence including 1.5g/t over 7.6 metres (downhole) in drill hole SSOR-05-AE which validates the mineralization thesis. Drilling is being conducted on three, 400 metre spaced lines with additional results pending from the program.

Fletcher: Drilling on the Fletcher Shear Zone continues to support a continuous mineralized shear zone with an intersection of 1.5 g/t over 4.0 metres (downhole) in drill hole AF-AZDDC1-11AE, over 130 metres down dip from the nearest intersection, extending the mineralized zone at depth. Further drilling is planned at Fletcher to test continuity of the zone and its potential as another major shear zone at Beta Hunt.

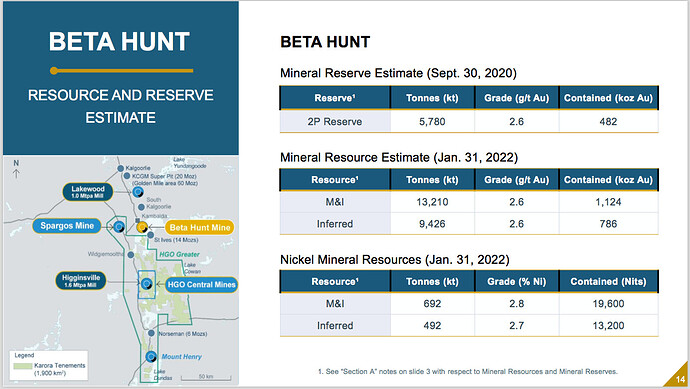

Nickel and Sampling Update

Nickel drilling re-commenced in the Beta Block targeting the 30C and 25C (south of the 30C), with an update to be provided once results are received and interpreted.

A re-sampling program of historical holes is underway at Beta Hunt, yielding additional impressive intersections in the Mason shear zone compared to those previously recorded (located to the West of the Larkin zone, see Figure 2). The results1. include:

- Historic drill hole BE19-296: 2.6g/t over 9.8 metres (previously 3.5g/t over 0.8 metres)

- Historic drill hole BE19-285: 1.2 g/t over 17.5 metres, including 2.4g/t over 3.8 metres (previously 2.0g/t over 6.5 metres)

- Interval lengths are downhole widths. Estimated true widths cannot be determined with currently available information

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

At Beta Hunt all drill core sampling is conducted by Karora personnel. Samples for gold analysis are shipped to SGS Mineral Services of Kalgoorlie for preparation and assaying by 50 gram fire assay analytical method. All gold diamond drilling samples submitted for assay include at least one blank and one Certified Reference Material (“CRM”) per batch, plus one CRM or blank every 20 samples. In samples with observed visible gold mineralization, a coarse blank is inserted after the visible gold mineralization to serve as both a coarse flush to prevent contamination of subsequent samples and a test for gold smearing from one sample to the next which may have resulted from inadequate cleaning of the crusher and pulveriser. The lab is also required to undertake a minimum of 1 in 20 wet screens on pulverised samples to ensure a minimum 90% passing at -75µm. Samples for nickel analysis are shipped to SGS Australia Mineral Services of Kalgoorlie for preparation. Pulps are then shipped to Perth for assaying. The analytical technique is ICP41Q, a four acid digest ICP-AES package. Assays recorded above the upper detection limit (25,000ppm Ni) are re-analyzed using the same technique with a greater dilution (ICP43B). All samples submitted for nickel assay include at least one Certified Reference Material (CRM) per batch, with a minimum of one CRM per 20 samples. Where problems have been identified in QAQC checks, Karora personnel and the SGS laboratory staff have actively pursued and corrected the issues as standard procedure.

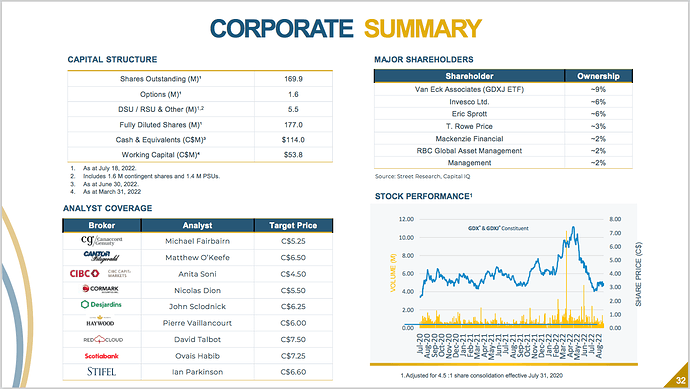

About Karora Resources

Karora is focused on increasing gold production to a targeted range of 185,000-205,000 ounces by 2024 at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, expanding to a planned 2.5 Mtpa by 2024, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. At Beta Hunt, a robust gold Mineral Resource and Reserve are hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. The Company also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.