Great post HR! After watching the presentation with narrative a couple weeks ago I also bought more at these prices, even though I’m already heavily overweight in this particular stock. A couple of items of particular interest to point out in Seeking Alpha’s excellent analysis that caught my eye were:

So, while many producers will see a $70/oz dip in margins if the gold price stays at current levels, Karora will see a 10%+ increase in margins even at $1,750/oz gold.

This is based on assumptions of a $100/oz gold price decrease year-over-year if gold price stays at current levels, offset by a $155/oz decline in AISC ($945/oz vs. $1,100/oz).

If we compare this market cap figure to an estimated net asset value of $1.02 billion, Karora is currently trading at 0.38x P/NAV, a valuation typically reserved for early-stage developers or producers in jurisdictions one would prefer not to venture into from an investment standpoint (Guatemala, Venezuela, South Africa, etc.).

I was impressed by other major takeaways that can be gleaned if one takes time to carefully observe the details in the latest presentation slide deck.

2 Likes

News out on Skeena Resources

Skeena mining has been mentioned previously on 3 of our threads, most recently March 29, 2022 on the main 1st Half General Discussion thread because of it’s connection to Hochschild mining. (disclosure: I have a position in Skeena Resources and Hochschild Mining) - Recall that:

There was another Hochschild project that I was unaware of until yesterday while watching a webinar on Skeena Resources (mentioned on our other threads) and the SNIP property it acquired from Barrick Gold in 2017. In the 1990s SNIP produced approximately 1M OZ of AU at an average grade of 27.5 g/t. October of last year Hochschild entered into an agreement as operator of SNIP.

Now a Feasibility Study is out:

SKEENA COMPLETES ROBUST FEASIBILITY STUDY FOR ESKAY CREEK: AFTER-TAX NPV (5%) OF C$1.4B, 50% IRR AND 1 YEAR PAYBACK

September 8, 2022

View PDF

NR: 22-17

Vancouver, BC (September 8th, 2022) Skeena Resources Limited (TSX: SKE , NYSE: SKE ) (“Skeena” or the “Company”) is pleased to announce the results of the Feasibility Study (“FS”) for the Eskay Creek gold-silver project (“Eskay Creek” or the “Project”) located in the Golden Triangle of British Columbia.

Eskay Creek 2022 FS Highlights:

• After-tax net present value (“NPV”) (5%) of C$1.41 billion at a base case of US$1,700 gold and US$19 silver

• Robust economics with an after-tax internal rate of return (“IRR”) of 50.2% and an industry leading after-tax payback on pre-production capital expenditures of 1 year

• High-grade open-pit averaging 3.87 g/t gold equivalent (“AuEq”) (2.99 g/t gold, 79 g/t silver) (diluted) with a strip ratio of 7.5:1

• Years 1 - 5 average annual production of 431,000 AuEq ounces, places Eskay Creek as a tier one operation

• Life of mine (“LOM”) production of 3.2 million AuEq ounces from 2.4 million ounces of gold and 66.7 million ounces of silver

• Estimated pre-production capital expenditures (“CAPEX”) of C$592 million, yielding a compelling after-tax NPV:CAPEX ratio of 2.4:1

• LOM all-in sustaining cost (“AISC”) of US$652/oz AuEq recovered in concentrate

• Proven and Probable open-pit mineral Reserves of 29.9 million tonnes containing 2.87 million ounces gold and 75.5 million ounces silver (combined 3.85 million AuEq oz)

• A carbon intensity of 0.20 t CO2e/oz AuEq produced, positioning Eskay Creek to be one of the lowest carbon intensity mines worldwide

The Company will be hosting a conference call to present the FS results for Eskay Creek on Thursday September 8th at 8:00 AM PT / 11:00 AM ET. A presentation by management will be followed by Q&A.

(Skeena Completes Robust Feasibility Study for Eskay Creek: After-Tax NPV (5%) of C$1.4B, 50% IRR and 1 Year Payback | Skeena Resources Limited)

Chile;

https://www.cnbc.com/2022/10/14/chile-has-outperformed-the-sp-500-this-year-heres-how-.html

KEY POINTS; …

- Chilean stocks this year are leapfrogging those in other countries, including the U.S.

- The iShares MSCI Chile exchange-traded fund (ECH) is up more than 3% year to date, while the U.S. benchmark S&P 500 is down more than 20% — officially trading in a bear market.

- There are several catalysts driving this outperformance, including the rejection of a proposed new constitution.

1 Like

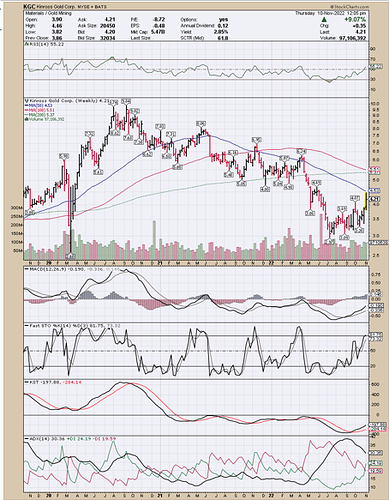

FYI - From Kinross news today (KGC bought out the Great Bear project):

Development projects:

- The Great Bear project in Red Lake, Ontario, continues to make excellent progress and the Company plans to declare an initial mineral resource estimate in early 2023. Drilling results continue to confirm Kinross’ vision of developing a large, long-life mining complex.

Copper, Copper, Copper the world is crying for more of it.

This year has been mostly a repeat of last year with gold and silver prices currently ending what many believe to be the end of a cyclic bear market in the PMs. We are in the early stages of a new bull for the PMs, for a variety of reasons, according to many who analyze the markets. I’ve held a position in this one (Blackrock Silver) quite a while (and most of the others mentioned previously in this thread). The underlying fundamentals of the majority of the stocks in my original list (see link) are still valid, although most have recently seen a 52 week lows. What better time to accumulate? I expect PMs will generally be heading up from here, although I expect significant volatility. I’ll be accumulating on major dips, and selling traunches some of those I’ve held a very long time as that fits my trading style and strategy. NOVO and NRGOF are the outliers that have been major disappointments, but the fundamentals of the rest of my list are fairly intact. I have already accumulated larger positions in some of my favorites which include KRRGF, NFG.V (NFGC), ELO.V (ELRRF), WPM, SKE, SSVR.V (SSVRF), DGMLF and BKRRF (BRC.V). You may be tired of seeing these same tickers appearing here, but the underlying assets appear very good for major future growth.I’m more than ready to have some major gains in next year’s portfolio! There are many others mining companies not on my list that will do very well in the next year or two. I’m sure some may benefit and appreciate from hearing news on them.

Blackrock Silver Drills Bonanza-Grade Gold At Silver Cloud, Nevada

by Ceo Technician | posted in: Charts | 0

Since the summer of 2020, Blackrock Silver (TSX-V:BRC, OTC:BKRRF) has been focused on its Tonopah West Project, defining a gold/silver resource of nearly 50 million ounces silver-equivalent (Ag-Eq) at an average grade of ~450g/t Ag-Eq in the process. However, Blackrock CEO Andrew Pollard never forgot about the project that started it all, Silver Cloud. Pollard always knew that he would return to Silver Cloud to test some of his favorite targets, including Northwest Canyon.

This morning, Blackrock announced that it has drilled 52.62 g/t gold and 606 g/t silver over 1.5 meters (hole SBC22-020) in the Northwest Canyon area, representing a new high-grade vein discovery now known as Zeus.

(Blackrock Silver Drills Bonanza-Grade Gold At Silver Cloud, Nevada | Energy and Gold Ltd.)

1 Like

This article is a little old, but it caught my eye because of the new vent raise and the new production that will result. It reminded me of our delays due to the pandemic, and what Maurizio and crew need to do to really open up the Don Luis vein and Antonio tunnel by constructing the properly placed vent raise. Yes, I’ve invested in both this company and our other two stocks for quite a while, but it was mostly in the old Other Mining Stock thread. This one is worth taking a look at, but there are so many other producing miners that will do well too in the upcoming year. I plan to stay invested!

Lundin Gold completes vent raise at Fruta del Norte mine

October 25, 2022, (Top Companies Latin America Gold)

Lundin Gold (TSX: LUG) announced the completion of the South ventilation raise (SVR) at its Fruta del Norte gold mine in southeast Ecuador. It is now complete and operational.

Fruta del Norte is the first large-scale modern gold mine in the country. The deposit is 150 km by paved road from Loja, the fourth largest city in Ecuador. The mine produces approximately 340,000 oz. of gold annually at an all-in sustaining cost between $860 and $930 per oz. in 2022.

The South vent raise has been under construction for the past three years. Delays were encountered due to the Covid pandemic and technical challenges. In mid-2021, Lundin revised the work plan to a 2.1-metre pilot raise followed by top-down slashing to 5.1 metres, rather than the 5.1-metre raise bore as originally planned. A concrete liner was also added.

Slashing was complete and the fans commissioned earlier this month. Ventilation at the mine has increased to 350 m3/s from 180 m3/s. The increase allows mining to proceed on all levels and has improved efficiency.

“The SVR project has had its challenges, but the team has worked tirelessly to ensure that the delays did not impact operations,” said Lundin Gold president and CEO Ron Hochstein. “With the SVR now complete and commissioned, the entirety of the Fruta del Norte deposit can be accessed and mined, and haul truck cycle times can be improved.”

The Fruta del Norte deposit was discovered in 2006 by Aurelian Resources and sold to Kinross Gold (TSX: K) in 2008. After taking the project through the prefeasibility stage, Kinross sold it and its other properties in Ecuador to Lundin Gold in 2014 for $249 million.

The mine reached commercial production in February after Lundin invested $692 million in preproduction capital.

(Lundin Gold completes vent raise at Fruta del Norte mine - MINING.COM)

Remember to Stay Healthy and find time to spend some time with your family, loved ones, and friends, now and always … Best wishes to all for a Merry Christmas, Happy Holiday Season, and a Very Happy & Prosperous New Year!

EZ